Summary

- The domestic gold price increased by 3.3% in June m-o-m and is 24% higher than at the end of 2019

- Economic activity improved as lockdown eased to some extent

- Jewellery demand improved further in the month but failed to recover completely due to recurring lockdowns, lower number of weddings and lack of auspicious days in the month

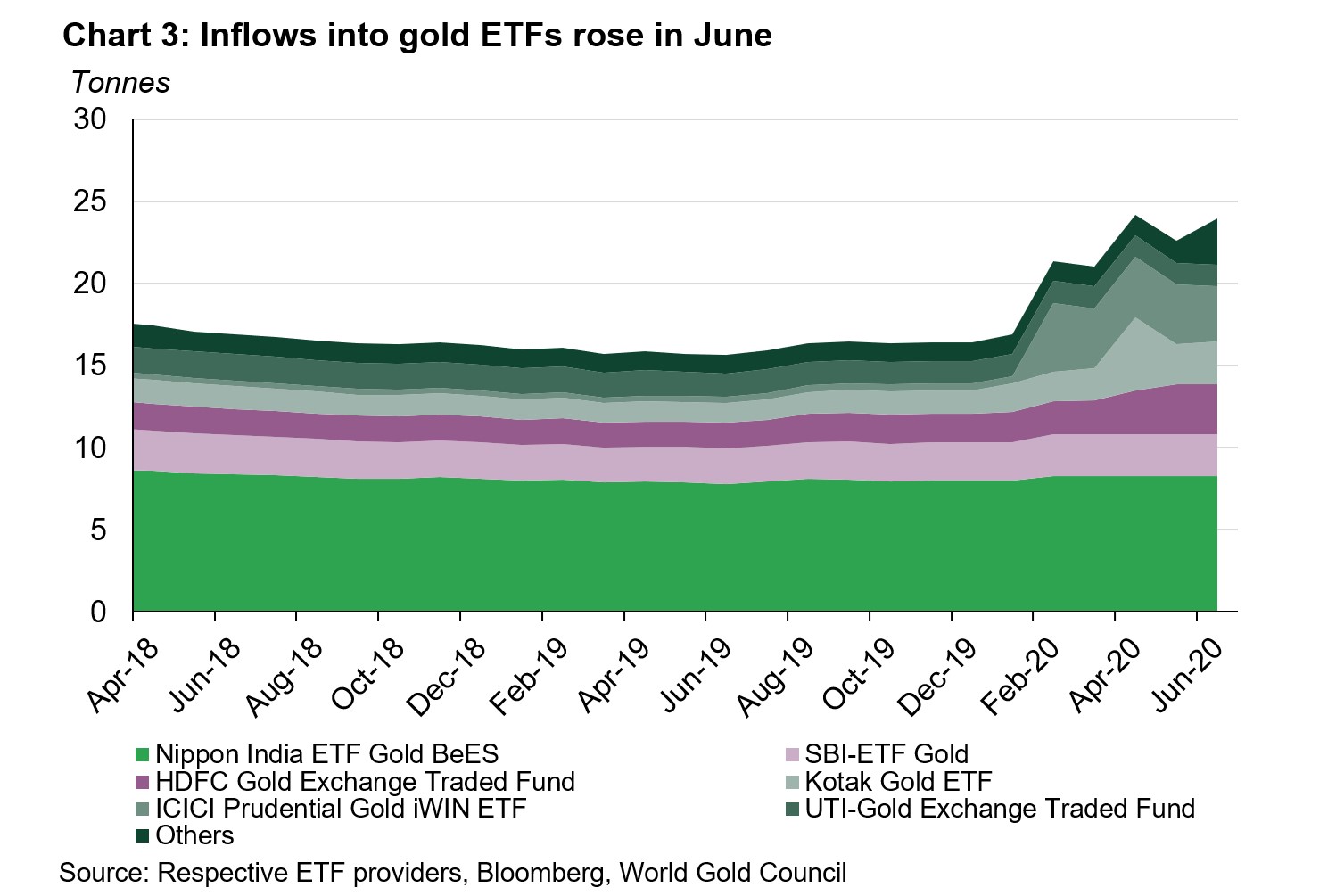

- Bullish gold price momentum and safe-haven demand lured investors towards gold ETFs. Total holdings for Indian gold ETFs reached to 24t in June

