Commodities are on a tear in 2022, driven by consumer spending, supply chain issues and most recently, tensions with Russia. Brent and WTI oil are well above $100/bbl., up more than 50%.1 Nickel was up over 200% at one point during the month- a move so large that the metallic value of a US $0.05 nickel was worth twice its monetary value. Finally, broad-based commodities indices like the S&P GSCI and Bloomberg Commodity (BCOM) indices are up anywhere between 30% and 40%. Broad-based commodities have provided solid returns for investment portfolios, but the exponential price increase for many commodities may require investors to re-evaluate the magnitude of their commodity holdings, and potentially rotate some of that exposure into gold.

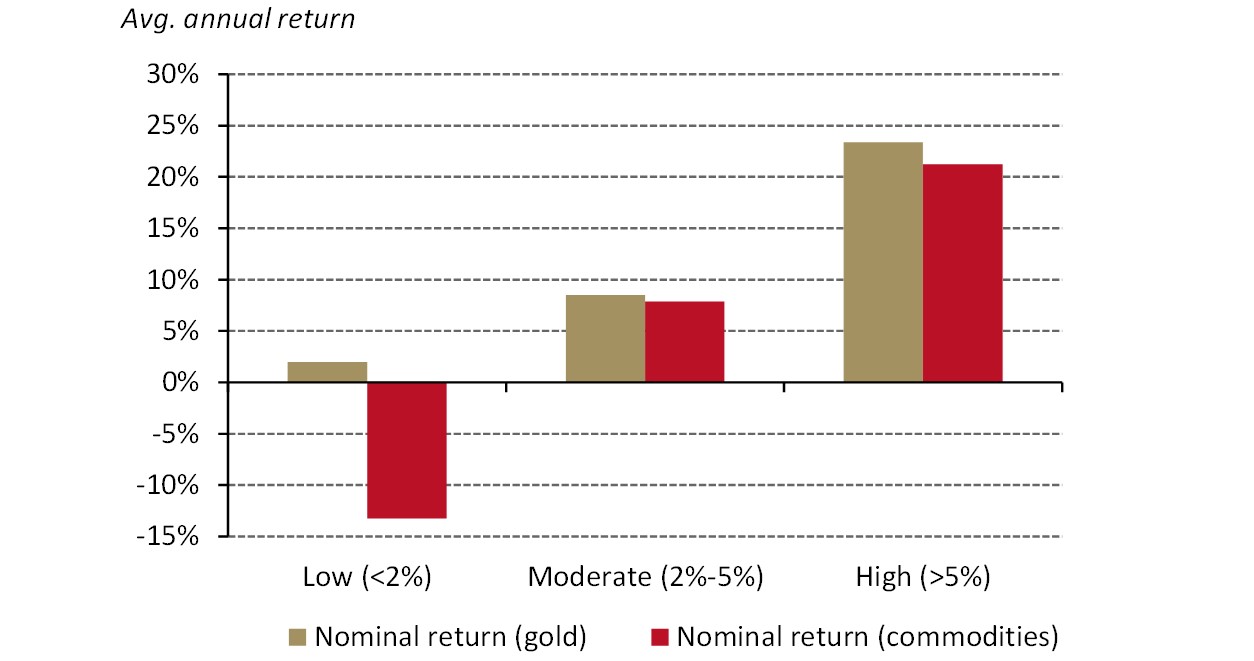

We’ve discussed extensively that gold is the most effective commodity investment separating itself from individual and broad-based commodity indices. While an inflationary environment is generally supportive for commodities, gold has historically outperformed broad-based commodities. Historical analysis shows that gold returns averaged 25% in years when inflation was above 5%. Commodities have returned just over 20% (Chart 1) – but that includes the strong commodity performance over the past 15 months. To put things into perspective, February’s US CPI showed a 7.9% y-o-y increase.

Chart 1: Gold and broader commodities perform well in high inflation environments, but commodities break down in low inflation markets

Gold and commodity returns as a function of inflation*

Based on y-o-y changes of the LBMA Gold Price, Bloomberg Commodity Index and US CPI between 1971 and 2022. Number of observations for each tranche: Low = 12, Moderate = 22, High = 12. The buckets were determined based on a 2% Fed target rating, a recent CPI number above 5% and a proportional amount of observations in each tranche. The results are consistent when adjusting tranche levels moderately.

Source: Bloomberg, Bureau of Labour Statistics, ICE Benchmark Administration, World Gold Council

Gold has historically lagged broader commodities in the preliminary stages of commodity reflationary periods, like the current one. Ultimately, it has tended to outperform, which could be replicated in the current case as it plays ‘catch-up’ in 2022 (Table 1).

