- Gold tends to rally when credit spreads widen…

- …but that’s usually the case when the move in credit spreads is driven by broader systemic risks

- US spreads have only recently begun to widen. Should this environment of higher inflation and geopolitical tension draw itself out, widening spreads are likely to signal further support to gold

Credit spreads1 are considered good gauges of market or economic risk. Why?2 Bond markets are large. The market capitalisation of US government and corporate bonds totalled US$32tn in Q1 2021 according to SIFMA.3 That makes them a little smaller than US equity markets but arguably more systemically important. This is because they represent funding by government as well as corporations. In addition, bond markets have relatively more certain future pay-outs than equities, with predetermined – albeit not entirely riskless – coupons and principal. Given the greater certainty, bond markets might be expected to incorporate new information more quickly. This may be why bond markets are often cited as ‘smarter’ than equity markets. Finally, there is a reflexive feedback mechanism in corporate credit whereby increasing yields, on fears of higher default risk, can make financing harder which in turn increases the risk of default further. For these reasons, bond markets and particularly credit spreads are watched closely as gauges of risk. When they widen materially it can signal broader fear of market or economic stress.

As a consequence, one might expect gold to rally on widening spreads given gold’s effectiveness as a hedge against market or economic stress. Is this the case? The answer is that it depends.

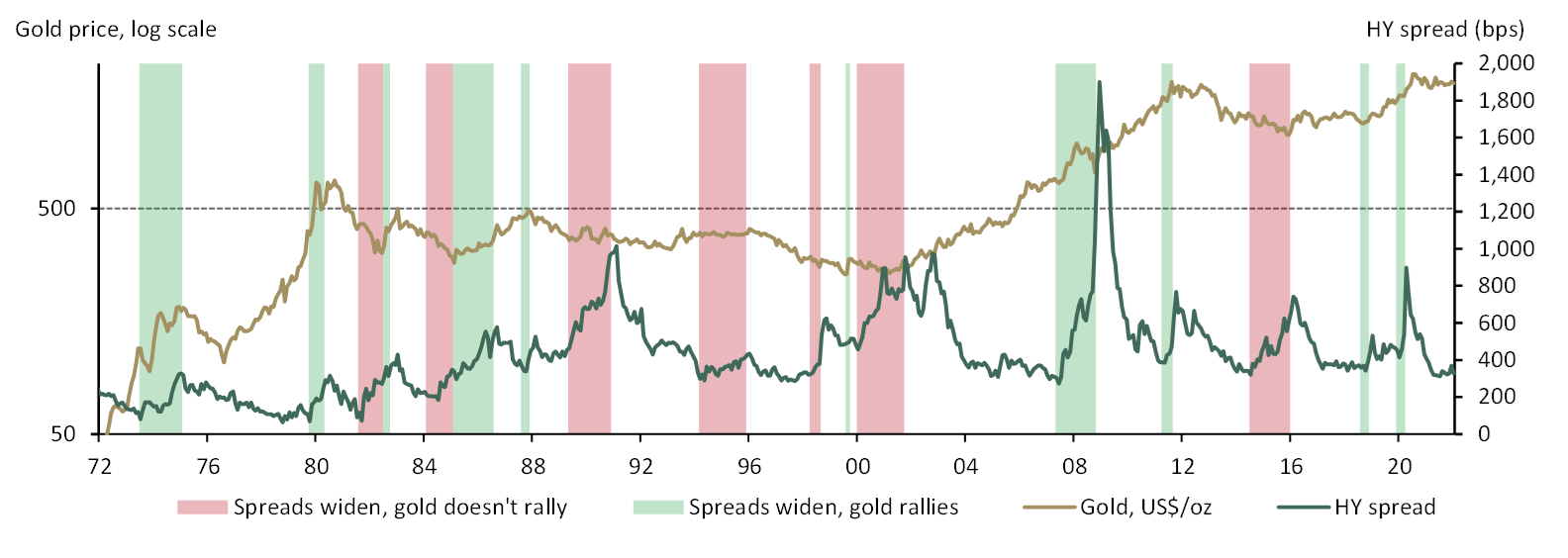

Taking a risk-sensitive measure of spreads: US high yield corporate bonds less 10-year Treasuries,4 we can see that since the 1970s (Chart 1), there are periods when gold rises as spreads widen (green shaded areas), but others when it doesn’t (red shaded area).

Chart 1: Gold’s relationship to credit spread widening is inconsistent

Source: Bloomberg, World Gold Council

Notes: Moodys BAA to Jan 1980. US High Yield 100 Index Yield Feb 1980 to Oct 1986. ICE BofA High Yield Corporate Index yield to March 2022. All indices less US 10-year Treasury yield. Data as of 22nd March 2022.

Why does gold rally with widening spreads in some instances but not in all? In our view, this is down to two factors:

- Gold’s dual nature and multiple demand drivers

- Credit spreads can reflect more idiosyncratic events; gold responds more to systemic events

Gold’s dual nature is one of key drivers of its low volatility and uncorrelated behaviour. It has diverse demand from both a usage and a geographic perspective. As such prices sometimes respond to drivers outside the sphere of US and investor considerations. This is a good thing, as it helps explain its near-zero long-run correlation to risk assets and relatively low volatility.

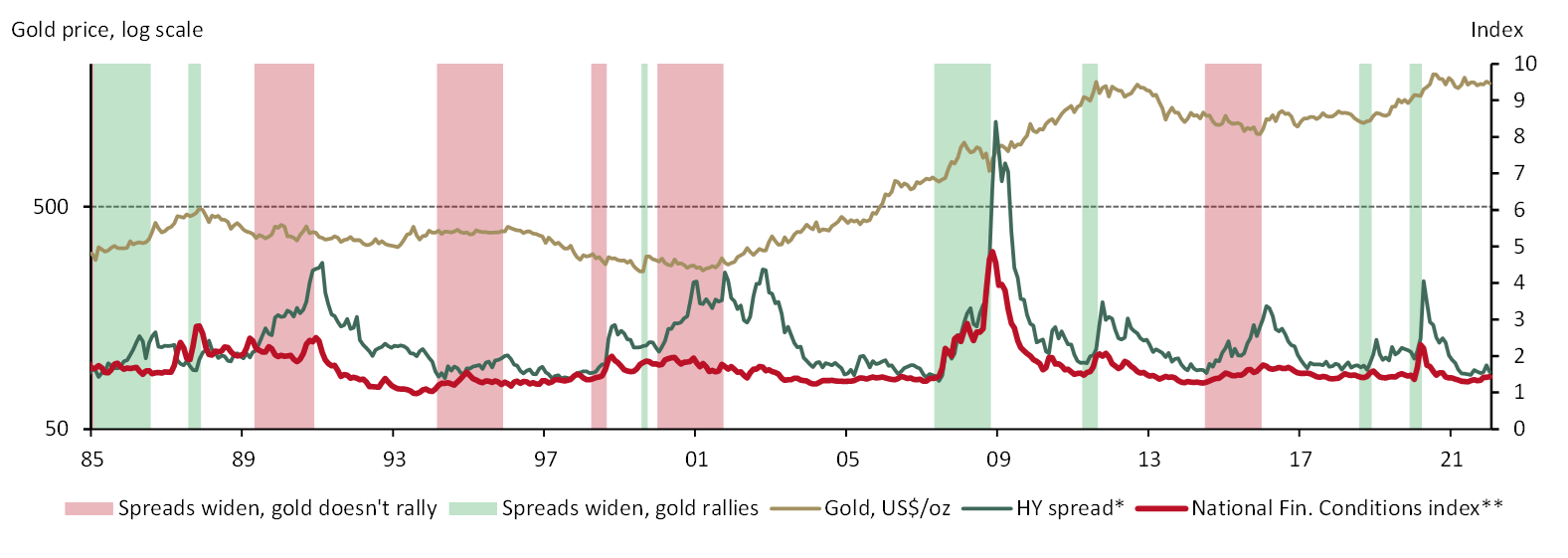

The second reason is that when gold responds positively to widening credit spreads, this appears to be linked to more systemic events: Black Friday, the Global Financial Crisis, the 2020 COVID selloff to name a few. Any widening in spreads that is not deemed to be systemic and perhaps only reflecting sector or company-specific default risk, asset allocation decisions, or just falling Treasury yields - is unlikely on its own to drive investors towards gold as a hedge. Chart 2 shows how gold tends to react to credit spread widening when it is accompanied by a rise in the National Financial Conditions Index (NFCI) – a broad proxy for systemic risk.5 The 1991 Gulf War, the Dot Com bubble and ensuing recession as well as the commodity-led slowdown in China in 2014-15 are examples of non-systemic spread widening events in which gold prices didn’t respond in kind.

Chart 2: Gold reacts to credit spreads widening when they are capturing more systemic risk episodes

Source: Bloomberg, World Gold Council

Notes: Moodys BAA to Jan 1980. US High Yield 100 Index Yield Feb 1980 to Oct 1986. ICE BofA High Yield Corporate Index redemption yield to March 2022. All indices less US 10-year Treasury yield. Data as of 22nd March 2022

*HY spread standardised then added 2 to remove negative values and facilitate charting

** National Financial Conditions index standardised then added 2 to remove negative values and facilitate charting

What are US credit spreads telling us about gold now?

Markets are volatile once again in 2022. Inflation, monetary tightening as well as geopolitical risk are all key drivers. These developments could create snowball effects that impact the credit markets.

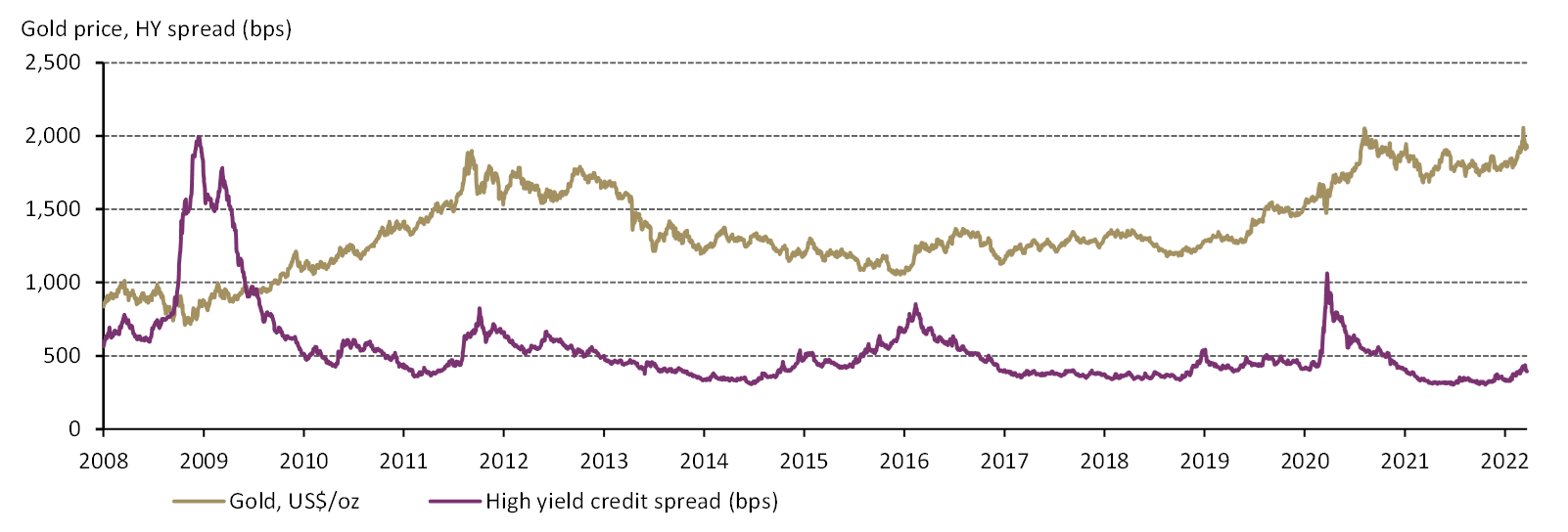

But credit spreads have only recently started to widen. In 2022 HY spreads have moved only slightly to around 400bps (Chart 3). This is below the 10-year average (440 bp) and well below spikes we saw during the GFC (2,000bps), and COVID (1,100bps).

Chart 3: Credit spreads have barely budged despite soaring inflation and the Ukraine crisis

Source: Bloomberg, World Gold Council

Notes: High yield credit spread: ICE BofA High Yield Corporate Index redemption yield less ICE BofA Current US 10-year Treasury yield. Data as of 22nd March 2022

The lack of movement in credit spreads in the face of soaring inflation and heightened geopolitical risks could be attributed to several factors., A combination of historically low government bond yields and excess stimulus money have drawn investment into higher yielding products, which have pushed spreads tighter. In addition, bond market participants seem to expect that the Ukraine may have a limited impact on the US economy, which remains in reflation mode. This has contained Treasury yields from moving lower relative to the High yield component of the spread.

Even though many equity indices are near bear-market territory, there has not been a significant impact on perceived creditworthiness or the underlying economy. Equities may just be repricing on the basis of elevated inflation, which has been exacerbated but not solely driven by the war.

But gold is nonetheless higher on the year. The combination of higher inflation and geopolitical uncertainty is drawing investors to gold as a hedge. Gold is also a global market, and while US bond investors may seem more confident, other investors – whether in Europe or elsewhere – are likely responding more to the potential ramifications of the armed conflict.

But if either high inflation or the Ukraine crisis become drawn out, we could see a material impact on US economic growth as well. That would likely send US credit spreads higher on more systemic grounds and further bolster support for gold going forward.

Footnotes

Commonly the difference between the yield on a corporate debt security and that of a Treasury security of the same maturity.

We refer to US credit spreads in this blog.

SIFMA

We could look at the difference between poor quality and good quality corporates solely, but would not capture flows outside of the corporate bond sector into Treasuries.

A broad index of factors reflecting tightening financial conditions and one that can function as a signal of general financial stress.