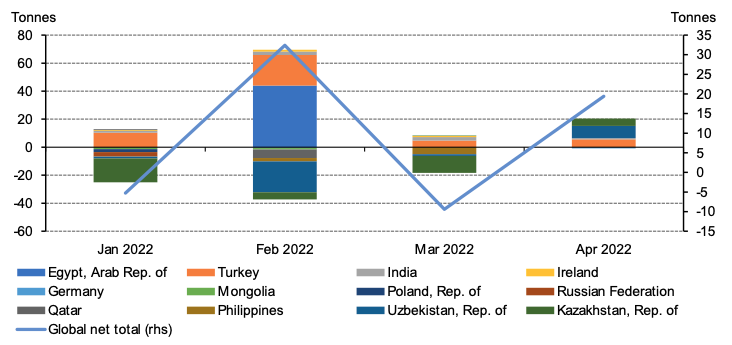

So far in 2022, central banks’ monthly gold reported activity has been bobbing between net purchases and sales linked to a fairly small number of banks. As such, any significant purchase or sale from those can tip the balance in a given month. In April, central banks were once again net purchasers, to the tune of 19.4t (Chart 1).

Chart 1: Monthly central bank purchases

*Data to 30 April 2022. Note: Japan’s reported 81t increase in its gold reserves in March 2021 has been excluded as this was the culmination of an off-market transaction between two different divisions within the Ministry of Finance.

Source: IMF IFS, Respective Central Banks, World Gold Council

Four banks contributed to gross purchases of 20.5t in April. Those central banks adding to their gold reserves during the month were all familiar names. Uzbekistan (+8.7t) and Kazakhstan (+5.3t) both saw their gold reserves rise during the month, their first monthly increases this year after three consecutive months of net sales. Turkey continued its gold buying this year, adding a further 5.6t in April which took its gold reserves to 436.7t (27.8% of total reserves). India increased its gold holdings by a fractional 0.9t to 761.3t.

Gross sales were limited to small number of central banks. Germany (-0.9t) was the notable seller in the month – likely related to coin-minting. Mexico (-0.1t) and Czech Republic (-0.1t) were other minor sellers in the month.

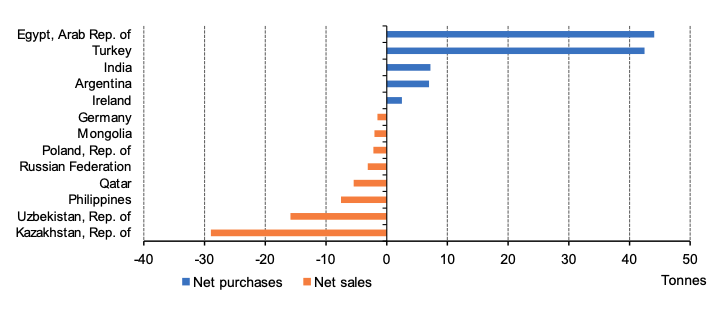

On a year-to-date basis, central banks remain net purchasers on the whole. Egypt is the largest buyer following its chunky 44.1t purchase in March, but Turkey is not far behind, having bought 42.5t to the end of April. Kazakhstan (-29t) and Uzbekistan (-15.9t) remain the largest sellers so far in 2022 despite the purchases in April (Chart 2).

In a notable development in the central bank space, incoming governor of the Czech central bank stated in an interview that he believes the central bank should significantly increase its gold reserves ‘from 11 tonnes to 100 tonnes or more’ as part of a proposed strategy to increase the expected return on official reserves and make the Czech National Bank (CNB) ‘profitable’. Ales Michl said that he believes that the increase in gold reserves should be gradual ‘over several years’, emphasising that gold is ‘good for diversification…’.

Chart 2: Year-to-date purchases/sales

*Data to 30 April 2022. Note: chart include only purchases/sales of 0.5t or above.

Source: IMF IFS, Respective Central Banks, World Gold Council

We will be publishing the findings from our 2022 central bank survey findings on 8th June 2022. This will provide a more up-to-date look at the most important factors for central banks in managing their gold holdings, as well as a raft of other details related to gold reserves. As always, this data will be available exclusively on Goldhub.