Table 1: Gold historically lagged in commodity-led reflation periods but outperformed over the long run

Inflation-related asset returns during the most recent reflationary periods in the US, on an annualised basis*

*As of 9 March 2022

Source: Bloomberg, World Gold Council

Gold really separates itself from other commodities is in systemic risk-off environments. Risk-on assets have fallen this year, but it has been more of a steady pullback of 10-12% versus a systemic event. Should equity markets fall very rapidly, historical data suggests gold to be a better hedge than commodities.

Commodities and gold have both been great components of diversified portfolios in 2022. But a sizeable portion of commodity index gains has been driven by the large weights of oil and energy in the indices. This weight is over 50% in the S&P GSCI and 30% in the BCOM Index. While many investors like to look at the relationship of oil and gold, we know that over the past 50 years there has been little correlation between oil and gold.

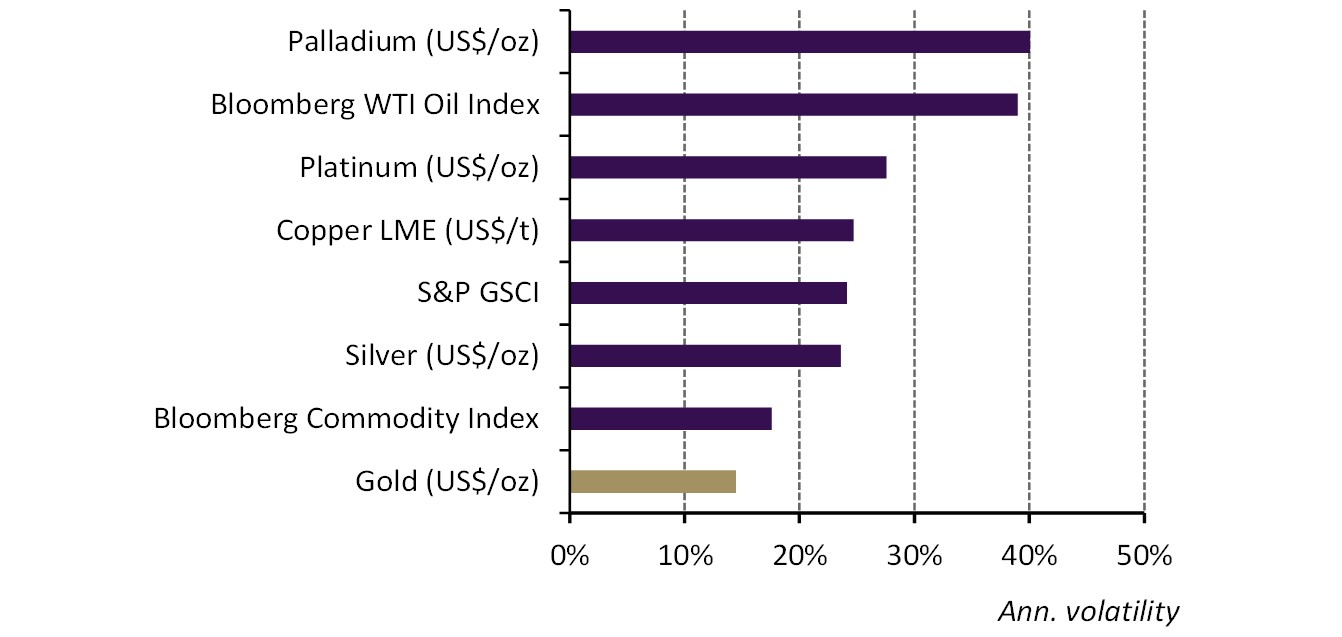

If global supply chains open, and/or geopolitical tensions in Russia ease, it would not be surprising to see a sharp pullback in oil and other currently-strained non-gold commodities. It is also possible that gold could lose some of its recent momentum as well. However, gold is much less volatile than individual commodities, particularly oil, and many times less volatile than broad-based commodity indices; both of which is the case over the past year (Chart 2). This is also the case over the long run, with the long term volatility of gold similar to that of US equities, and well below individual commodities.

Chart 2: Gold is less volatility than most individual and broad-based commodity indices

Annualised daily volatility of various commodities over the past year*

*Based on period of 1 March 2021 to 9 March 2022 annualised daily volatility of various commodities.

On Goldhub.com see Gold volatility.

Source: Bloomberg, World Gold Council

But the inflation story is unlikely to go away anytime soon, and market risks remain. Should gold fall, it would not be surprising to see more strategic gold investors opportunistically step in to buy at lower price levels. Therefore, it may be an ideal time to consider a rotation from broad-based commodities to gold. Gold possesses the positive qualities a commodities investor wants at a time like today: it offers downside protection, lower volatility and varied sources of demand. All of which leave gold in a better position to diversify a portfolio should oil or broad-based commodities retreat.

Footnotes

1As of 9 March 2022