Summary

- The domestic gold price decreased by 4.4% m-o-m but ended the month 31.1% higher y-t-d1

- Economic indicators sent mixed signals during August, suggesting that the Indian economy is unlikely to witness a quick recovery

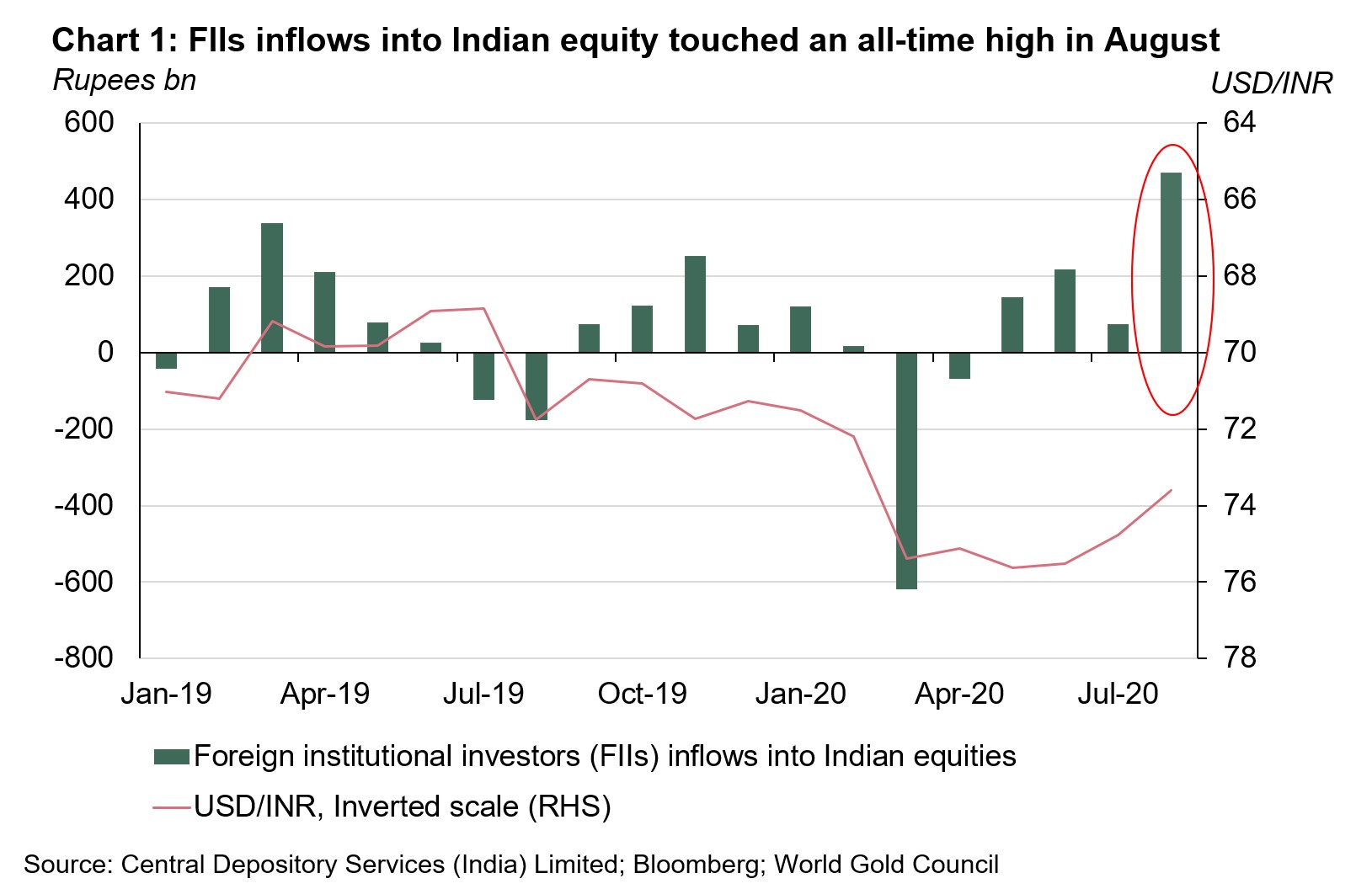

- Foreign Institutional Investors (FIIs) inflows into Indian equities touched an all-time high of US$6.4bn and USD/INR appreciated by 1.6% during the month

