Summary

- The domestic gold price ended the month 29.6% higher y-t-d at Rs50,645/10g1

- The economic recovery gained momentum in October but concerns remained over its sustainability

- Retail gold demand improved in October due to a lower gold price and Navratri sales but demand was lower y-o-y due to the higher gold price and impact on incomes due to COVID-192

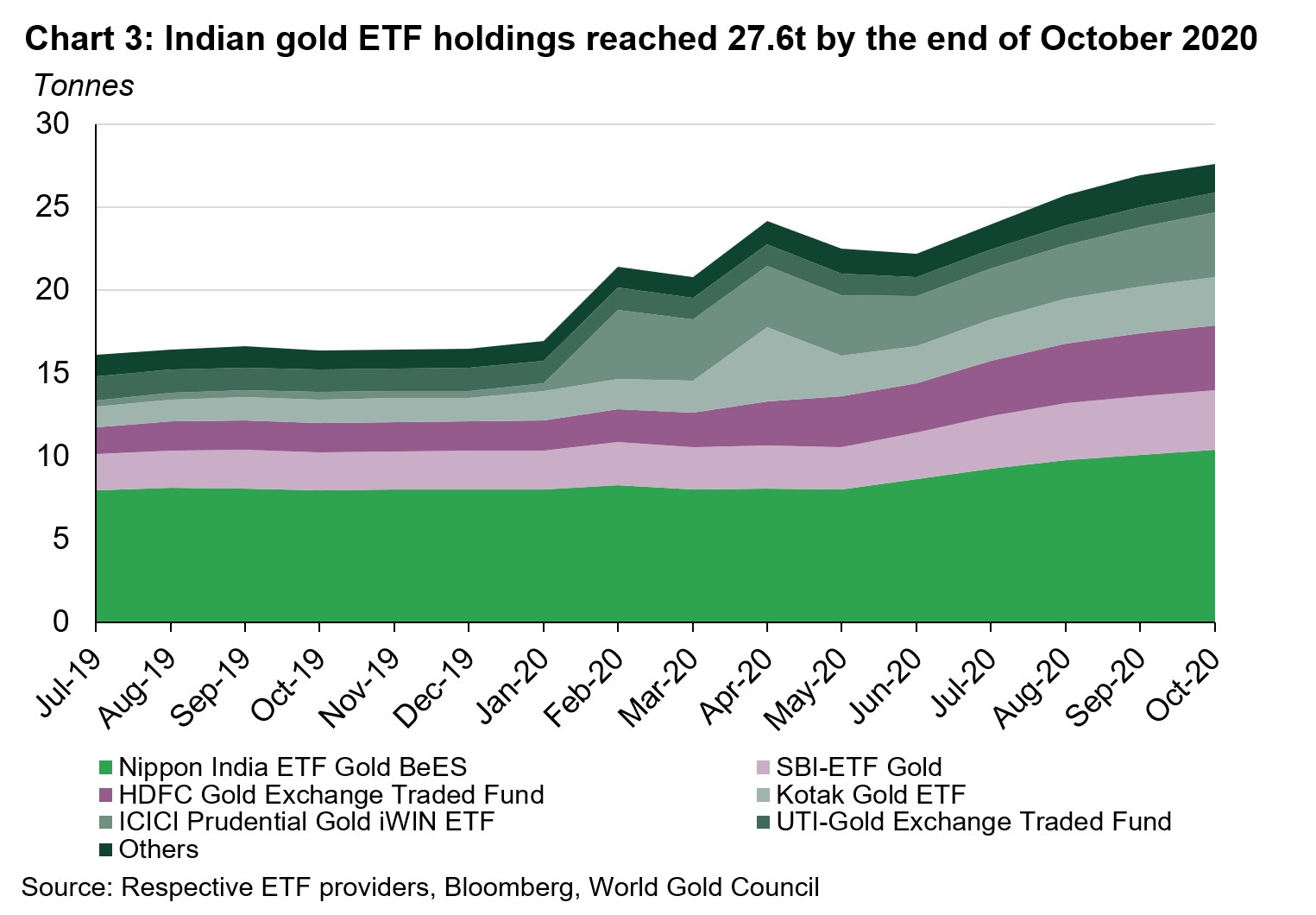

- Demand for safe-haven assets and strong y-t-d performance (+29.6%) supported gold ETF flows. Total holdings for Indian gold ETFs reached 27.6t by the end of October; a net inflow of 0.7t during the month

