Last week central banks stepped up their response to soaring inflation. Having been regarded as “behind the curve” in their attempts to control this issue thus far, they are now showing greater concern and resolve in bringing consumer prices down.

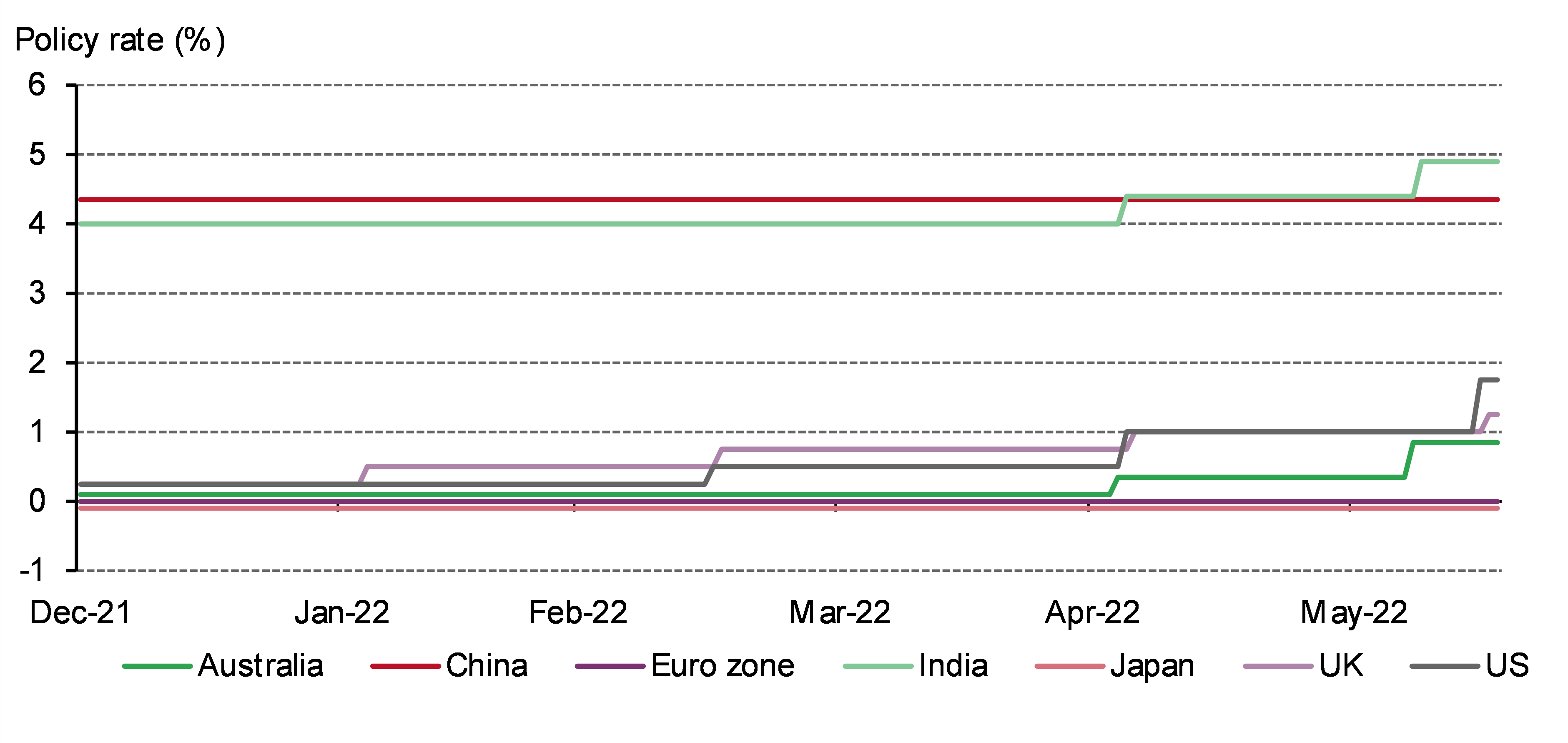

Most notably, the US Fed hiked its funding rate by 75bp to a 1.5%-1.75% range – the largest single rate hike in almost three decades – thus readjusting monetary policy expectations from as recently as the previous week. But while the Fed policy action dominated the headlines, several other central banks also bolstered their hawkish credentials. The Bank of England increased its base rate by a further 0.25%, its fifth consecutive increase, to 1.25%; the ECB held an emergency meeting to discuss a potential response to rising sovereign borrowing costs; and the Swiss National Bank hiked rates for the first time in 15 years. The Bank of Japan, in contrast, bucked the trend by maintaining its accommodative stance despite increased pressure on the yen (Chart 1).

While equities initially rallied following the Fed announcement – that the overall pace of rate rises will be more gradual than expected – they quickly resumed their year-to-date decline, as the market assessed the potential impact of this action. Year-to-date, US and European equity indices have fallen 15-20%, (US technology stocks have fallen ~30%), while US 10-year yields are up almost 200bps. Sovereign bond yields also continued their rise having initially dropped on the Fed news. In our view, this speaks to lingering investor concerns about the growth outlook given more aggressive monetary policy. The Fed is threading the needle to navigate the US economy to a “soft landing”, and other central banks face a similar challenge, while the ECB has to also contend with potential fragmentation in sovereign borrowing costs (various European sovereign 10-year yields are up 200-300bps year-to-date).

Amid these changes and concerns, gold remains steady: up 1% year-to-date in US dollars and far higher in other currencies. Our analysis has shown that gold has been well-supported by inflation and geopolitical risks, although higher interest rates continue to be a headwind. Although higher rates are concerning, with Fed Chairman Powell explicitly saying he would like to see positive real rates across the curve, the Fed is pointing to 2.3% inflation by 2024 and terminal rate of 3.8%. While we don’t know where longer yields might be resting then, a shorter maturity real yield of 1.5% is below what we’ve identified, historically at least, as a threshold for gold to be significantly impacted by real rates. We’ve found that historically, real yields below 2.5% have not been substantially negative for gold (Table 1). A return to a real rate environment of 0–2.5% tends only to result in slightly lower real returns on gold compared to its 6.2% long-term average.

Table 1: Gold has outperformed in moderate real- and nominal-rate environments

While interest rates are rising, we believe the combined impact of inflation pressure and widespread geopolitical risks will reinforce gold as an attractive hedge for both retail and institutional investors seeking protection and liquidity in this turbulent environment.