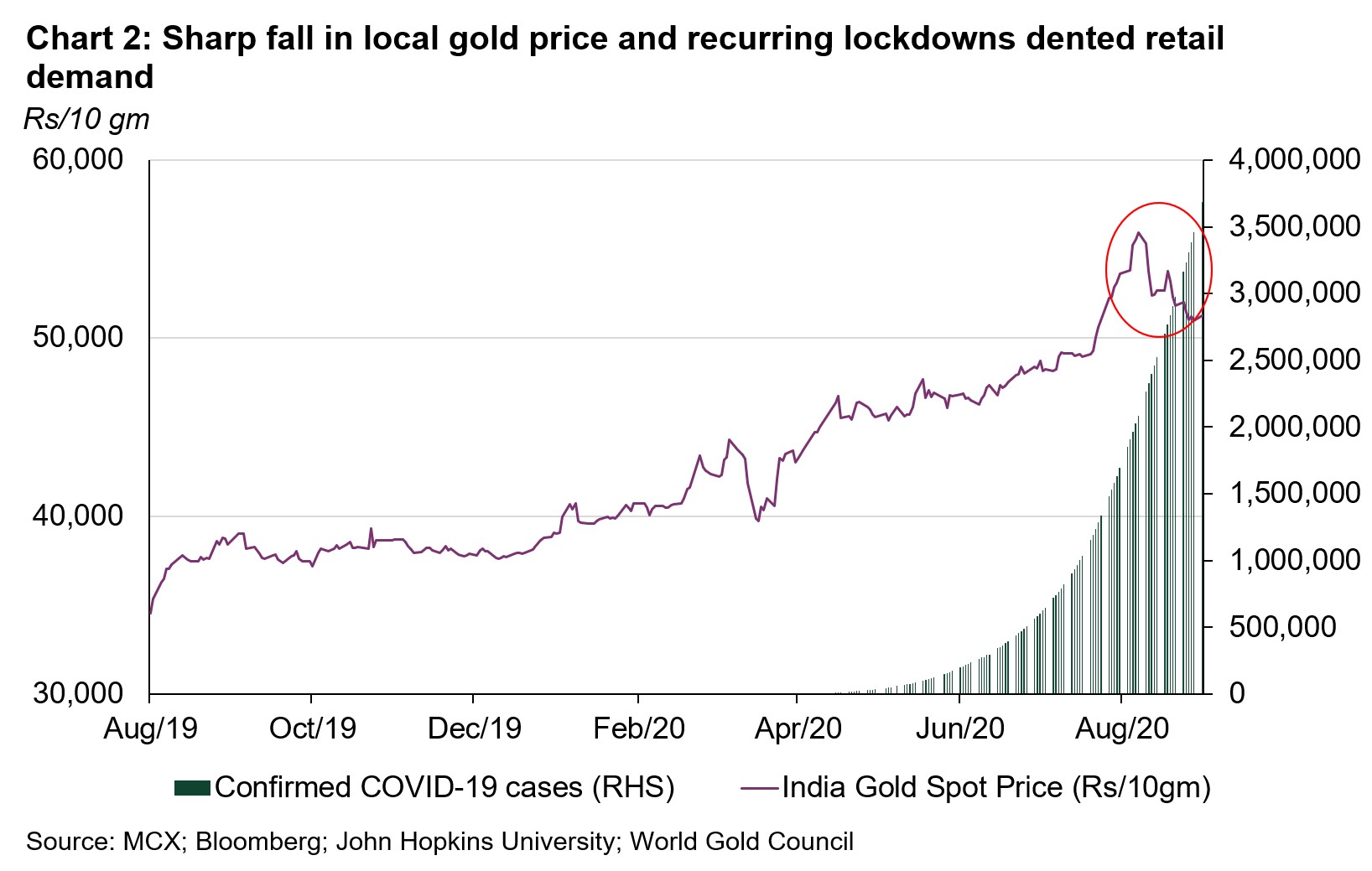

- Retail gold demand weakened as consumers waited on the sidelines following a sharp correction in the domestic gold price amid rising COVID-19 cases

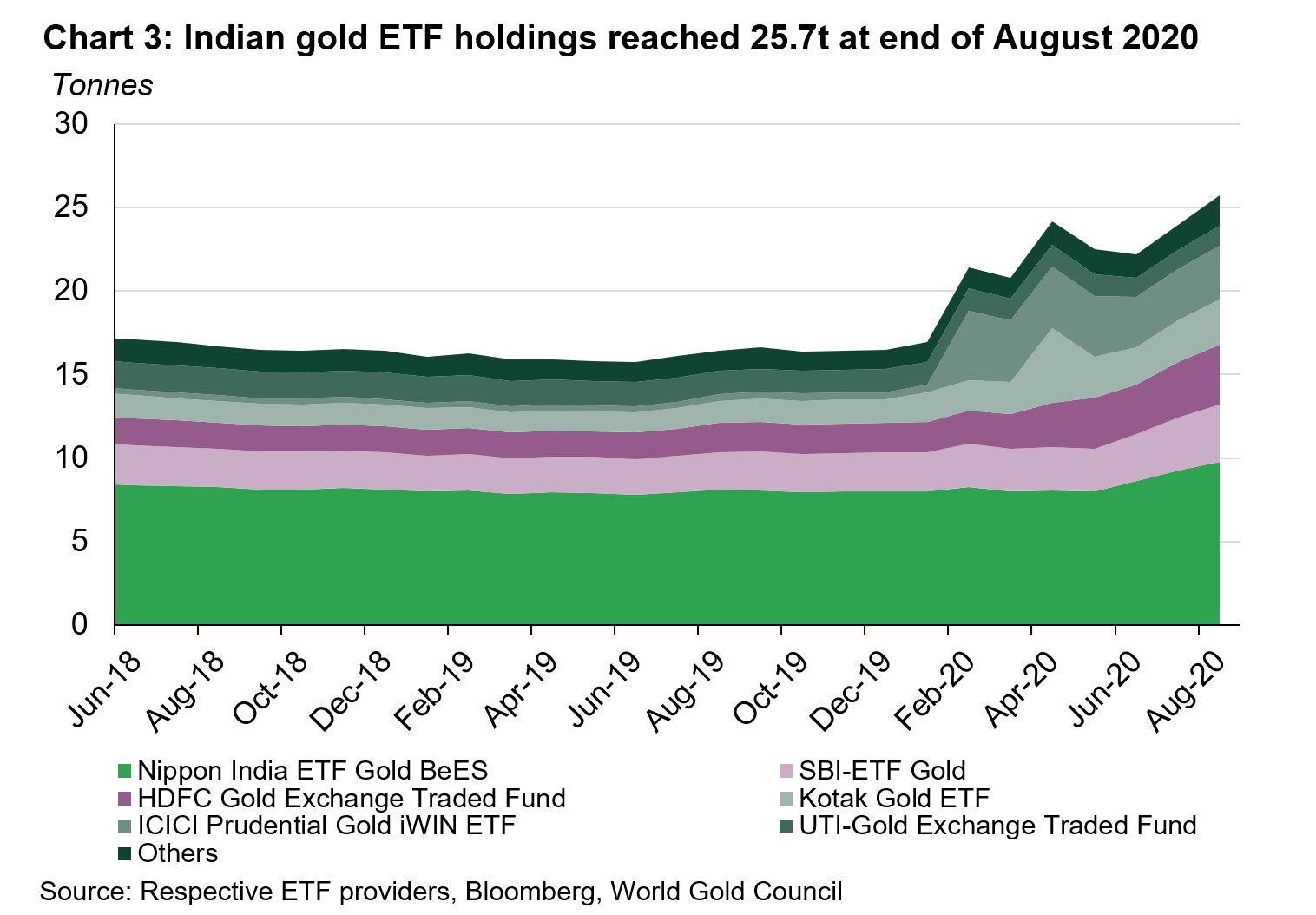

- Demand for safe haven assets and strong year-to-date performance, coupled with the price correction likely seen by investors as a buying opportunity, supported gold ETF flows. Total holdings for Indian gold ETFs reached 25.7t at end of August; a net inflow of 1.8t during the month

