In the February 2019 edition of Gold Investor, I wrote about how robust, informative, and accessible data can act as an invaluable tool for enhancing knowledge, improving understanding and providing context. This was the primary motivation for the creation of Goldhub, as data is key to more informed decision making.

And in recent years, the gold market has continued to take steps towards greater transparency by improving the availability and accessibility of data. Today, another step forward is taken.

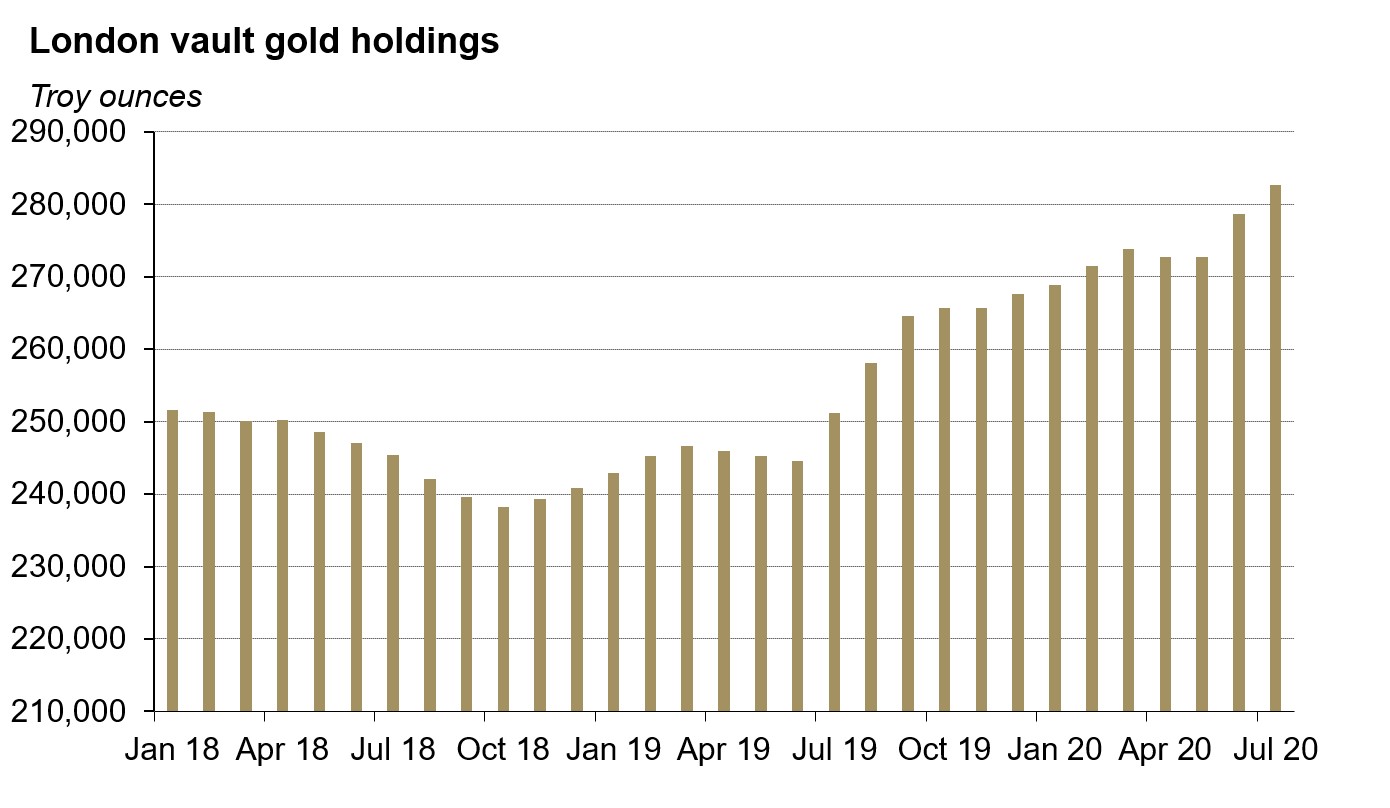

The London Bullion Market Association (LBMA), the Bank of England, and the commercial vaults have announced they will now be publishing gold and silver holdings within the vaults in London with a one-month lag, compared to the previous three month lag.1 This data provides insight into the flows of gold (and other precious metals) into and out of London, the heart of the physical gold OTC market.