Summary

Last week, the CSI300 stock index dropped by 5.5%, its largest weekly loss since February. Interestingly, China’s efforts to encourage new births were signalled as the main driver. After the announcement of the 3-child policy this June, policy makers unveiled detailed supporting measures in July.1 As a part of these measures, China started reforming the private education industry, banning companies in this sector from making profits, raising capital or going public.2 This move, which hampered Chinese private education and tutoring stocks, aims to ease local families’ burdens of raising children and encourage new births: an industry survey conducted in 2019 showed that a quarter of Chinese families spent between 20% and 30% of their annual income on children’s education and related services.3

While the possible outcomes of the three-child policy and various supporting measures remain uncertain, we believe there is a link between birth rates and gold consumption, and the details are worth analysing.

- In the long term, economic growth is likely to benefit from higher birth rates, thereby increasing gold consumption

- The tradition of gifting gold – in various forms – to newborns, supports gold demand in China with the birth rates rising

- While the costs of raising additional children deplete the family’s discretionary budget in the short and mid-term, the economic implication of higher birth rates could accelerate a family’s income growth over the long term, thus supporting expenditure on recreational consumption such as gold jewellery.

China’s response to the population challenge

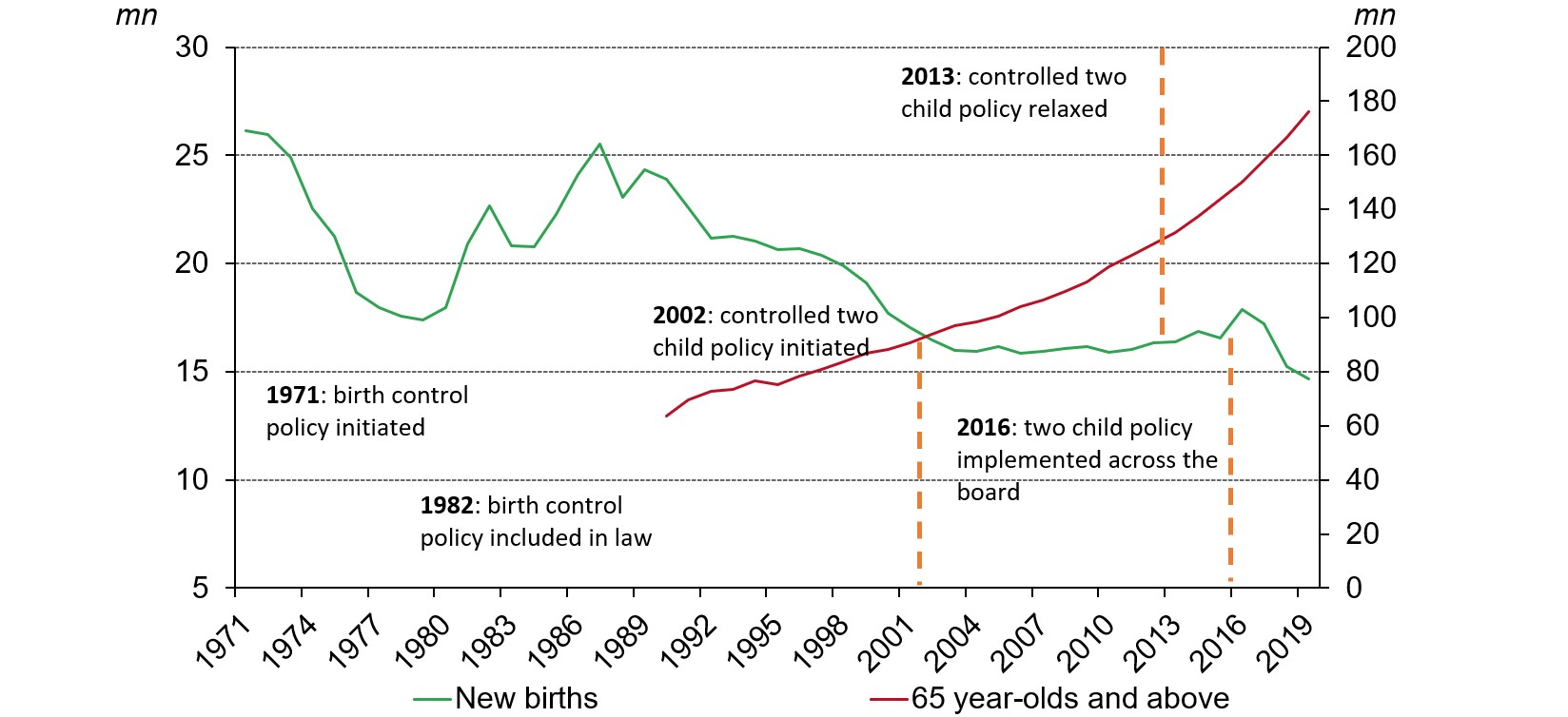

China’s population structure is creating challenges to the country’s long-term economic growth. New births in China have fallen sharply since 2017, dropping to 14.65 million in 2019, the lowest since 1961. Meanwhile, the population is aging rapidly: Chinese population census data shows that the percentage of those aged 65 and over increased from 7% in 2000 to 8.9% in 2010 and 13.5% in 2020. And this aging trend is likely to intensify as forecasted by the World Health Organisation.

The Chinese population: fewer new births, intensifying aging trend

Source: National Bureau of Statistics, World Gold Council

In acknowledgment of these challenges to long-term economic growth China has been gradually relaxing its birth control policy since the early 2000s. Recently, policy makers announced at the Political Bureau of the CPC Central Committee meeting on 31 May that Chinese couples may have up to three children – the previous limit was two.4 And in July, detailed plans reducing Chinese households’ burdens of raising children and encouraging new birth started to unfold.5

Could this revised policy impact China’s gold demand? We believe it can, conditional on its effectiveness.