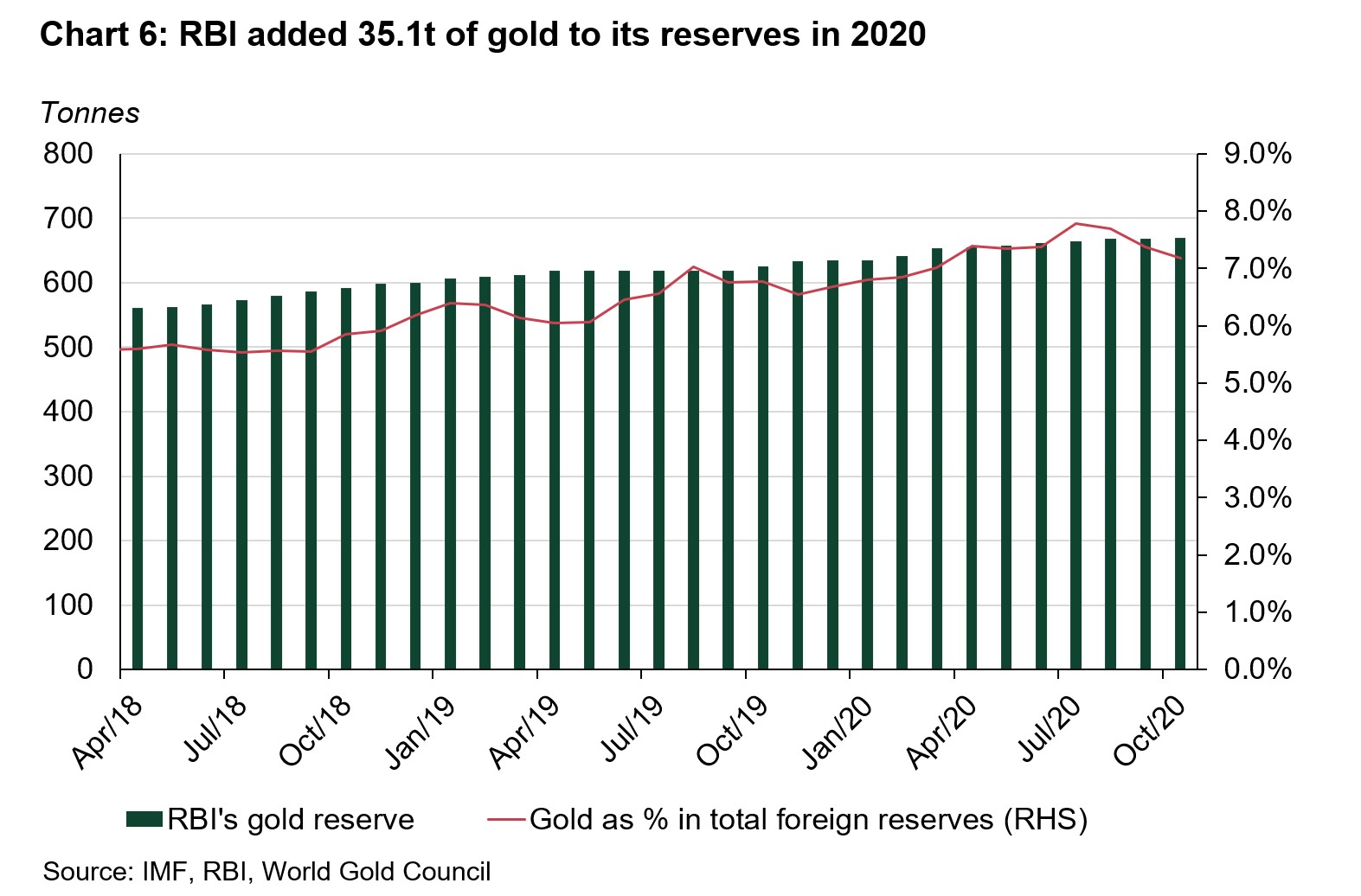

- The Reserve Bank of India (RBI) added 35.1t of gold y-t-d in 2020.