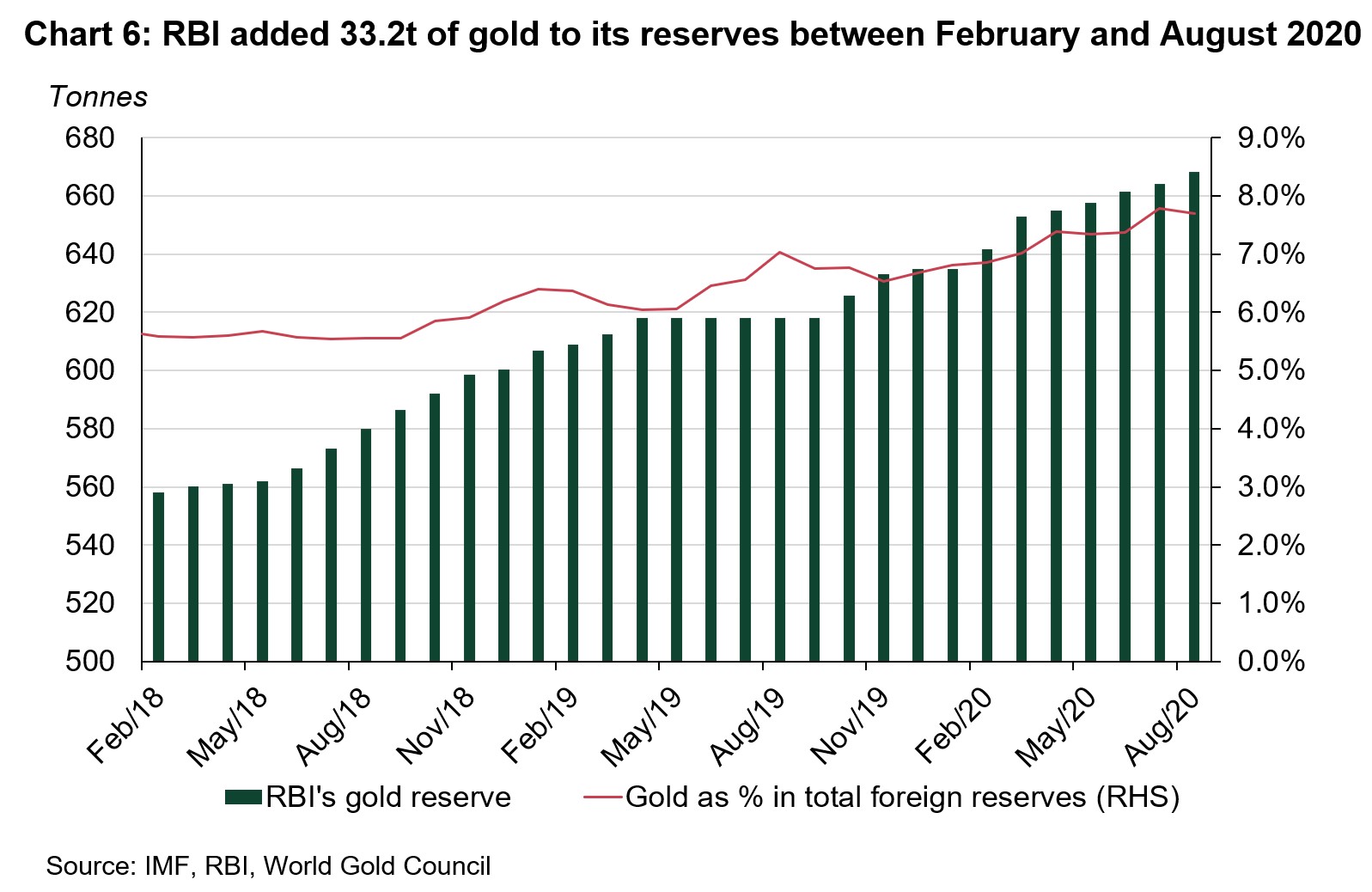

- The Reserve Bank of India (RBI) added 33.2t of gold to its reserves between February and August 2020