Potential implications for China’s gold consumption

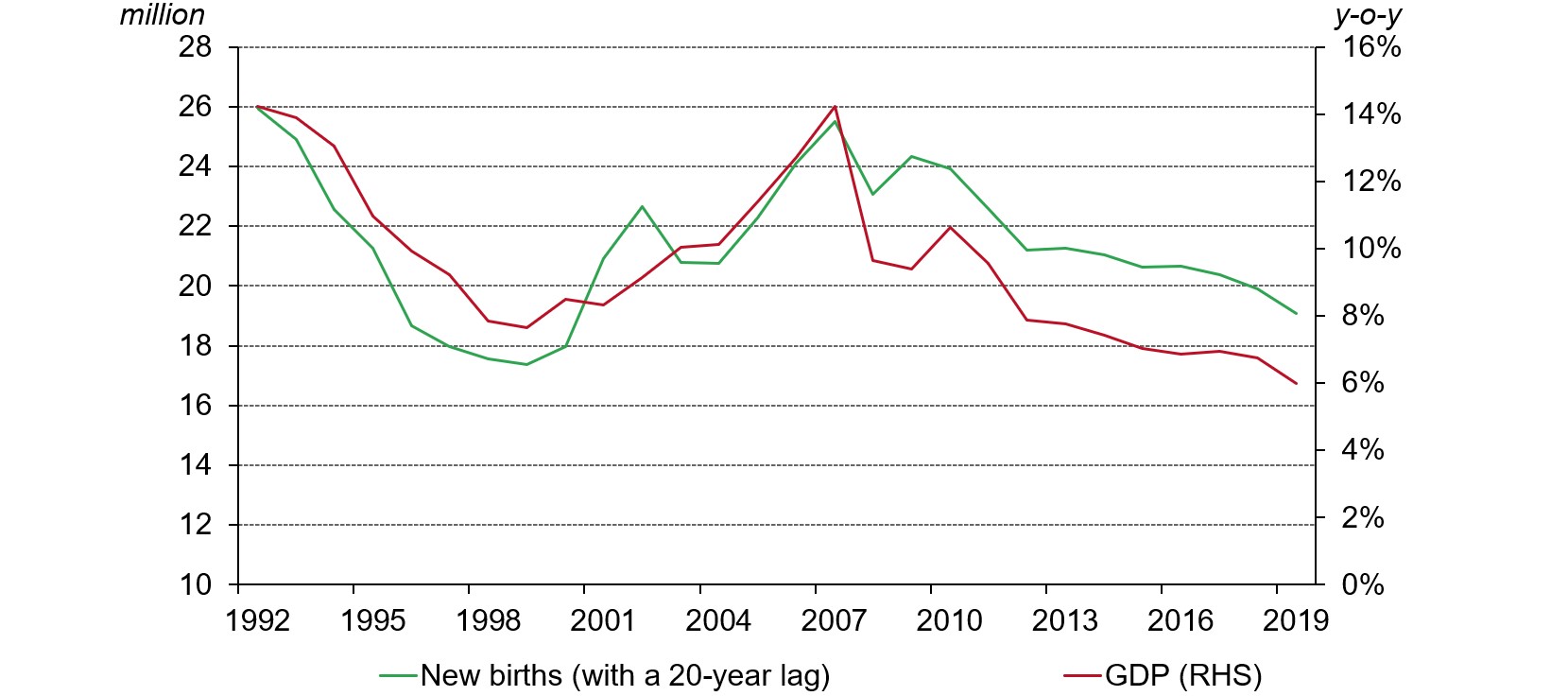

From a macroeconomic perspective, policies aiming to slow or reverse a declining birth rate could be beneficial to Chinese gold demand in the long run. According to the Cobb-Douglas Production Function, a country’s aggregate output depends primarily on the nation’s capital and labour inputs. And the Nobel Prize winning Solow’s Growth Model also indicates that the long-term growth of an economy is a function of labour growth, capital