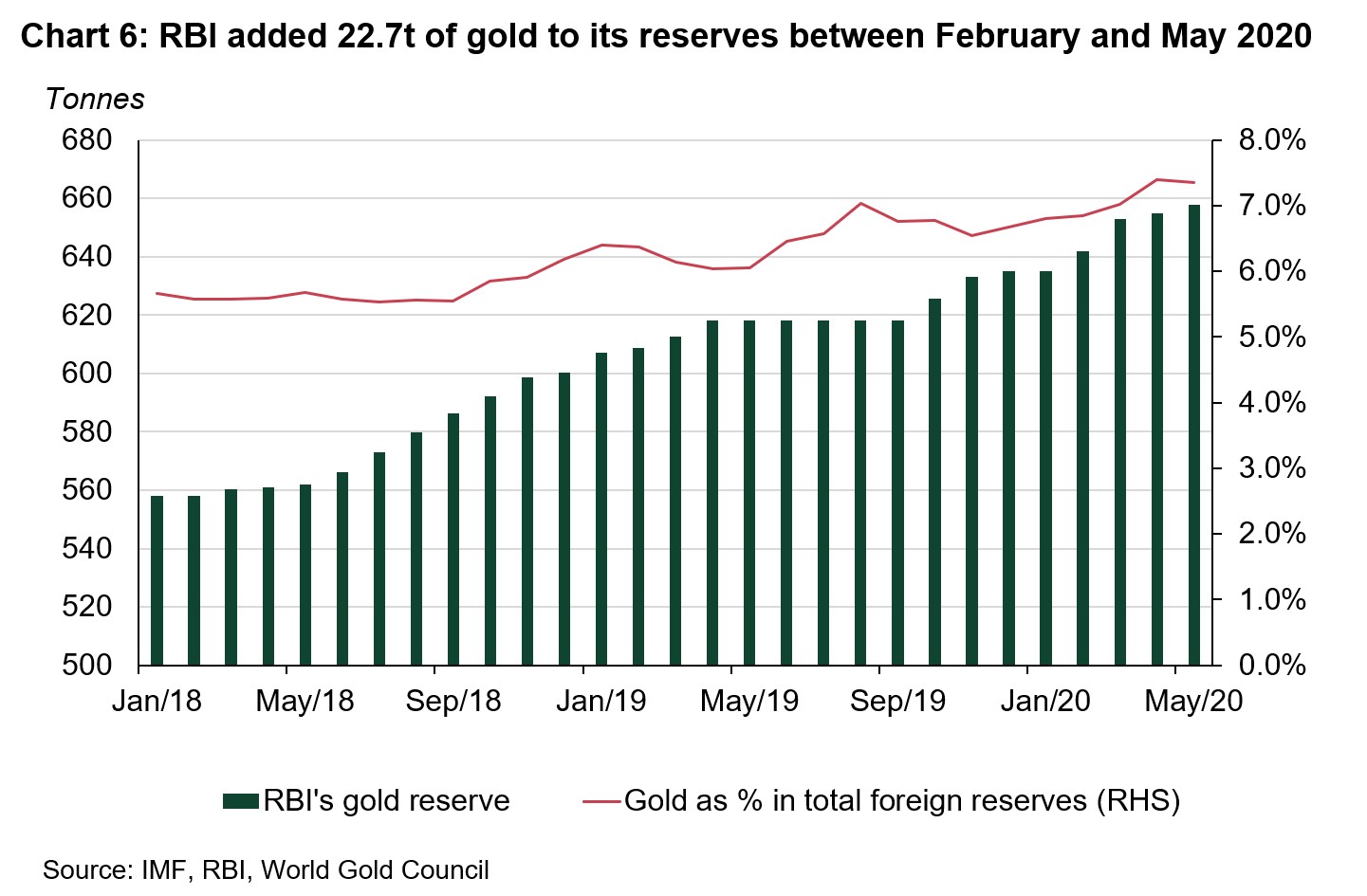

- The Reserve Bank of India (RBI) added 22.7t of gold to its reserves between February and May 2020

