Summary

- The domestic gold price increased by 11% m-o-m and is 37.2% higher y-t-d1

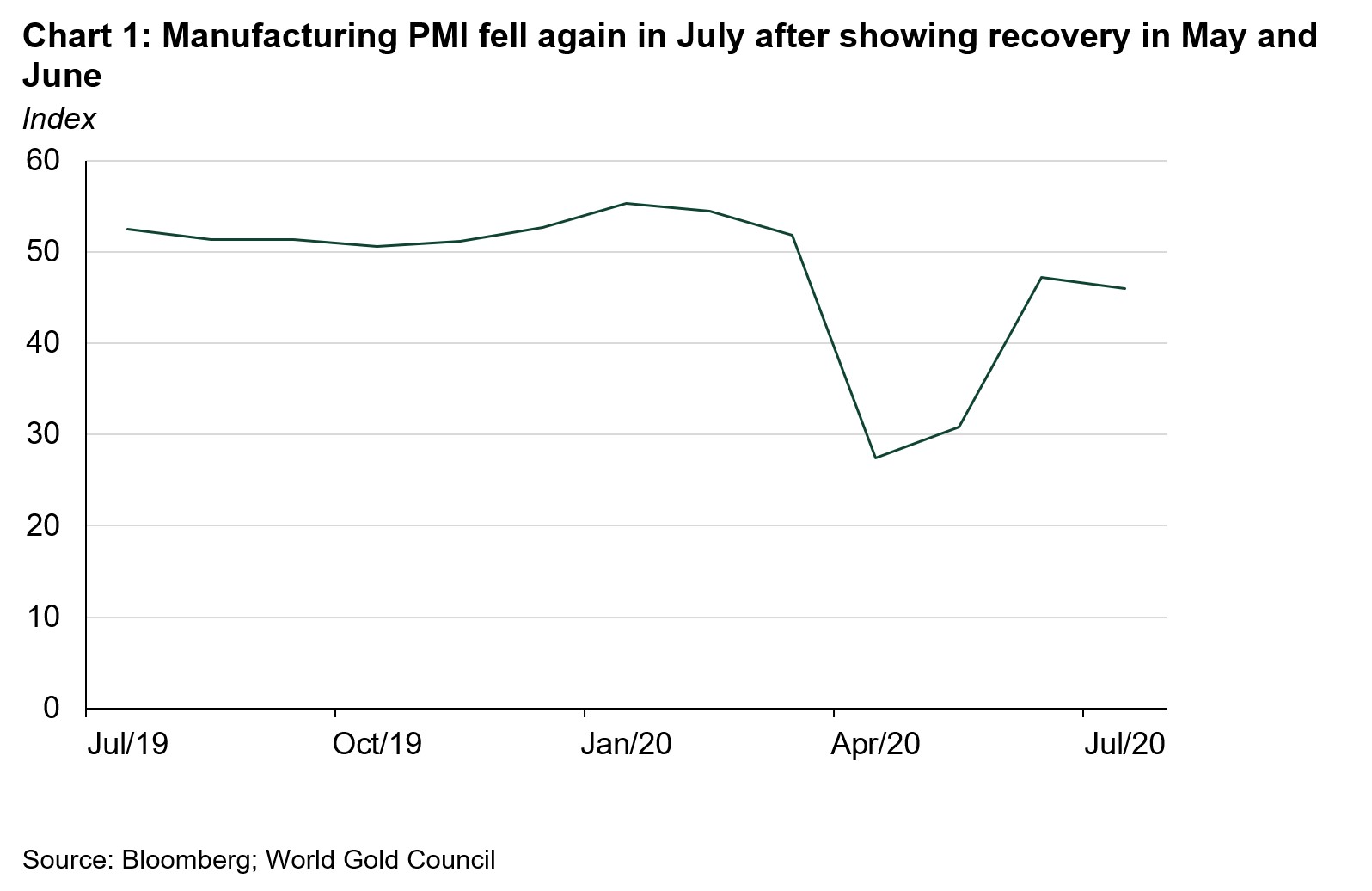

- Economic activity weakened in July after showing signs of recovery in May and June

