Introduction

To widen the tax revenue the Finance Minister, Nirmala Sitharaman, announced during the annual budget of 2020-21 an extension to the scope of Tax Collected at Source (TCS). Under the new provisions of the clause 206C(1H) of Income-tax Act (1961):

- The seller is required to collect TCS from the buyer if the seller’s annual turnover exceeds INR 100 million (US$1.36 million) in the preceding financial year (FY 2019-20 for the current financial FY 2020-21)

- TCS is collected from the buyer of goods in a financial year when total consideration for the sale of any good or aggregate of any value (excluding goods exported) received from the buyer during the financial year (FY 2020-21) exceeds INR 5 million (US$70,000)

- TCS rate is fixed at 0.1% on the sale consideration1 value exceeding INR 5 million for an individual buyer in the financial year

- TCS will be refunded to the buyer after filing of income tax return and completion of assessment by tax authorities.

Although announced in April 2020, the TCS was not immediately implemented. After various representations from the industry, and in order to provide sufficient time for smooth compliance, TCS was deferred by six months to 1 October 2020. To provide further relief to the industry in the wake of COVID-19, the Finance Ministry temporarily reduced TCS to 0.075% until 31 March 2021, after which the rate will be restored to 0.1%.2

The implementation of TCS is intended to bring transparency to the trade by keeping track of all business to business (B2B) sales exceeding INR 5 million in a financial year. But an unintended consequence of this policy may be the blockage of working capital, as well as an increased compliance burden for trade. This will impact various industries, including gold. This blog discusses the impact of TCS on bullion dealers and the resultant impact on other participants in the gold supply chain.

Impact on bullion dealers

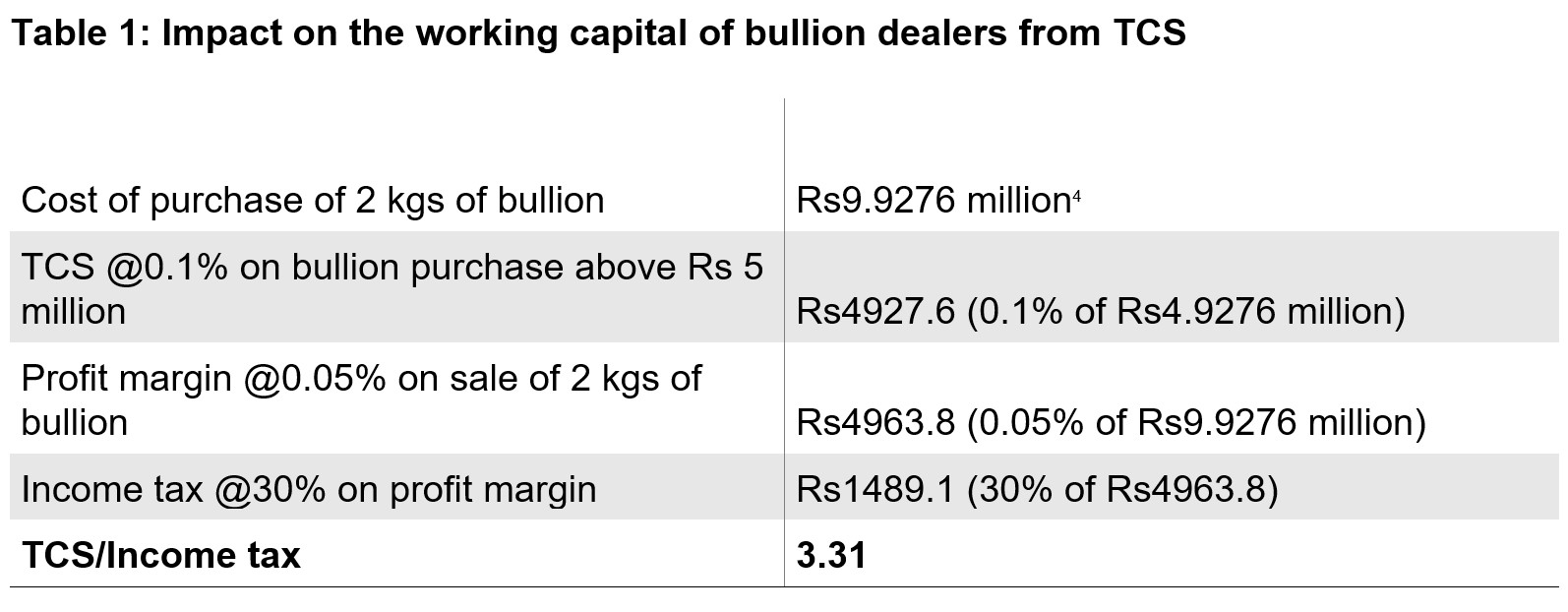

The implementation of TCS will not only impact the working capital of the gold industry across the value chain but will also have a dire impact on bullion dealers in the trade. They operate on a very narrow profit margin of ~0.05%, and despite this they will have to pay 0.1% for each transaction above INR 5 million (~1 kg based on domestic gold prices).3 The TCS paid for each transaction will also far exceed the Income Tax paid on profit margins at 0.015% (Table 1). The refund on TCS will be available only after the filing of income tax and completion of assessments by income tax authorities, which could take a minimum of 18 months. This will block crucial working capital of bullion dealers and increase the compliance burden for the industry.

The blockage of working capital will have an adverse impact not only on bullion dealers but also on participants further down the gold value chain, including jewellery manufacturers and retailers, as bullion dealers play an important role in supplying bullion to the trade. This will also impact the livelihoods of artisans/workers already reeling from job losses due to the pandemic.

Increased compliance burden

The implementation of TCS will increase the compliance burden for the Indian gold industry. Under the provisions of TCS, the seller needs to undertake the following procedures in order to properly comply with the new regulations:

- The seller must file the quarterly TCS returns within 15 days of the end of the preceding quarter

- The seller must issue a Certificate of TCS to the buyer within 15 days of filing the quarterly TCS returns

- The seller may be required to make necessary changes to their invoice/receipt vouchers to facilitate the TCS collection. Changes in their enterprise resource planning (ERP) accounting software and standard operating procedures may also be required to keep a check on threshold, receipts, etc.

Thorny issues

There are other issues that require further clarification. There is an ongoing debate as to whether TCS should be applied on sale consideration inclusive or exclusive of Goods and Sales Tax (GST). Further, bullion purchased on a commodity exchange platform, where buyers and sellers are not known to each other, will make compliance almost impossible. Ministry of Finance recognised the practical difficulty in implementing TCS for commodity trading on exchanges and clarified that there will no TCS for commodity and securities transactions or cleared and settled by recognised clearing corporations including recognised exchanges or recognised clearing corporation located in International Financial Service Centre.

The way forward

This is a challenging situation for the gold industry. The implementation of TCS may force out small bullion dealers who operate on razor-thin margins and it could help to promote the use of transactions without an invoice or a bill. This is counter to the very intention of the TCS, which is to track and curb the usage of unaccounted money and widen the tax net.

Traceability of transactions in bullion can be achieved by technology such as blockchain, which can trace gold through its entire supply chain. On a broader basis, TCS should be kept out of the ambit of B2B transactions to avoid the unnecessary blockage of working capital and increased compliance burden.

Footnotes

1 Consideration is the price the buyer promises to pay to the seller.

2 There is a typographical error in the press release, which states a reduced rate of 0.75 per cent instead of 0.075 per cent.

3 Based on end of day MCX Gold Spot Price of Rs49638/10gm on 24 September 2020.

4 Based on MCX Gold Spot Price of Rs49638/10gm on 24 September.