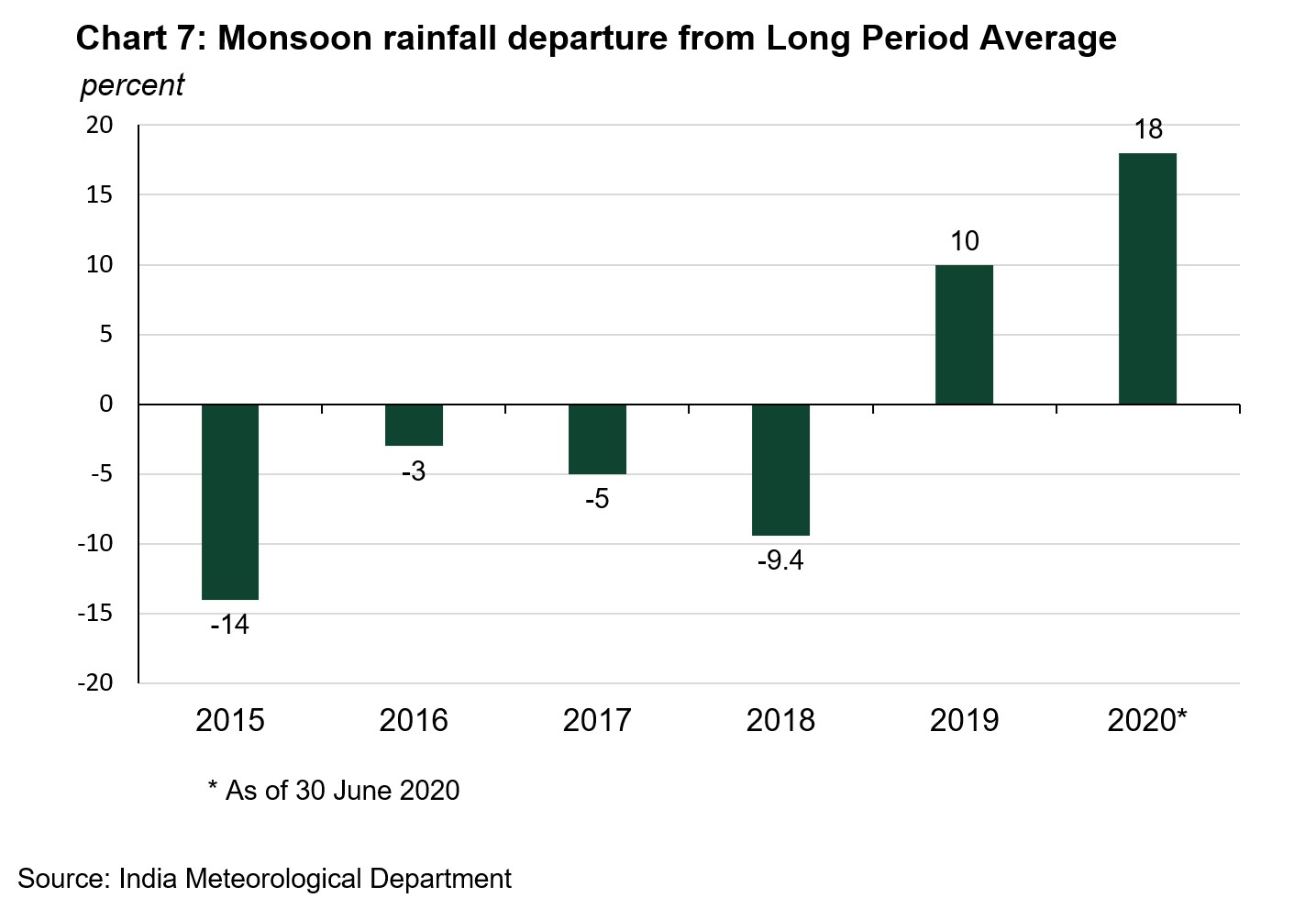

- Monsoon is 18% above Long Period Average (LPA) rainfall with Kharif sowing almost double compared to the last year- normal monsoon and healthy sowing bodes well for rural gold demand in Q4 2020.

