If, as you ponder what life might look like beyond the current traumas and damage of the COVID-19 pandemic, you also find yourself asking what lessons of value may have been learnt from the crisis, you are certainly not alone. This train of thought has been preoccupying the minds of business and political leaders (and commentators) across the globe. It has been particularly dominant among those considering how we might plan to build greater resilience in future, particularly when it comes to managing the climate crisis.

A recent message from the UN’s COVID-19 Response team states, “As the world begins planning for a post-pandemic recovery, the United Nations is calling on Governments to seize the opportunity to “build back better” by creating more sustainable, resilient and inclusive societies”.1

You will likely have heard this phrase, ‘build back better’, quite a lot recently. It originally emerged in the wake of the 2004 Indian Ocean Tsunami and was used in a UN Special Envoy Report at the time to define propositions for a robust recovery and future damage limitation. But it is now more broadly taken to refer to opportunities to not only restore what was damaged or destroyed by a disaster but to build greater resilience in the recovery process to systematically address causes of potential vulnerability.

So, what lessons might we derive from the pandemic and our response to it in order to build back better? And, more specifically, how might these learnings be relevant to the most pressing challenge facing humanity - that of climate change? And, of course, what does this have to do with gold?

Before I seek to answer these questions (or at least suggest ways in which they might be addressed), I am reminded of another phrase - the ‘New Normal’ - that also seems to become ubiquitous after major crises. In the wake of a crisis, we often expect a radically and enduringly changed world, in which previously extreme or abnormal conditions are made commonplace. Conversely, however, we often also seek comfort in the prospect of reverting to norm.

You may remember after the Global Financial Crisis (GFC) of 2008-09, we were frequently informed we would have to adjust to a very different set of realities; to adapt to a post-GFC world, we would need to reconsider our approach to market risk, extend our horizons, look to the long term, and acknowledge the interconnectedness of the modern world. And yet, for a great many people and organisations, the New Normal rapidly started to look a lot like the Old Normal and all those urgent calls to change our ways were soon and easily forgotten.

For years prior to the GFC, the World Gold Council had been proposing that investors adapt a longer-term perspective, better risk management and greater portfolio diversification, while consistently and repeatedly demonstrating that gold could play a significant role in protecting portfolios in times of duress. And in the wake of the crisis, gold’s performance did not disappoint. While there are still questions regarding what institutional investors actually learnt from that challenging period, sufficient numbers of them (and central bankers) took note of gold’s outperformance to cause a rapid and substantial change in the overall structure of gold demand; these buyers have been the key source of growth in the gold market ever since.

I mention this because, while many investors may previously have proven to have short memories after a crisis, in the context of climate change, returning to old habits - defining recovery via a reversion to ‘Business As Usual’ - is simply not an option open to anyone. Which brings me to…

Lesson One: Be guided by science

Climate science tells us, starkly and irrefutably, there is no turning back the clock; no comfort or safety to be found in recent or past behaviour. The data is deeply alarming. Atmospheric CO2 has just reached a high of 417 parts per million and is now at levels not seen for 3 million years. 2019 was the hottest year on record. The global sea level has continued to rise into 2020. And alongside these sad stats, we have witnessed raging wildfires, intense storms and frequent floods. Climate-related impacts increasingly threaten ecosystems, accelerate extinction trends and soil erosion, and contribute to greater food and water insecurity. They are also a very major threat to public health, increasingly the likelihood of famine, and infectious and non-communicable diseases.

However, science also informs us that, if we act now and in a globally co-ordinated manner, guided by science-based targets, we should be better able to manage the climate, moderate its impacts and, ultimately, arrive at a more secure and sustainable, future. This applies to all sectors of the economy, including gold.

Our recent research2 indicates that the gold supply chain, and gold mining in particular, might be in a constructive position to embrace change and make a positive contribution to achieving net zero carbon targets. Overall, gold’s carbon footprint is relatively small, estimated at around 0.3% of annual global greenhouse gas (GHG) emissions. The vast majority of these emissions are generated by the mining and milling of gold and, more specifically, from the electricity and fuels used in powering these processes.

