Summary

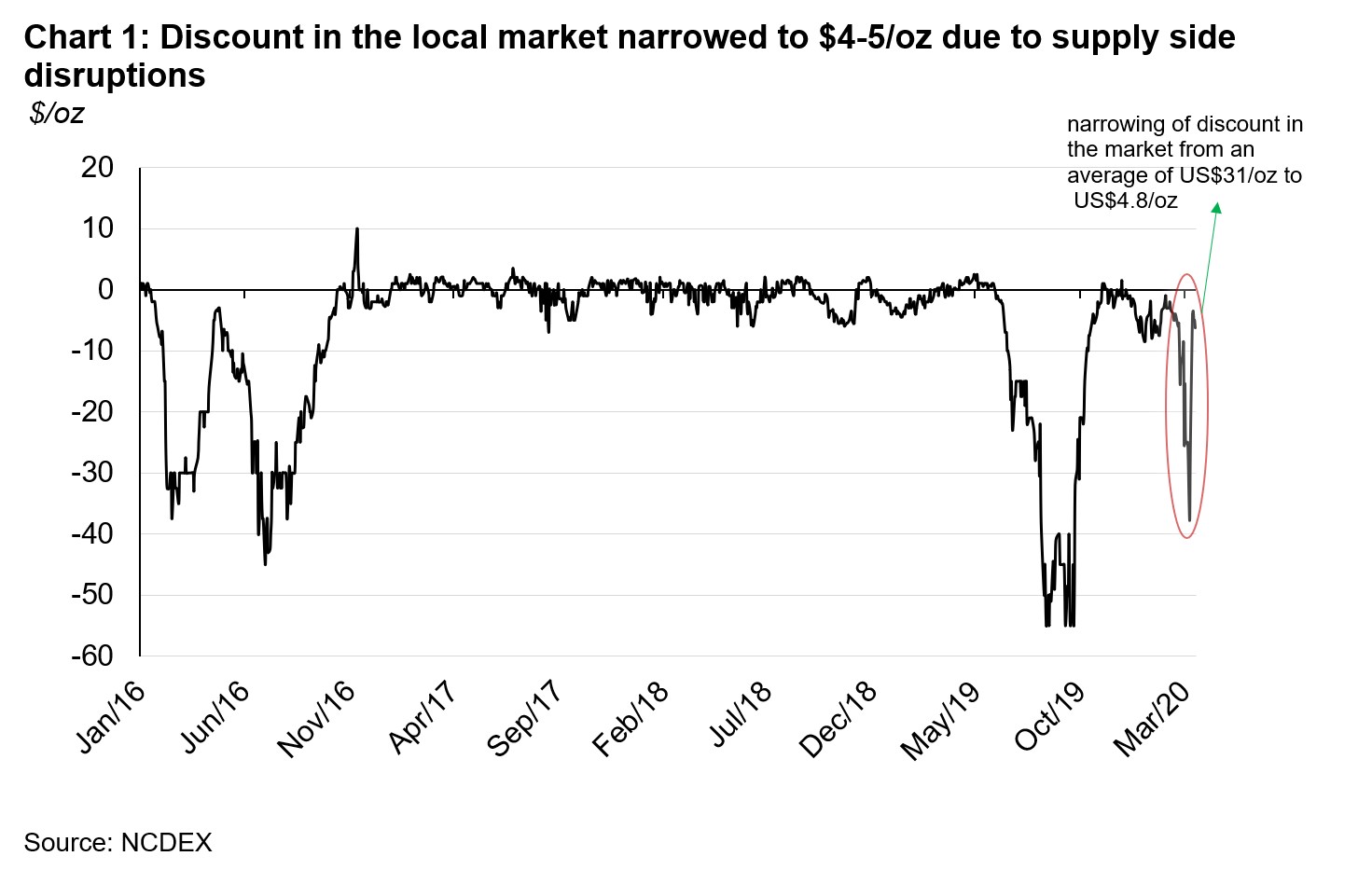

- With supply-chain disruptions, the gold price discount in the Indian market narrowed to US$4-5/oz for the week ending 20 March, from an average discount of US$31/oz in the previous week