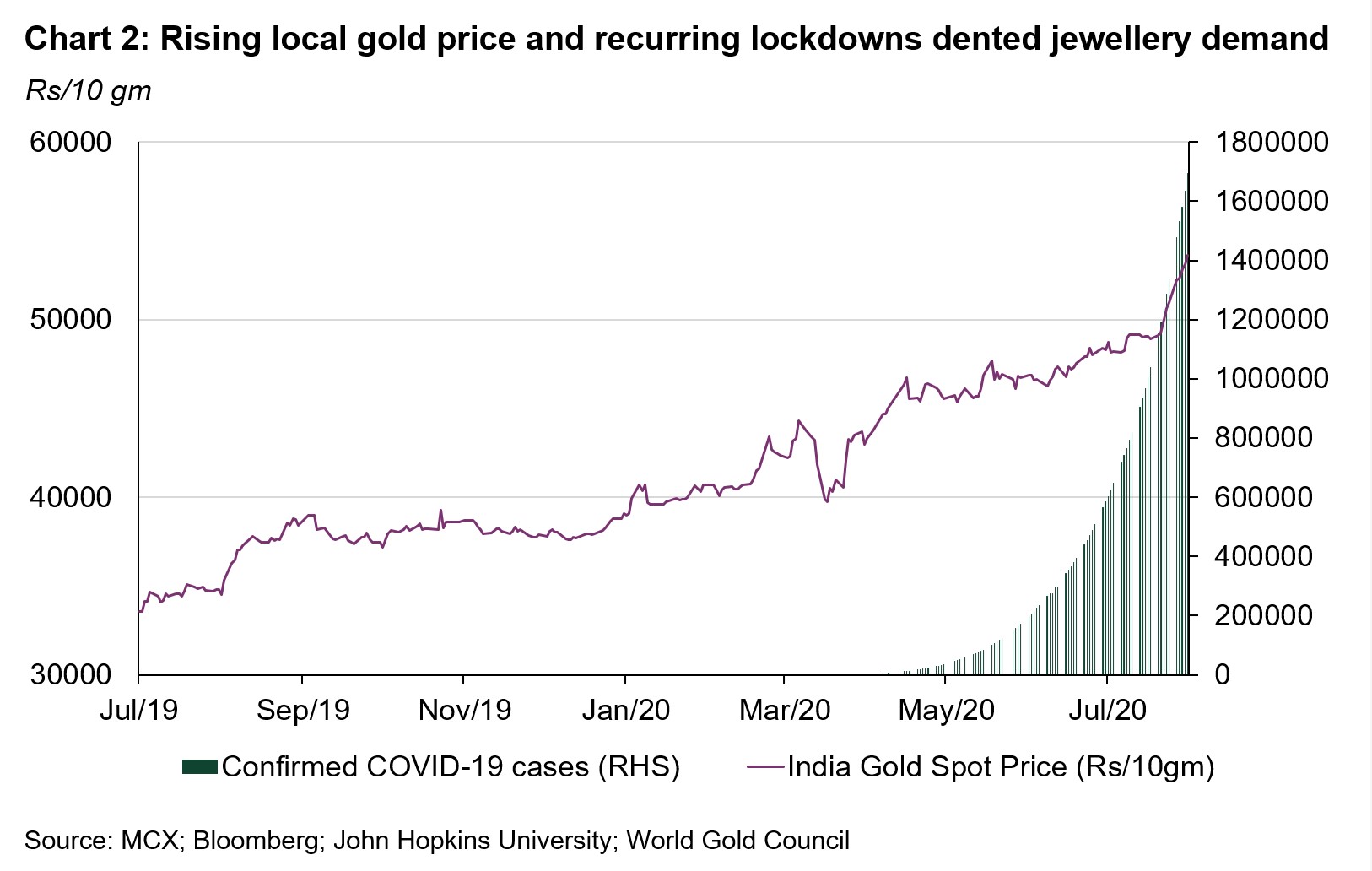

- Jewellery demand was supported by weddings and promotions but faced headwinds of gold price rises and recurring lockdowns

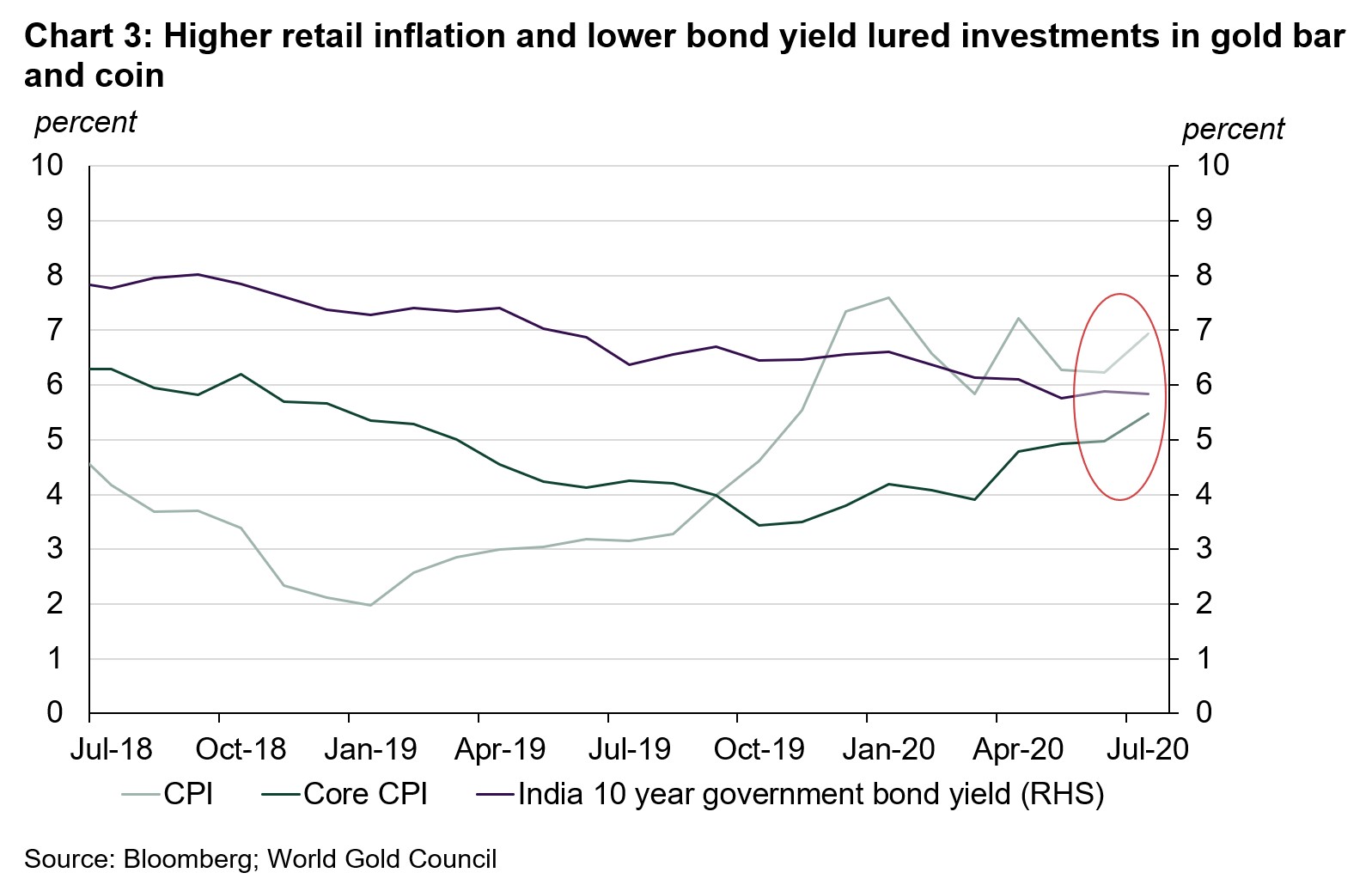

- Gold bar and coin demand was healthy, buoyed by the rising gold price, higher retail inflation and lower government bond yields that attracted investors

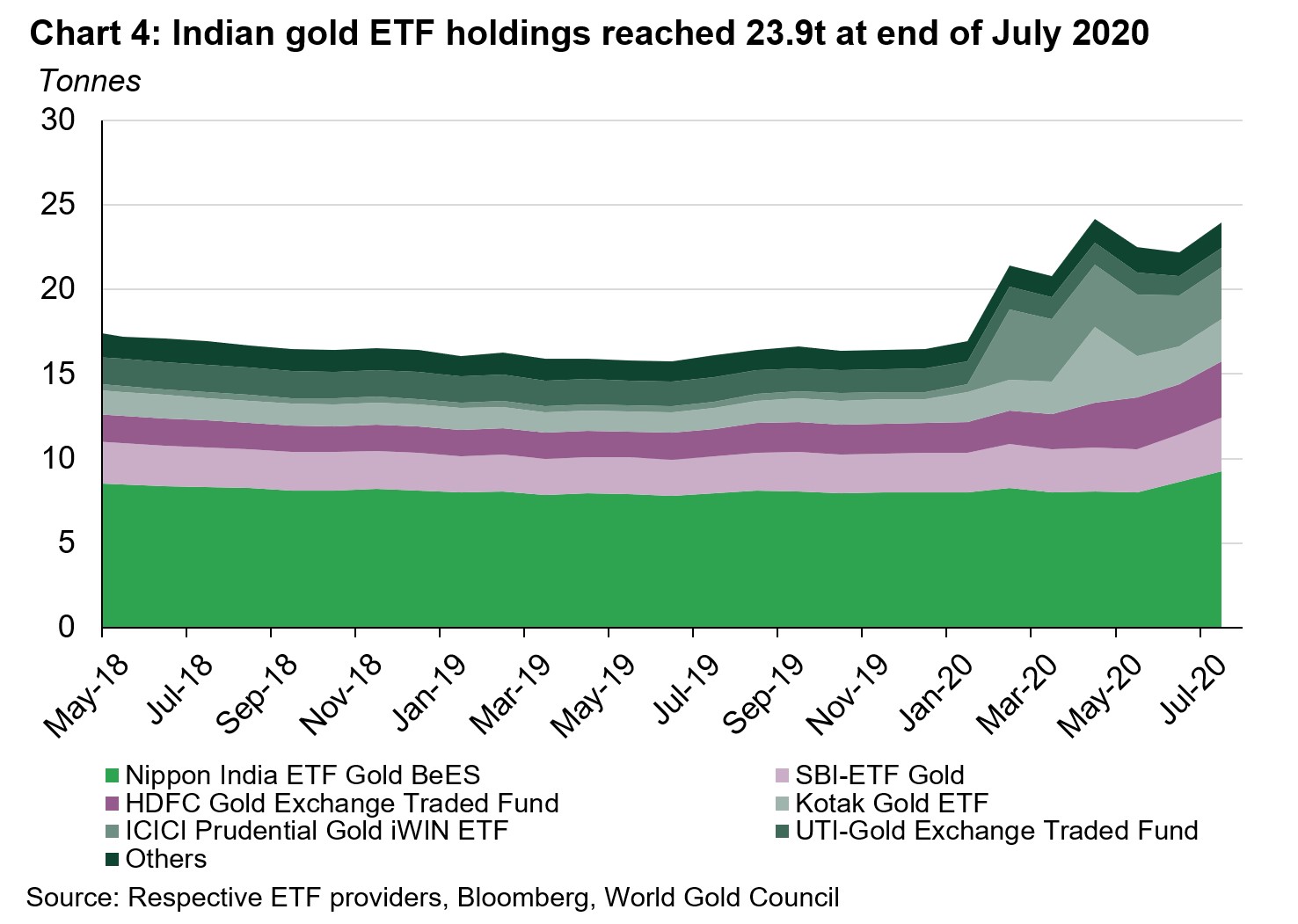

- Bullish gold price momentum, higher domestic gold price volatility and safe-haven demand lured investors towards gold ETFs. Total holdings for Indian gold ETFs reached 23.9t at end of July; a net inflow of 1.7t in the month

- The Reserve Bank of India (RBI) added 26.4t of gold to its reserves between February and June 2020

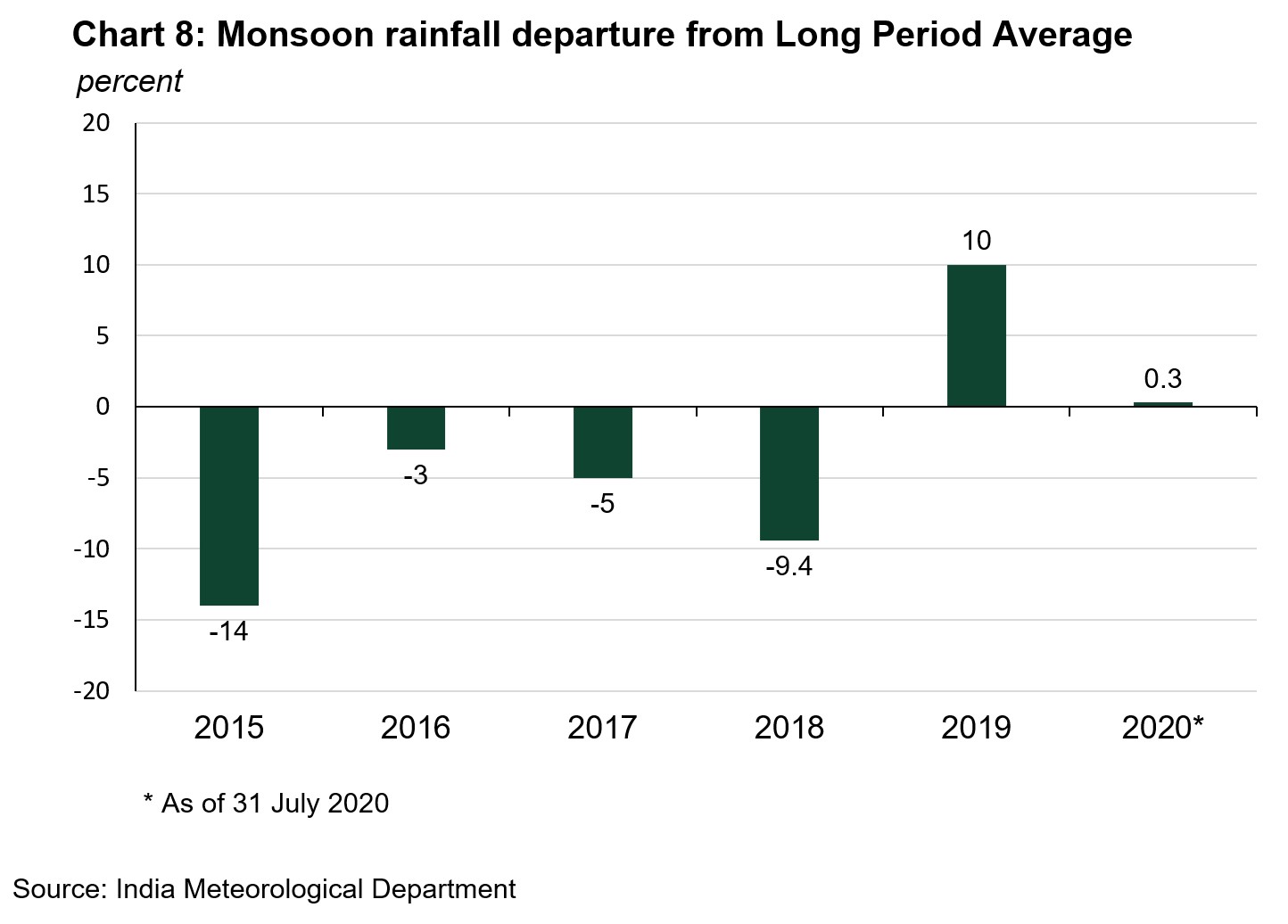

- Cumulative rainfall in June and July was 0.3% above Long Period Average (LPA) rainfall, with Kharif sowing 13.9% higher compared to last year.

Economic activity weakened in July following signs of recovery in May and June

India’s manufacturing purchasing managers’ index (PMI) fell to 46 in July from 47.2 in June. This was the first m-o-m fall in manufacturing PMI since May, indicative that pent-up consumer demand – due to lockdown restrictions in April and May – is being exhausted (Chart 1). After showing signs of recovery over previous months, fuel demand – a reflection of economic activity in the country – fell by 11.7% y-o-y and 3.5% m-o-m in July.2 As shown in the RBI Survey, the Consumer Confidence Index fell to an historic low of 53.8 in July from 63.7 in May with the one-year ahead confidence index indicating signs of recovery.3

Jewellery demand received support from wedding purchases and promotions in July but faced headwinds from a higher local gold price and recurring lockdowns throughout the country

Consumers brought forward wedding purchases scheduled for Q3 and Q4 of the year, as the continued price momentum raised expectations of higher gold prices ahead. Jewellery demand was further supported by the delivery of gold against advance bookings and wedding purchases in Kerala.4 Jewellery retailers also ran promotions and offers on making charges to entice consumers.

Jewellery demand faced headwinds due to the higher gold price and recurring lockdowns (Chart 2). The domestic gold price inched higher to an average of Rs49918/10gm in July, 44.7% higher y-o-y and 5.5% higher m-o-m, impacting discretionary spending on gold jewellery. With the gradual relaxation of lockdown, COVID-19 cases started to rise in July, posing a further challenge for jewellery demand. Full, partial or weekend lockdowns were announced to contain the pandemic. States such as Bihar, Sikkim, Nagaland were under complete lockdown; West Bengal announced a two-day lockdown every week, and states such as Punjab, Uttar Pradesh and Madhya Pradesh opted for weekend lockdowns. This added further pressure to already subdued jewellery demand.

Gold bar and coin demand benefitted from the rising gold price, higher retail inflation and lower government bond yields

The domestic gold spot price rose by 11% over the month. In India, returns on gold of 37.2% y-t-d have outperformed returns on BSE SENSEX of -10.3% and 10-year government bond returns of 14.9% – supporting gold’s appeal as an asset.5 Retail investment demand in gold was further reinforced by higher retail inflation and lower government bond yield (Chart 3). Retail inflation (CPI) increased to 6.9% in July from 6.2% in June due to higher food prices and has remained above the RBI’s target of 6% for four consecutive months. The 10-year government bond nominal yield fell further to 5.8% at end of July and has fallen sharply since March. In such a scenario, investors flocked to purchase bars and coins, taking advantage of returns on gold price, a hedge against inflation and the lower opportunity cost of holding gold.

Bullish gold price momentum, higher volatility in the domestic gold price and safe- haven demand lured inflows into gold ETFs

MCX Gold Spot (995 fineness) in INR ended the month 11% higher than at the end of June. Against a backdrop of rising COVID-19 cases, volatility of MCX Gold Spot price at end of the July reached 11.87 – higher than the volatility of XAU at 10.59.6 Bullish gold price momentum, higher volatility and safe haven demand lured investors towards gold-backed ETFs. Net inflows into gold-backed ETFs were 1.7t in July, pushing total AUM to 23.9t by the end of the month (Chart 4).

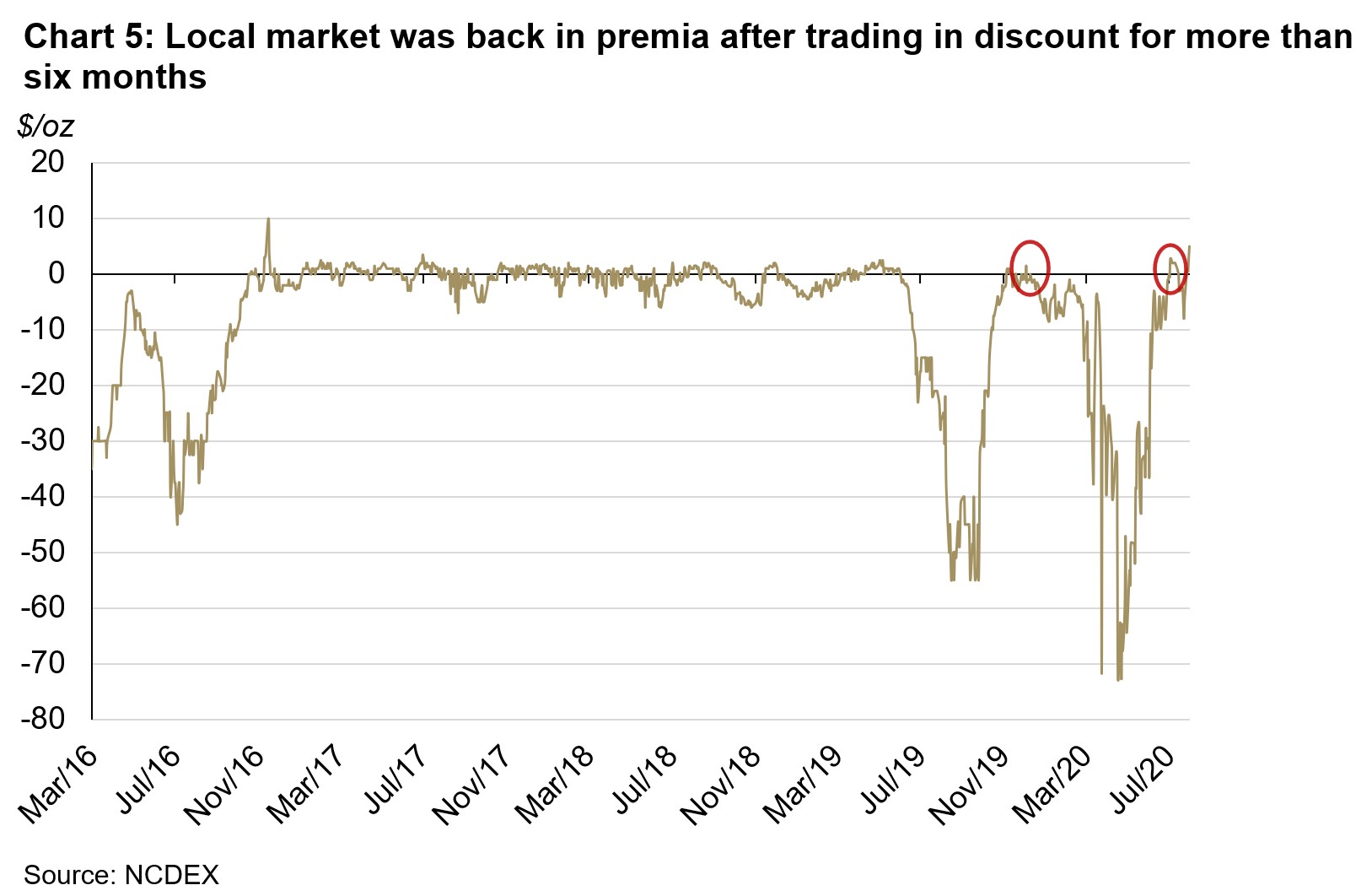

Local market was back in premia after trading in discount for more than six months

With narrowing discount in the month of June, the local market was back in premia in the first week of July. This was driven by improved investment demand (bar and coin and gold ETF demand), curtailed official imports and a sharp fall in unofficial imports (Chart 5). The Indian domestic market traded in premia for the first time since November 2019 – a gap of more than six months.

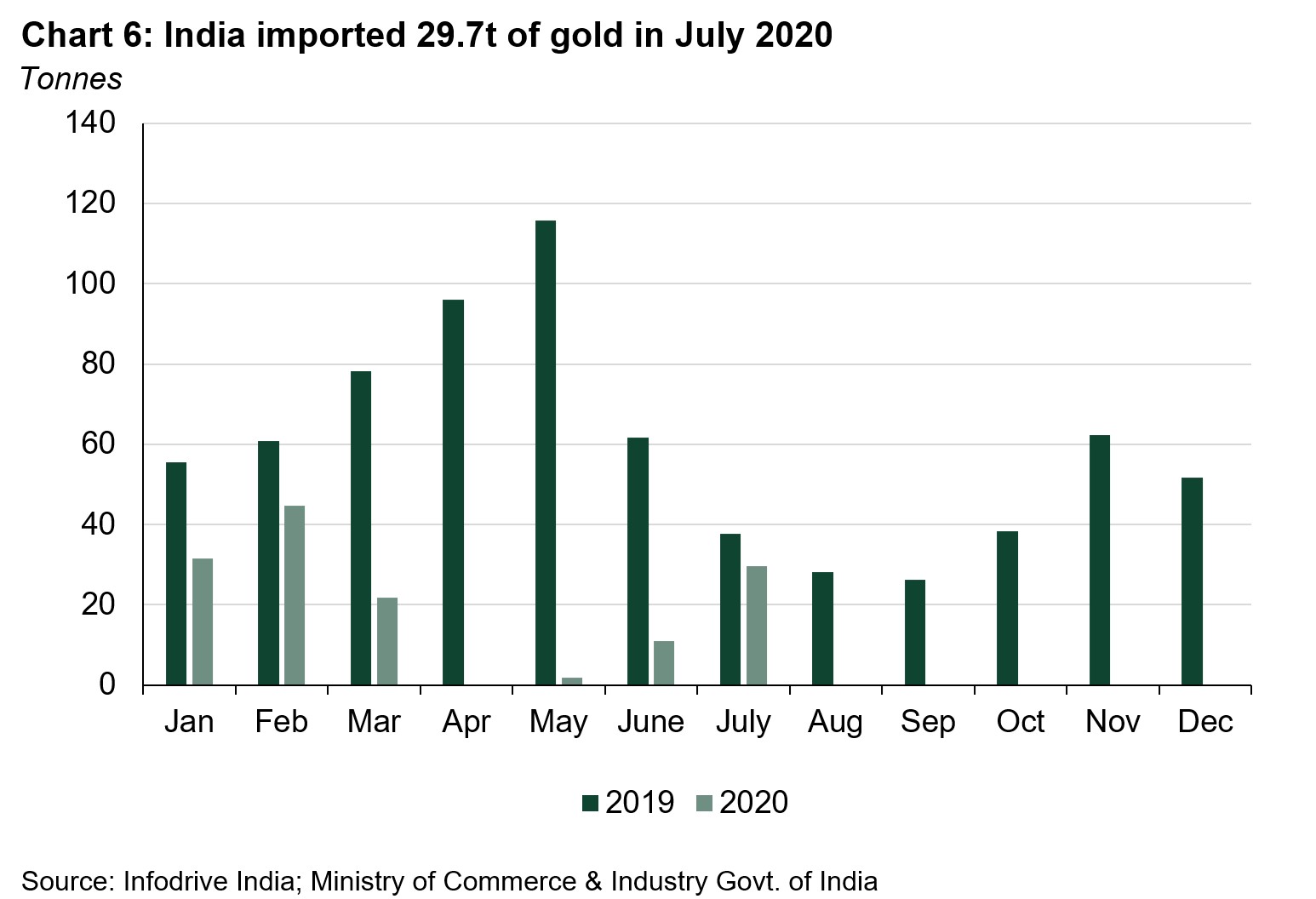

India imported 29.7t of gold in July

Indian official gold imports reached a five-month high of 29.7t in July 2020 – 21.2% lower y-o-y and 72.2% lower y-t-d (Chart 6). A total of six banks, nominated agencies and exporters imported 16.2t of bullion during the month, and fourteen refineries imported 13.5t of gold doré (fine gold content).

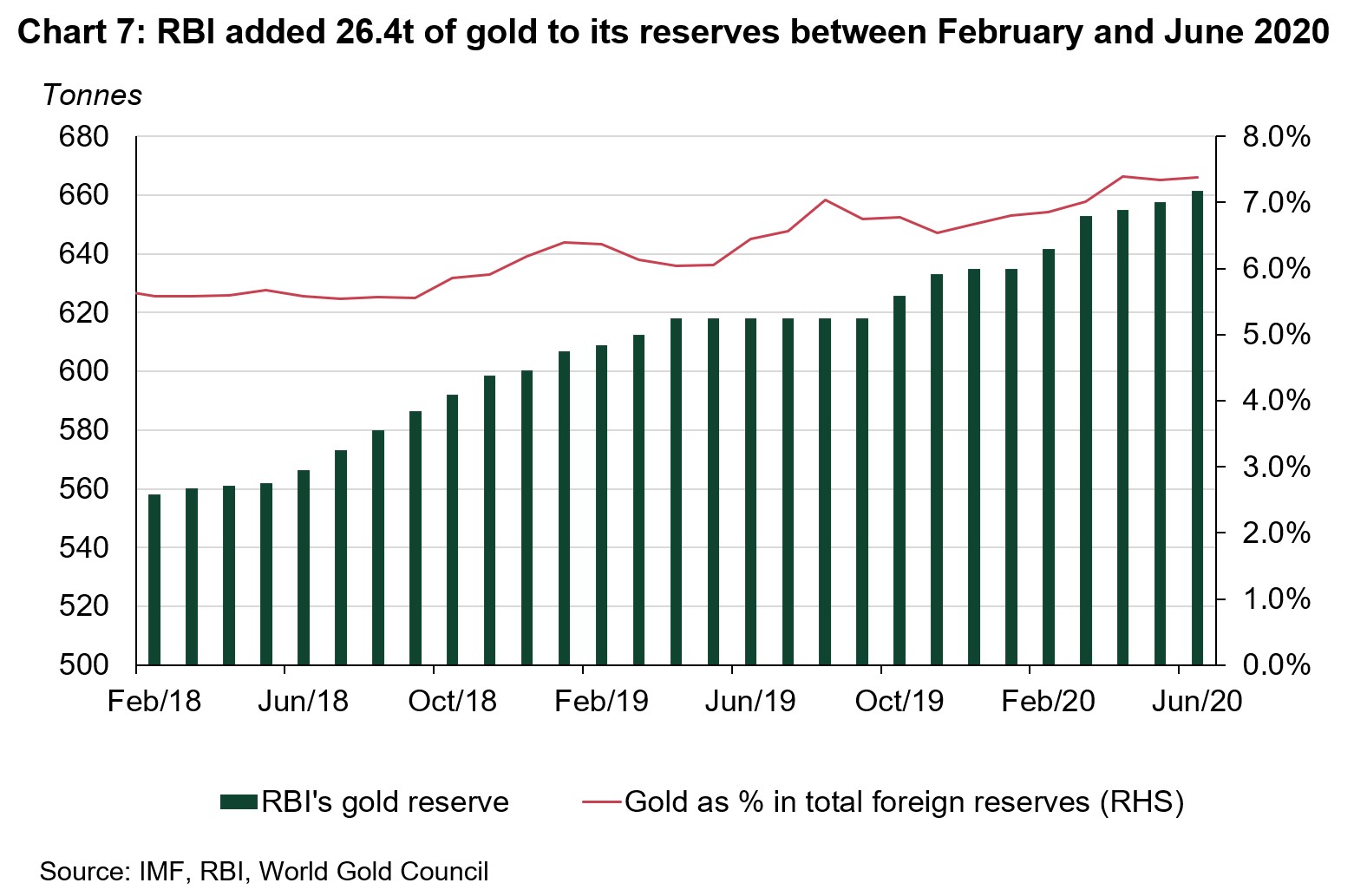

RBI added 26.4t of gold reserves between February and June

The RBI purchased a total of 26.4t of gold between February and July, taking its total gold reserves to 661.4t by the end of June 2020 (Chart 7).7 The RBI stepped up its gold purchase to maintain the safety and liquidity of its forex reserves.

Monsoon slowed in July but Kharif sowing remained healthy

The India Meteorological Department (IMD) has forecasted a normal monsoon in its second stage forecast for the southwest monsoon 2020.8 After 17.6% above Long Period Average(LPA) rainfall in June, monsoon slowed during July and ended 9.8% lower than the Long Period Average in July. Cumulative rainfall in the months of June and July ended at just 0.3% higher than LPA at end of July (Chart 8). Kharif crop sowing, however, remained healthy and was 13.9% higher than the previous year.9

Footnotes

1 As of 31 July 2020.

2 Petroleum Planning and Analysis Cell (PPAC) of the Ministry of Petroleum & Natural Gas.

3 Consumer Confidence Index is compiled from the survey conducted by RBI on 5,342 households in 13 major cities of India during 1-12 July 2020.

4 Jewellery retailers run an advance booking scheme where consumers can lock-in prices by choosing the lower of the gold price at the time of booking or at the time of delivery. The wedding season in Kerala starts after mid-August.

5 As of 31 July 2020. Computations in Indian Rupee of total return indices for BSE Sensex and S&P BSE India Government Bond Index. For domestic gold price MCX India Gold Spot Index is considered.

6 Bloomberg; 30-day historical volatility.

7 Central Bank data is taken from IMF-IFS. IFS data is two months in arrears; hence data is available until the end of June. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics

8 Long Range Forecast Update for The 2020 Southwest Monsoon Rainfall, Press Information Bureau 1 June 2020.

9 Monsoon rainfall is taken from the India Meteorological Department and Kharif crop sowing is from the Ministry of Agriculture, using data as of week ending 31 July 2020.