Economic activity improved as lockdown eased to some extent in June

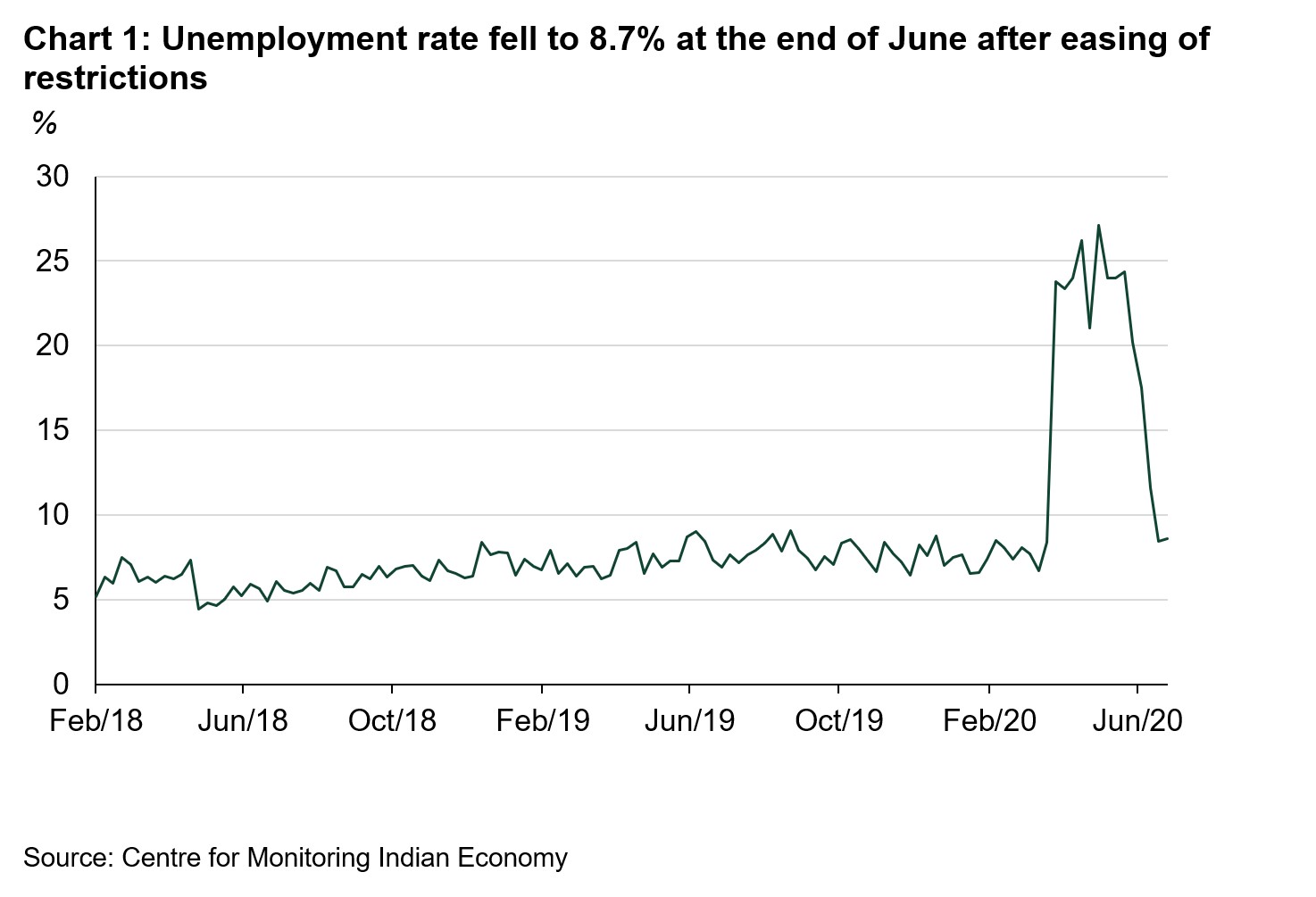

The Ministry of Home Affairs announced phase-wise resumption of economic activities outside COVID-19 containment zones.1 Following this, domestic economic activity improved in the month. India’s top two-wheeler manufacturers, Hero MotoCorp and Bajaj Auto, reported y-o-y falls in domestic two-wheeler sales of 27% and 26% respectively during the month- lower than 83% and 81% decline in the month of May. With the easing of the restrictions and re-opening of the economy, unemployment rate fell to 8.7% by end of June from a high of 27.1% in the first week of May. (Chart 1).

Jewellery demand witnessed further improvement in June but demand failed to recover completely due to recurring lockdowns

With the easing of lockdown in June, jewellery markets re-opened in most of the cities of India. In the state of Tamilnadu, branded jewellery stores re-opened in major gold consumption cities of Coimbatore and Chennai but only without air-conditioning as per state directive. However, footfalls remained tepid and retailers reported average daily sales of 20-25% of the comparable period in the previous year.

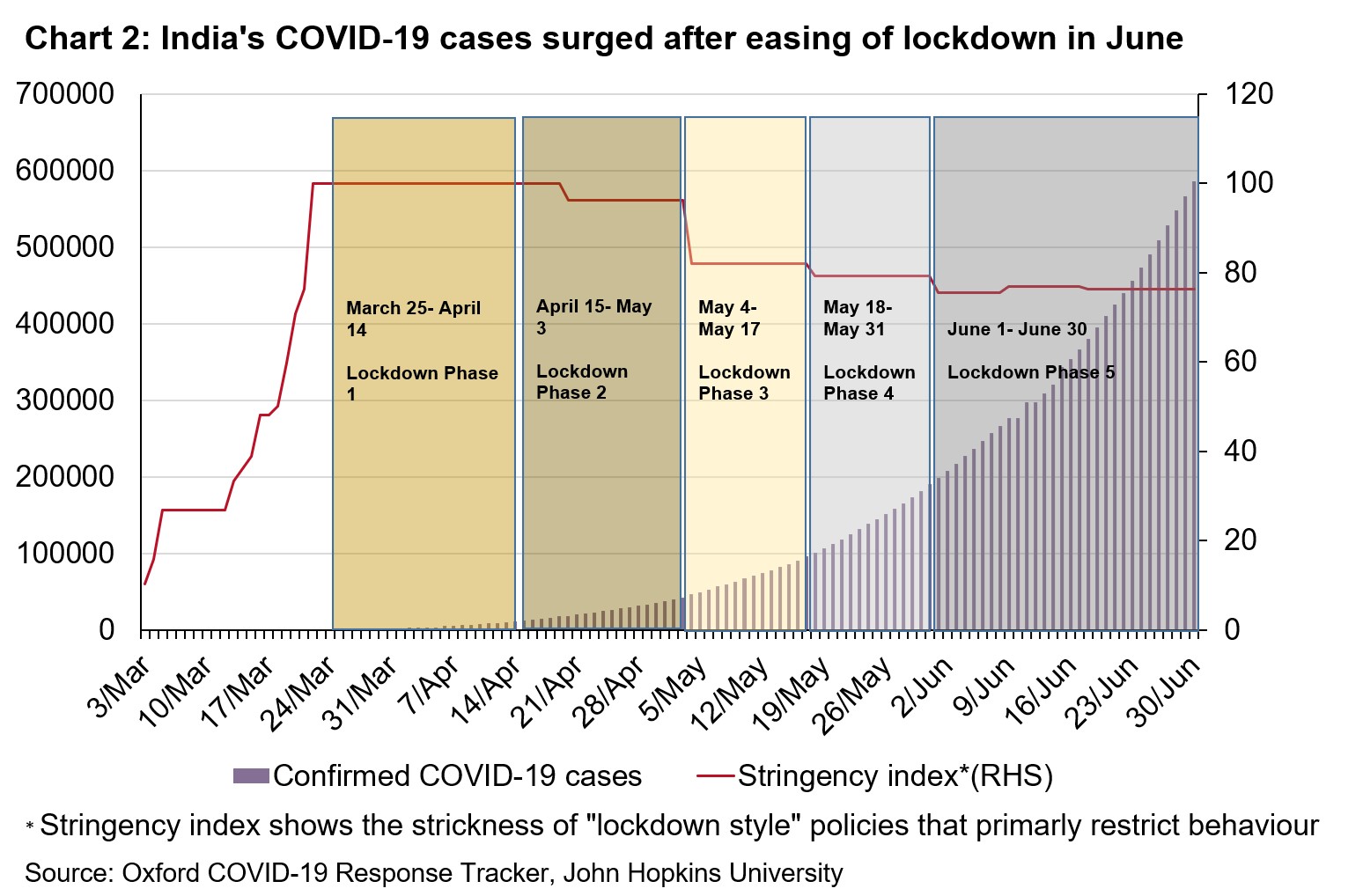

With the gradual relaxations to the lockdown, COVID-19 cases started to rise in June posing further challenge for jewellery demand (Chart 2). Demand failed to recover completely due to the recurring lockdowns in cities to contain the pandemic. Lower number of weddings and lack of auspicious days in the month further dampened demand.

Bullish gold price momentum and safe haven demand lured inflows into gold ETFs

The MCX Gold Spot (995 fineness) in INR ended the month 3.3% higher than at the end of May, outperforming the LBMA Gold Price AM in USD (+3%) over the same period.2 Bullish gold price momentum and safe haven demand lured investors towards gold-backed ETFs – a flight to the safe haven. Inflows into gold-backed ETFs continued in June, reaching a total AUM of 24t at end of the month (Chart 3).

Discount in the local market narrowed to US$1/oz by end of the month

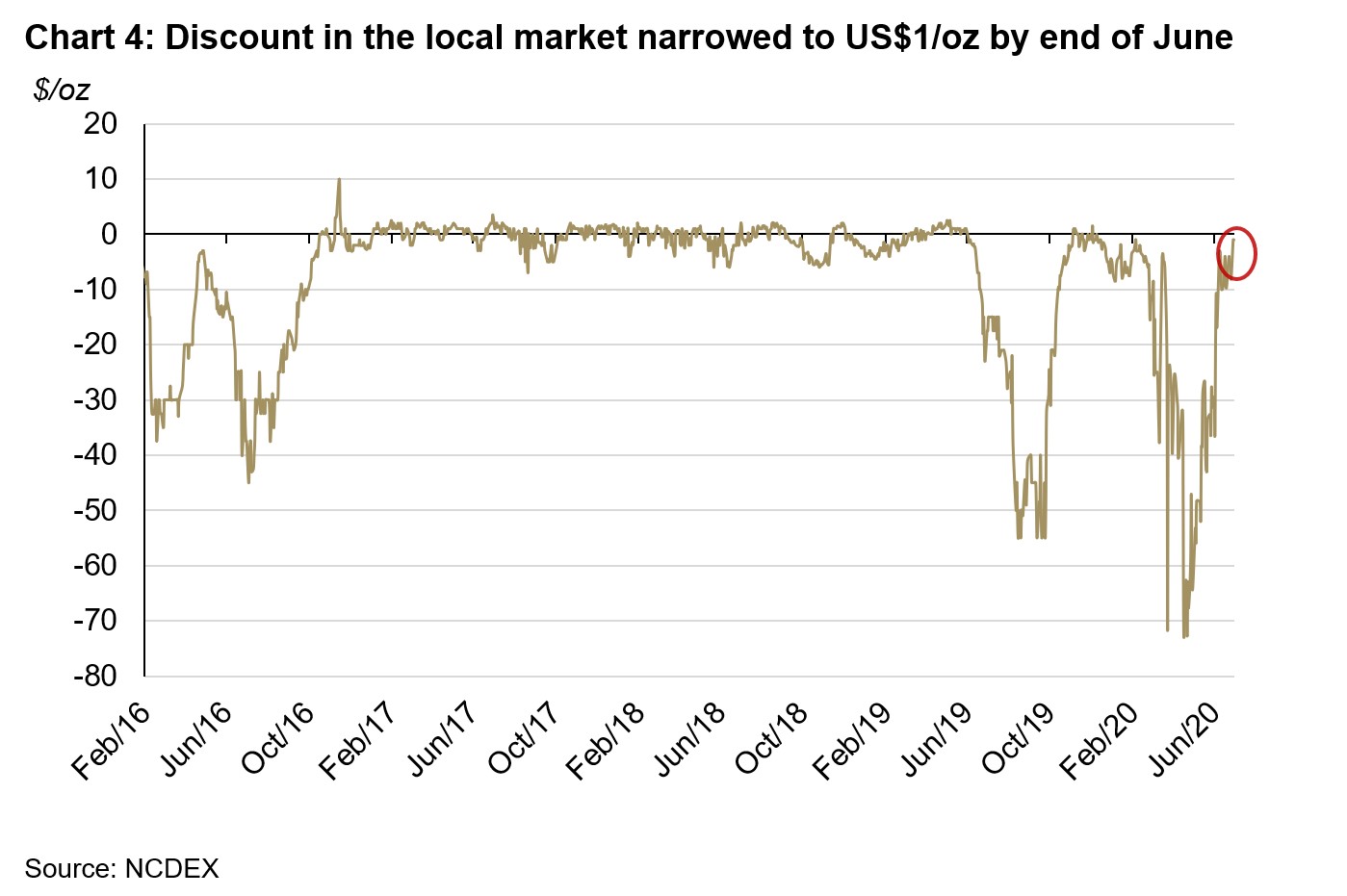

The average discount in the local market started to trend lower in June after the re-opening of jewellery stores. Discount in the month narrowed from US$30/oz at the start of the month to US$1/oz by end of the month due to a sharp fall in unofficial imports and improved retail demand (Chart 4).

