India has made great strides since its economic liberalisation in 1991. Looking back over the past 30 years underlines how far the country has come. Between 1991 and 2021, India’s economy grew from US$275bn to US$ 2,946bn and its foreign exchange reserves soared from US$1bn to more than US$630bn. The middle class expanded and household incomes rose, with per capita net annual income rising from Rs7,000 in the early 90s to Rs126,968 in FY2020-21.1

India’s middle class is expanding fast. Analysis from consultancy Bain & Company, for instance, suggests that the number of middle-class households will grow by 140mn between 2018 and 2030, while the number of high-income earners could increase by 21mn.2 This is likely to presage an almost four-fold increase in consumer spending, from US$1.5tn in 2018 to US$5.7tn by 2030. India has also seen a change in saving patterns among its households in recent years: the savings rate, which was above 34% in 2010, had dipped to 30% in 2018 and continues to inch lower to this day.3 Rather than just putting money into saving, consumers in India have begun to invest.

With rising incomes and an increase in spending, investors have shown a growing interest in Indian equities. This is exemplified by the increase in ‘demat’ accounts, used to hold shares and securities in an electronic (or ‘dematerialised’) format. The number of these accounts more than quadrupled from 16.7mn in 2009 to 73.8mn by the end of October 2021.4 Similarly, the amount of money flowing into equities through Systematic Investment Plans (SIPs) has also surged in recent years, reflecting growing awareness of mutual fund investment. Average inflows to SIPs more than doubled between 2016 and 2020, from Rs.35bn to Rs.95bn a month in 2021.5

As Indian investors allocate a higher share of their capital to equities, they have exposed themselves to greater risk. Gold plays an important role in helping investors manage the risk-return profile of their overall portfolio allocation. Gold played its role as a safe-haven asset during the pandemic year of 2020 and has continued to provide a hedge against market volatility in 2021. These attributes have been recognised not only by Indian investors but also by the Reserve Bank of India (RBI).

