Summary

- The domestic gold price declined by 0.7% during June, ending the month at Rs50,809/10g 1

- Retail demand remained muted as the wedding season ended and sowing activity picked up with the onset of the monsoon 2

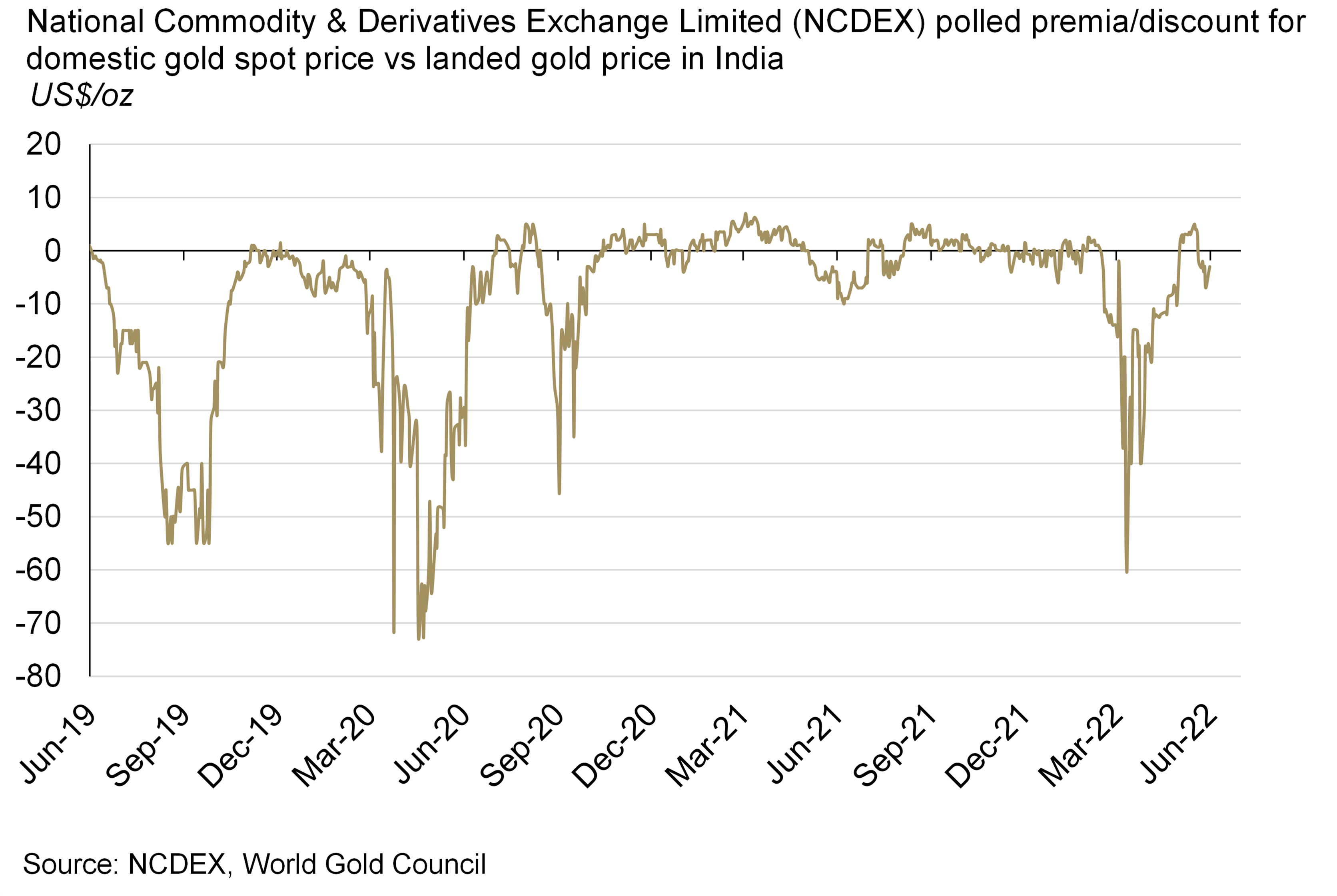

- With subdued retail demand, the local market traded in a discount averaging US$5/oz during the month