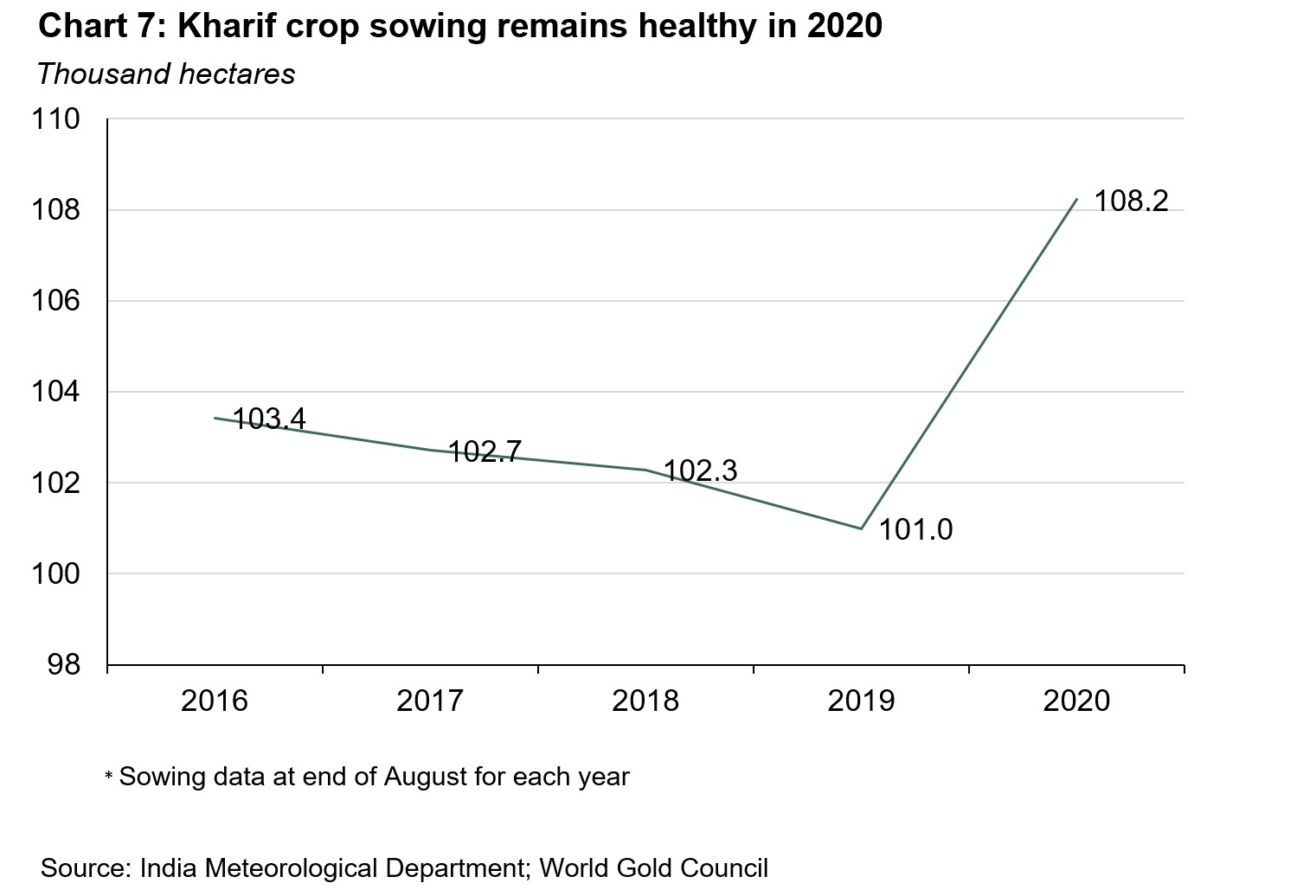

- Cumulative rainfall between June and August was 9.8% above the Long Period Average (LPA) rainfall, with Kharif sowing 7.2% higher than last year.

Economic indictors sent mixed signs in August

As lockdown restrictions have gradually eased, some indicators have started to show a recovery in economic activity:

- India’s manufacturing purchasing managers’ index (PMI) rose to a six-month high of 52 in August from 46 in July

- Retail sales of tractors improved in August – 27.8% higher y-o-y

- Nomura India Business Resumption Index (NBRI) rose to a post-lockdown high of 75.7 at the end of August, up from 73.4 the week before.

However, other indicators still point to weakness in the economy:

- India’s power demand continued to be marginally negative in August (0.9% lower y-o-y)

- Average daily e-way bills stagnated at 1.6mn in August2

- GST collections in August totalled Rs864.49 bn (12% lower y-o-y and 1.1% lower m-o-m)

- Consumption of petroleum products remained negative in August (16.2% lower y-o-y and 7.5% lower m-o-m).

Thus, key activity indicators presented a mixed picture, with some showing signs of improvement while others moderated. This indicates that the Indian economy is unlikely to witness a quick turnaround.

Foreign Institutional Investors (FIIs) inflows into Indian equity markets touched an all- time high

The risk-on sentiment in global equity markets – triggered by global monetary easing policies weakening the USD and the Fed’s new policy towards average inflation targeting – has created liquidity in the market, a part of which went into the Indian equity market. Against such a global scenario, inflows into the Indian equity market through foreign institutional investors touched an all-time high of Rs470.8bn (US$6.4bn) in August. This combined with the RBI’s willingness to accept Rupee appreciation to combat imported inflation, saw the rupee appreciate by 1.6% in August, reaching INR73.6/USD at end of the month (Chart 1).

Retail demand suffered as consumers waited on the sidelines

Bullish momentum in the international gold price paused after it touched an all-time high in early August. With increased global economic activity and the rally in global equity markets, the gold price faced headwinds and was further impacted by an announcement from the Russian government about the development of the first COVID-19 vaccine – Sputnik V. As a result, both the LBMA Gold Price AM (US$) and MCX Gold Spot fell sharply by 4.9% and 5.3% respectively between 10 August and 12 August. With INR appreciating by 1.6%, and the Indian Government 10-year bond yield strengthening by 28bps, the MCX Gold Spot fell by 4.4% in August compared to a 1% fall for the LBMA Gold Price AM (US$).3

Retail demand, particularly for bars and coins, was strong until 10 August, gaining momentum as the gold price rose. Once the gold price corrected, consumers opted to wait on the side-lines to watch the future trajectory of the gold price, halting further purchases. This was exacerbated by rising COVID-19 cases in India (Chart 2). With such a weak sentiment, retailers in Kerala reported 40-50% lower y-o-y jewellery volumes sales this Onam.4

Correction in the domestic gold price, safe haven demand amid rising number of COVID-19 cases and high y-t-d returns on gold attracted inflows into gold ETFs in August

The sharp correction in gold prices in August provided a good entry point for investors. The market inflow into Indian gold ETFs was supported by safe haven demand and strong returns on gold y-t-d (31.1%). Gold has outperformed the BSE SENSEX (-6.4%) and 10-year government bonds (8.3%) – supporting gold’s appeal as an asset.5 Against such a backdrop, net inflows into Indian gold-backed ETFs were 1.8t in August, pushing total gold holdings to 25.7t by the end of the month (Chart 3).