Indian gold ETFs continued to attract inflows in 2021

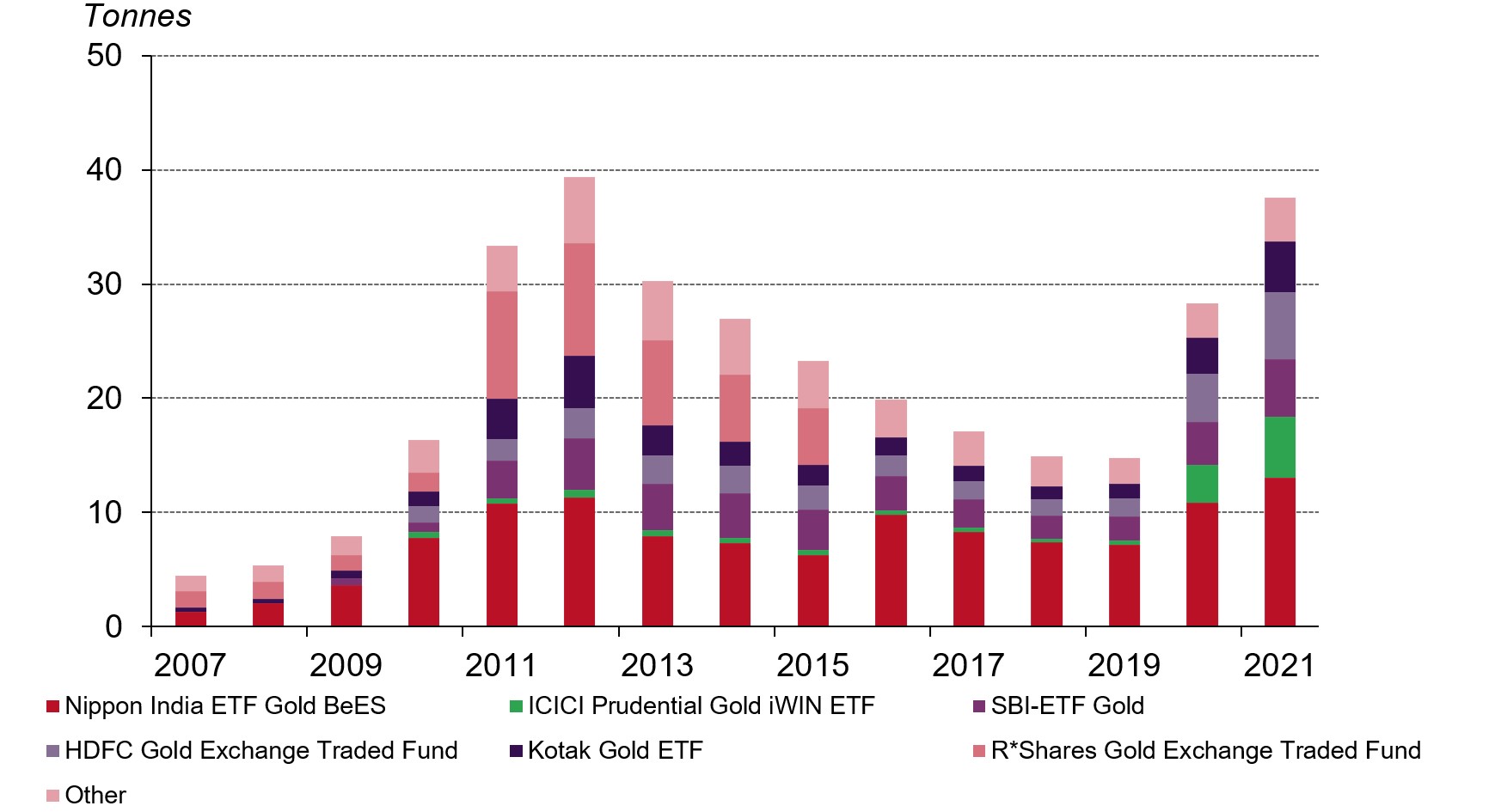

As the gold price rose more consistently in 2019, sentiment in the Indian gold ETF market improved - albeit marginally. It was in 2020 that momentum picked up significantly. The rising gold price, increased volatility in equity markets and economic uncertainty due to COVID-19 fuelled safe-haven demand into Indian gold ETFs. As a result, net inflows almost doubled in 2020 taking total gold ETF holdings in India to 28.3t by the end of that year.

This positive momentum carried into 2021. Indian investors continued to pile into Indian gold ETFs, driven by a lower price point, concerns over higher equity valuations and safe haven demand. Net inflows increased by 9.3t, taking gold holdings to 37.6t by the end of 2021 (Chart 1).

Chart 1: Total holdings of Indian gold ETFs increased further in 2021

Holdings of Indian gold ETFs on Indian exchanges

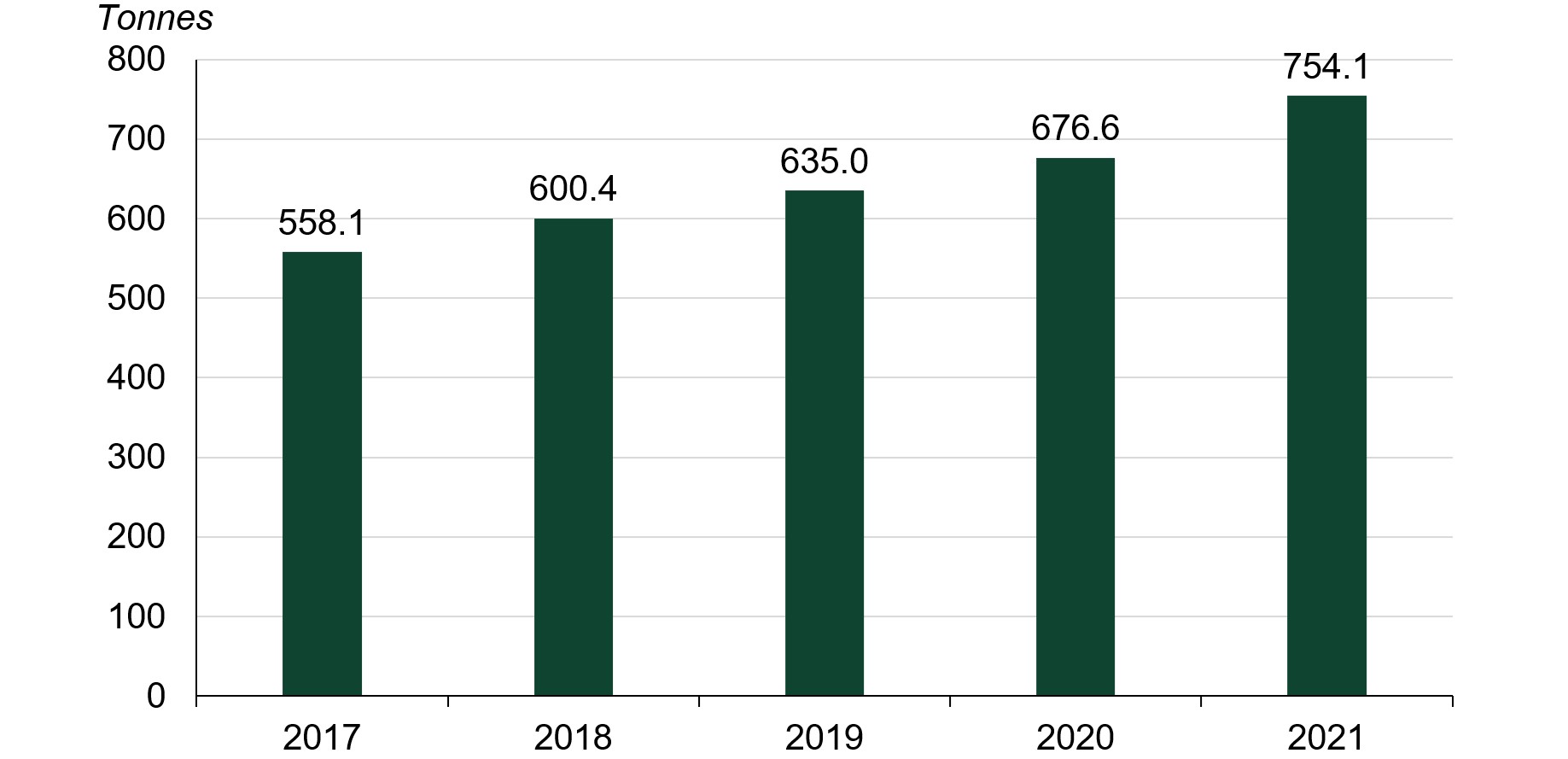

The Reserve Bank of India (RBI) ramped up its gold purchases in 2021

After adding 41.6t in 2020, the RBI ramped up its gold purchases in 2021, buying an additional 77.5t and taking its total gold reserves to 754.1 by the end of the year (Chart 2).6 The RBI added gold in order to diversify its foreign reserves and it is highly likely that it will continue to purchase gold in 2022. Many of the factors for gold ownership highlighted in our 2021 Central Bank Gold Reserves Survey are likely to remain relevant, giving continued uncertainty over the outlook for the economy.7

Chart 2: RBI ramped up its gold purchases in 2021

RBI 's gold reserves at end of the year

Indian investors face new challenges in 2022

Indian investors faced challenges in 2021: concerns of economic slowdown amid the emergence of the Delta variant and elevated equity markets. There may be similar concerns in 2022, but in addition there are likely to be new challenges:

- the possibility of higher and persistent consumer price inflation (CPI)

- an expectation of depreciation in the Indian rupee (INR), driven by the Fed’s higher interest rate and the widening trade deficit of 2021

- unexpected sharp and frequent policy rate hikes by the RBI.

In an environment of greater uncertainty and increased market volatility, gold’s attributes may help Indian investors improve the performance of their portfolios. Gold can enhance an investor portfolio through the following characteristics:

Gold is an effective portfolio diversifier

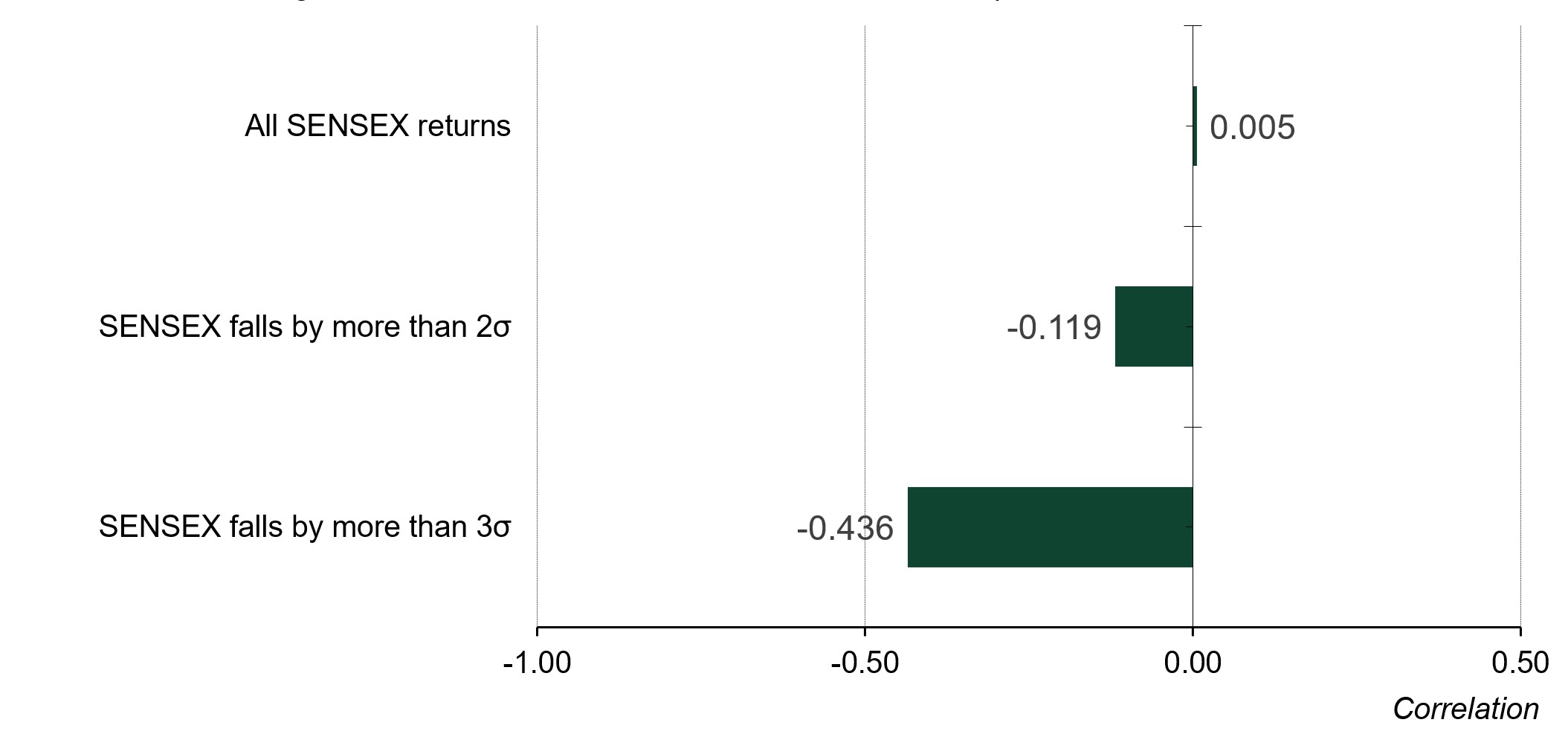

Gold benefits from flight-to-quality inflows during periods of heightened risk. The greater a downturn in stocks and other risk assets the more negative gold’s correlation to these assets becomes. But gold’s correlation not only works for investors in times of turmoil. Due to its dual nature as both jewellery and investment, gold’s long-term price trend is supported by income growth. When stocks rally their correlation to gold can increase, driven by the wealth effect and, sometimes, by higher inflation expectations (Chart 3).