inputs and technological developments.6 Assuming positive outcomes of the three-child policy, a higher birth rate is likely to increase the labour force in 15 years, contributing to China’s economic growth in the long run.7

The number of new births has a long-term impact on China's economy

Source: National Bureau of Statistics, World Gold Council

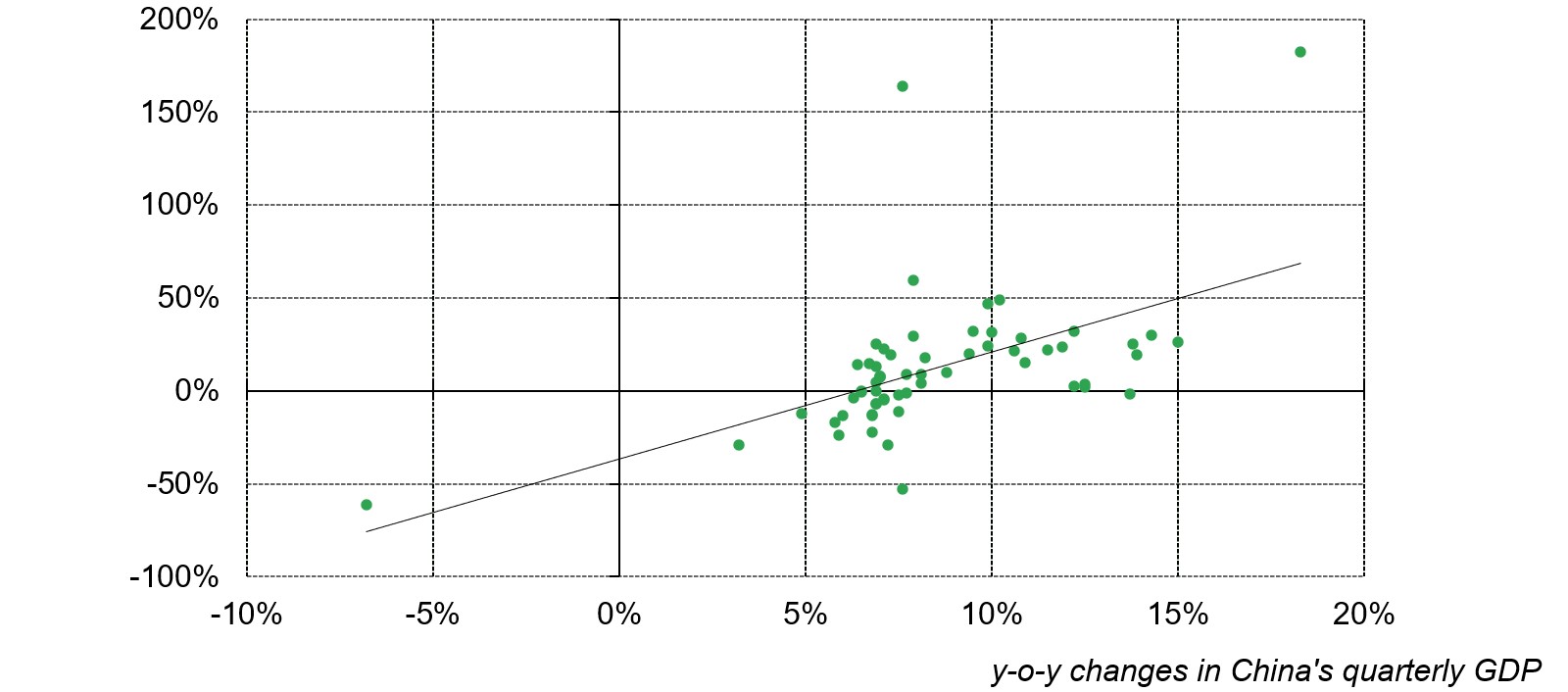

And our historical analysis suggests a positive relationship between China’s gold consumption and the nation’s economic strength.

