Summary

- The domestic gold price ended 5.1% lower in June at Rs46,504/10g1

- Retail demand improved as lockdowns eased

- Indian official imports remained muted and the discount in the local market narrowed

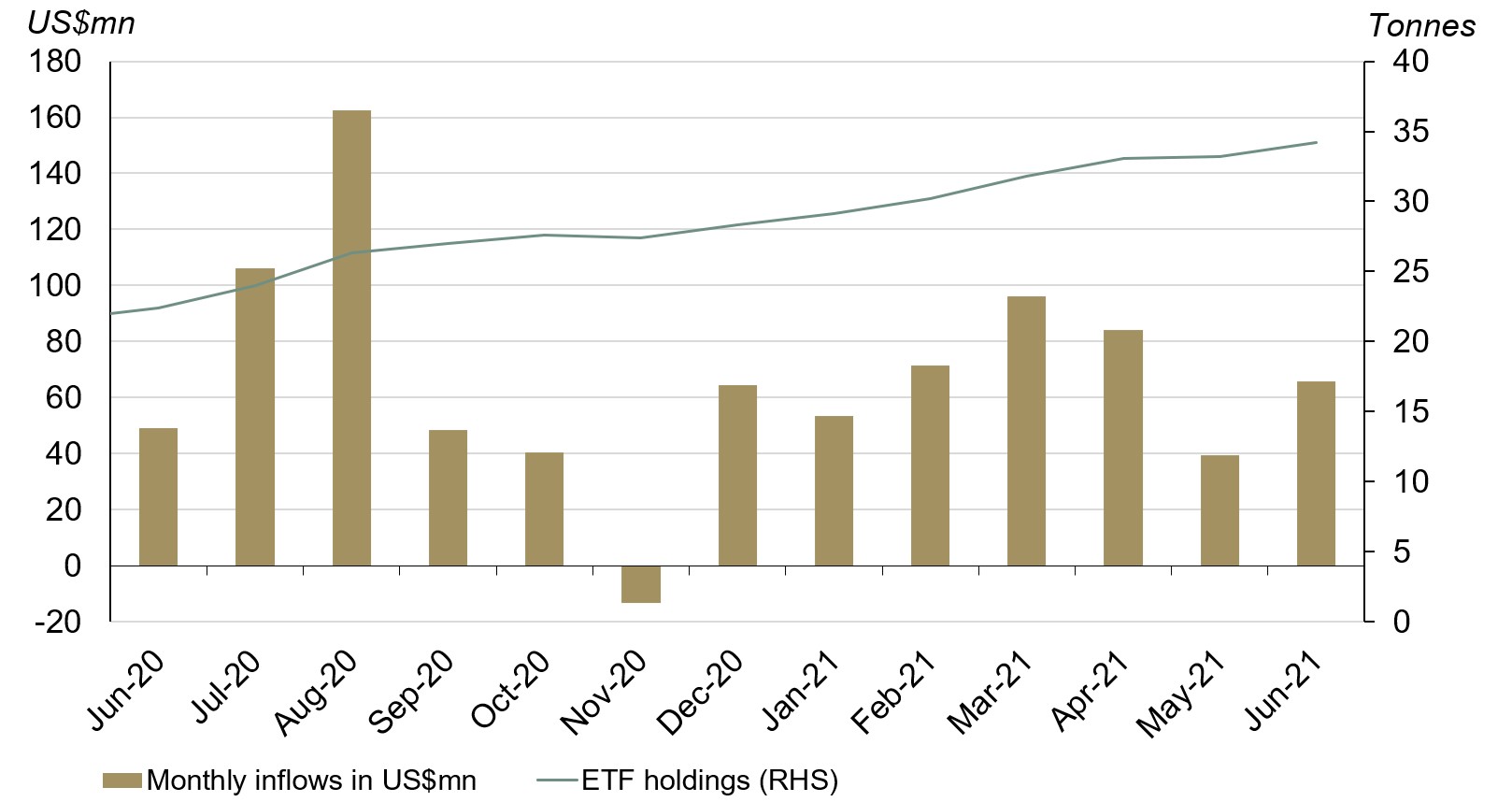

- The correction in the domestic gold price lured local investors towards gold ETFs. Total holdings for Indian gold-backed ETFs (gold ETFs) reached 34.2t by the end of June; a net inflow of 1t (Rs3.6 bn; US$66mn)

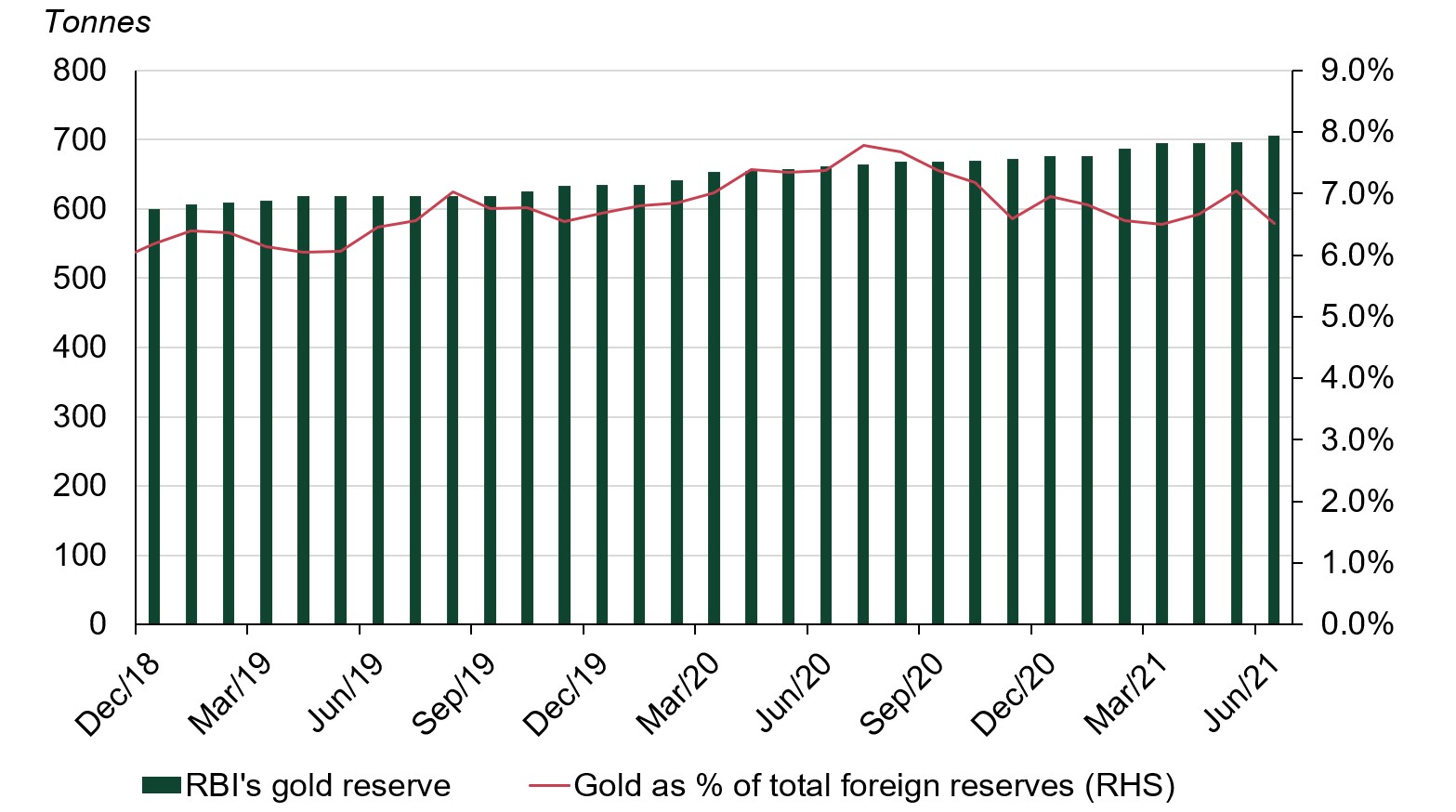

- The Reserve Bank of India (RBI) added 9.4t of gold to its reserves in the month increasing its total gold reserves to 705.6t.