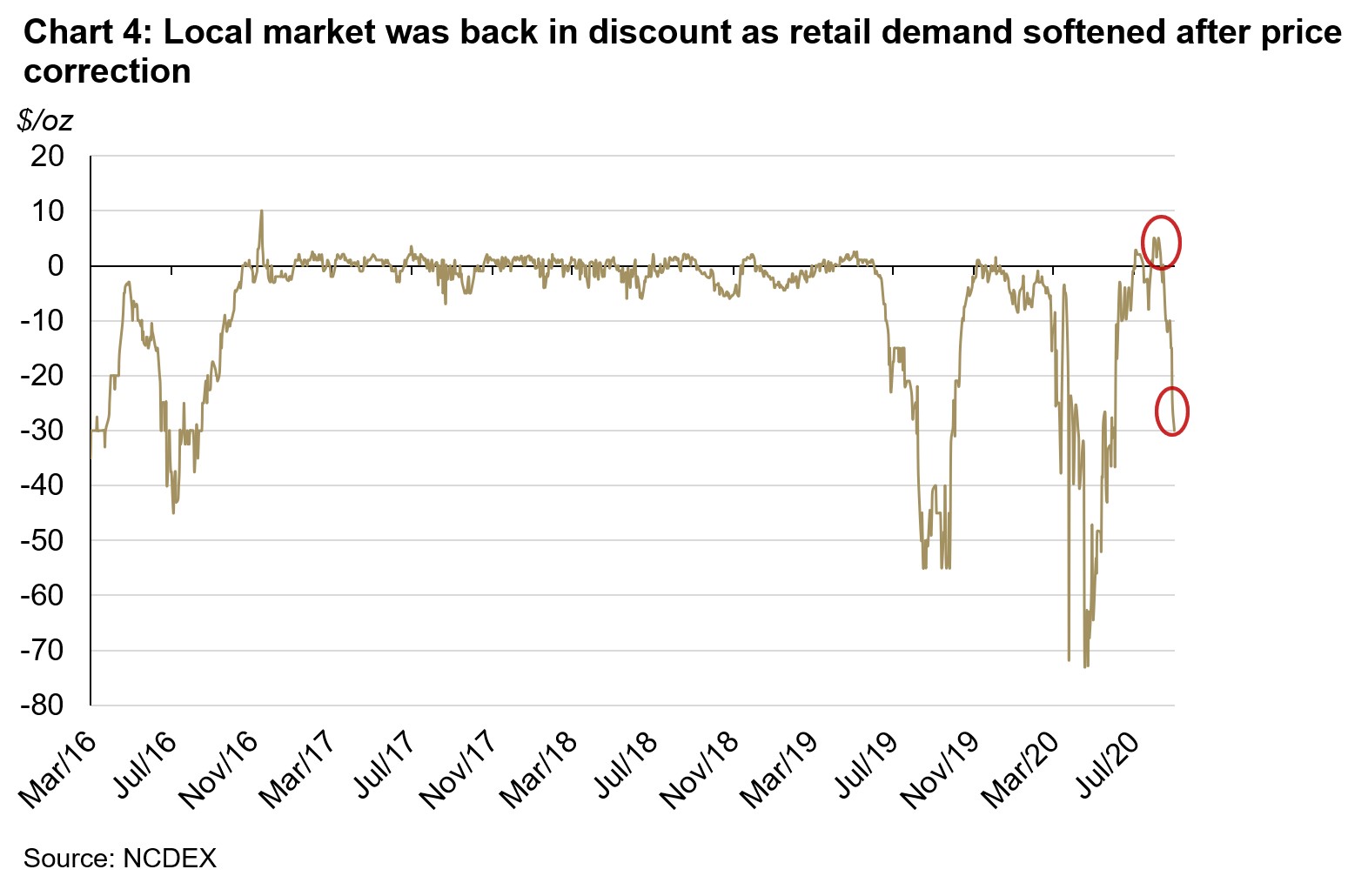

Local market was back in discount as retail demand softened after price correction

Demand for gold started to improve with the onset of a rising gold price from 27 July. The demand momentum received support with a sharp rally in the local gold price, which rose by 6% between 27 July and 10 August. The domestic market traded at an average premium of US$3/oz during this period. Aligned with the international gold price, the domestic gold price fell by ~Rs3,000/10 gm – down 5.3% between 10 August and 12 August. With consumers postponing further purchases, the market fell back into discount. The weak retail demand continued through the entire month and discount in the local market widened to US3$30/oz by the end of August (Chart 4).

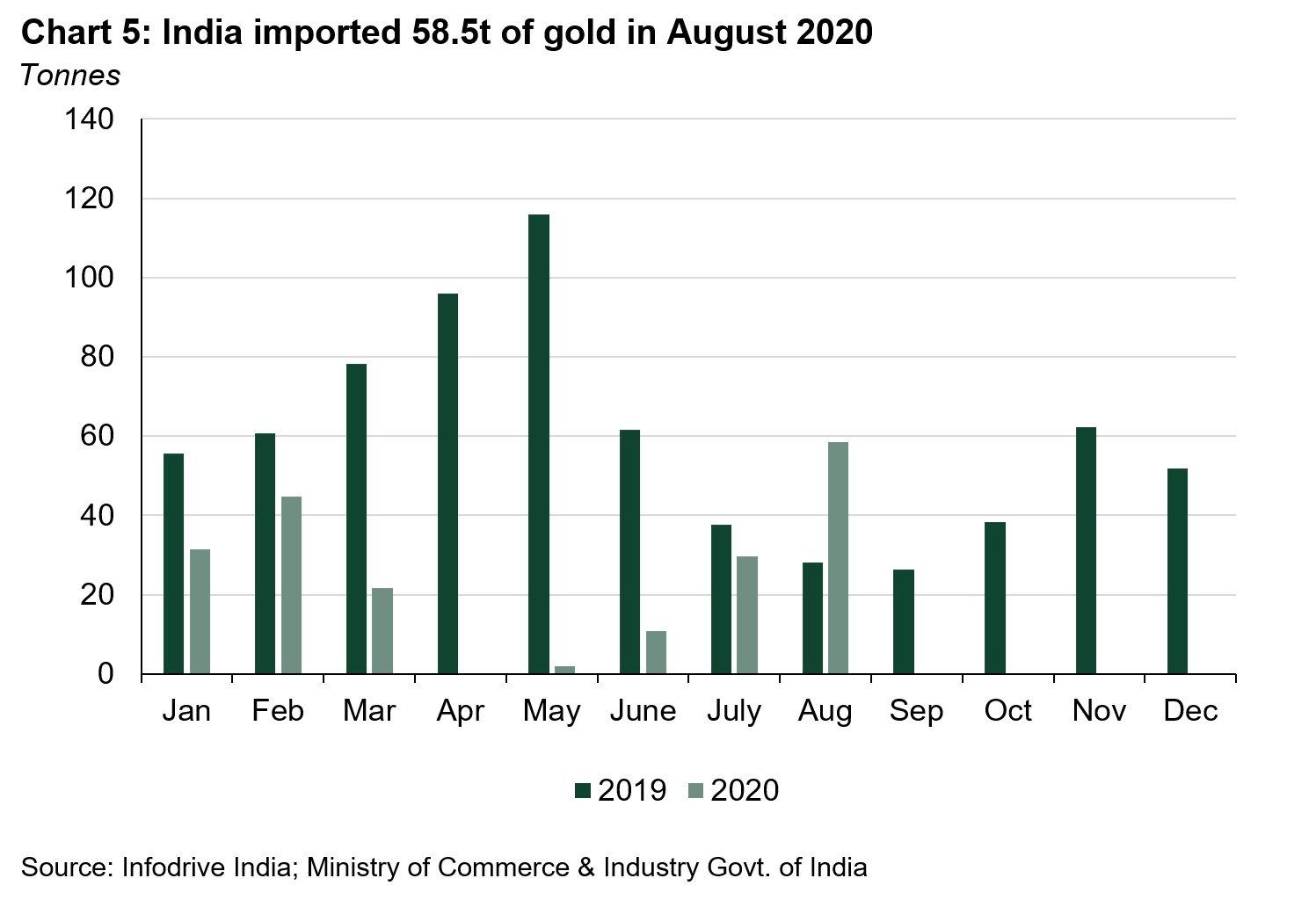

India imported 58.5t of gold in August

Indian official gold imports reached a nine-month high of 58.5t in August 2020 – although imports were more than double those of August 2019, y-t-d they remain very weak (-63%) (Chart 5). A total of ten banks, nominated agencies and exporters imported 48.2t of bullion during the month, and 17 refineries imported 10.3t of gold doré (fine gold content).

Looking at imports data in August, ~70% of the official imports landed in India during the first two weeks of the month – when the retail demand was strong following a sharp rally in the international gold price. Further, out of a total of 58.5t official imports in August, 16.5t were imported in Sri City Free Trade Warehousing Zone (FTWZ).6 These imports landed in FTWZ with an expectation of strong demand in August, which failed to materialise after the correction in the domestic price. Those imports are expected to move to the domestic market when demand improves ahead of the wedding and festival season.

RBI added 33.2t of gold reserves between February and August

The RBI purchased an additional 4t in August, bringing y-t-d purchases to 33.2t and taking its total gold reserves to 668.2t (Chart 6).7 The RBI has stepped up its gold purchases with the aim of diversifying its foreign reserves and maintaining the safety and liquidity of its forex reserves.

Monsoon gained strength in August and Kharif sowing remained healthy

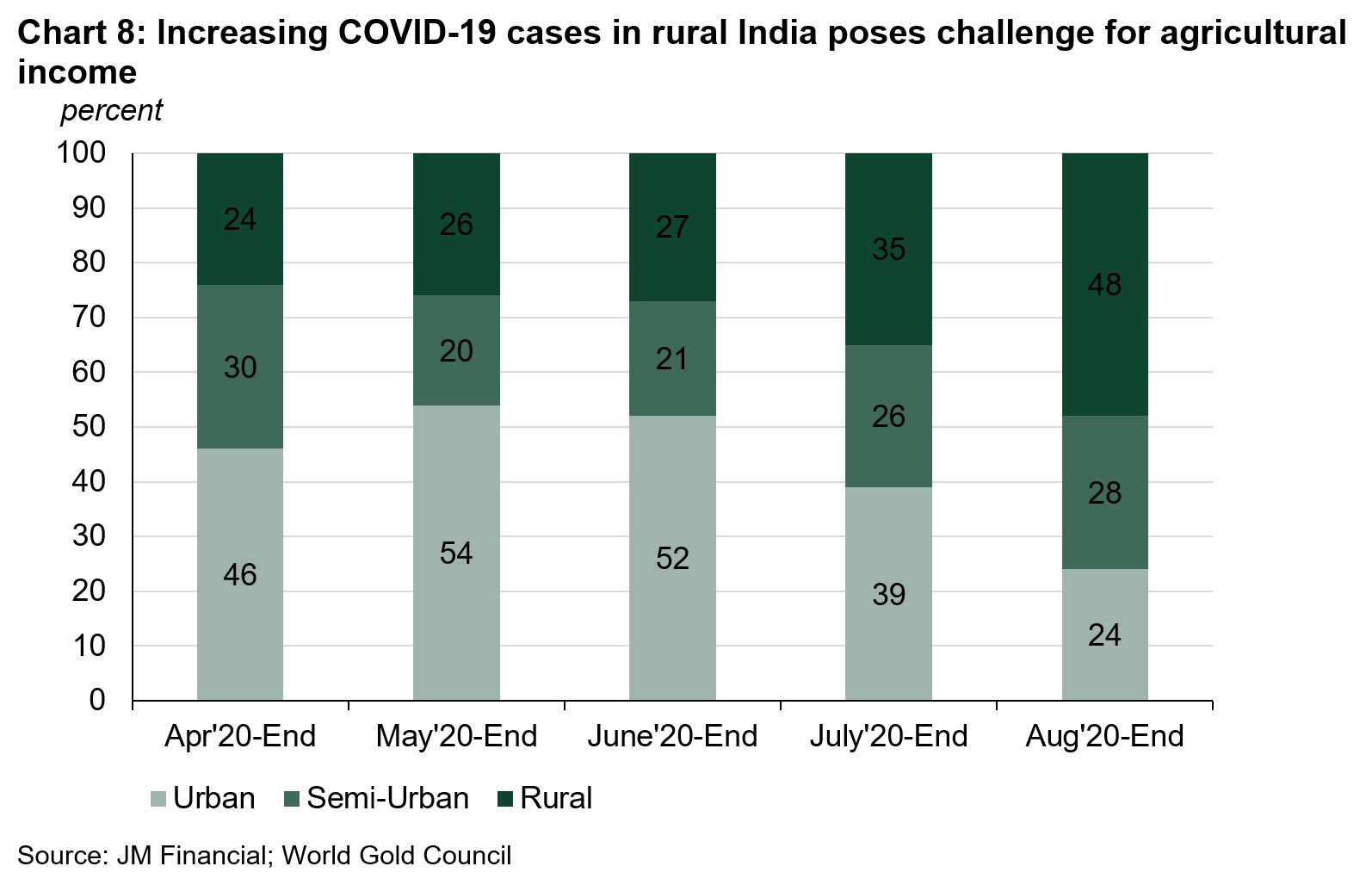

The India Meteorological Department (IMD) has forecast a normal monsoon in its second stage forecast for the southwest monsoon 2020.8 After rainfall was 9.8% lower than the Long period Average (LPA) in July, the monsoon gained strength in August and reached a 44-year high in terms of monthly departure from LPA, with rainfall 27% higher than the LPA in the month. Cumulative rainfall in the months of June to August ended at 9.8% higher than LPA at end of August. Kharif crop sowing at end of the month remained healthy (+7.2% y-o-y), which should help boost agricultural incomes (Chart 7).9 Rapid spread of COVID-19 in rural India, however, poses a risk to those incomes (Chart 8).

Footnotes

1 As of 31 August 2020.

2 EWay Bill is an Electronic Way bill for movement of goods generated on the eWay Bill Portal. A GST registered person cannot transport goods valued more than Rs50,000 (Single Invoice/bill/delivery challan) in a vehicle without an e-way bill that is generated on ewaybillgst.gov.in.; https://cleartax.in/s/eway-bill-gst-rules-compliance

3 We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

4 Onam is a Hindu harvest festival celebrated in Kerala by local citizens. It is an auspicious day for gold purchases and this year fell on 31 August.

5 As of 31 August 2020. Computations in Indian Rupee of total return indices for BSE Sensex and S&P BSE India Government Bond Index. For domestic gold price MCX India Gold Spot Index is considered.

6 FTWZ has a distinct advantage as overseas suppliers can import gold into the custom bonded warehouse of FTWZ without paying customs duty for authorised operations. Imported gold can be stored in FTWZ for a long period, whilst the validity of the letter of approval (LOA) is valid, thus reducing the logistics time in supplying to the domestic market as compared to importing from the overseas market.

7 Central Bank data is taken from IMF-IFS. IFS up until July and weekly statistics have been taken from RBI for August. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics

8 Long Range Forecast Update for The 2020 Southwest Monsoon Rainfall, Press Information Bureau 1 June 2020.

9 Monsoon rainfall is taken from the India Meteorological Department and Kharif crop sowing is from the Ministry of Agriculture, using data as of week ending 31 August 2020.