Chart 3: Correlation of Indian stocks versus gold*

Correlation between gold and SENSEX in various environment of stocks' performance

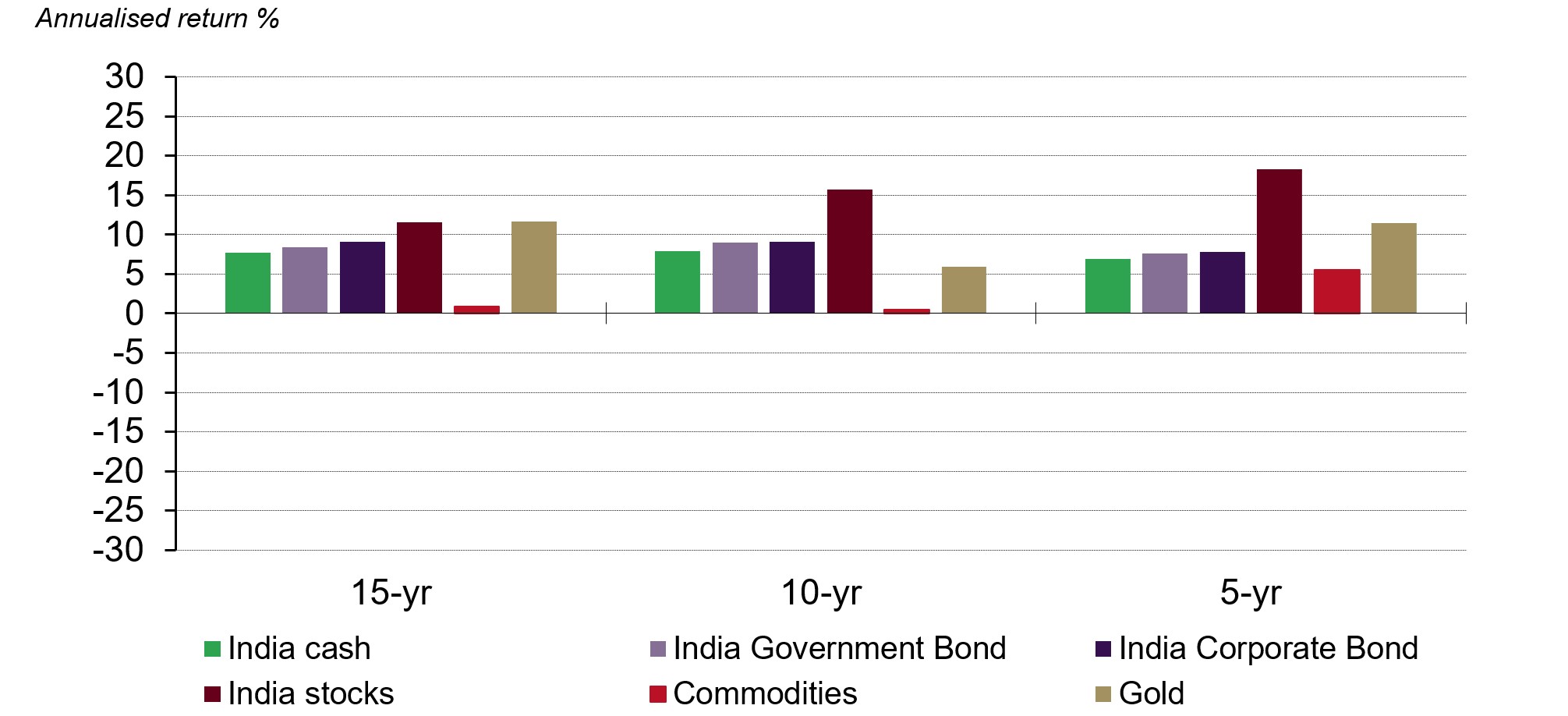

Gold has provided healthy returns in the long run

Returns are a crucial factor for any asset class. Looking at the last fifteen years, gold in rupees has delivered an annualised rate of return of 11.7%, marginally higher than equities (11.6%) and higher than returns on other asset classes such as bonds (government and corporate) and cash.8 Over the last five years, gold has underperformed equities but outperformed other asset classes such as bonds and cash (Chart 4).

Chart 4: Gold's long-term performance compared to other assets*

Gold can enhance portfolio performance

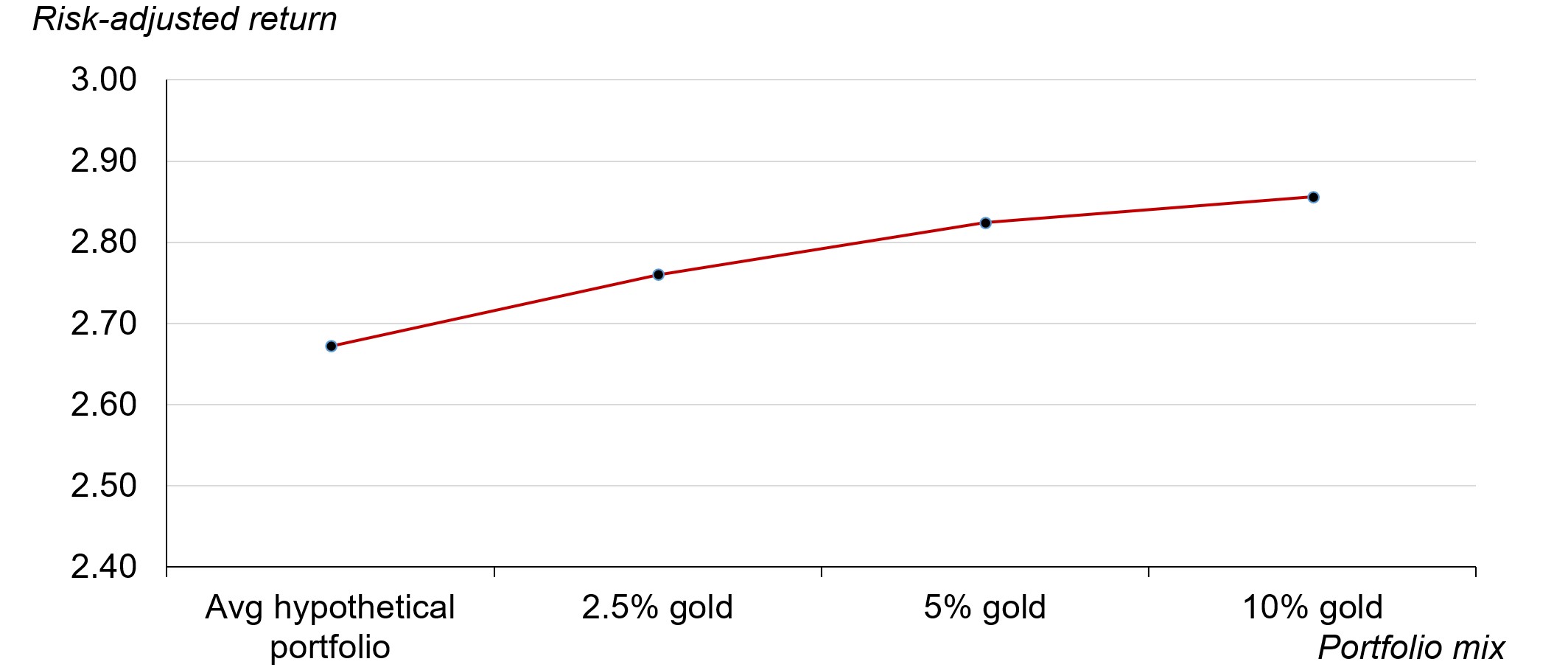

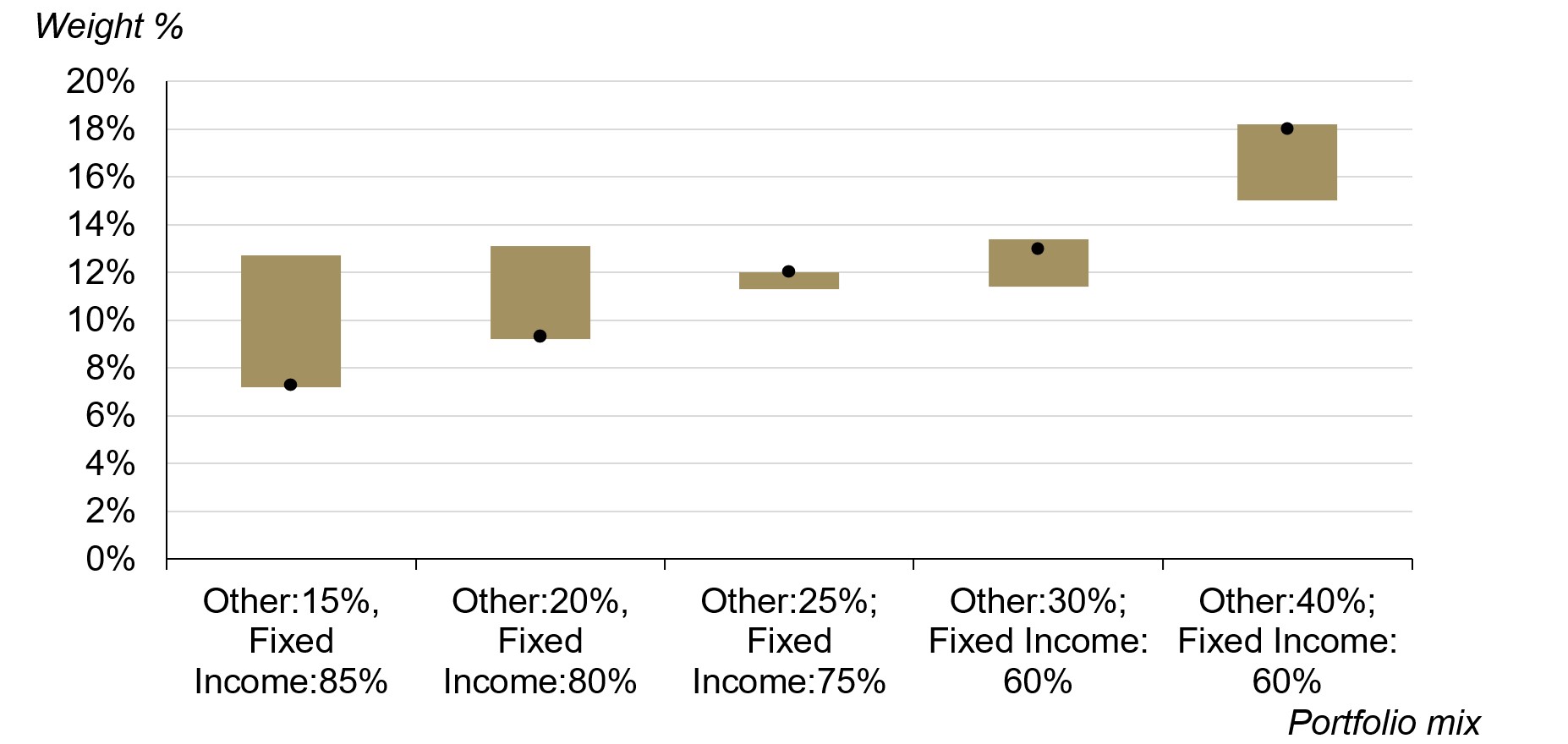

This combination of returns and diversifier properties means that adding gold can enhance the risk-adjusted returns of a pension fund portfolio. Indian investors with an asset allocation equivalent to that of an average institutional investor portfolio would have benefitted from including gold (Chart 5). Our analysis also shows that adding between 7% and 18% in gold to an average Indian institutional portfolio over the last decade would have resulted in higher risk-adjusted returns (Chart 6).9

Chart 5: Risk-adjusted return of a hypothetical institutional investor portfolio with various allocations to gold

Chart 6: Range of gold allocation for each hypothetical portfolio mix

Conclusion

Gold can clearly be considered a good investment for Indian investors. Well recognised for its diversification properties, it can deliver strong returns too. Adding 7-18% of gold to an Indian institutional average portfolio over the last decade would have resulted in higher risk-adjusted returns – an appealing scenario in these uncertain times.