Summary

- At the last monetary policy meeting held in October, the Reserve Bank of India (RBI) maintained its accommodative stance and kept its policy repo rate unchanged at 4%1

- The RBI suspended its bond-buying program but cautioned against premature tightening of monetary policy

- India’s retail inflation (CPI) has declined but core inflation remains elevated

- Gold can play a role in downside protection, diversification and as a hedge against inflation amid India’s low-rate environment and the current upside risk to inflation.

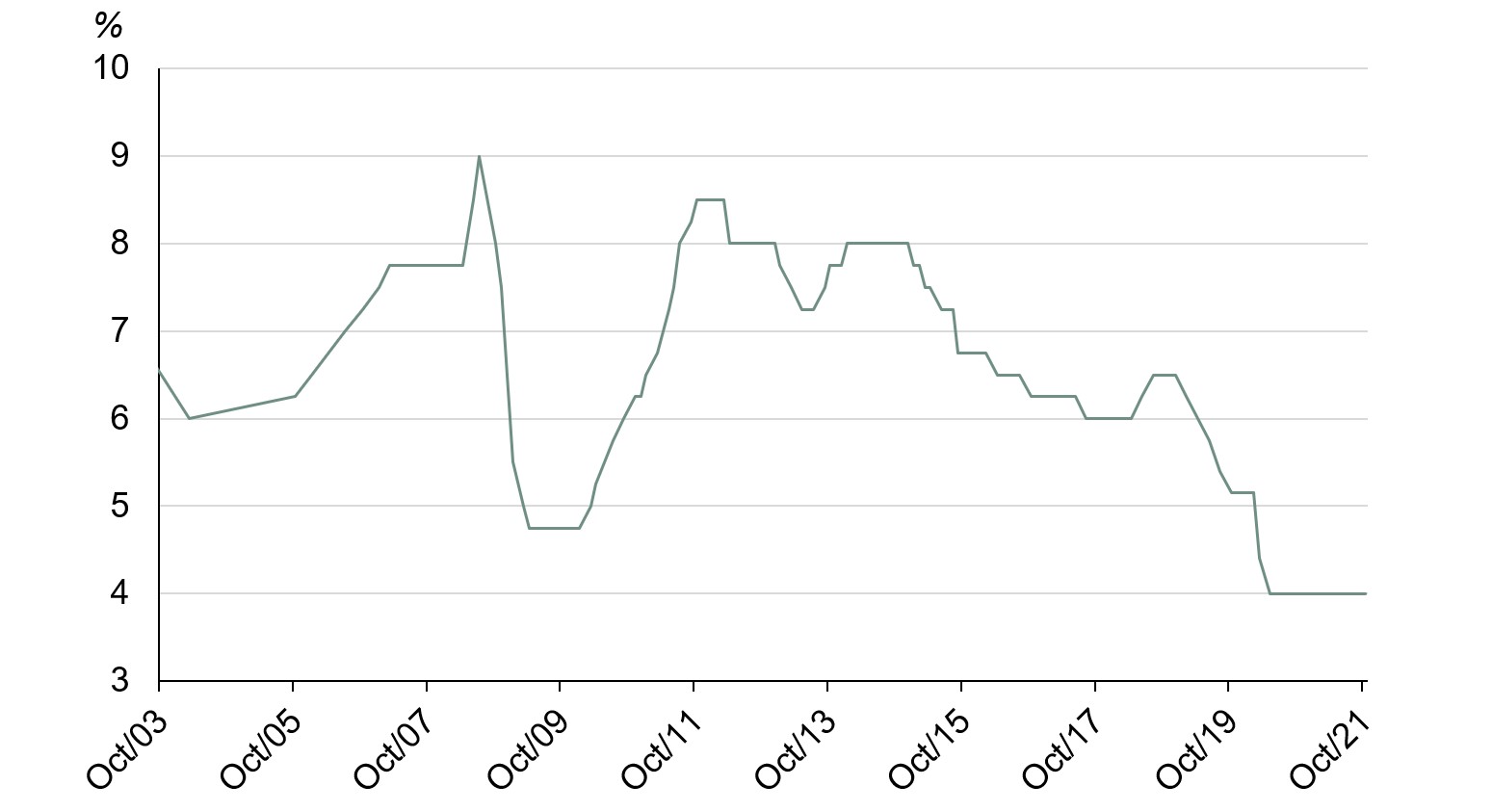

RBI kept its policy repo rate unchanged at the October meeting

Like many other central banks, the RBI lowered its policy repo rate during 2020 to mitigate the impact of COVID-19 on the Indian economy. In total, the rate was cut by 115bps last year to a record low of 4% in May 2020 (Chart 1).2

Chart 1: RBI has cut its policy rate to record low of 4%

Source: RBI, Bloomberg, World Gold Council

At its latest monetary policy committee meeting the RBI kept the policy repo rate unchanged at 4% and stated that it would continue with its accommodative monetary stance to achieve a medium-term target of 4% Consumer Price Inflation (CPI) within a band of +/-2%.

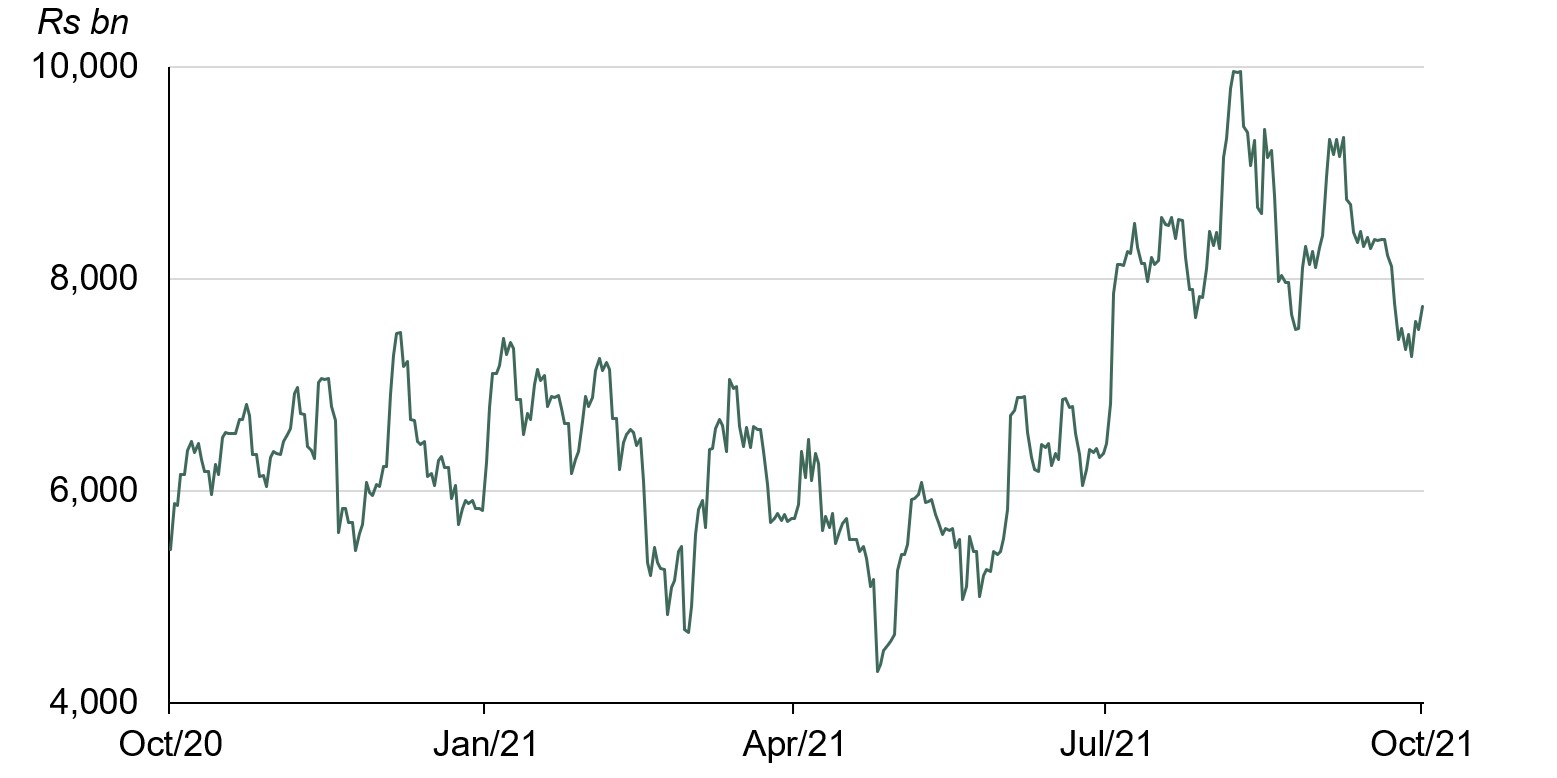

The RBI suspended its bond-buying program but cautioned against premature tightening of monetary policy

To provide liquidity to the market during the second wave of the pandemic, in April the RBI launched a secondary market G-sec Acquisition Programme (G-SAP).3 Under G-SAP, the RBI made bond purchases of Rs1tn (US$14bn) and Rs1.2tn (US$17bn) in Q2 and Q3 2021 respectively. Signalling the start of tapering, this quantitative easing measure was discontinued at the recent monetary policy meeting, as the RBI aims to reduce surplus cash in the banking system (Chart 2). This huge liquidity, which has swelled to Rs7.7tn (US$100bn) could lead to further steepening of the yield curve and presents an upside risk to inflation (Chart 3).

Chart 2: Excess cash in the banking system remains elevated

Source: Bloomberg, World Gold Council

Chart 3: Indian government bond yield curve has steepened after monetary easing

'10-year' minus '2-year' Indian government bond yield spread

Source: Bloomberg, World Gold Council

But despite the removal of its bond-buying programme, the RBI cautioned against any premature tightening of monetary policy in its latest monthly bulletin. Tighter monetary policy could stall recovery in the economy and result in stagflation. Considering this, the RBI will continue to provide policy support until economic growth is sustained and broad.

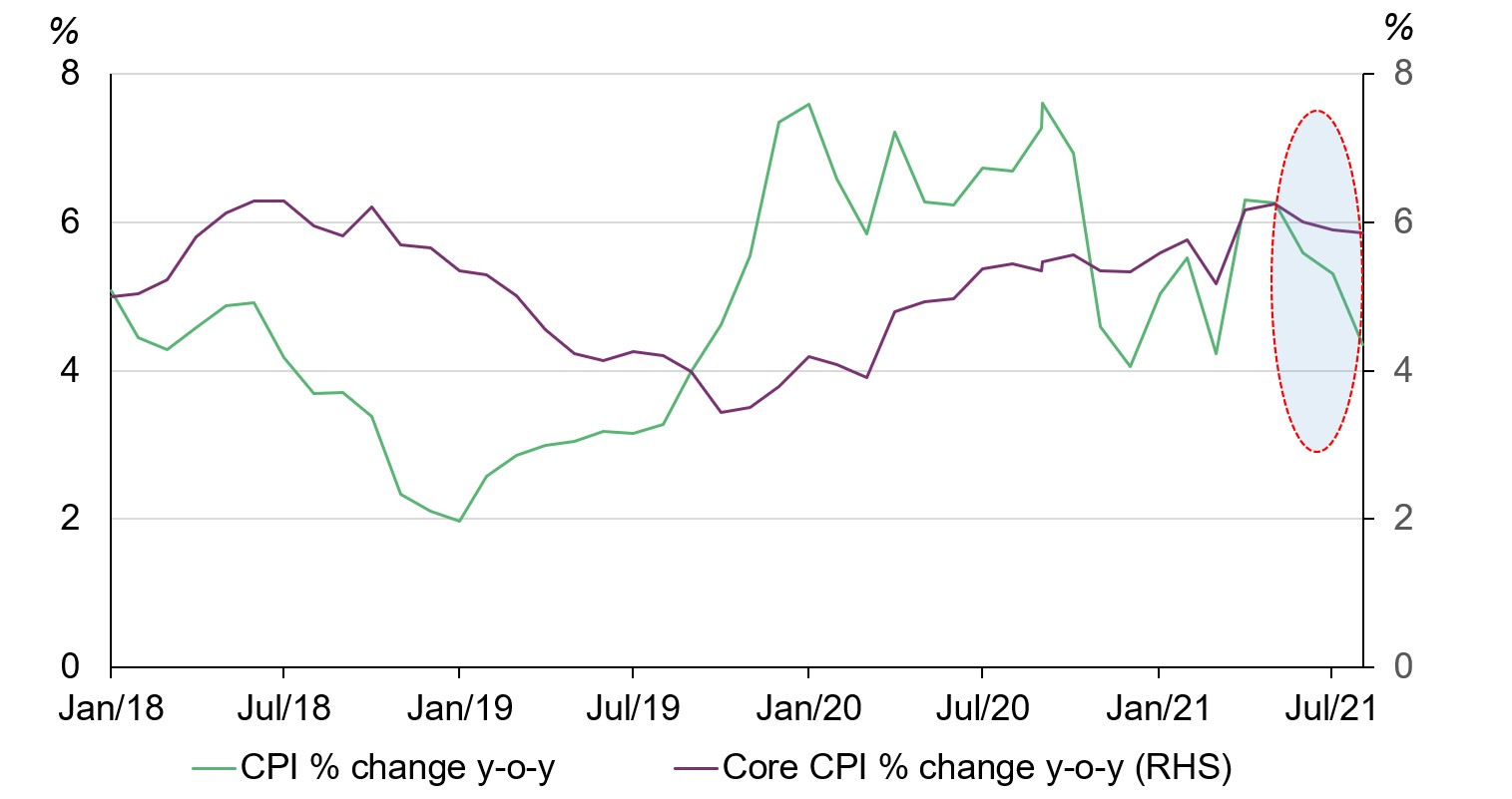

India’s retail inflation has declined but core inflation remains elevated

India’s retail inflation (CPI) declined from a high of 6.3% in June to 4.35% in September due to a moderation in food prices. Core inflation (excluding food and fuel) remains elevated and sticky at 5.9% during August-September (Chart 4) due to the pass-through of higher input costs in key goods such as passenger vehicles, two-wheelers, washing soda, hair shampoo and stainless steel.

In the latest Monetary Policy Report the RBI highlighted the following factors as upside risks for inflation:

- 10% rise in crude oil prices to raise inflation by 30 bps

- 5% depreciation in INR exchange rate to raise inflation by 20 bps

- 1% higher global growth in global economy to raise inflation by 30 bps.

Chart 4: India's retail inflation has declined but core inflation remains sticky

India's CPI % change y-o-y vs core CPI % change y-o-y

Source: Bloomberg, World Gold Council

Gold’s role in India’s low-rate environment

The low interest rate environment that has challenged investors over the past year is creating structural changes in asset allocations, pushing investors toward greater portfolio risk in search of return. Our analysis suggests that this will likely increase the need to hold assets such as gold for downside protection and diversification.

The huge liquidity in the banking system presents an upside risk to inflation. Over the last 40 years gold has delivered an average annual return of 10% in rupees, clearly outperforming CPI inflation, which grew by an average of 7.4% over the same period.4 Gold can provide an effective hedge against the expectation of an upside risk of inflation in India.

Conclusion

The RBI has started tapering its stimulus measures, but excess cash in the banking system poses an upside risk to inflation. Inflation may also stem from pass-through of higher input costs. The RBI is showing caution against premature tightening of its monetary policy in an effort to avoid stagflation.