Our central banks team, in partnership with Yougov, recently concluded the 2020 Central Bank Gold Reserves Survey.1 This year’s survey, which saw a jump in the number of responses, shows strong signs of an increase in gold’s relevance for central bank reserve management: 20% of respondents say that they plan to add gold to their reserves this year, up from 8% in the 2019 survey. The results also indicate shifts in investment attitudes towards gold as the impact of the COVID-19 pandemic continues to affect the global financial and economic outlook.

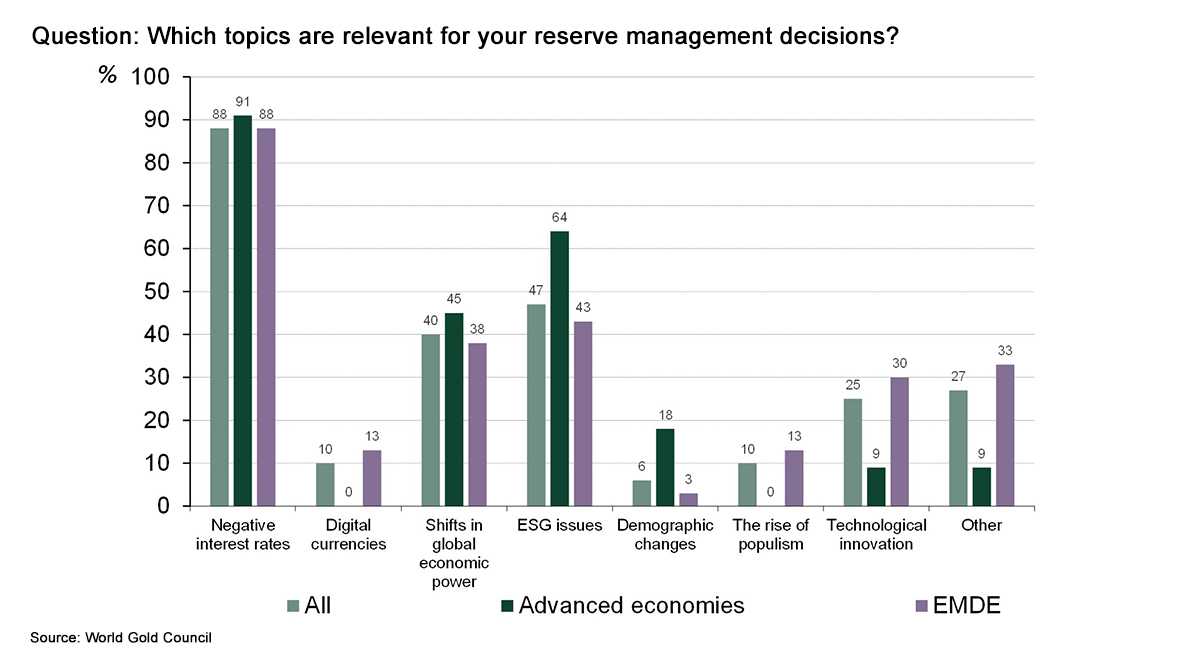

Several key findings from the survey are worth highlighting. We polled 51 central banks on the themes which are relevant for their investment decisions. The overwhelming majority – 88% – picked “negative interest rates” as relevant. This view will probably be reinforced in the post-COVID-19 era as continued monetary expansion will keep global rates low or negative for the foreseeable future, a situation that increases gold’s attractiveness (“opportunity cost”) relative to fixed income.

We also asked central bankers to rank the factors behind their decision to hold gold reserves. As in last year’s survey, “Historical position” and “Long-term store of value” were the top two factors. However, the similarities end there. Gold’s “Performance during times of crisis” has risen to become the third most relevant factor (79%), up from fifth place in the 2019 survey (59%). Similarly, other investment-related factors like “No default risk”, “Effective portfolio diversifier”, and “Highly liquid asset” all saw significant increases in their relevance this year. The COVID-19 pandemic may have reshaped thinking towards risk management and the need for portfolio diversification, leading to these factors for holding gold gaining more prominence.

The same question also illustrates the dichotomy of views towards gold between advanced economy and emerging economy respondents. Emerging economy respondents (denoted as Emerging Market and Developing Economy – EMDE – in the survey) rated nearly every factor as more relevant than their advanced economy counterparts. This underscores the differences in reserve management philosophies between advanced and emerging countries, and may also explain why emerging market central banks have been the driving force behind official sector gold purchases in the last decade.

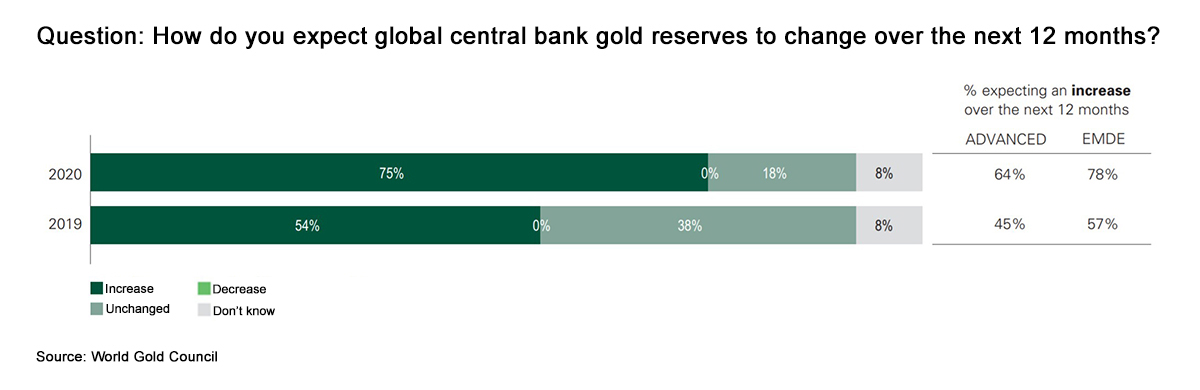

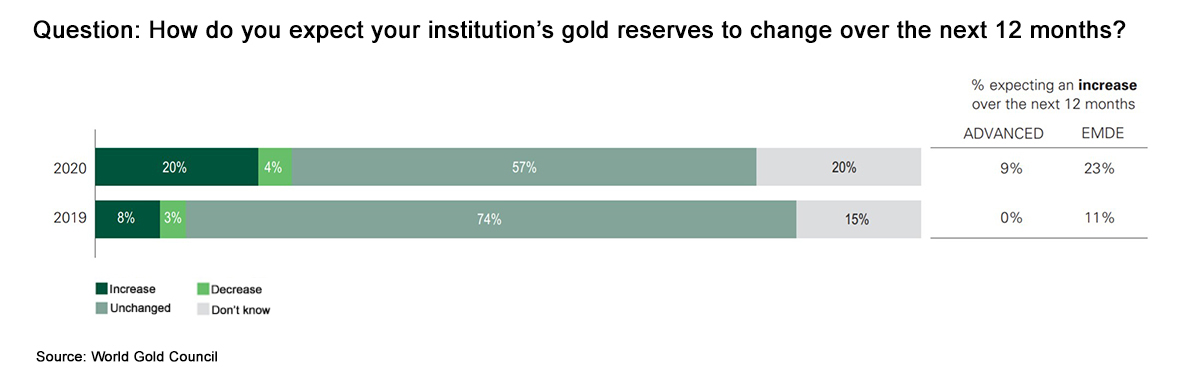

Finally, we asked central bankers to share their predictions for changes in the level of gold holdings this year, both at an aggregate level and for their own institution. The results show that consensus opinion is significantly more positive than last year. Three-quarters say that global central bank gold holdings will increase in 2020, up from 54% last year. No respondents believe that global central bank gold holdings will decrease. Furthermore, 20% of central banks will add gold to their own holdings this year, up from 8% last year.

This year’s survey marks notable shifts in central bank attitudes towards gold. The impact of the pandemic may have played a role in changing views, but its after-effects –prolonged low and negative rates, worries about fiscal sustainability, and continued financial market instability – are likely to persist long after the virus has subsided. These factors may be driving central bankers to re-evaluate gold’s position in their portfolios, and in turn, support the continuation of the decade-long trend of central bank gold purchases.

Footnotes

1 The World Gold Council conducts the survey in partnership with Yougov, an independent research firm. This year marks the third year of the survey. We received 51 responses from 150 central banks contacted, an uptick from the 39 responses received in 2019 and the 22 responses received in 2018. Anonymized links to an online survey were distributed to central bank contacts. The survey results are anonymous and not traceable to a specific respondent. The survey field work was conducted between 20 February and 17 April 2020.