- Official imports declined to 44.3t in June, 55% lower m-o-m

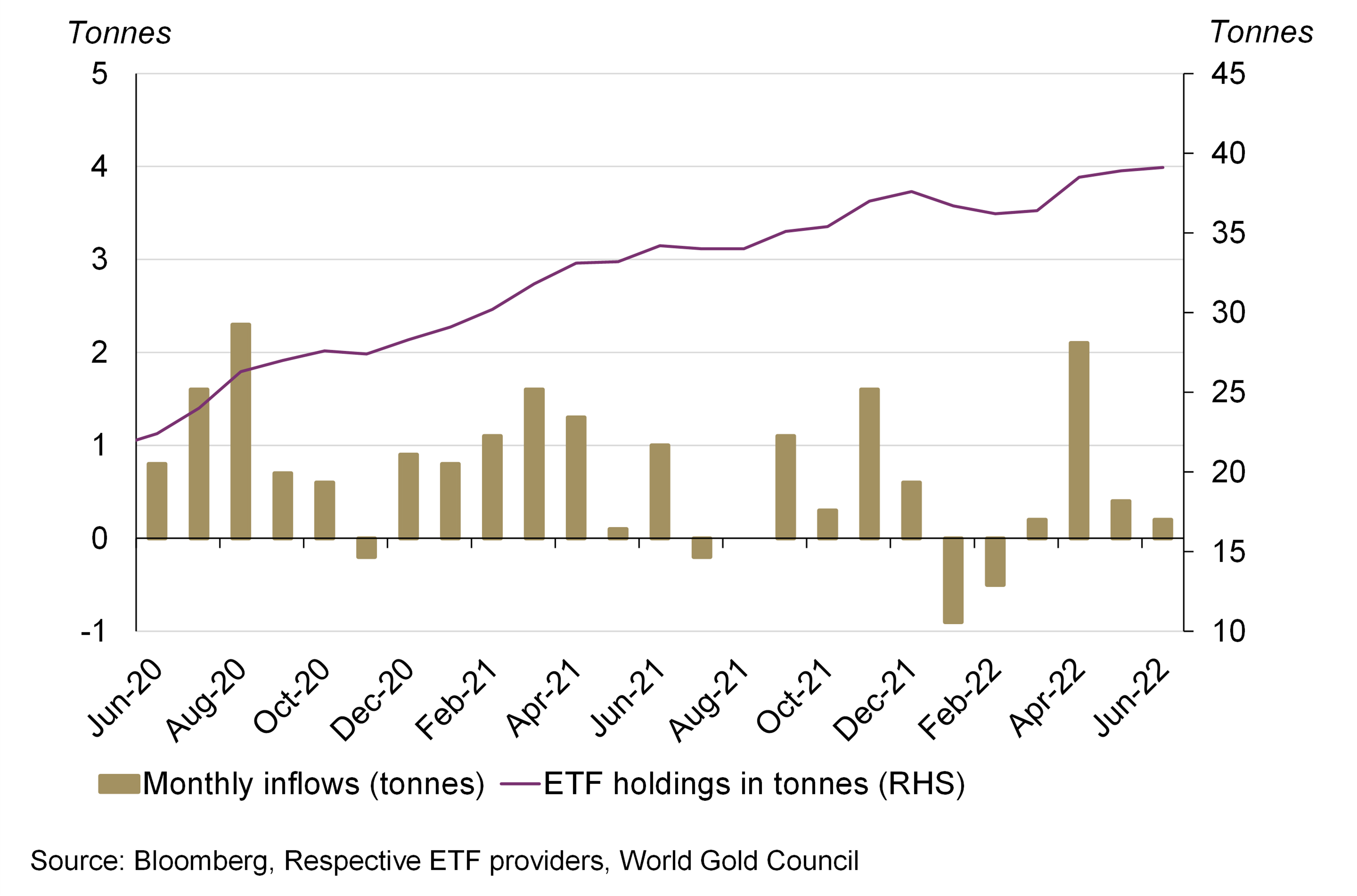

- Indian gold ETFs witnessed a paltry net inflow of 0.2t in June, primarily driven by higher inflation and a depreciating rupee, lifting total holdings to 39.1t

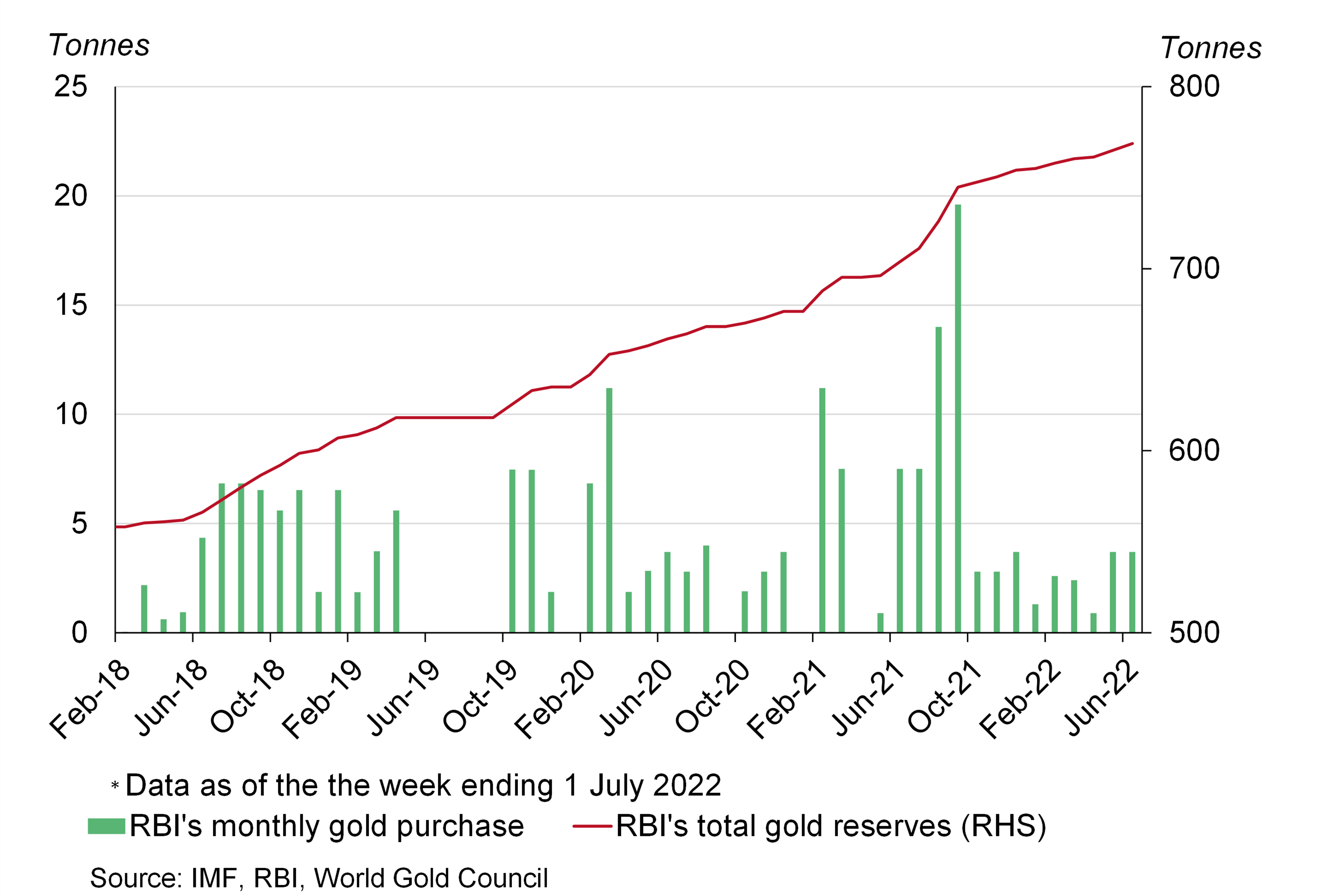

- The Reserve Bank of India (RBI) added 3.7t of gold in June, increasing its total gold reserves to 768.8t.

Looking ahead

- Retail demand has continued tepid so far in July due to soft rural demand, the end of the wedding season and higher import duty on gold 3

- Gold ETFs in India saw a net outflow of 0.6t during the first two weeks of July; we believe this is primarily driven by investors booking profits amid a sharp correction in the gold price 4

- Official imports are expected to remain subdued during the rest of July due to the muted demand environment.

Local market traded at a discount in June

On the back of muted retail demand the local market traded at an average discount of US$5/oz during June (Chart 1). 5

The Indian government hiked import duties on gold from 1 July: our industry contacts suggest that demand for bullion has subsequently been muted. The local market discount widened to US$20-21/oz during the first two weeks of the month.