Fortunately, there are already a range of options, increasingly accessible and cost effective to allow gold miners to move away from fossil fuels and decarbonise both their electricity and transport needs. Renewable energy sources, such as wind, solar and hydro power, are already at a stage they are likely to prove more cost effective for miners than any persistent commitment to the existing carbon-intensive options. And the further development of complementary technologies will likely support and accelerate the further appeal of renewables and the path to net zero carbon.

While some of the COVID-19 impacts on the reduction of energy and fossil fuel consumption may prove short lived, the pandemic has at least loosened our bondage to fossil fuels, allowing us to glimpse a cleaner future and it would be a great pity if we turned our back on that vision.

Lesson Two: Commit, plan, and act

One very immediate lesson from the COVID-19 lockdowns is the clear demonstration it has offered of how quickly a change in human activity can result in environmental improvements. We now need to apply that lesson to the longer term, make a more sustained commitment to build on recent improvements, and translate our plans into action.

Bill Gates, talking in 2015, stated, “If anything kills over 10 million people in the next few decades, it is most likely to be a highly infectious virus… We should be concerned. But, in fact, we can build a really good response system.”3 We unfortunately did not build that global response system, but COVID-19 has since taught us that governments, businesses and individuals can act swiftly and at the scale required to avert disastrous consequences. If we establish and maintain a similar level of commitment and take concerted action to align our emissions with the Paris Agreement, we might be able to ‘flatten the climate curve’,4 while ensuring we also build greater resilience.

The Responsible Gold Mining Principles, launched by the World Gold Council late last year, include a clear commitment from our member gold mining companies to support “the objectives of global climate accords through avoidance, reduction or mitigation of carbon emissions” while enhancing the ability of their “operations and nearby communities to be resilient to the effects of climate change”.5

Lesson Three: Opportunity is knocking

Numerous policy makers and commentators have been quick to recognise that the recovery process from COVID-19 shocks may also represent a significant opportunity for economic transformation, with support for climate mitigation as a key driver.

To achieve net zero carbon emissions by around 2050 – a pre-requisite to stabilising the climate over the century - will require radical changes across all corners of the economy and society, including the restructuring of energy, land use, transport and buildings, with unwavering support from governments, businesses and individuals. Before COVID-19, the prospect of implementing such colossal structural changes looked overwhelming to many. However, the scale of the financial and social support packages and plans to resuscitate the global post-pandemic economy now make such substantial actions look far more achievable. The opportunities to link those support and recovery plans with specific Paris-aligned objectives are now clearly evident to policy makers, regulators and investors. The World Economic Forum, launching its 'Great Reset' initiative, recently commented, “We have looked at ways to “build back better” and it's very clear that investing in greener economies is going to be a huge part of recovery efforts.”6 Other leaders at the WEF event, including Kristalina Georgieva, Managing Director of the IMF, agreed that “this moment of crisis was also a moment of opportunity to chart a different course”.7

And, even as I write this, Reuters reports that Mark Carney, ex-Bank of England Governor turned UN Special Envoy for Climate Action and Finance, is telling investors they have an “enormous opportunity” to enable the shift to a low-carbon future in the wake of the coronavirus pandemic.8

Recognising the time is now, and cognisant of the strong business case for energy transition, many gold mining companies are already embracing change. If the sector continues to acknowledge climate-related risks as a strategic driver of business interests and increasingly at the heart of investment decisions, it might also be able to demonstrate sectoral leadership in its responses. This, in turn, might create further opportunities to widen investor interest in - and societal appreciation of - the industry.

Lesson Four: Reconsider risk and time horizons

In addition to the question of how a company or sector might impact climate change, a key issue for potential gold investors – and, indeed, investors in all asset classes – is how climate-related risks and future scenarios are likely to impact the value of their investments and the performance of their portfolios. With this in mind, the World Gold Council’s research on climate change has sought to not only identify a credible path for the gold mining sector to move towards carbon neutrality, but to also offer insights into how gold’s value as an asset might be impacted by climate risks.

The acceptance that climate impacts will reshape future asset performance is increasingly mainstream investment thinking, and the regulatory environment was already moving to formalise this well before COVID-19. But the greening of the post-pandemic recovery might be the trigger needed to accelerate this tendency, translating it from aspirational trend into established good practice.

The economic convulsions caused by COVID-19 might also be the shock needed to finally counter the short-termism that has blinkered investors for decades. The UN Global Compact has stated that “short-termism in investment markets is a major obstacle to companies embedding sustainability in their strategic planning and capital investment decisions.”9 Climate change has been described as ‘COVID-19 in slow motion’10 and it requires a long-term perspective to understand the risks and opportunities it represents, and to plan accordingly.

The World Gold Council has produced a substantial body of work, over decades and different market cycles, looking at gold’s long-term performance as an asset, not least because we believe strategic investment objectives and longer time horizons are key to securing optimal portfolio performance in the service of wealth preservation. Recent circumstances might further validate this perspective.

Lesson Five: Take out insurance

A key lesson for investors emerging from the pandemic is the need for protection or ‘insurance’ against the economic and convergent market responses to global crises. Surveying the investment landscape in the wake of the damage inflicted by COVID-19 lockdowns, the asset that stands out, having again demonstrated its resilience and reliability as a safe store of value in troubled times, is gold. As the majority of mainstream assets plummeted recently, gold’s value rose to 7-year highs.

This robust performance may have something to teach us when we consider how to protect our investments from the ravages of future crises. Our analysis suggests that gold is likely to prove relatively resilient in the face of a range of climate-related physical and transition risks, particularly in comparison to the potential vulnerability of many other asset classes. Gold’s performance over the pandemic offers further support for that view.

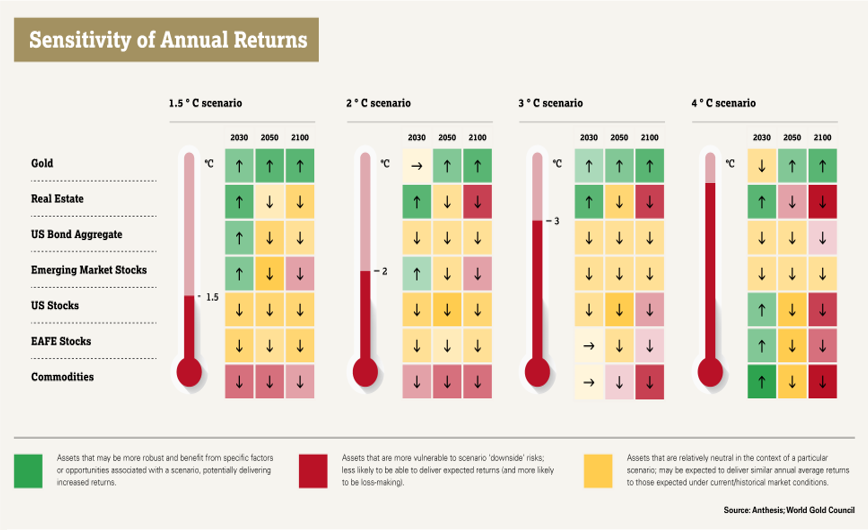

Potential sensitivity of asset returns to climate risks and scenarios

Emerging from the severe constraints and damage of the COVID-19 crisis, we should grasp the opportunity to learn from recent challenges and construct the recovery in a way which reduces risks and boosts resilience in the face of a changing climate and its potential catastrophic consequences. Those invested in gold, or as stakeholders in the industry, might find cause for optimism in the positive role gold can play in the transition to a net zero carbon future and, ultimately, in helping build a more secure and sustainable tomorrow.

Footnotes

1 https://www.un.org/en/un-coronavirus-communications-team/un-urges-countries-‘build-back-better’

2 Gold and climate change: current and future impact, 2019, World Gold Council

3 https://www.ted.com/talks/bill_gates_the_next_outbreak_we_re_not_ready?language=en

4 https://www.economist.com/briefing/2020/05/21/can-covid-help-flatten-the-climate-curve

5 Principle 10.3 – Combating climate change, Responsible Gold Mining Principles, 2019, World Gold Council

6 https://www.weforum.org/agenda/2020/05/covid-19-risks-outlook-saadia-zahidi/

7 https://www.weforum.org/agenda/2020/06/end-fossil-fuel-subsidies-economy-imf-georgieva-great-reset-climate/

8 https://www.reuters.com/article/us-health-coronavirus-climate-summit-idUSKBN23C2NV

9 https://www.unglobalcompact.org/take-action/action/long-term

10 ‘Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change?’, Smith School Working Paper 20-02. (2020). Hepburn, C., O’Callaghan, B., Stern, N., Stiglitz, J., and Zenghelis, D.