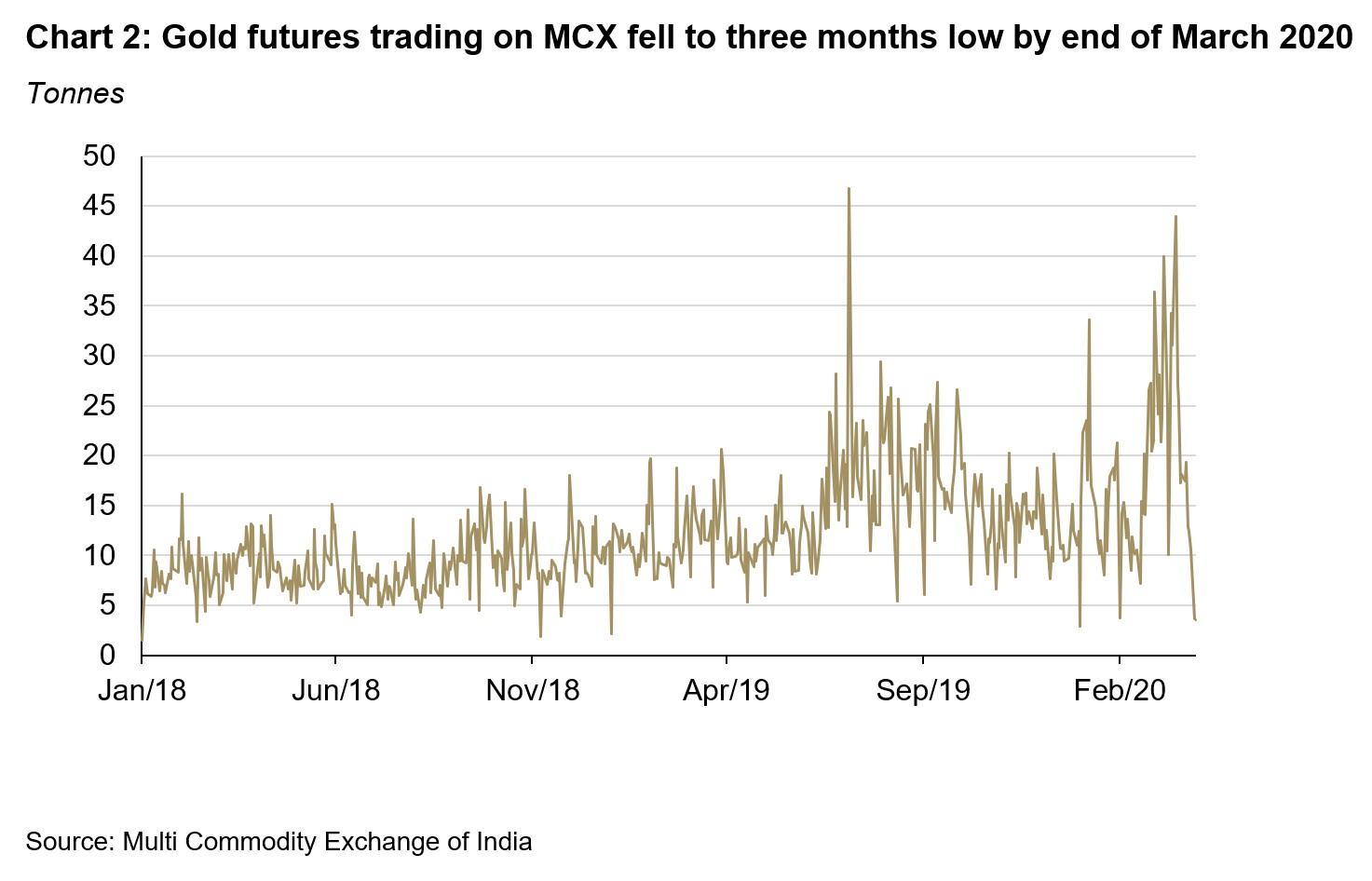

- Daily gold trading volumes on India’s leading commodity exchange Multi Commodity Exchange of India (MCX) fell to a three-month low of 3.6t by end of March - just 17% of the average daily trading volume of 21.2t in the month

- Gold recycling could jump once the market opens after the lockdown

Discount in the local market narrowed due to supply side disruptions

To curb the spread of COVID-19, the global restrictions have impacted the global gold supply chain, from production to refining. These supply-chain disruptions have impacted both bullion and gold dore’ imports into India. As a result, the average discount in the Indian domestic market narrowed to US$4.75/oz for the week ending 20 March, from an average discount of US$31/oz in the previous week (Chart 1).

Daily trading volumes on MCX fell to a three-month low

With the lockdown of major states in India, the spot gold market remained shut and India’s leading commodity exchange Multi Commodity Exchange of India (MCX) stopped publishing a spot gold price from 23 March. Since the announcement of a complete three-week lockdown on 25 March, the local gold industry has come to a complete stand-still.1 The disruption in the supply of gold has impacted gold futures trading volumes on MCX. Daily volumes fell to a three-month low by end of March at 3.6t- just 17% of the average daily trading volume of 21.2t in the month (Chart 2).

Official gold import is expected to remain muted in March

Following conversations, I had with key industry participants, official gold imports in the country have been hampered by the restrictions on flights since 16 March. The impact received further jolt with closure of three swiss refineries and three weeks of lockdown in the country.2 This is likely to mean that official gold imports will be muted in March. Based on media articles, official gold imports in March is 23.8t- 70% lower y-o-y and 47% lower m-o-m.

Gold recycling could jump once the market opens after the lockdown

The Indian equity index S&P BSE SENSEX has plunged by 25.7% and local gold price has increased by 17.4% y-t-d.3 Consumers may turn to gold recycling to take advantage from the higher gold price and meet their liquidity needs in times of economic hardship due to the lockdown. This could lead to higher gold recycling volumes once the market opens after the lockdown.

Footnotes

1 Press Information Bureau notification dated 24 March PM calls for complete lockdown of entire nation for 21 days

2 https://www.reuters.com/article/precious-refining-argor/update-1-three-swiss-gold-refineries-suspend-production-due-to-virus-threat-idUSL8N2BG3ZJ

3 Till the end of 13 April 2020