Chart 1: Local market traded at discount in June as retail demand remained soft

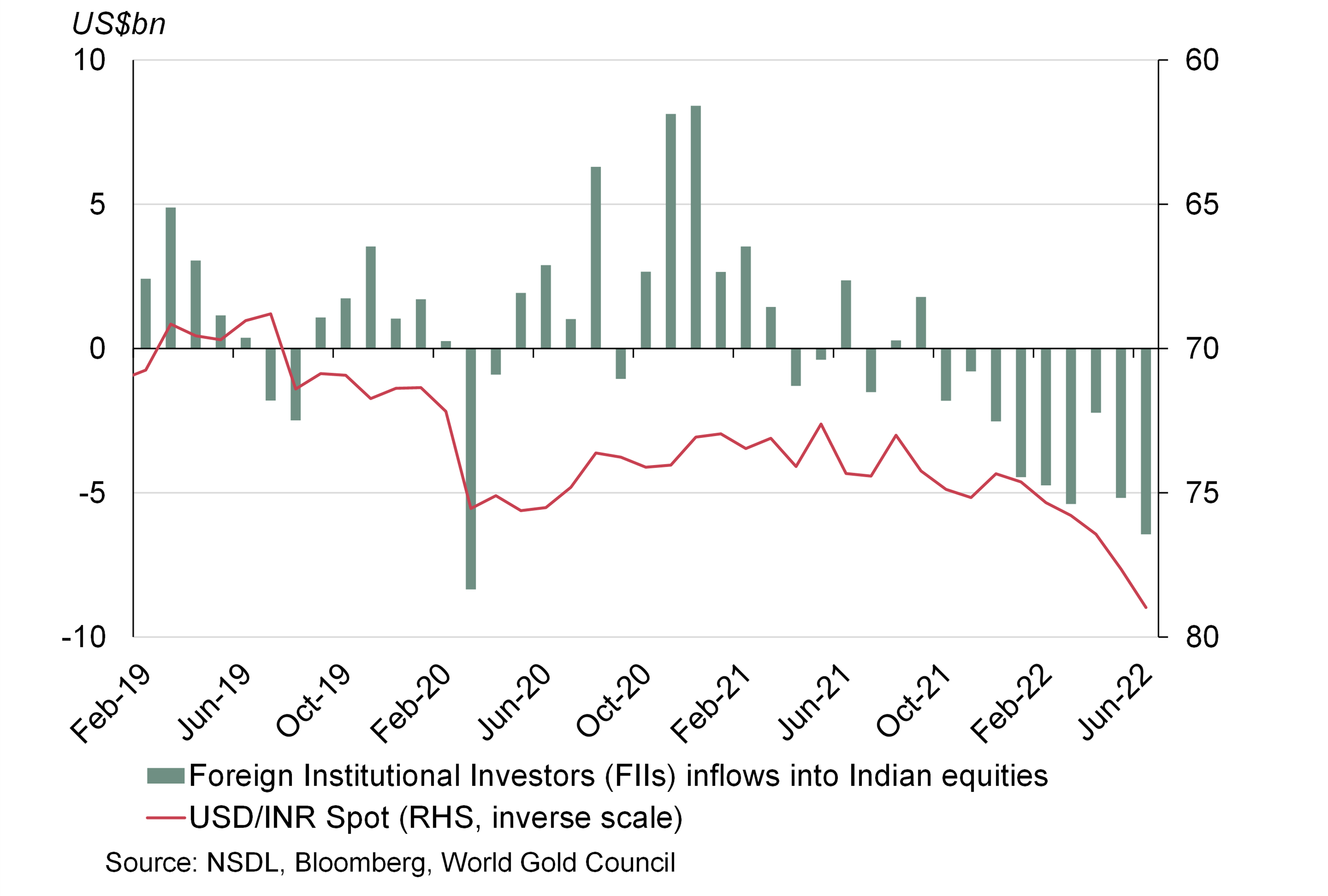

The rupee fell to a record low during the month

With policy rate hikes by the US and other advanced economies, foreign institutional investors (FIIs) have continuously pulled out money from Indian equity markets, with a net outflow of US$28.4bn during H1 2022 compared with a net inflow of US$3.8bn during FY 2021. The exodus of FIIs has put pressure on the rupee, which stood at a record low of Rs78.97/USD at the end of June (Chart 2).

The RBI has recently issued notifications to boost short-term dollar inflows and allow international trade settlements in rupees. These steps are expected to stem the currency’s depreciation in the short to medium term.