Economic recovery momentum strengthened

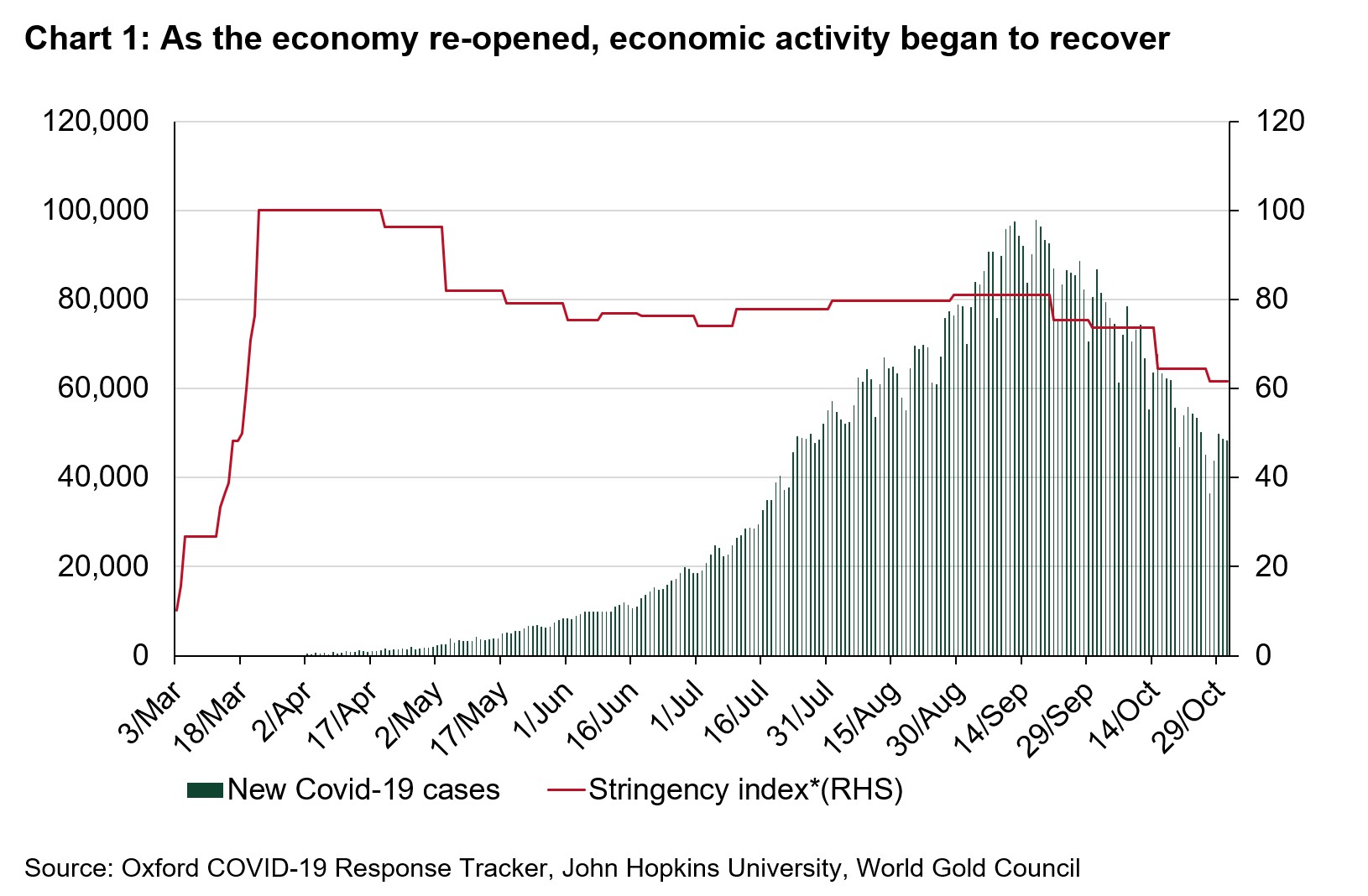

Daily new COVID-19 cases averaged ~62,000 during the month, down from ~87,000 in September. With lower daily infections lockdown restrictions were eased throughout India, helping the economy recover (Chart 1).