Stronger economic growth, higher gold demand in China*

y-o-y % changes in China's quarterly gold consumption

*Based on y-o-y % changes in China’s quarterly gold jewellery, bar and coin sales as well as the y-o-y changes in China’s quarterly GDP between Q1 2006 and Q1 2021.

Source: Metals Focus, National Bureau of Statistics, World Gold Council

We believe that the country’s efforts to boost the birth rate should be good news for Chinese gold retailers. First, it is tradition to gift gold to new-born babies in the form of locks, bracelets, anklets or zodiac-themed pendants for good luck. And sales of these gold products fluctuate with the number of new births each year in China. Second, as previously stated, a higher birth rate has the potential to lead to stronger economic growth in the long run, supporting retailers’ gold product sales.

Figure 2: Various baby gifting gold products

Source: Chow Taifook, Batar

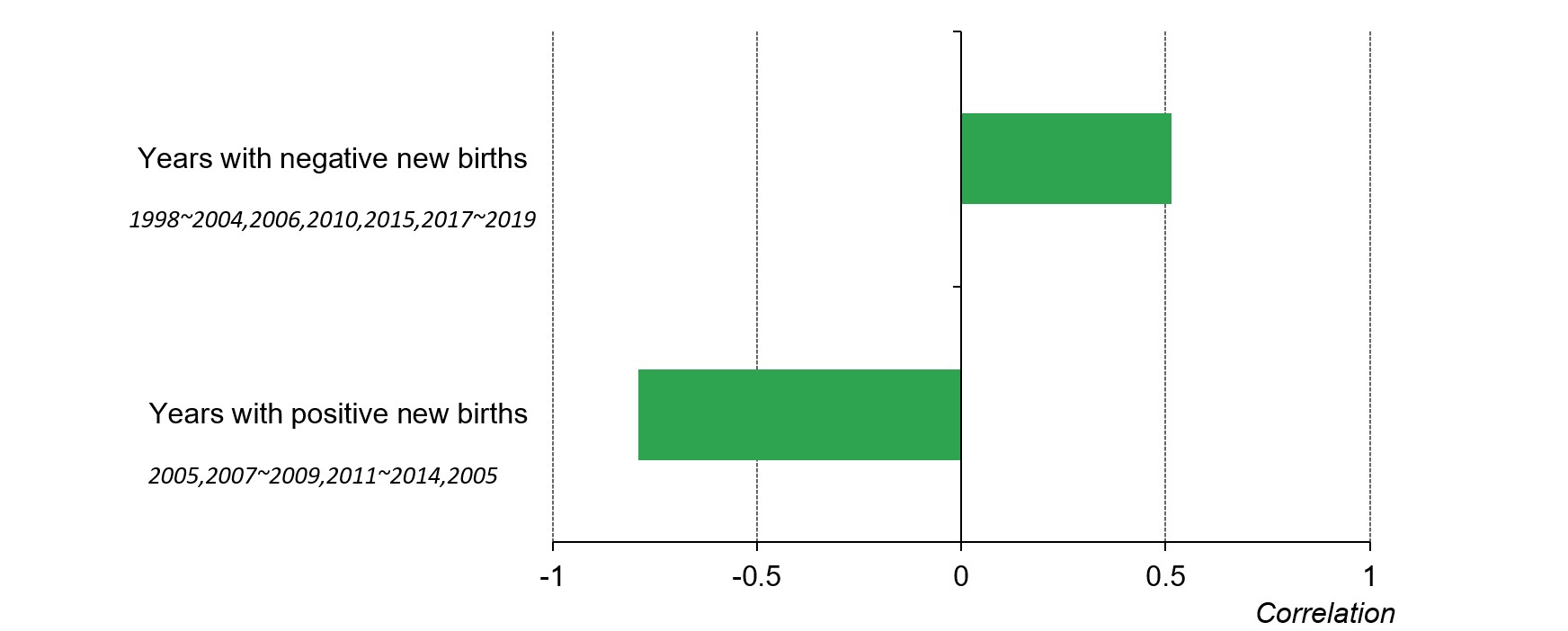

In theory, however, the cost of raising a larger family lowers discretionary budget over the short and medium term. Raising children is costly. Direct costs of raising a child to the age of 18 include food, clothes, healthcare, childcare, education, transportation and entertainment, but there are also indirect costs such as time out from paid work. Hence, as the number of children increases, the family’s fixed costs rise, limiting disposable income for items such as gold jewellery.

In general, less children to raise, higher discretionary purchasing power*

Conditional correlation between changes in China's new births and retail consumption of gold, silver, jade and gem jewellery products

Source: National Bureau of Statistics, World Gold Council

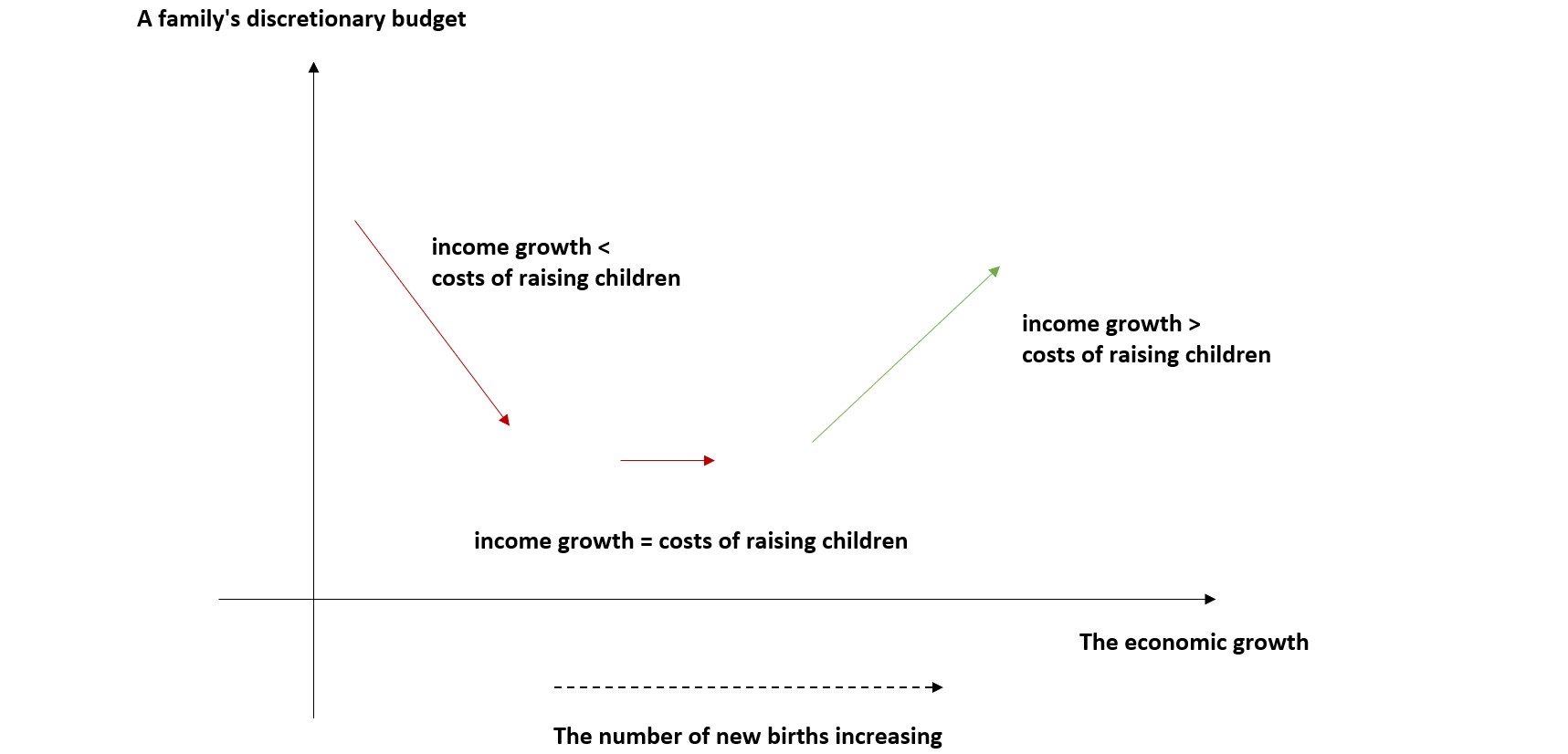

In the future it is possible that incentives may be offered for families to have more children and this would, over the longer term, change the relationship between the cost of raising children and the family’s discretionary budget. As previously mentioned, a higher birth rate has been positively linked to economic growth in the long run. Therefore, there is likely a turning point when the growth in a family’s income outweighs the reduction in its discretionary budget.

The diagram below stylises the hypothetical interaction between a family’s discretionary budget and the economic development conditional on the family’s “net” income growth, after the costs of raising children. We believe that when a family’s income growth, resulting from the economic growth amid a higher birth rate, outweighs the cost of raising additional children, the family’s purchasing power on discretionary items – such as gold jewellery – will likely increase.