Gold prices declined in the month

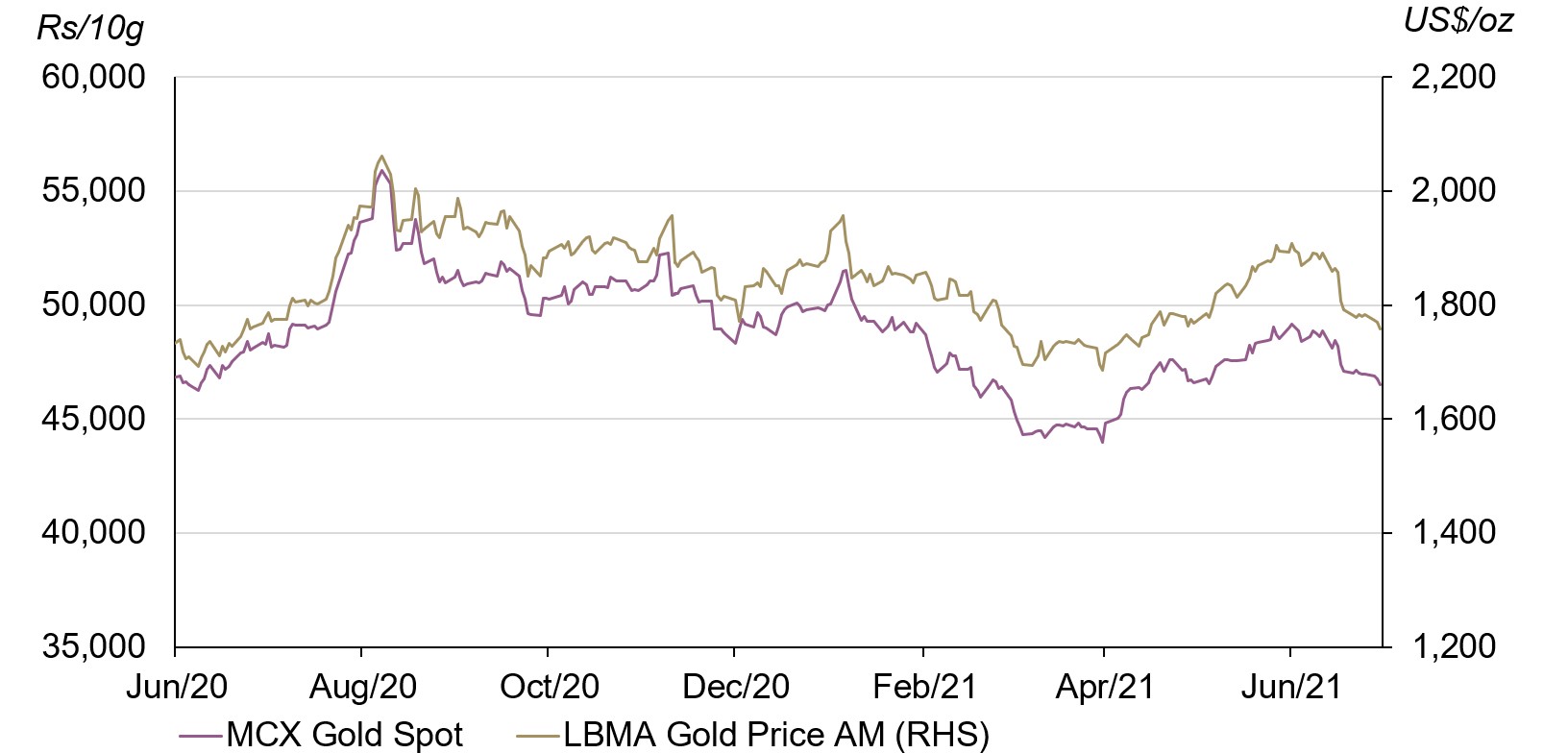

International gold prices fell in June on the back of a more hawkish-than-expected statement by the US Federal Reserve.2 But with the INR depreciating by 2.5% against the USD, the downside to the local gold price was curtailed. As a consequence, the LBMA Gold Price AM in USD and MCX Gold Spot in INR fell by 7.1% and 5.1% respectively during the month (Chart 1).3

Chart 1: Gold prices declined in the month

Domestic gold price in rupees vs LBMA Gold Price AM in US dollars

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Economic indicators showed signs of recovery spurred by unlocking measures

As restrictions eased, several economic indicators showed signs of recovery during the month. The high-frequency indicators of trade and demand, such as E-Way bill, fuel demand and automobile sales, witnessed a m-o-m growth in June.4 While these signs of economic recovery are positive, we wait to see whether there will be sustainable increase in demand.