As restrictions eased, pent-up demand was released and several high frequency indicators started to show a recovery in economic activity:

- India’s manufacturing purchasing managers’ index (PMI) rose to 58.9, its highest level since January 2012, due to a sharp pick-up in manufacturing to meet the backlog and fulfil new orders

- Power demand was 12.1% higher y-o-y

- Railway tonnage movement was 15.2% higher y-o-y

- Retail sales of tractors improved – 55.5% higher y-o-y

- Average daily E-Way bills generated rose – 17.4% higher y-o-y3

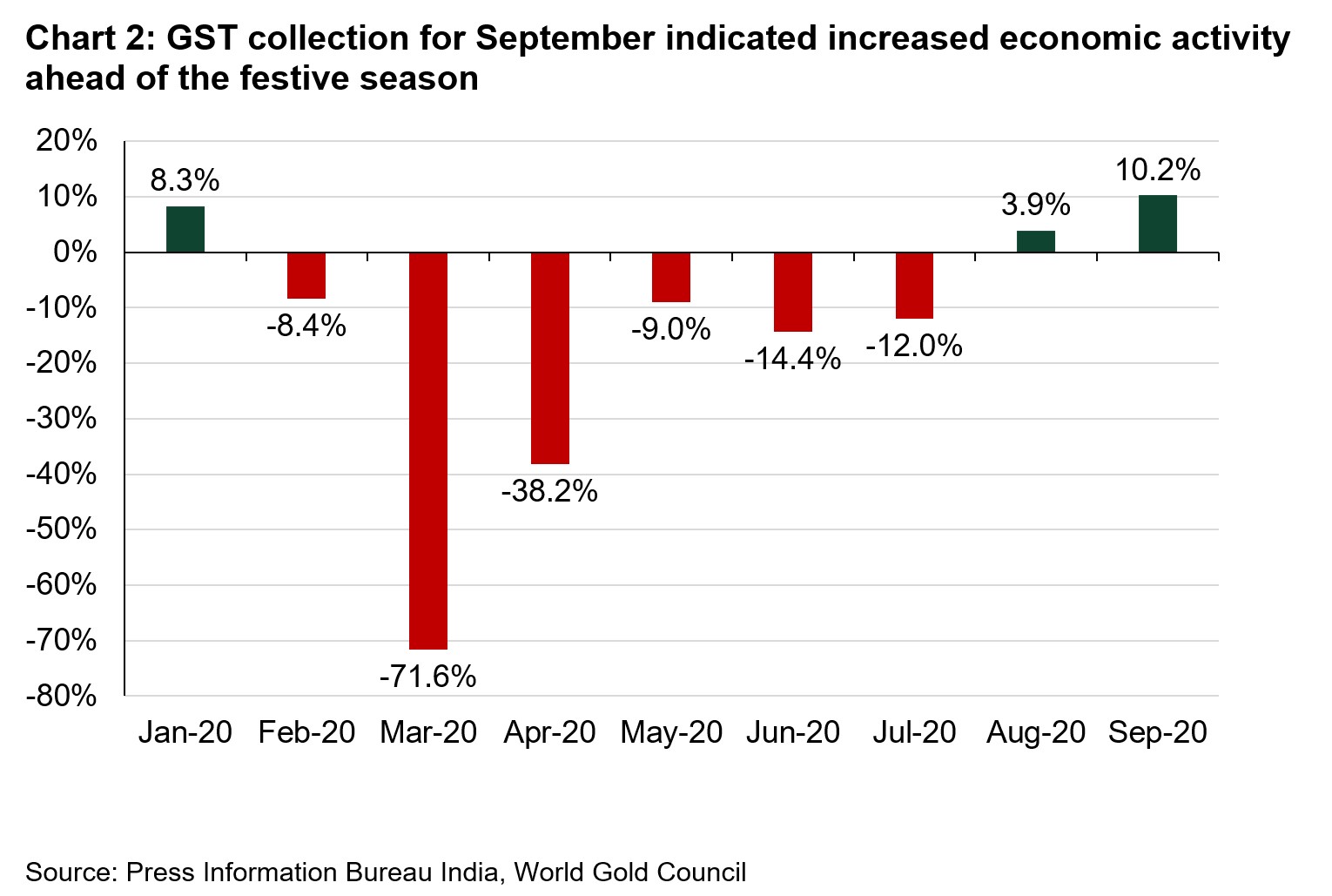

With an improvement in economic activity, GST collection for the month of September touched an eight month high at INR 1.05tn (10.2% higher y-o-y), reaching a pre-COVID level of GST collection last seen in February (Chart 2).4

The improvement in high frequency indicators bodes well for the economy, however investors remain cautious on the sustainability of this growth due to concerns that it has been skewed towards manufacturing or led by festival season demand (from October to December).

Retail demand improved in October but remained weak y-o-y

Retail demand improved following muted sales in September. The month got off to a slow start due to Adhik Maas – considered to be inauspicious for gold purchases – before picking up mid-month ahead of the Navratri festival. This seasonal demand, as well as a lower average gold price of Rs50,700/10gm (-0.4% lower m-o-m), supported gold sales. However, the average gold price in October was still 32.4% higher y-o-y, impacting retail gold demand compared to October 2019 (~25-30% lower in volume terms).

Focusing on Navratri sales, jewellers in the southern states of Tamilnadu and Karnataka reported marginally higher volume sales in the range of 5% to 15% y-o-y. A prominent southern-based retailer reported 12.5% y-o-y gold jewellery sales growth during October due to a lower gold price and Navratri sales. Retailers in tier 2 and tier 3 cities with strong rural demand also reported better sales during Navratri (Figure 1). In other states, including Gujarat, Maharashtra, Delhi and West Bengal, retailers reported more muted sales during Navratri, with 30-40% lower volume y-o-y. Retailers here reported that sales had primarily been impacted by a higher gold price and lower consumer income resulting from the impact of COVID-19. As a result, the overall volume of gold sales during Navratri was lower y-o-y.

Figure 1: Jewellery showroom getting busy during Navratri in Ratlam city

Safe haven demand and high y-t-d returns on gold attracted inflows into gold ETFs in October

Indian gold ETFs saw inflows during the month, the seventh consecutive month of AUM growth. This was supported by safe haven demand and strong returns on gold y-t-d (29.6%). Gold has outperformed the BSE SENSEX (-2.8%) and 10-year government bonds (10.6%), supporting gold’s appeal as an asset.5 However, the net inflows of US$42.8mn were 40% lower m-o-m as some investors switched into equities (BSE SENSEX: + 4.1% m-o-m) as the economy improved and optimism grew over a potential coronavirus vaccine. Against such a backdrop, net inflows into Indian gold-backed ETFs were 0.7t during October, pushing total gold holdings to 27.6t by the end of the month (Chart 3).