Chart 2: Rupee fell to a record low amid growing equity outflows

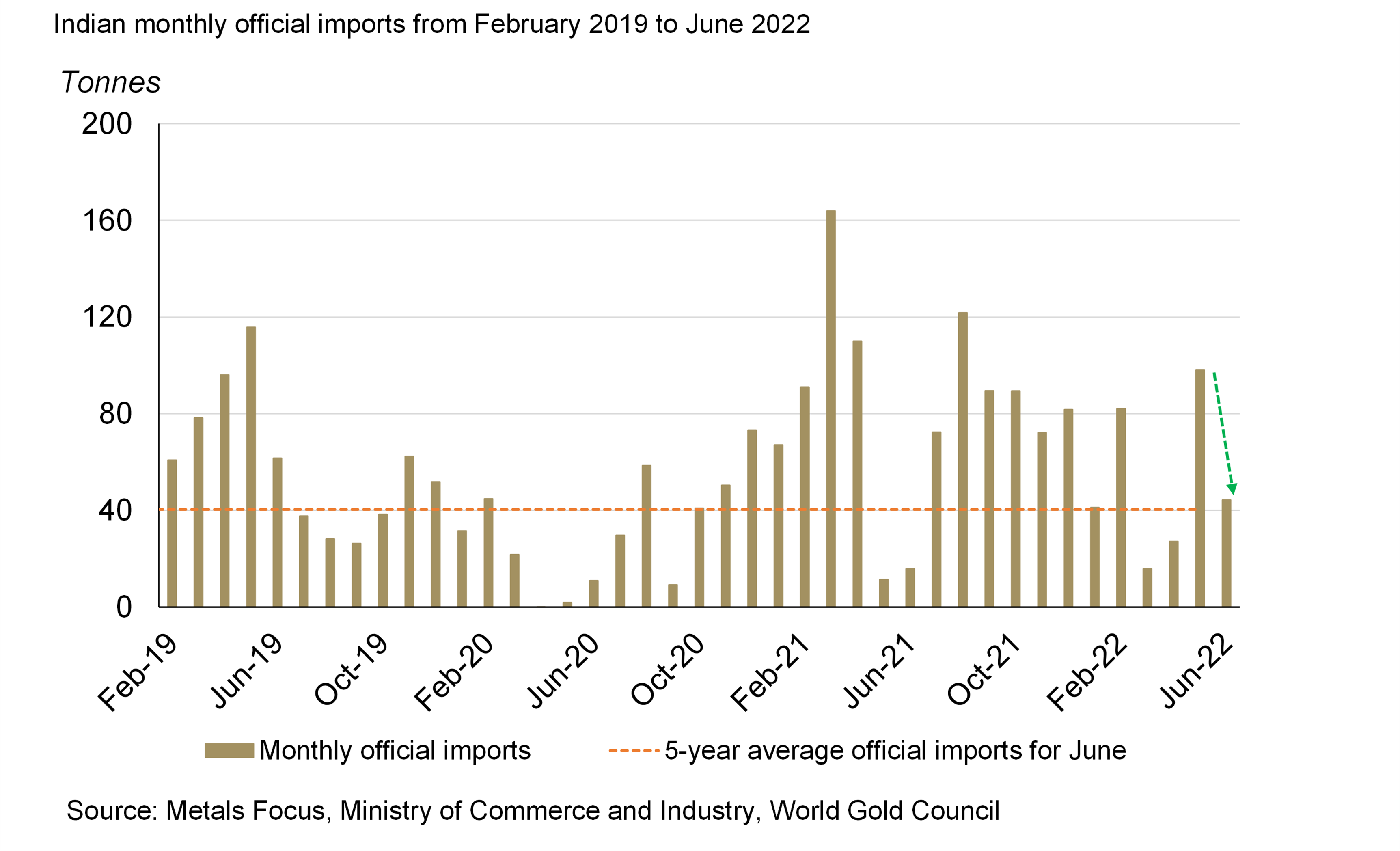

Retail demand remained soft and imports declined

Retail demand remained muted during the month as the wedding season ended and the onset of the monsoon prompted sowing activity in rural communities. Against this backdrop, official imports declined. Official gold imports in June were 44.3t – 55% lower m-o-m and 168% higher y-o-y (Chart 3).6 Official imports in the month were driven by:

- May’s strong imports (98t) gave rise to a healthy inventory across the value chain and lower official imports in June

- The higher custom tariff of US$597/10gm – which applied during the first two weeks of June – resulted in a higher landed cost of gold

- Weak retail demand.

Chart 3: Indian gold official imports slowed in June 2022

Conversations with industry contacts reveal that retail demand remained tepid in July due to muted rural demand, the wedding season drawing to a close and the higher import duty on gold. Even with the 4% correction in the local gold price during the month, retail demand remained quiet. In this environment, official imports are expected to remain soft in July too.

June inflows into Indian gold ETFs were paltry

Indian gold ETFs witnessed modest net inflows during the month (0.2t), primarily driven by the macroeconomic backdrop of higher inflation and a depreciating rupee. The minor increase lifted total gold ETF holdings to 39.1t by the end of June (Chart 4). Investors withdrew 0.6t from gold ETFs in the first two weeks of July, primarily due to profit booking amid a sharp correction in the gold price.

Chart 4: Indian gold ETFs saw fourth consecutive month of net inflows

The RBI added 3.7t to its gold reserves

The RBI added 3.7t to its gold reserves in June – the same volume purchased in May. This took total gold reserves to 768.8t (7.6% of total reserves) by the end of the month (Chart 5)7. India’s fx reserves posted the biggest weekly drop in three months with a decline of US$5bn during the week commencing 24 June. The weak rupee contributed to the fall in fx reserves. So far in July the RBI has added another 6t to its gold reserves (data correct as at the week ending 8 July).

Chart 5: RBI added 3.7t to its gold reserves in June