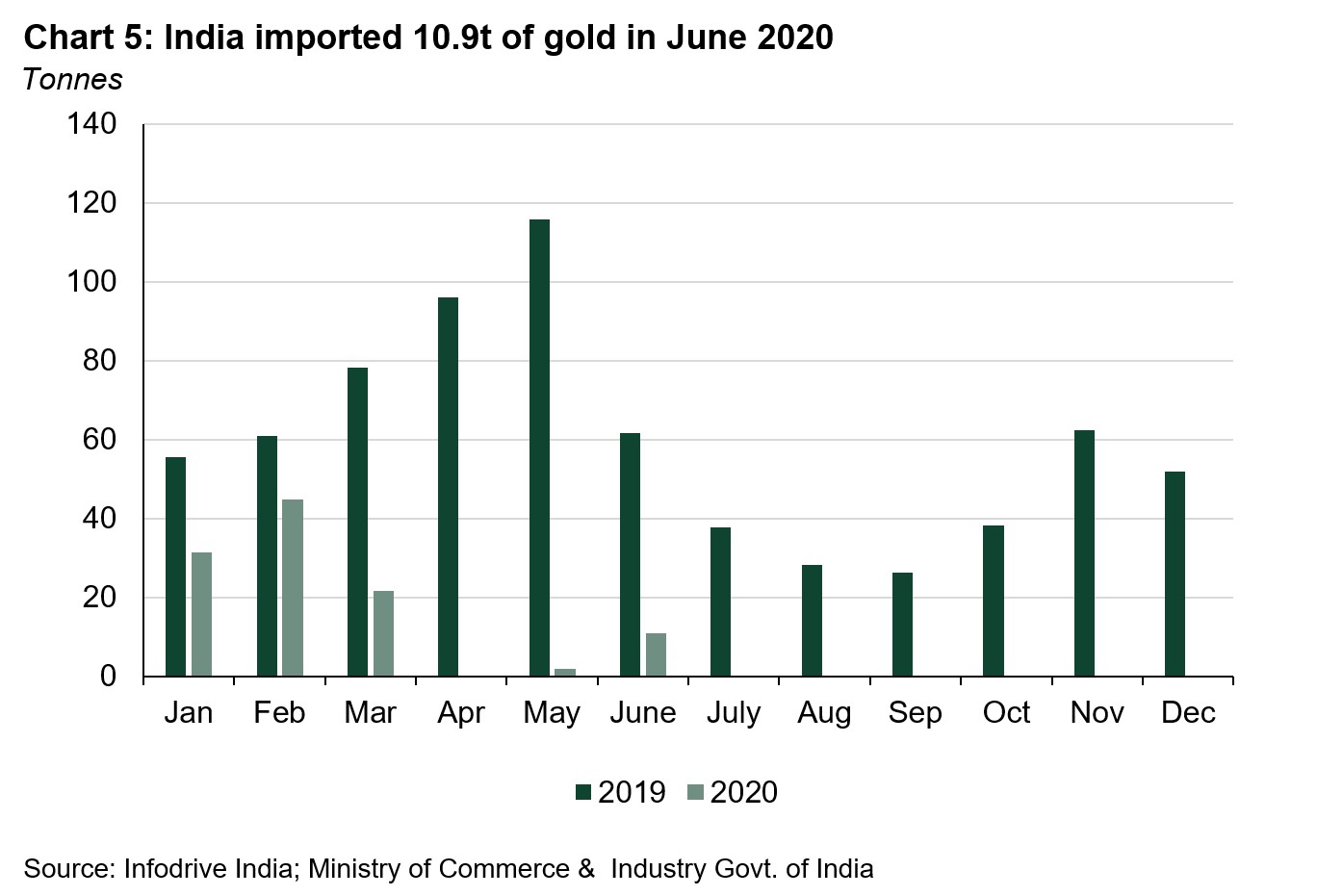

India imported 10.9t of gold in June

Indian gold imports totalled 10.9t in May 2020 – 82% lower y-o-y and 76% lower y-t-d (Chart 5). A total of two banks, nominated agencies and exporters imported 7.4t of bullion during the month, and twelve refineries imported 3.5t of gold doré (fine gold content).

RBI added 22.7t of gold reserves between February and May

The RBI purchased a total of 22.7t of gold between February and May, taking its total gold reserves to 657.7t by the end of May 2020 (Chart 6).3 The RBI stepped up its gold purchase to maintain the safety and liquidity of its forex reserves.

Monsoon is progressing well

The India Meteorological Department (IMD) gave a forecast of normal monsoon for second stage forecast for southwest monsoon in 2020.4 Monsoon has started on a positive note and ending at 18% above the LPA at end of June (Chart 7). Following strong monsoon in the month, Kharif crop sowing has more than doubled in June as compared to the last year.5 A normal monsoon and healthy Kharif sowing bodes well for rural gold demand in Q4 2020.

Footnotes

1 The perimeters of the containment zone are decided based on the number of positive cases in the area, contact tracing history and population density.

2 We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

3 Central Bank data is taken from IMF-IFS. IFS data are two months in arrears, hence data is available until end of April. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics

4 Long Range Forecast Update for The 2020 Southwest Monsoon Rainfall, Press Information Bureau 1 June 2020

5 Monsoon rainfall is taken from India Meteorological Department and Kharif crop sowing is from Ministry of Agriculture with data as of week ending on 26 June 2020