In this article for Pensions Age, I review the key findings from a recent World Gold Council/Pensions Age poll and highlight why gold might provide an answer.

Pensions Age: Shifting approach to pension fund strategies an opportunity for gold

4 May, 2021

In many ways you could be forgiven for thinking 2020 never ended. While optimism has risen recently, with many hopeful that the worst is over, there are nonetheless several significant risks which investors must still face.

The development and ultimate roll-out of vaccines has been a giant leap in the global fight against Covid-19 but concerns around the long-term well-being of the global economy continue to dominate the agenda. Governments have unleashed unprecedented amounts of fiscal stimulus and central banks have committed to keeping interest rates low in the short term, as well as indicating a greater tolerance for higher levels of inflation.1

These actions, while understandable, could have far-reaching consequences for investors. Expanding budget deficits and growing money supply may increase inflationary pressures, while prolonged periods of loose monetary policy may impact asset performance and distort asset allocations for years to come.

For pension funds the stakes are particularly high. With depressed bond yields reducing income and low interest rates inflating future liabilities, this has led to more fund managers considering increasing portfolio allocations towards alternative investments. A recent snap poll conducted jointly by the World Gold Council and Pensions Age highlights how portfolio strategies are expected to evolve in response to the new financial environment.

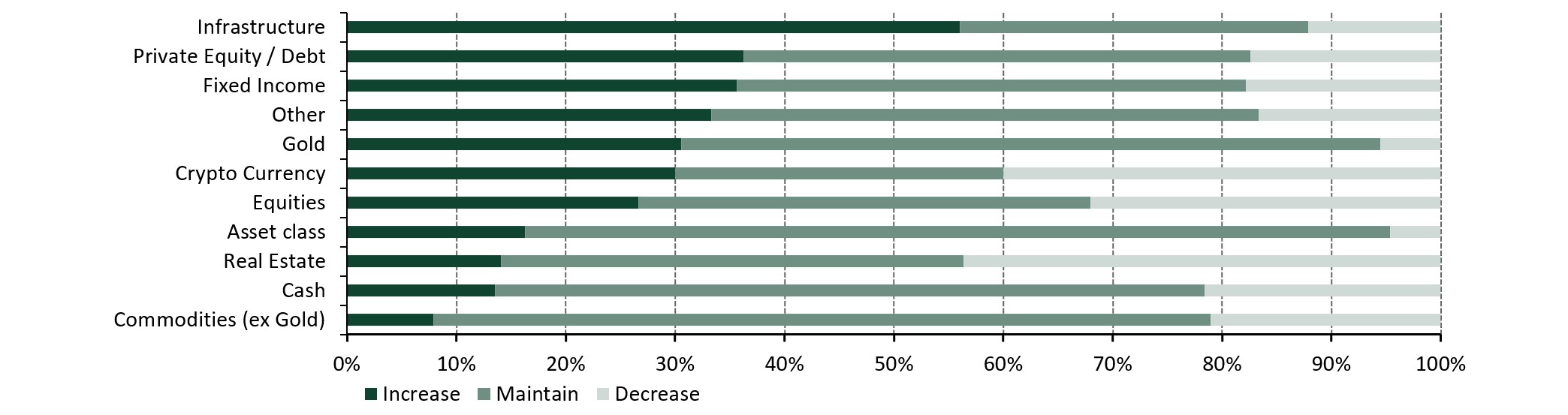

How do you think your asset allocation will change during 2021?

Source: World Gold Council

Respondents indicated that they planned to increase allocations to infrastructure (56%), private equity/debt (36%) and real estate (14%), at the expense of more mainstream asset classes such as equities and, to a lesser extent, cash. Findings from Willis Towers Watson also show that by the end of 2020 alternative assets accounted for 26% of all pension fund assets, up from 23% in 2019.2

While these asset classes have the potential for greater returns, thereby helping to plug the funding deficit in the UK, our analysis has revealed that they can be associated with lower levels of liquidity and higher levels of volatility.3 This represents a significant risk for pension funds aiming to achieve their funding targets and manage costs.

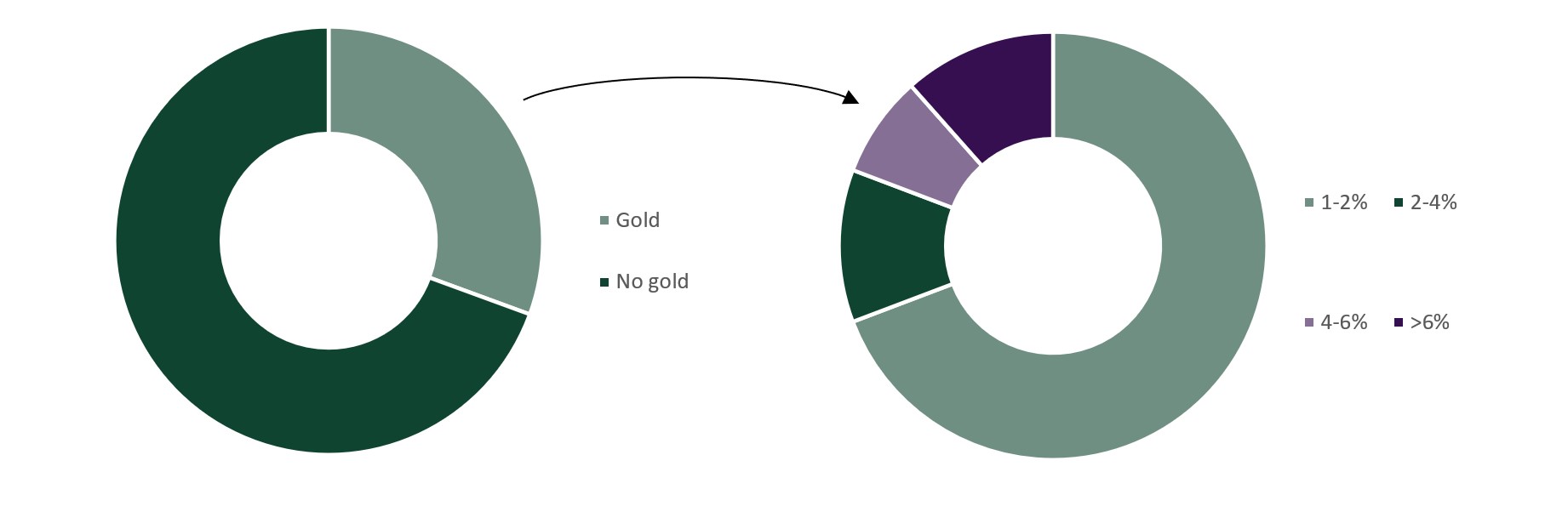

Gold, on the other hand, is still relatively under-owned by pension funds, and the findings from the poll confirm this. Less than a third (31%) of respondents hold an allocation to gold, and of those that do, 69% only had an allocation between 1-2% of their overall portfolio.

Gold’s unique characteristics could bring multiple benefits to a pension fund portfolio

With many pension funds looking to de-risk their long-term liabilities, there is a need to protect yield as well as generate it. For this reason, we believe that an investment in gold can address these concerns. During periods of heightened risk and uncertainty, gold has historically benefitted from flight-to-quality flows, providing both positive returns and helping to reduce portfolio losses. The gold price, measured in pounds sterling, has increased by an average of almost 12% per year since 19714 , and over multiple time periods since then gold has outperformed a number of equity, fixed income, and commodity indices. This is significant given gold does not pay a coupon or dividend since, and as a hard currency, it carries no credit risk.

The global gold market is large and liquid, meaning it can be bought and sold with relative ease when liabilities need to be met. Average trading volumes – which include estimated OTC flows and exchange-traded volumes - increased to over $180 billion per day in 2020; up from $145 billion per day in 2019. Furthermore, gold’s liquidity profile is a well-recognised attribute amongst respondents, with almost two-thirds (65%) perceiving gold as a liquid asset.

What percentage of your portfolio is currently allocated to gold?

Source: World Gold Council

Gold is a proven and effective portfolio diversifier. Our analysis demonstrates that gold generally has a positive correlation when equities rise but, crucially, a negative correlation during risk-off periods. And this correlation to risk assets does not only work in times of crisis; gold’s dual nature as an adornment and an investment supports gold’s long-term price trends through income growth.

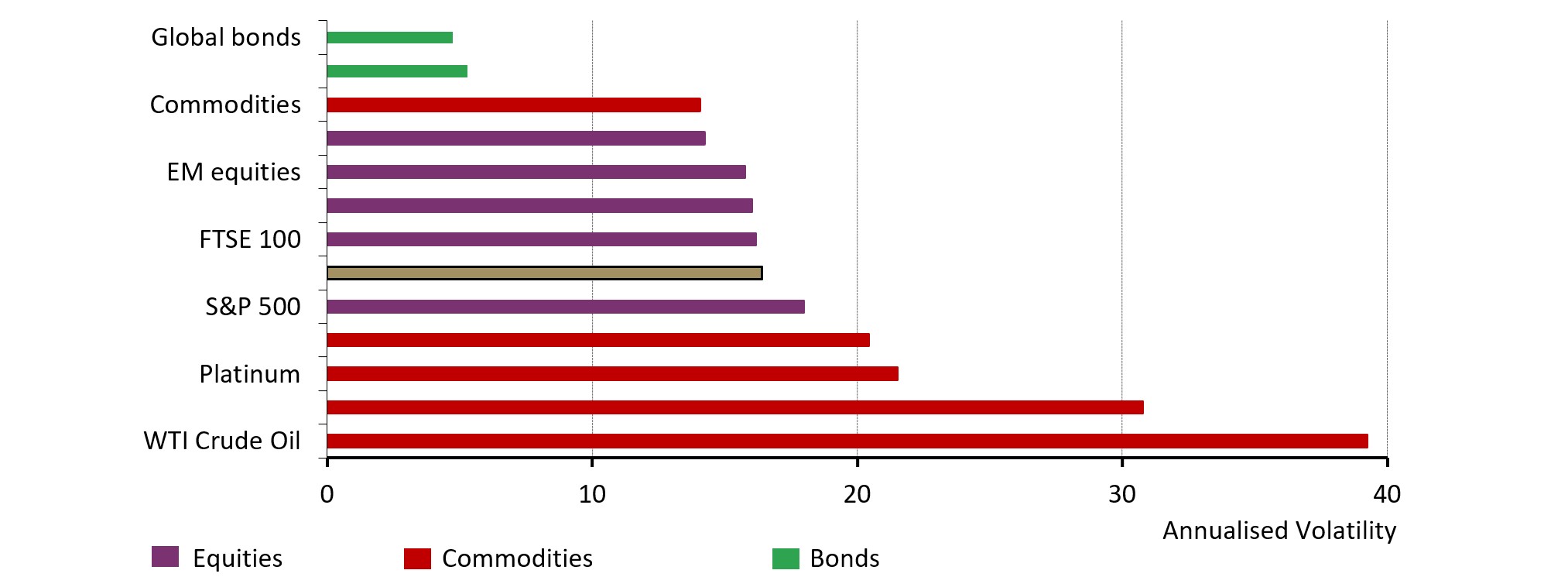

However, nearly three quarters of respondents (72%) also associate gold with greater levels of volatility. As with any asset, an allocation is by no means risk free, and its price may fluctuate in the short term. But over the long term, gold’s annualised volatility has averaged 16-17%, substantially less than other traditional asset classes such as equities and fixed income.

ESG and climate related investment

Environmental, social and governance (ESG) issues are increasingly top-of-mind for investors. In fact, impact awareness is now often intertwined with risk and return. When asked, 79% of respondents agreed that ESG factors are decisive in shaping their asset allocation strategy.

These are not just driven by societal expectations, but also by continued changes to legal and regulatory frameworks. In a series of coordinated statements in November 2020, the UK government, and regulatory authorities (such as the FCA and the Bank of England) confirmed the direction of travel regarding regulations around sustainable finance. Greater reporting requirements and disclosures for pension funds in relation to climate-related risks and impacts have been introduced.

Here too, gold can play a role: 71% of those surveyed disagreed with the statement that gold does not meet ESG requirements according to their investment policy. This highlights the strides the gold mining industry has made to ensure that gold is produced sustainably and sourced responsibly. Key market participants across the supply chain have developed and adhered to a range of industry initiatives and standards, boosting confidence in the provenance of gold as a responsibly sourced asset. There is also strong evidence that gold can play a constructive role in mitigating climate-related risks, helping to enhance portfolio resilience to climate change impacts.5

Average daily volatility of several major assets since 2000*

*Annualised volatility is computed based on daily returns in pound sterling between 31 December 2000 and 31 December 2020. Computations of total return indices for S&P 500 Index, MSCI Daily Gross EM, MSCI Daily Gross EAFE, LBMA Gold Price PM, Bloomberg Commodity Index, LBMA Silver Price, Bloomberg WTI Crude Oil, Bloomberg Barclays Global-Aggregate Index, S&P GSCI Copper Official Close Index, S&P GSCI Platinum Index, Bloomberg Barclays Global-Aggregate Total Return Index Value Unhedged, MSCI UK Gross Total Return Local Index, S&P U.K. Investment Grade Corporate Bond Index Total Return.

Sources: Bloomberg, CBOE, COMEX, World Gold Council

Conclusion

Pension funds continue to face a raft of challenges, forcing a shift in both their investment approach and asset allocation strategies. To navigate the new financial landscape ahead, both traditional and alternative investments should be considered to help balance risk, return, and impact. Gold’s unique characteristics, which help set it apart from other mainstream assets, could bring multiple benefits to a pension fund portfolio; not only helping to manage overall risk but as a means of diversifying returns over the long term.

1FT: Fed to tolerate higher inflation in policy shift (August 2020) and The ECB begins its shift to a new inflation goal (October 2020).

2Willis Towers Watson, Global Pension Assets Study – 2020

3www.pwc.co.uk/press-room/press-releases/pwc-pension-funding-index-new-funding-approach-could-leave-db-pension-schemes-70bn-in-the-black-analysis-shows.html

4Gold began to trade freely following the end of Bretton Woods in 1971

5 World Gold Council, Gold and climate change: The energy transition, December 2020

The World Gold Council/Pension Age survey was conducted in Feb 2021 and participants were from 85 UK Master Trusts, DC and DB schemes