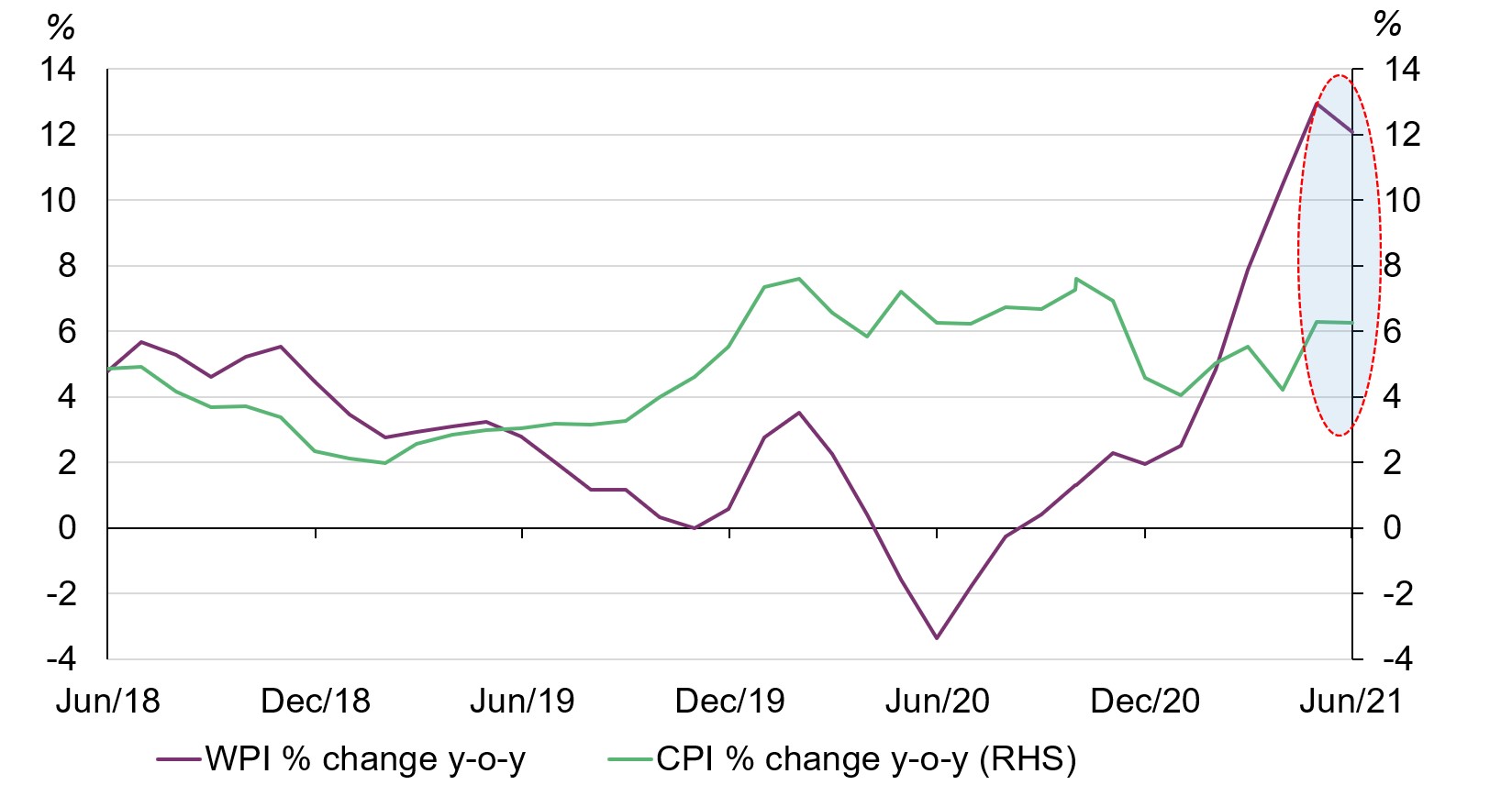

Wholesale and retail inflation eased marginally

In June, India’s wholesale inflation (WPI) and retail inflation (CPI) eased marginally to 12.07% and 6.26% respectively y-o-y, from May’s y-o-y figures of 12.94% WPI and 6.3% CPI; the reduction was due to moderation in food prices. Continuing double-digit WPI inflation and the possibility that it will spill over into CPI inflation remains a concern and the RBI will likely keep watch on the CPI’s future trajectory.

Chart 2: India's wholesale price and retail inflation eased in June

India's WPI % change y-o-y vs CPI % change y-o-y

Source: Bloomberg, World Gold Council

Retail demand improved as lockdowns eased

With the daily number of COVID cases falling to ~130k at the end of May from a peak of ~400k in the first week of the month, states started to ease lockdown restrictions from mid-June. Retail demand improved during the month on the back of the re-opening of jewellery stores. Retailers witnessed encouraging recovery trends and increased footfall as consumers made wedding purchases for ceremonies scheduled in July, as well as retrospective purchases for weddings solemnised in April and May when stores had been closed.

The 4% correction in the gold price in mid-June led not only to the release of pent-up jewellery demand but also to an increase in investment demand, with small denomination coins (4g and 8g) preferred by retail investors. Despite the lockdown, which had been imposed for almost the entire month in important gold-consuming states such as Tamilnadu and Karnataka, one prominent large retailer recorded marginally better demand in June 2021 than in June 2020.

For July, anecdotal evidence suggests that gold demand has remained moderately strong in the first half of the month, predominantly for wedding purchases. However, demand is expected to fizzle out from mid-July onwards as there are no further wedding dates in the month and as the onset of Aadi month in Tamilnadu approaches.5

Mandatory hallmarking is introduced from 16 June

A press release from the Ministry of Consumer Affairs announced the implementation of mandatory hallmarking, effective 16 June across 256 districts of India for 14k, 18k and 22k gold. Other caratages of 20k, 23k and 24k could also be included and clarification from Bureau of Indian Standards (BIS) is awaited in this regard. Mandatory hallmarking will help to safeguard consumer interest and trust in gold and is an important step for the development of gold industry in India.

Regarding implementation of mandatory hallmarking, the industry has raised issues regarding the hallmarking unique ID (HUID) process due to the time it requires (two to three times more than for pre-HUID regime). Backend software from BIS is not yet completely automated and requires manual intervention.6 The delay this causes to the hallmarking process is likely to continue and could create operational challenges for retailers.

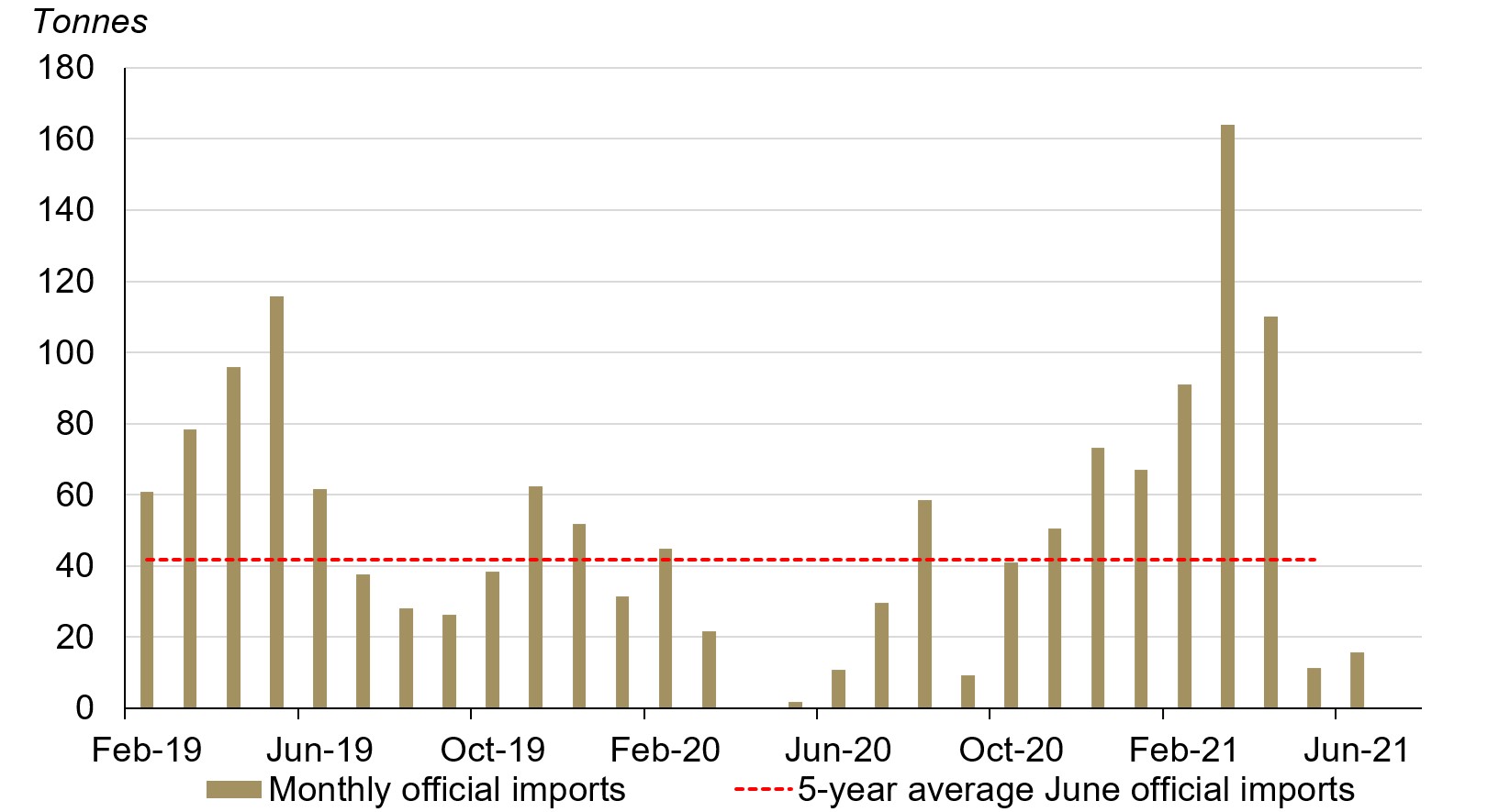

Indian official imports remained muted

Indian official gold imports totalled 15.8t in June 2021 – 45% higher y-o-y and 39% higher m-o-m but still well below 5-year average June monthly official imports of 41.8t (Chart 3). During June a total of six banks, nominated agencies and exporters imported 5.9t of bullion and 16 refineries imported an equivalent of 9.9t of fine gold content in the form of gold doré. With mandatory hallmarking becoming effective from 16 June, the trade is likely to be more focused on reducing its inventory of non-hallmarked jewellery. Considering this, we anticipate that official imports will increase only marginally in July.

Chart 3: Indian gold official imports well below 5-year average June monthly imports

Indian monthly official gold imports from February 2019 - June 2021

Source: Infodrive India, Ministry of Commerce & Industry Govt. of India, World Gold Council

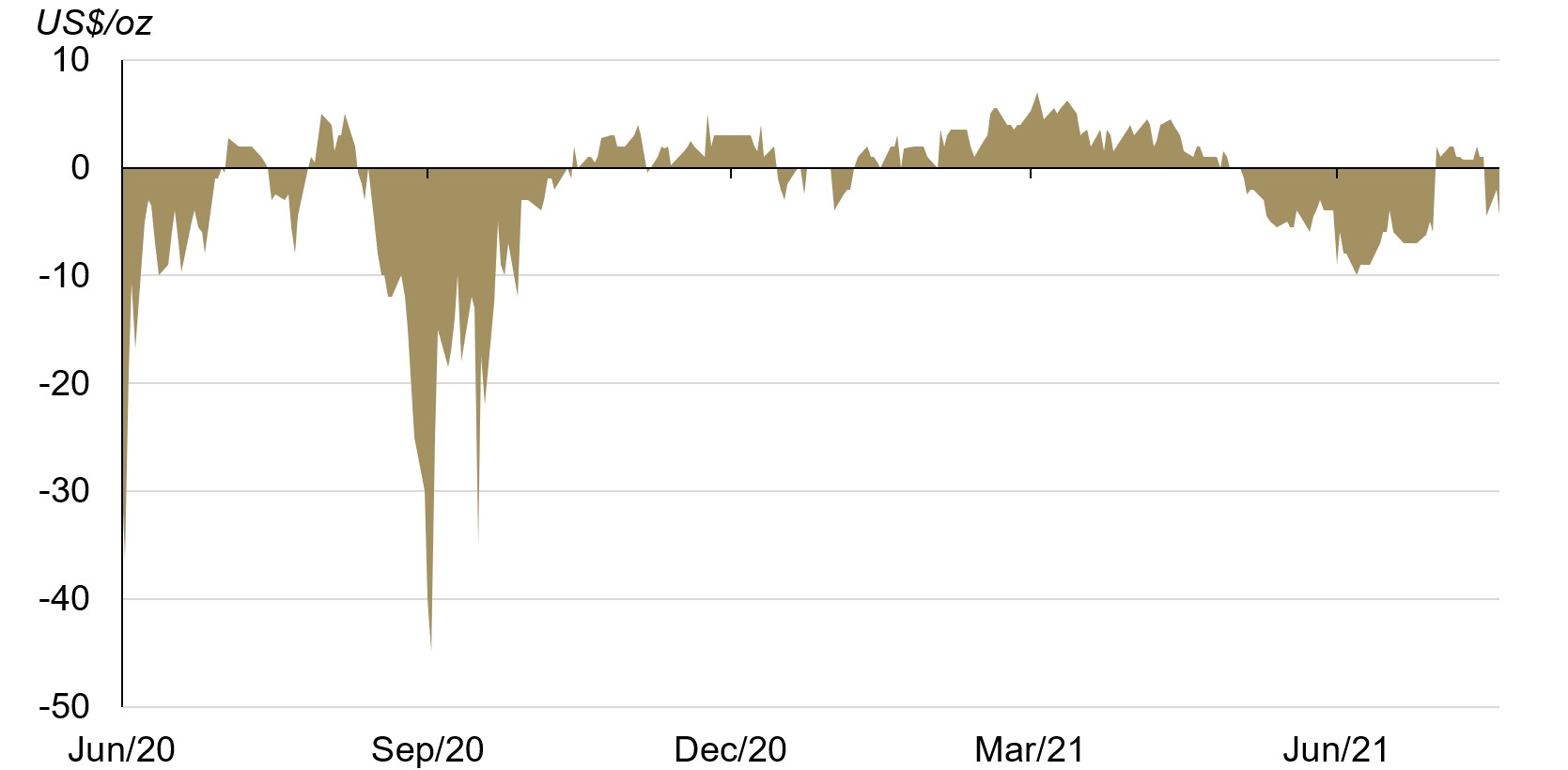

Discount in the local market narrowed

With most states remaining under lockdown through to the second week of June, the discount in the local market widened further to US$9-10/oz. However, as lockdowns eased and activity resumed, by the third week of June the discount had narrowed to US$4/oz (Chart 4). The local market flipped back into premium in the first week of July, led by the recovery in retail demand and some restocking from retailers in expectation of a higher international gold price. The local market remained in premium of US$1-1.5/oz for the first two weeks of July before the price jump disrupted the recovery in demand and pushed the local market into a discount of US$4-5/oz during the third week of July.

Chart 4: Discount in the local market narrowed towards the end of the month as demand recovered but the trend is fragile

Difference between MCX Gold Spot Price and landed gold price in India derived from LBMA Gold price AM

Source: NCDEX, World Gold Council

The lower gold price enhanced investor interest in gold ETFs

The correction in the domestic gold price lured local investors towards gold ETFs with inflows increasing by 1t (Rs3.6bn; US$66mn) during June, taking total gold ETF holdings to 34.2t – the highest since September 2013 (Chart 5).

Chart 5: Indian gold ETF holdings reached 34.2t by end of June

Source: Respective ETF providers, Bloomberg, World Gold Council

The RBI added 9.4t to its gold reserves

After purchasing 0.9t of gold last month, the RBI bought 9.4t of gold in June, increasing its gold reserves fractionally to 705.6t or 6.5% of total reserves (Chart 6).7 The RBI has stepped up purchases over recent years, adding 29t to its gold reserves y-t-d. As per our central bank gold reserves survey 2021, central banks continue to remain positive towards gold, with roughly the same number of central banks expected to buy gold this year as compared to last year.

Chart 6: RBI added 9.4t to its gold reserves in June

Source: IMF, RBI, World Gold Council

Based on MCX Gold Spot price in rupees as of 30 June 2021.

Federal Reserve FOMC Statement, 16 June 2021.

We compare the LBMA Gold Price AM with the MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

An E-Way bill is an electronic bill for movement of goods and is generated on the E-Way Bill Portal. A GST registered person cannot transport goods in a vehicle without an E-Way bill if the value of goods exceeds Rs50,000.

Aadi month starts from 17 July and ends on 16 August in 2021. It is considered an inauspicious period for gold purchases by the local community in Tamilnadu.

HUID is a six-digit alpha-numeric code tagged on to each piece of jewellery to identify assaying and hallmarking centers (AHCs) or the jeweller who had hallmarked the jewellery. HUID was implemented from 1 July 2021 and is currently restricted to assaying and hallmarking centres (AHCs) and not jewelers.

Central Bank data is taken from IMF-IFS; IFS up until May and weekly statistics from the RBI for June. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics