Summary

- The domestic gold price ended the month 25% higher y-t-d at Rs48,778/10g1

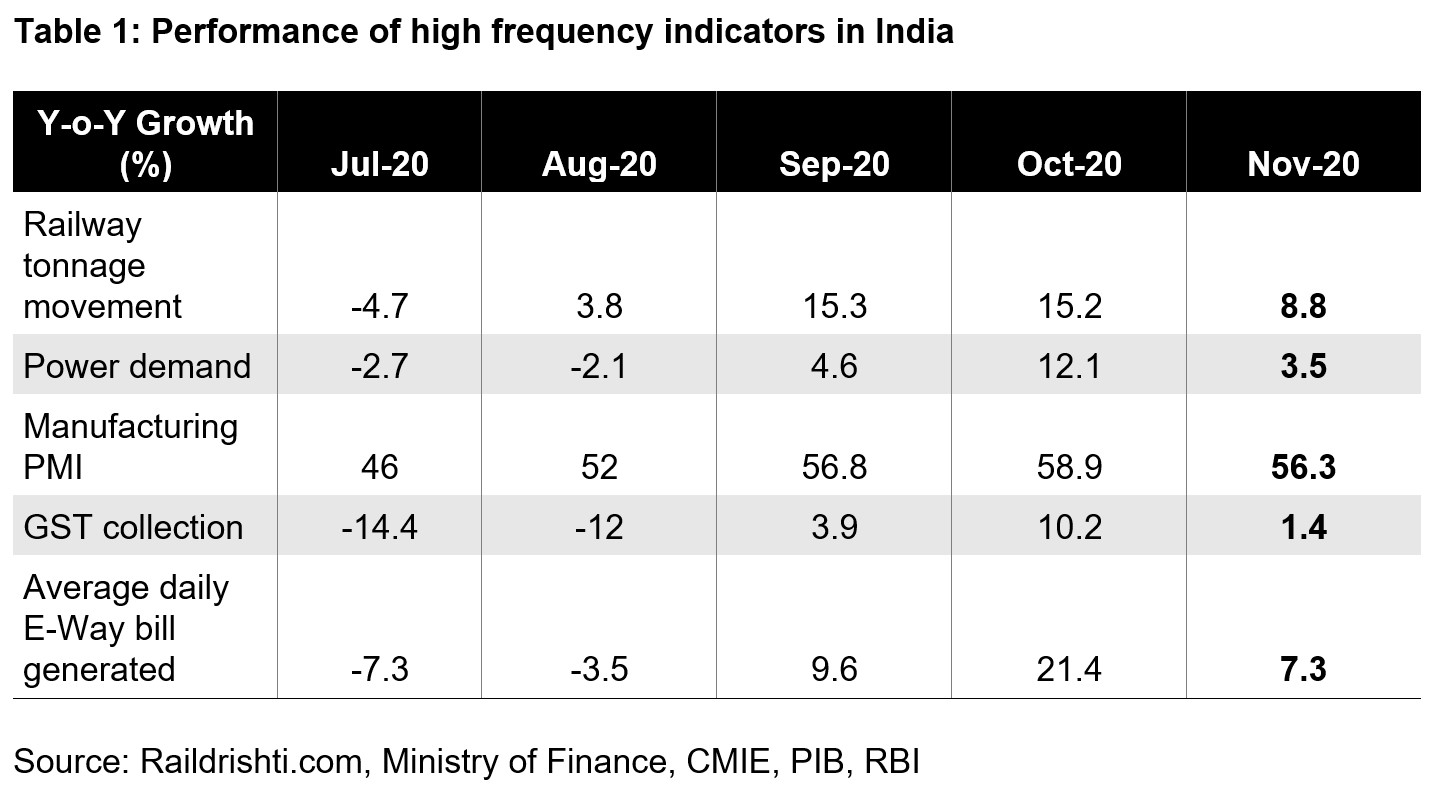

- The economic recovery momentum softened in November

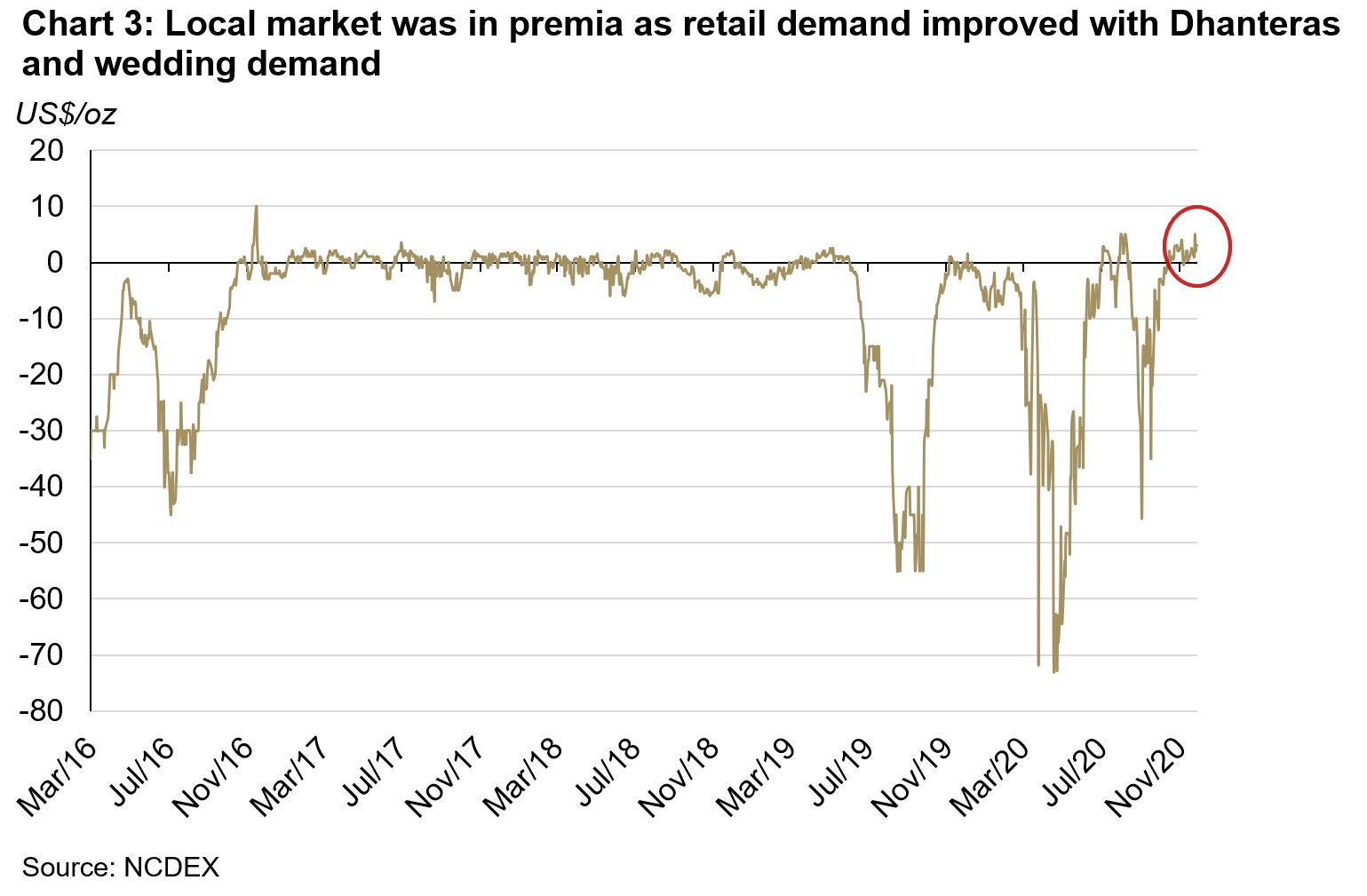

- Retail gold demand continued to improve with Dhanteras and wedding demand

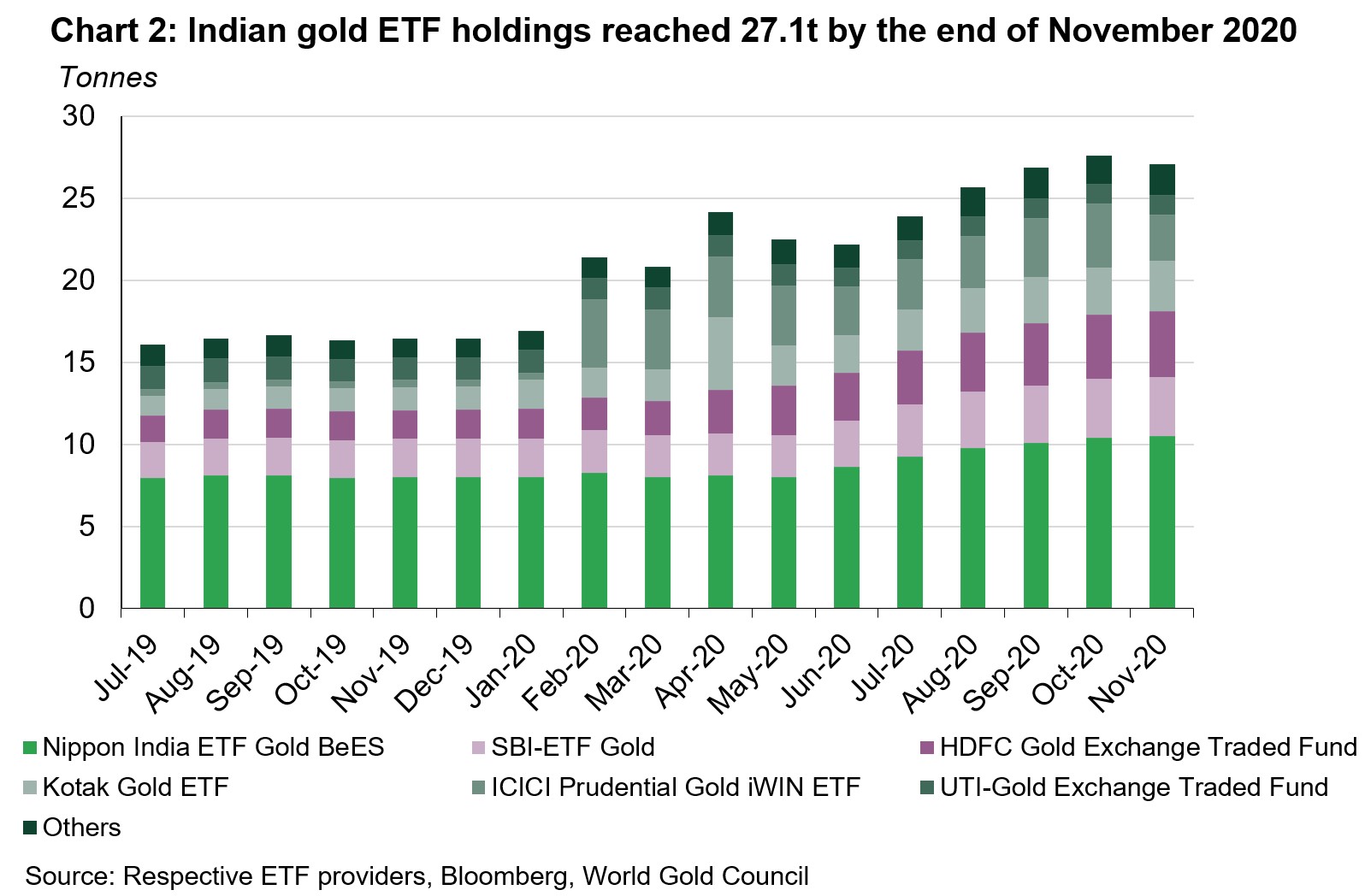

- The strong performance of the equity market, declining COVID-19 cases and a lower domestic gold price contributed to ETF outflows. Total holdings for Indian gold ETFs reached 27.1t at the end of November; a net outflow of 0.5t during the month