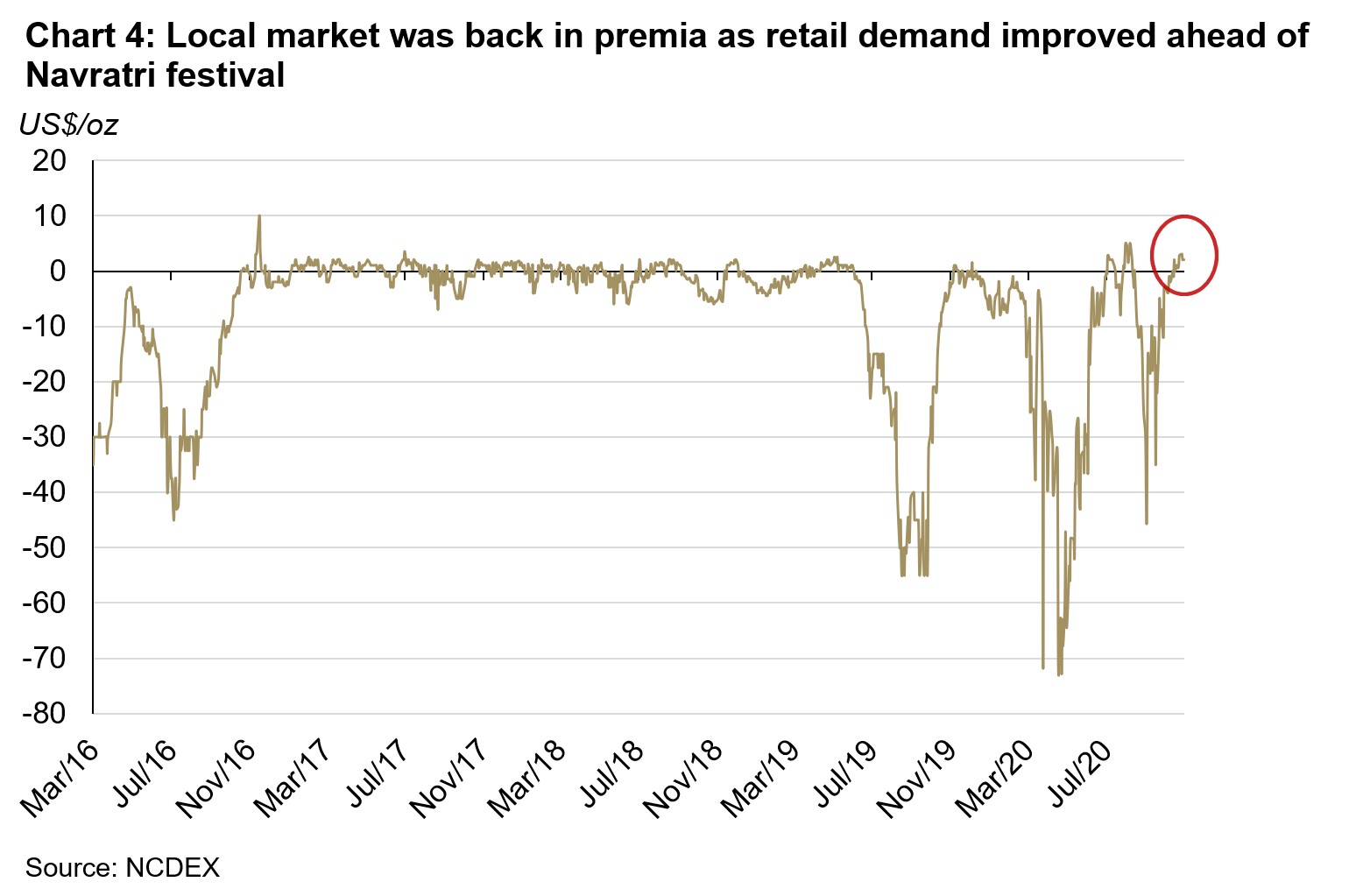

Local markets was back in premia as retail demand improved ahead of Navratri

Local discount narrowed from US$40/oz to US$3/oz during September due to a gradual revival in retail demand and stocking by jewellers ahead of Navratri and the upcoming wedding season. Despite this, the local gold price was back in premium by mid-October, just ahead of the Navratri festival, with the average premium remaining at ~ US$2/oz during the second half of October (Chart 4).

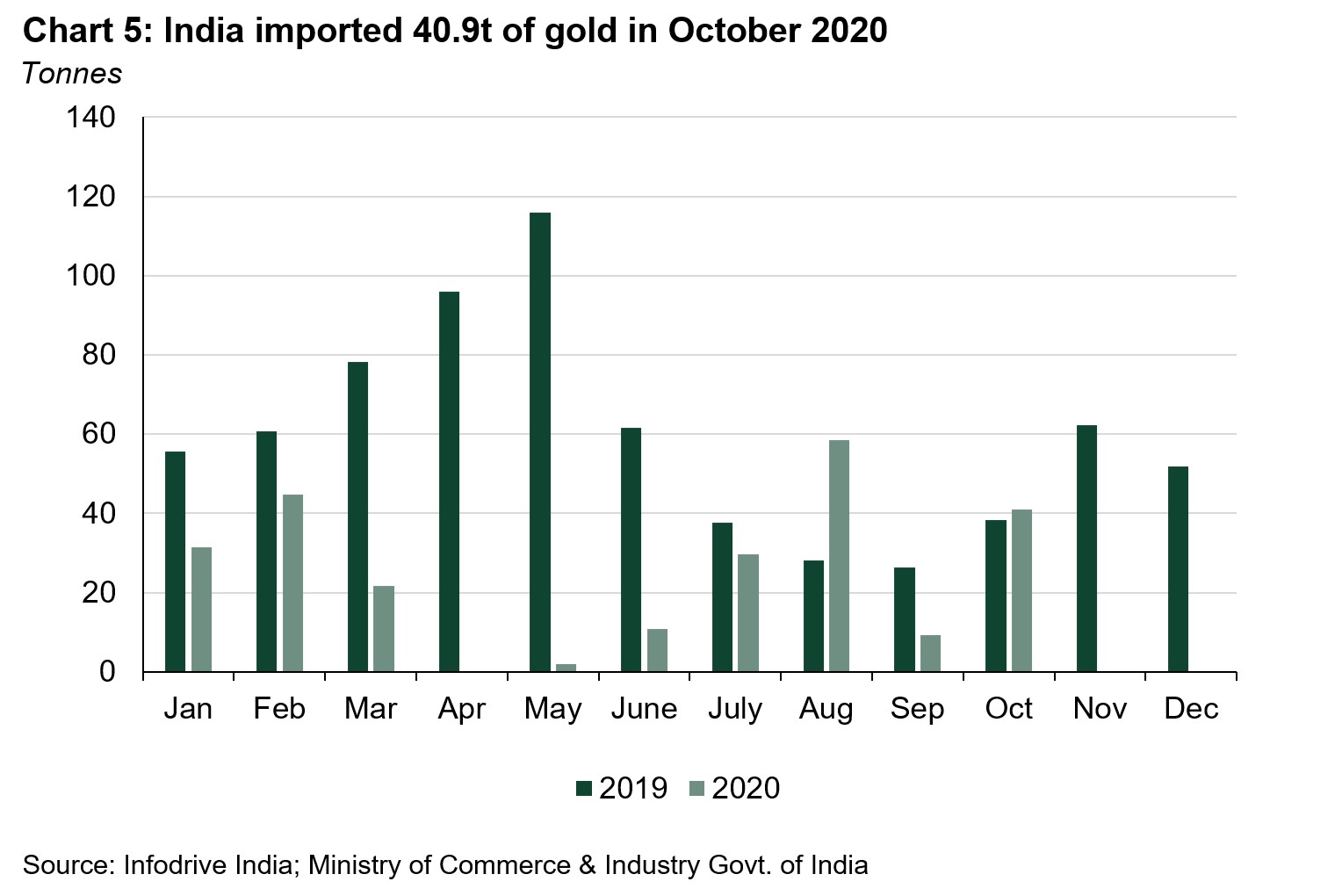

India imported 40.9t of gold in October

Indian official gold imports recovered to 40.9t in October, four times higher than the 9.2t seen in September. But y-t-d, gold imports remain very weak – 58% lower than the same period in 2019 (Chart 5). A total of nine banks, nominated agencies and exporters imported 24.3t of bullion during the month, and 17 refineries imported 16.3t of gold doré (fine gold content).

Looking at import data in October, ~66% of the official imports landed in India during the last two weeks of the month when the retail demand improved ahead of the Navratri festival. Further, out of a total of 40.9t official imports, 11.5t were imported in Sri City Free Trade Warehousing Zone (FTWZ).6 These imports landed in FTWZ with an expectation of recovery in demand at the beginning of the festival season – from Navratri in October to Dhanteras in November, as well as the wedding season.

RBI added 35.1t of gold reserves in 2020

The RBI purchased an additional 1.9t in October, bringing y-t-d purchases to 35.1t and taking its total gold reserves to 670.1t – 7.2% of total reserves (Chart 6).7 The RBI has stepped up its gold purchases with the aim of diversifying its foreign reserves and maintaining the safety and liquidity of its forex reserves.

Footnotes

1As of 30 October 2020.

2 Navratri is an annual Hindu festival which spans nine nights and is celebrated as a mark of victory of good over evil. Navratri was celebrated in India from 17 October to 25 October.

3 E-Way bill is an electronic way bill for movement of goods generated on the E-Way bill portal. A GST registered person cannot transport goods valued more than Rs50,000 (single invoice/bill/delivery challan) in a vehicle without an E-Way bill that is generated on ewaybillgst.gov.in.; https://cleartax.in/s/eway-bill-gst-rules-compliance

4 GST collection data reported on 1 October 2020 is for the GST collection in the month of September. GST data is published on the first day of every month for the GST collected in the previous month.

5 As of 30 October 2020. Computations in Indian Rupee of total return indices for BSE Sensex and S&P BSE India Government Bond Index. For domestic gold price MCX India Gold Spot Index is considered.

6 FTWZ offers a distinct advantage as overseas suppliers can import gold into the custom-bonded warehouse of FTWZ without paying customs duty for authorised operations. Imported gold can be stored in FTWZ for a long period – as long as the letter of approval (LOA) is valid – thus reducing the logistics time in supplying to the domestic market as compared to importing from the overseas market.

7 Central Bank data is taken from IMF-IFS. IFS up until September and weekly statistics have been taken from RBI for October. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics