The resurgence of COVID-19 and the subsequent lockdowns in major Chinese cities since late February have made headlines. These lockdowns are leading to households spending less – especially for discretionary items – as well as saving more due to limited spending opportunities and cautious behaviour. According to the National Bureau of Statistics, y-o-y growth in retail sales value was just 3% in the first quarter, the second worst Q1 since 2000 – 2020 saw the worst Q1 when COVID-19 first took its toll on China’s economy.

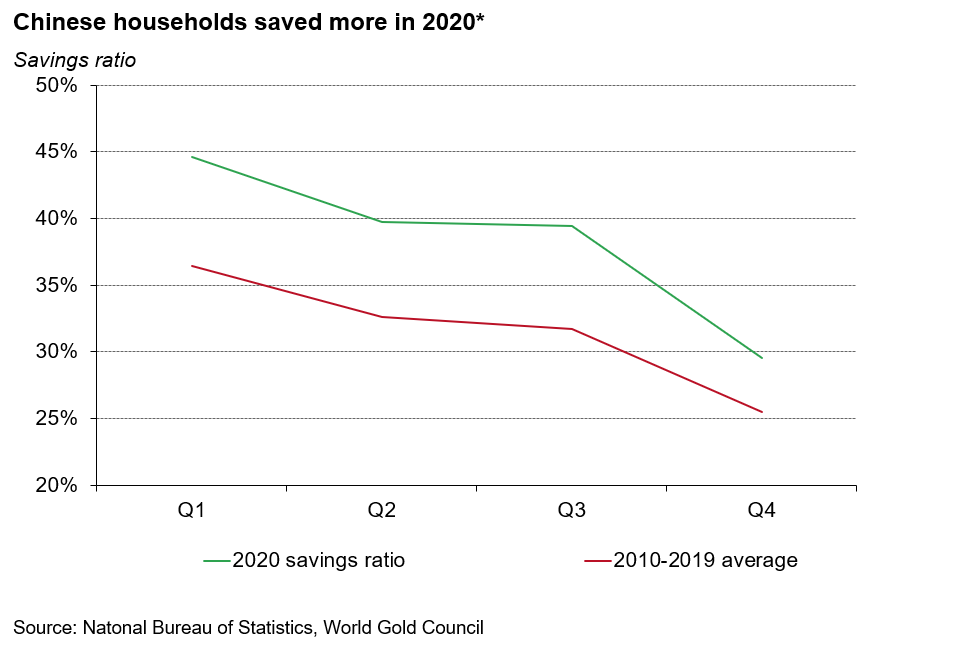

Meanwhile, household savings as a percentage of disposable income amounted to 43% in Q1, significantly higher than the 10-year average – between 2010 and 2019 – and near the peak of Q1 2020.1 A survey by the People’s Bank of China (PBoC) in Q1 2022 showed a similar trend: the tendency of local households to save has been increasing.2 We believe this growing inclination to save post-2020 might be driven by:

- a desire for precautionary savings amid the on-off COVID-19 resurgence and lockdown uncertainties

- a lower willingness to spend due to the slowdown in consumers’ disposable income growth

- an inability to spend amid COVID-related mobility restrictions.

Experience from 2020 tells us that the willingness of households to save is likely to remain elevated throughout 2022. When the pandemic first hit China in Q1 2020, nationwide lockdowns were implemented, leading to a higher-than-average level of savings amid fewer opportunities for spending on non-essentials. And even when most industries and retailers returned to normal post-Q1, the savings ratio for local households remained well above its average level, mainly due to precautionary savings behaviour – for “that rainy day” – and slower income growth.

*Based on quarterly household disposable income and expenditure from the National Bureau of Statistics. Savings ratio is calculated as (Households' disposable income-expenditure)/Households' disposable income.

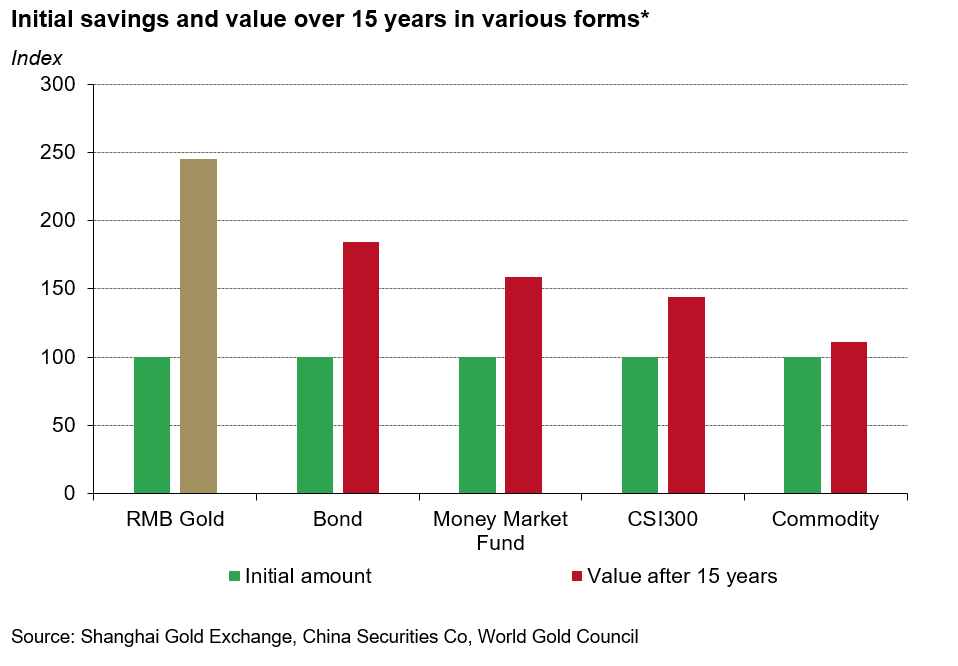

While savings are often in the form of bank cash deposits – savers see banks as stable and can readily access their funds – we believe that gold could also benefit savers. RMB gold has offered a compound annual growth rate of 6% during the past 15 years, higher than other assets including money market fund and government bonds.

*Based on monthly data of Au9999, ChinaBond New Composite Index, CSI Money Market Fund Index, CSI300 Stock Index and Wind Commodity Index in RMB between April 2007 and April 2022. Index=100 in April 2007.

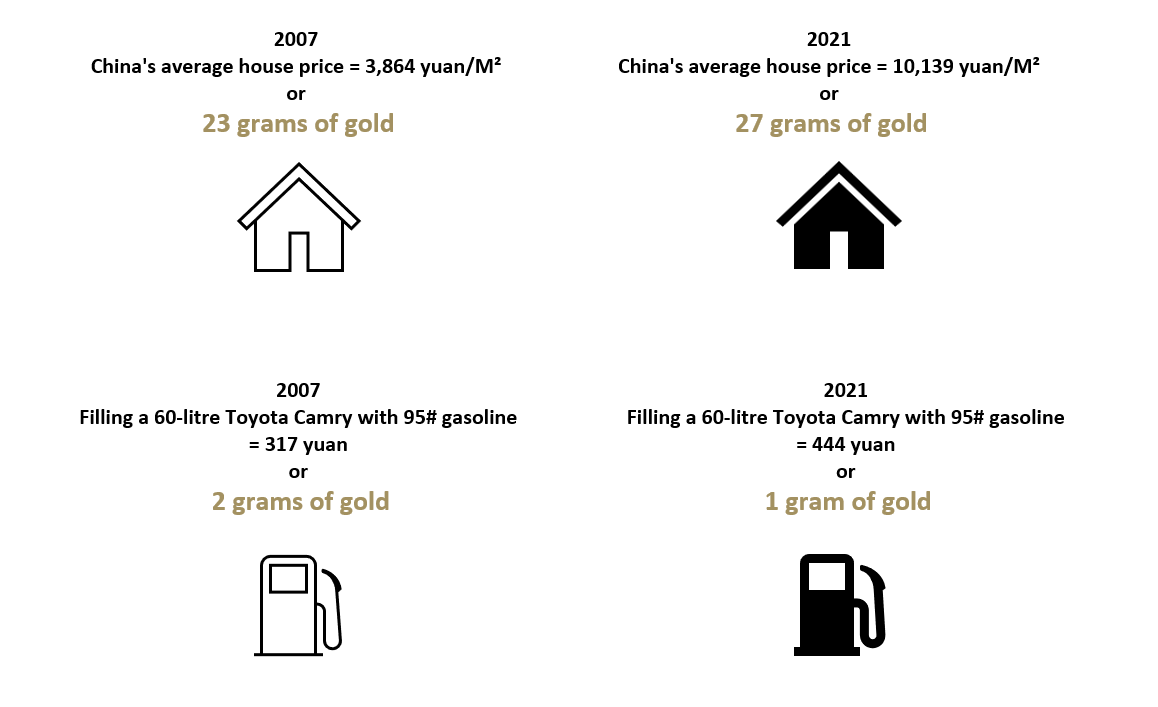

Gold’s return-generating ability and limited supply underpin its role as an inflation hedge and a store of value. Our analysis shows that gold has outpaced the CPIs of major regions, as well as the global money supply. Gold’s role as a protector of purchasing power and a hedge against inflation is best illustrated with practical examples using historical data.

Figure 1: If you saved gold 15 years ago….*

Source: Shanghai Gold Exchange, National Bureau of Statistics, Shanghai Municipal Development and Reform Commission, Toyota, World Gold Council

*Based on the annual average Au9999 price, the annual average property price in China and the annual average 95# gasoline retail price in Shanghai, between 2007 and 2021 due to data availability.

Gold’s ability to generate a long-term return, hedge against inflation and provide purchasing power protection could be attractive to savers. In the form of gold accumulation plans, ETFs, bars, coins or fine jewellery, gold is easily accessible for Chinese investors via both online and offline channels. And we believe gold’s role as an efficient means of saving could become more relevant to Chinese savers as:

- the possibility of higher inflationary pressure in China rises further amid ongoing lockdowns in many cities3

- the potential grows for further devaluation of the Chinese yuan due to the narrowing interest rate differential between China and developed markets, as well as the clouded economic outlook.4