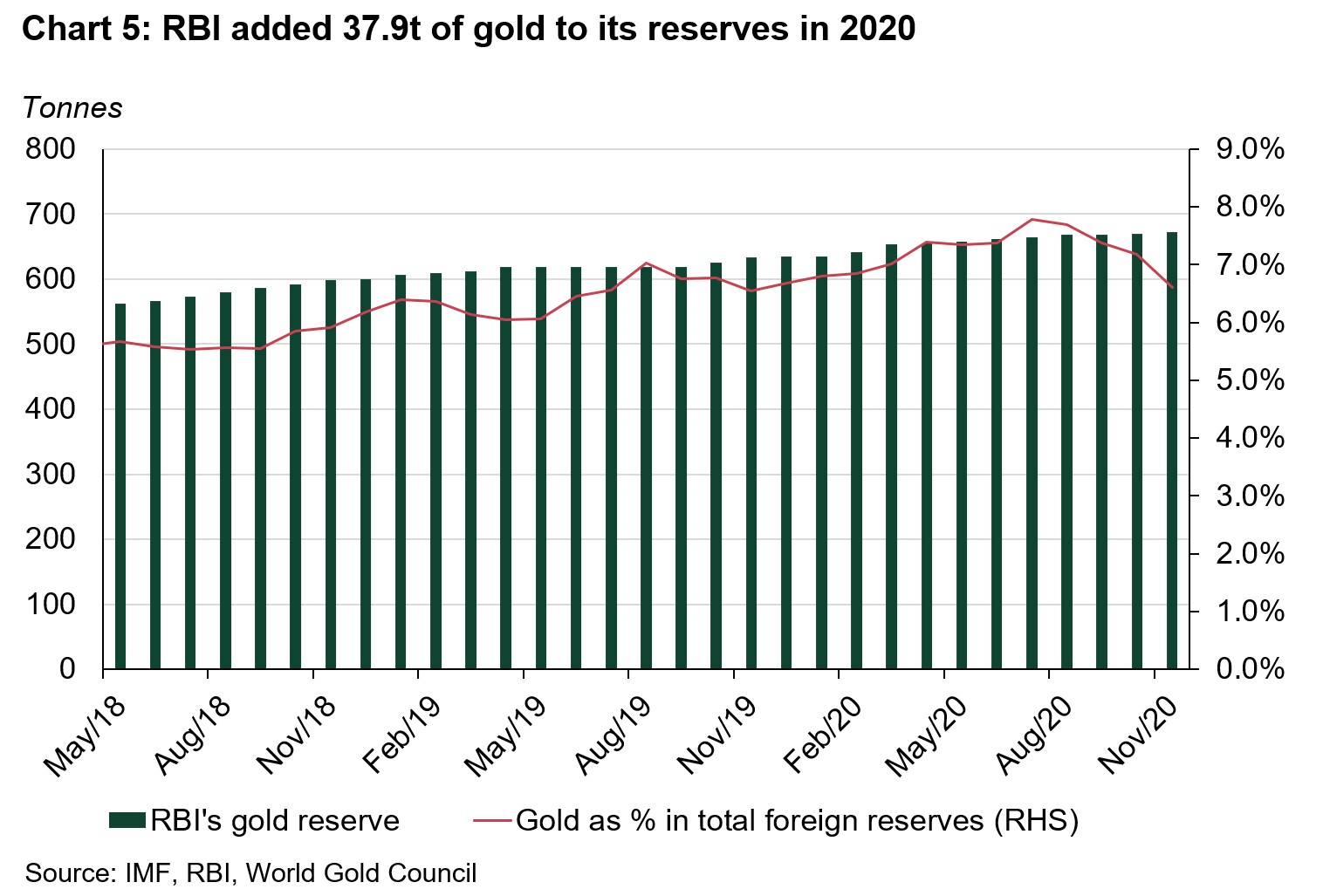

- The Reserve Bank of India (RBI) has added 37.9t of gold y-t-d in 2020.

Economic recovery momentum softened in November

After making a strong recovery over the past few months since COVID restrictions were eased, the pace began to moderate in November. While a number of economic indicators continued to expand y-o-y, they did so at a slower pace than over recent months (Table 1).

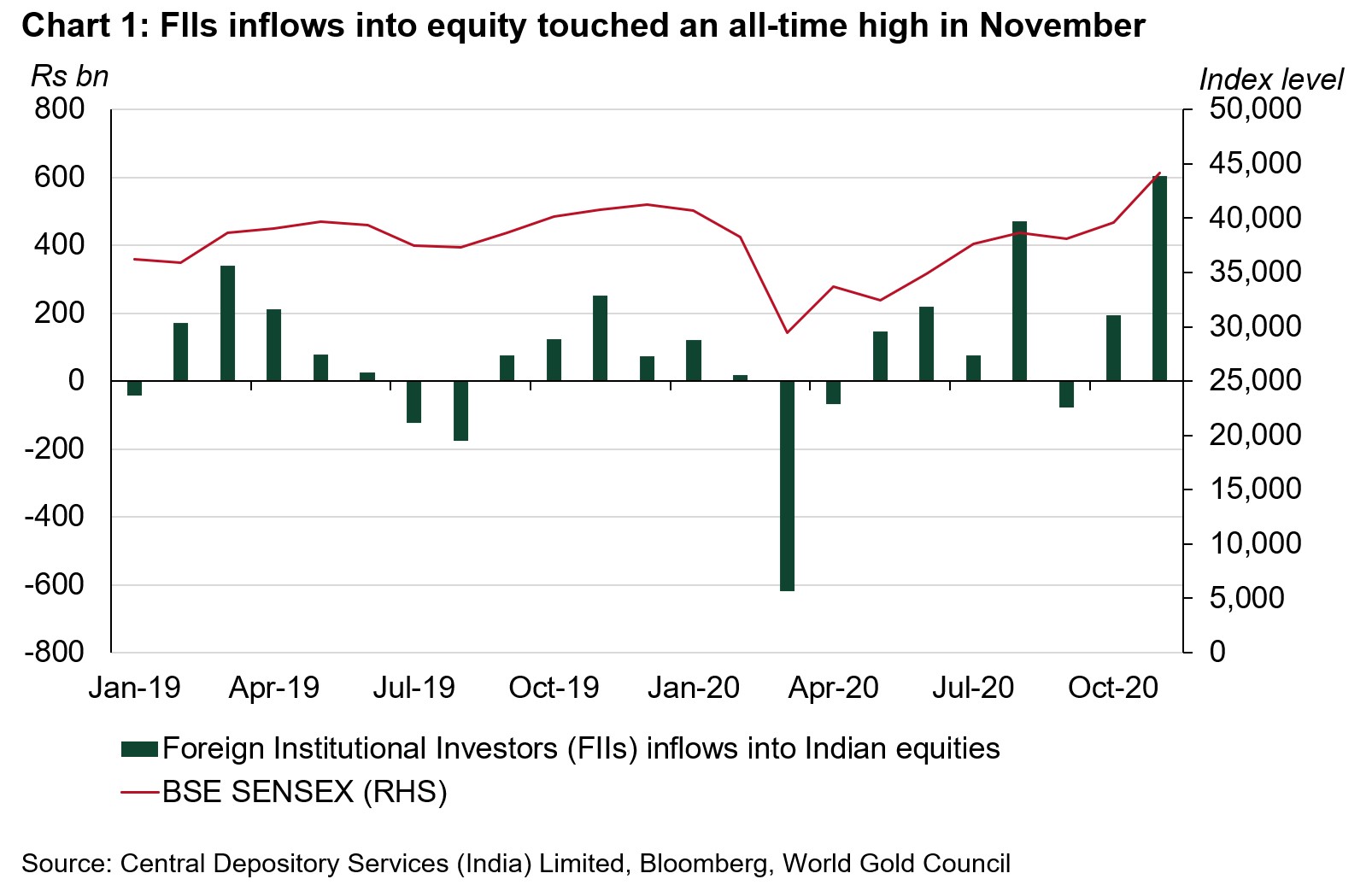

Foreign Institutional Investors (FIIs) inflows into Indian equity markets touched an all- time high

Foreign Institutional Investors (FIIs) inflows into Indian equities have remained strong this year. During the month, FIIs bought equities worth Rs603.6bn (US$8.1bn) – the highest ever net inflows into Indian equities on record. With strong inflows into the stock market, festive demand and optimism around a COVID-19 vaccine, the BSE SENSEX gained 11% during the month (Chart 1).

Retail demand continued to improve with Dhanteras and wedding sales

With the positive news around COVID-19 vaccines, the result of the US presidential election, and normalisation of domestic economic activity supported by pent-up and festive demand, investors piled into equity markets, pulling down the gold price. In India, with the rupee (INR) appreciating and real interest rates in negative territory, gold performed better in INR compared to USD.2 In November, the LBMA AM Fix decreased by 5.5% while MCX Gold Spot fell 3.7%.3

Retail demand continued to improve due to Dhanteras and wedding season demand.4 Dhanteras sales were impacted by the higher gold price (32% higher y-o-y) and the impact on consumers’ disposable income due to COVID-19. However, the overall sales volume (~20% lower y-o-y) and sentiment during Dhanteras was better than the trade’s expectations, supported by the following factors:

- Auspicious purchase timing for Dhanteras fell on two days this year – 12 and 13 November

- The correction in gold price (~Rs2000/10gm) in the week leading up to Dhanteras

- Improvement in consumer confidence following the easing of lockdown restrictions and improved economic activity: the RBI’s consumer confidence index increased to 52.3 in November from 49.9 in September.

Our conversations also revealed some interesting themes during Dhanteras:

- Retailers in tier 2 and tier 3 towns (Figure 1), where consumer income is dependent on agriculture, reported better sales than retailers in metro cities. With a better monsoon and positive rural income, rural demand outperformed urban demand during Dhanteras. Large retailers with good presence in tier 2 and tier 3 towns reported better sales than single store retailers in metro cities.

- Jewellery demand accounted for a larger share of sales than gold bars and coins, and this was bolstered by the concurrent wedding season. Lightweight plain bridal jewellery items were in demand due to a higher gold price. Although consumers also purchased gold coins and bars this year, anecdotal evidence reveals that jewellery accounted for 60-65% of sales, with bars and coins 30-35%.

- Gold sales on established digital platforms remained robust during Dhanteras due to ease of purchase and greater affordability. Paytm reported an 86% rise in digital gold sales y-o-y during the week of Dhanteras and PhonePe reported a six-fold jump in digital gold sales during the run-up to Dhanteras.5

The volatility in the gold price remained a key theme during the month and clearly played on the minds of consumers. The correction in price following Dhanteras supported wedding demand in some cities, but overall consumers remained on the side-lines waiting for more direction on the gold price before making further purchases.

Figure 1: Jewellery showroom getting busy during Dhanteras in Ratlam city

Gold ETFs lost shine amid a surge in equity markets

Indian gold ETFs saw marginal outflows in November, ending seven consecutive months of AUM growth. The strong performance of equity markets, declining COVID-19 cases, and a lower domestic gold price contributed to the outflow. Net outflows from Indian gold-backed ETFs were 0.5t during November, pushing total gold holdings to 27.1t by the end of the month (Chart 2).

Local market was in premia as retail demand improved with Dhanteras and wedding demand

The local gold price was back in premium by mid-October, just ahead of the Navratri festival. With the arrival of Dhanteras in November and wedding-related purchases, the average premium remained at ~ US$2/oz during November (Chart 3).

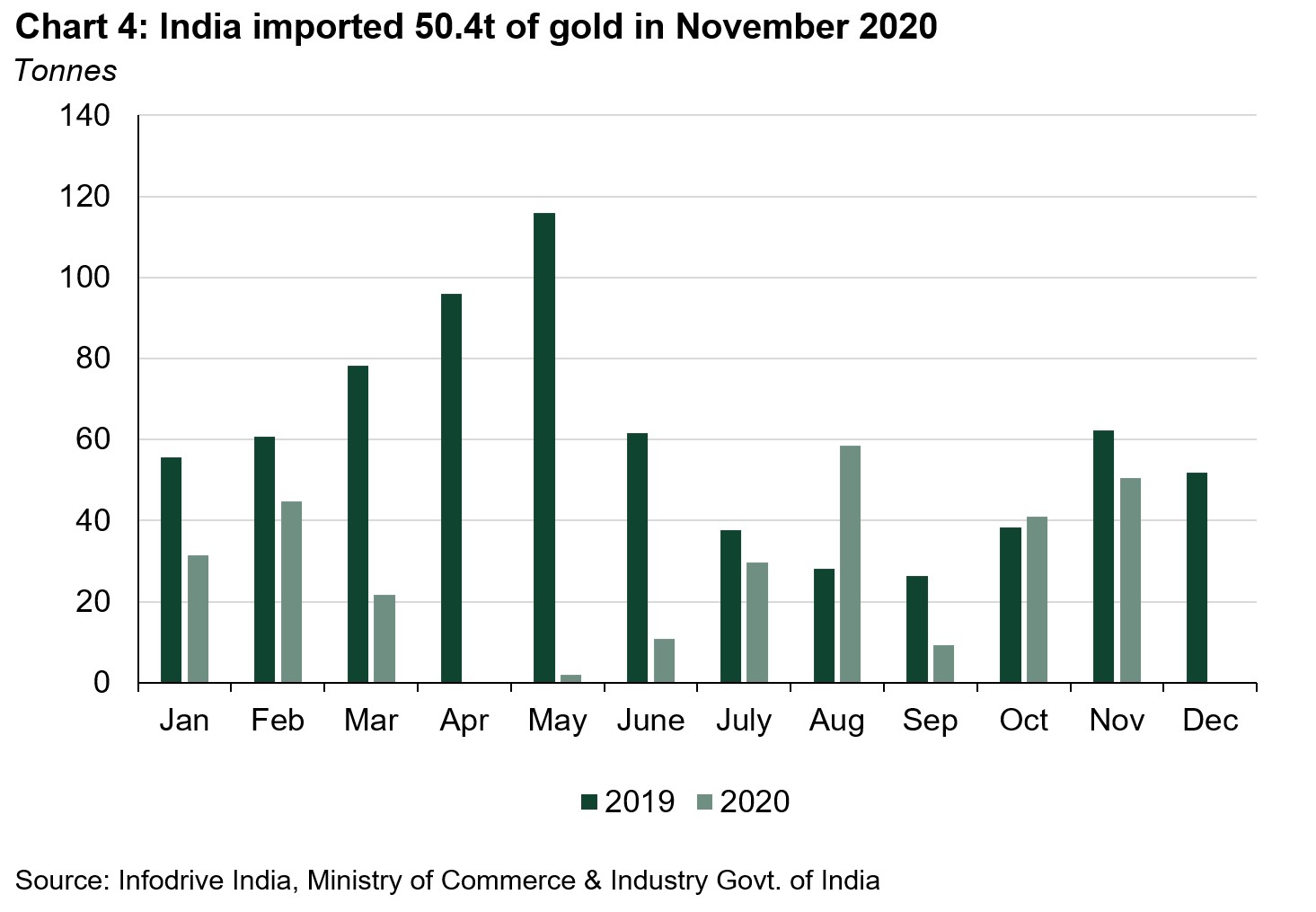

India imported 50.4t of gold in November

Indian official gold imports recovered to 50.4t in November – 23% higher m-o-m but 19% lower y-o-y. Gold imports remain very weak on a y-t-d basis – 55% lower than the same period in 2019 (Chart 4). A total of ten banks, nominated agencies and exporters imported 38.1t of bullion during the month, and 16 refineries imported 12.3t of gold doré (fine gold content).

Further, out of a total of 50.4t official imports, 17.8t were imported in Sri City Free Trade Warehousing Zone (FTWZ).6 These imports landed in FTWZ with the expectation of a recovery in demand at the beginning of the festival season, as well as demand created by the wedding season.

RBI added 37.9t of gold reserves in 2020

The RBI purchased an additional 2.8t in November, bringing y-t-d purchases to 37.9t and taking its total gold reserves to 672.9t – 6.6% of total reserves (Chart 5).7 The RBI has stepped up its gold purchases with the aim of diversifying its foreign reserves and maintaining the safety and liquidity of its forex reserves.

Footnotes

1 As of 30 November 2020

2 In November, India’s CPI inflation rate was 6.93% and the interest rate was 4%.

3 We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

4 Dhanteras is the first day that marks the festival of Diwali in India. Hindus consider this an extremely auspicious day for making new purchases, especially gold and silver articles and utensils. The auspicious time to purchase gold during Dhanteras this year was from 11am on 12 November until 6:52am on 13 November. Another auspicious time on 13 November was from 4:18 pm to 5:39 pm

5 Digital gold gains currency in small cities (livemint.com)

6 FTWZ offers a distinct advantage as overseas suppliers can import gold into the custom-bonded warehouse of FTWZ without paying customs duty for authorised operations. Imported gold can be stored in FTWZ for a long period – as long as the letter of approval (LOA) is valid – thus reducing the logistics time in supplying to the domestic market as compared to importing from the overseas market.

7 Central Bank data is taken from IMF-IFS; IFS up until October and weekly statistics from RBI for November. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics