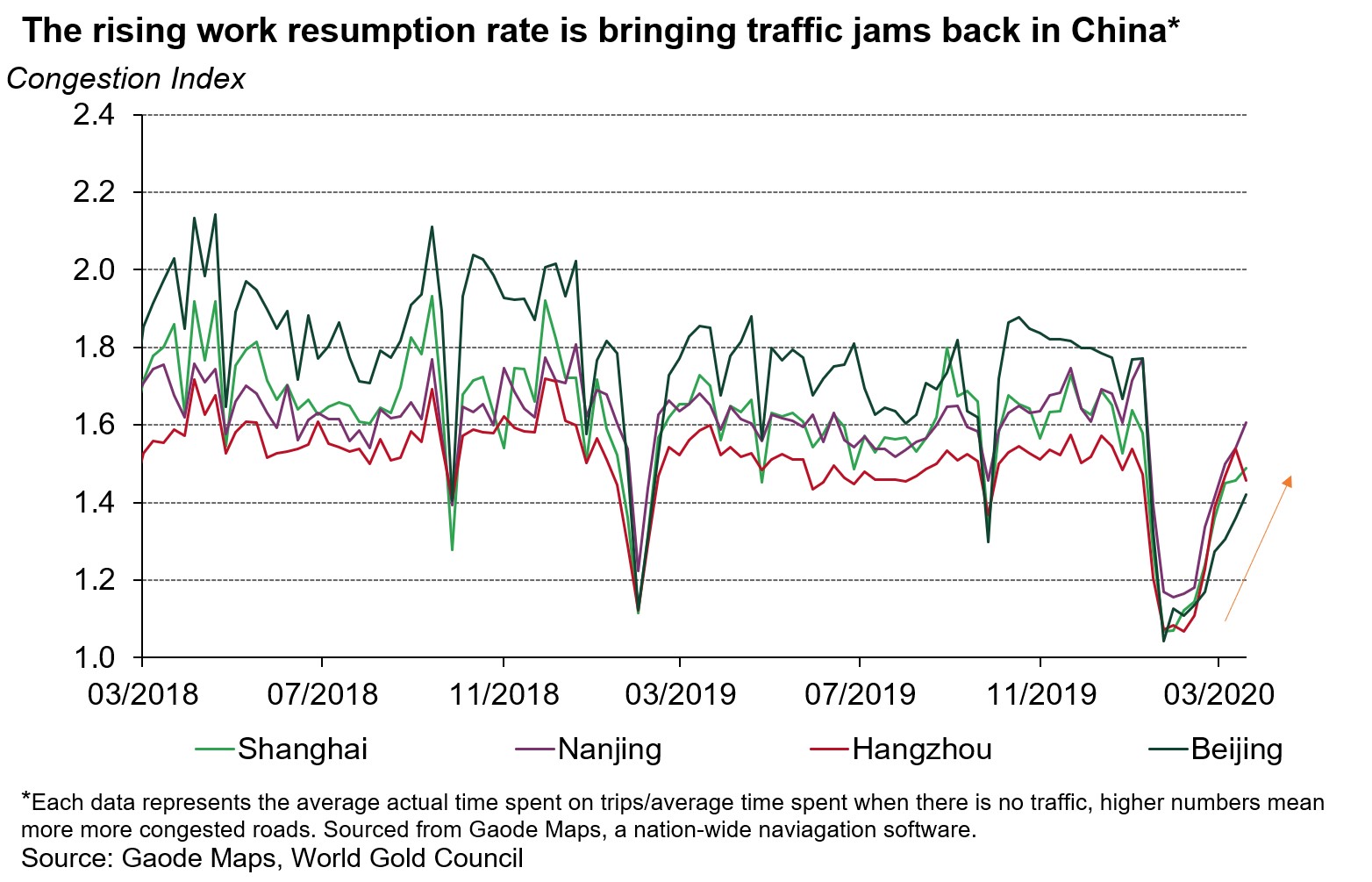

Recent indications suggest that the coronavirus (COVID-19) outbreak in China appears to be virtually contained. Even though there are still new imported infection cases, China’s reported local infections have remained near zero for a significant period. Existing confirmed cases dropped to around 2,000 on 31st March from over 80,000 in February.1 With the situation improving, more and more Chinese people have returned to work.

Industries are resuming to production

Most companies in China have resumed operations gradually since early March. According to the Ministry of Industry and Information Technology, around 99% of large-scale enterprises and over 76% of small- and medium-sized companies had restarted work as of 30th March.2 Furthermore, 85% of leading industrial industries in Hubei, the most severely affected province in China, have also returned to operation.3

Although not all companies are operating at their full capacities currently, China is gradually recovering. As a result, China’s official purchasing managers’ indexes rebounded in March, showing signs of a potential speedy recovery.

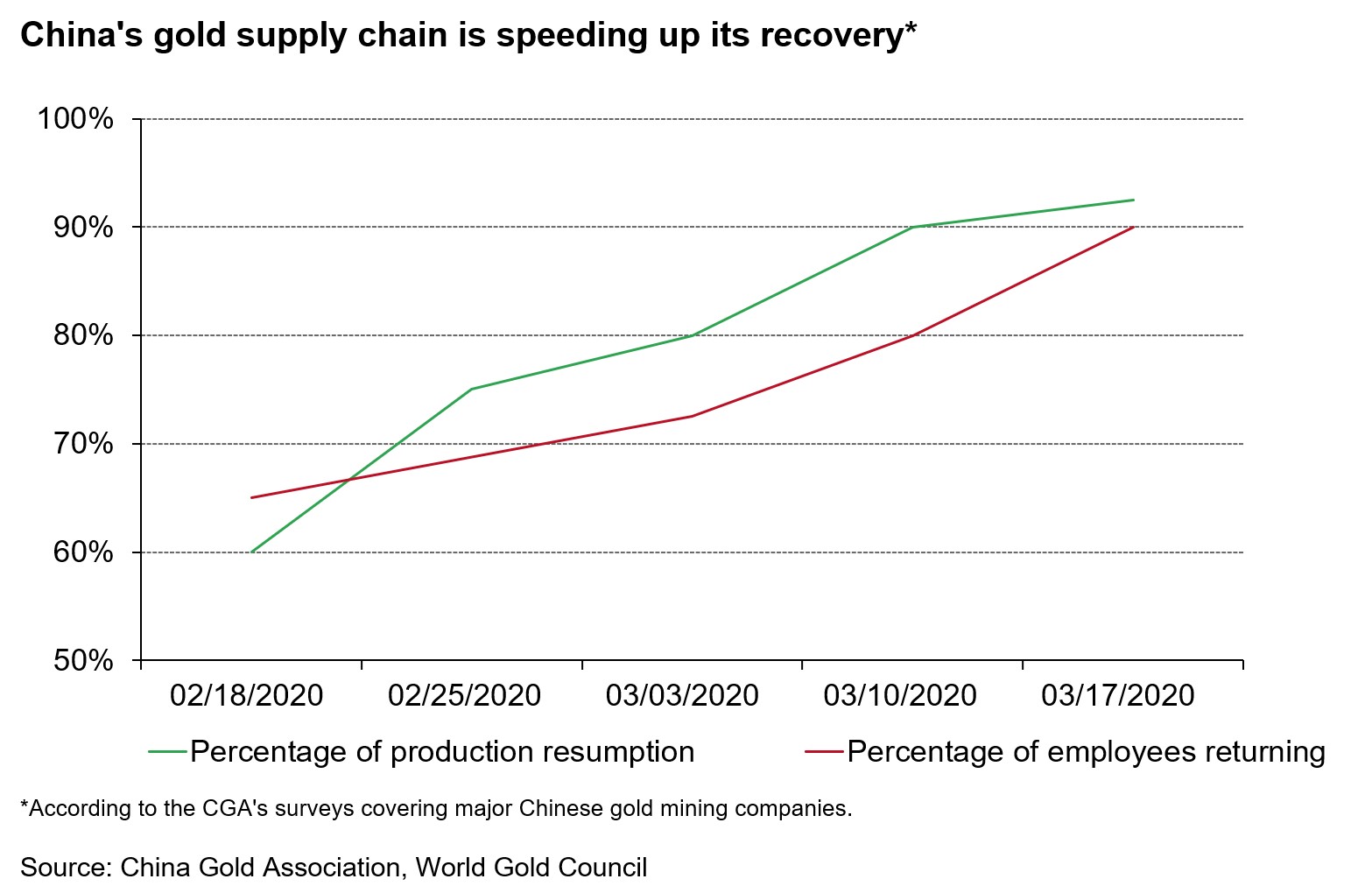

China’s gold mining sector is also on the path to restoring normalcy. Major Chinese gold miners’ production resumption rate averaged 93%, and over 90% of their employees returned to work as of 17th March, according to a survey conducted by China Gold Association (CGA).

And these gold mining companies are catching up with their original production plans. First, many gold mining sites continued their operations during Chinese New Year’s holiday in late January. Second, there was no infection case reported in any of these mining sites. Third, with the gold price hovering around the highest level in nine years in March, Chinese gold mining companies went all out in resuming production.

Jewellery manufactures in Shenzhen are also recovering, albeit at a slower pace. Discussions with our trade partners indicted that jewellery manufacturing lines had been restored to 50-70% of pre-outbreak levels by mid-March. The speed of recovery in jewellery manufacturing has been impacted by the subdued jewellery demand:

- many people are still avoiding public places such as malls and jewellery stores

- the highest monthly average gold price since 2013

- reduced income due to the late work resumption

Both price and income levels are two fundamental factors driving jewellery demand as we noted in our recently published China’s gold market. Also, non-necessities’ consumption tends to be severely pressurised in such circumstances.

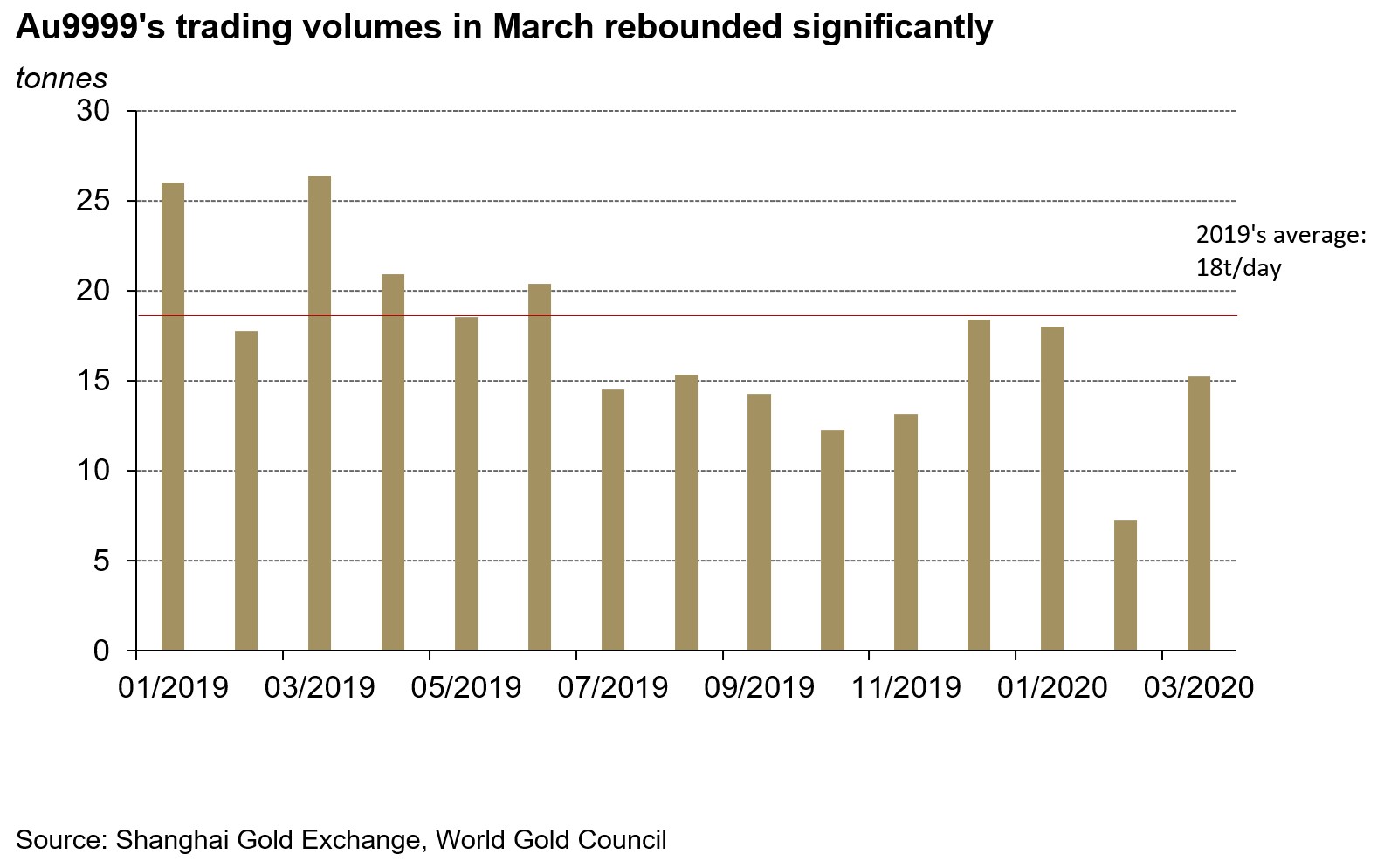

The rebounding Au9999’s trading volumes, a proxy for China’s physical gold demand, also reflected the gradual recovery in China’s domestic gold supply. In March, trading volumes averaged 16 tonnes (t) per day, 114% higher m-o-m, but below 2019’s monthly average of 18t per day.

China’s consumption under stimulus and online promoting

To stimulate consumption in wake of COVID-19, the Chinese government enacted various supportive policies. Re-opening malls across the country, with strict health guidelines, is one example. Many cities also handed out e-vouchers worth billions of renminbi (RMB) to boost leisure spending such as dining and shopping.4 This contributed to the 7% rise in key retailers’ sales as of mid-March compared to mid-February, according to the Ministry of Commerce.

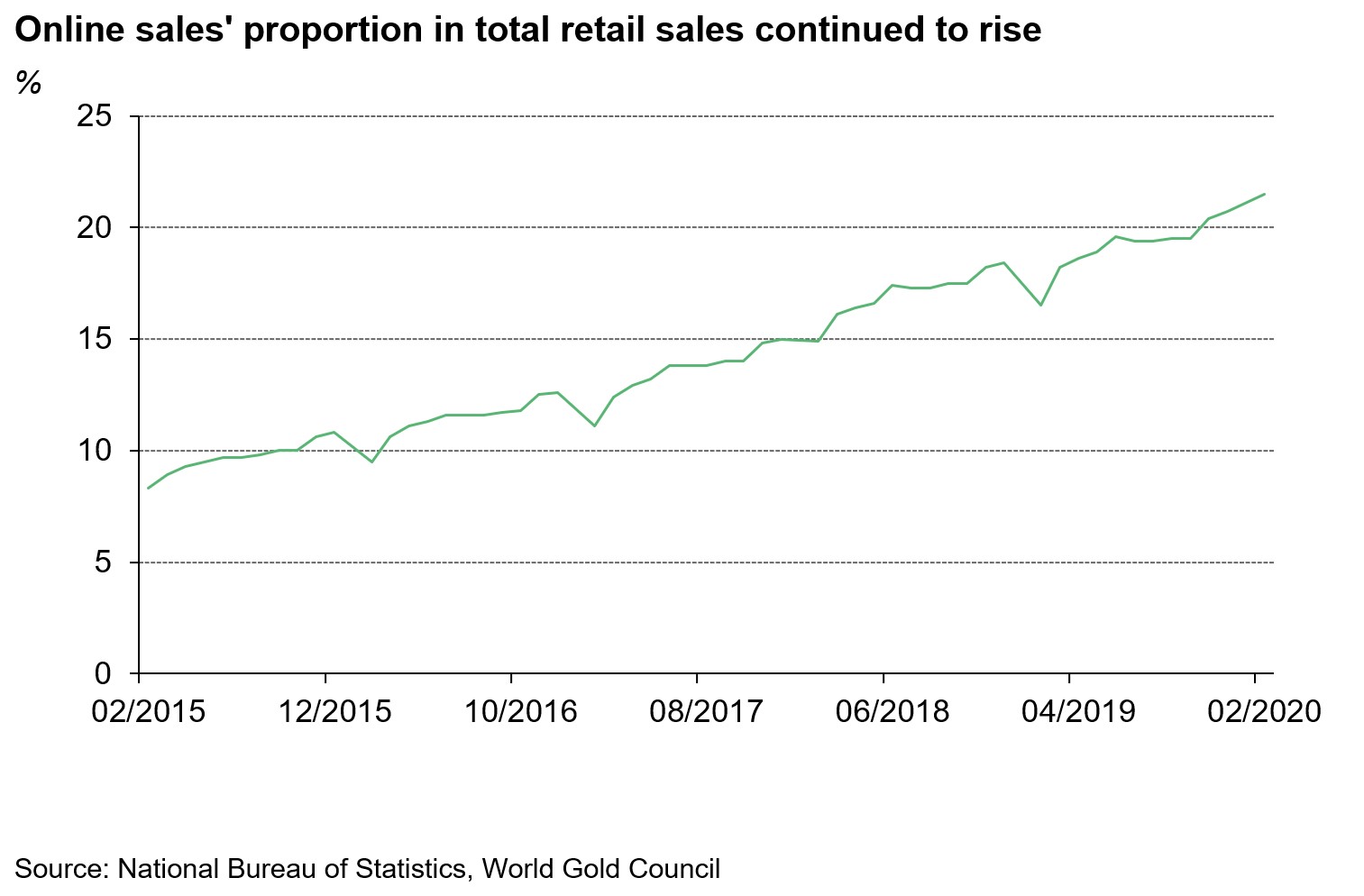

While nearly all sectors in China’s economy were hampered by COVID-19 outbreak, online consumption bucked the trend. As making purchases online and waiting for deliveries are becoming many Chinese people’s daily routine, online sales’ in January and February grew by 3% y-o-y, in contrast to the 21% fall in total retail sales.5 Online channel’s importance is also rising, accounting for 22% of total retail sales as of February.

Recognising the importance of online channels when the public is confined to their homes, Chinese jewellers increased their efforts in online marketing. We learnt that one of China’s leading brands was able to attract thousands of new online customers by promoting and upgrading their digital store in February. Jewellery manufactures in Shenzhen are also bringing their businesses online, helping to reduce the health risk and improving efficiency. After this pandemic, China’s gold industry will gain a much deeper understanding of on-line business models and be more digitalised.

Investment in gold rising

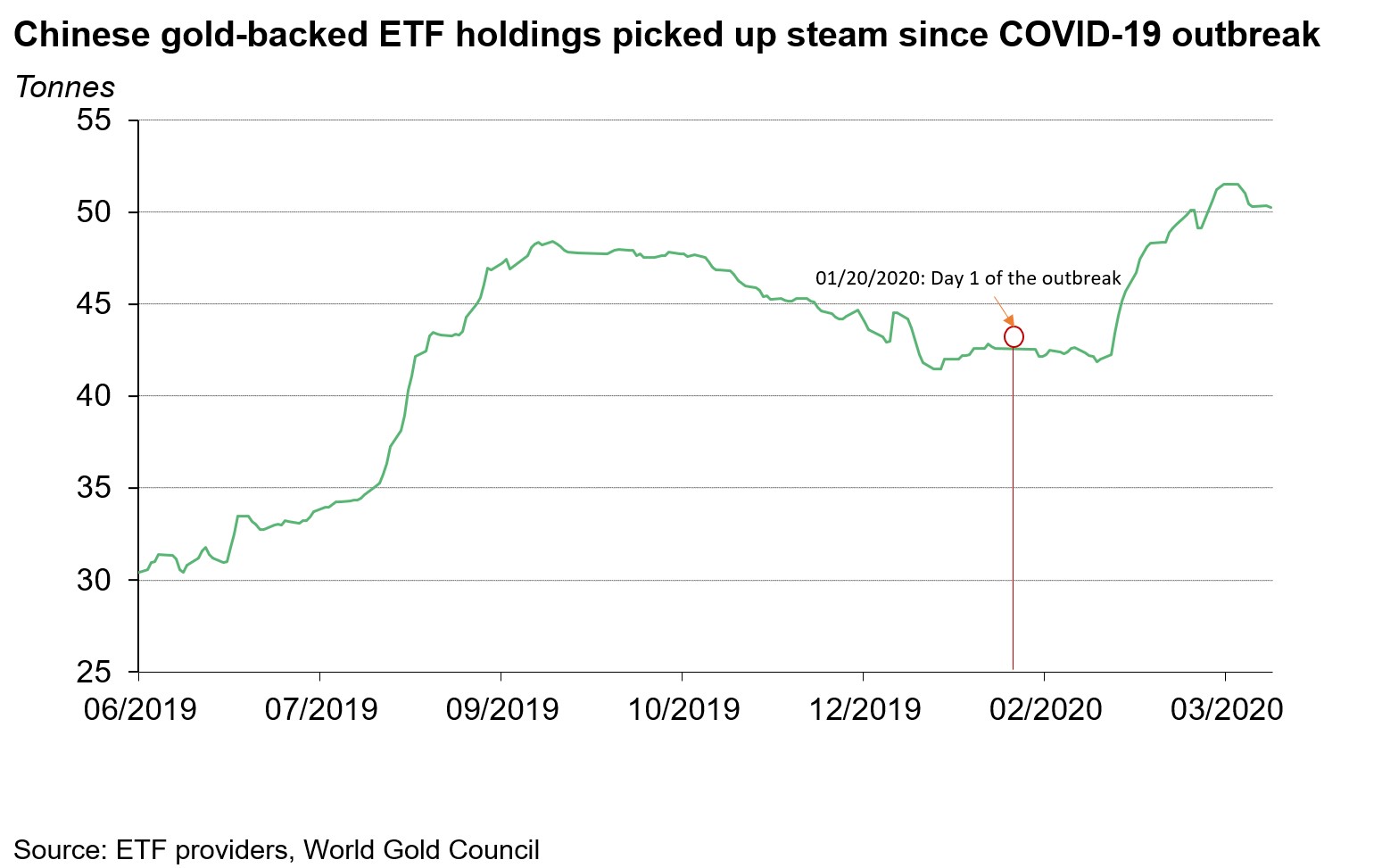

Chinese gold-backed ETF holdings have kept increasing during the COVID-19 outbreak.6 As of 31st March 2020, these ETFs’ gold holdings totalled 51.3t, 8.7t higher than day 1 of the outbreak. Uncertainties from China’s equity and commodities markets as well as concerns for the economy under COVID-19 have been the main drivers. During the same period, the gold price increased by over 5%, while CSI 300 stock index dropped by more than 12% and the RMB depreciated by more than 3.4% against US dollar.

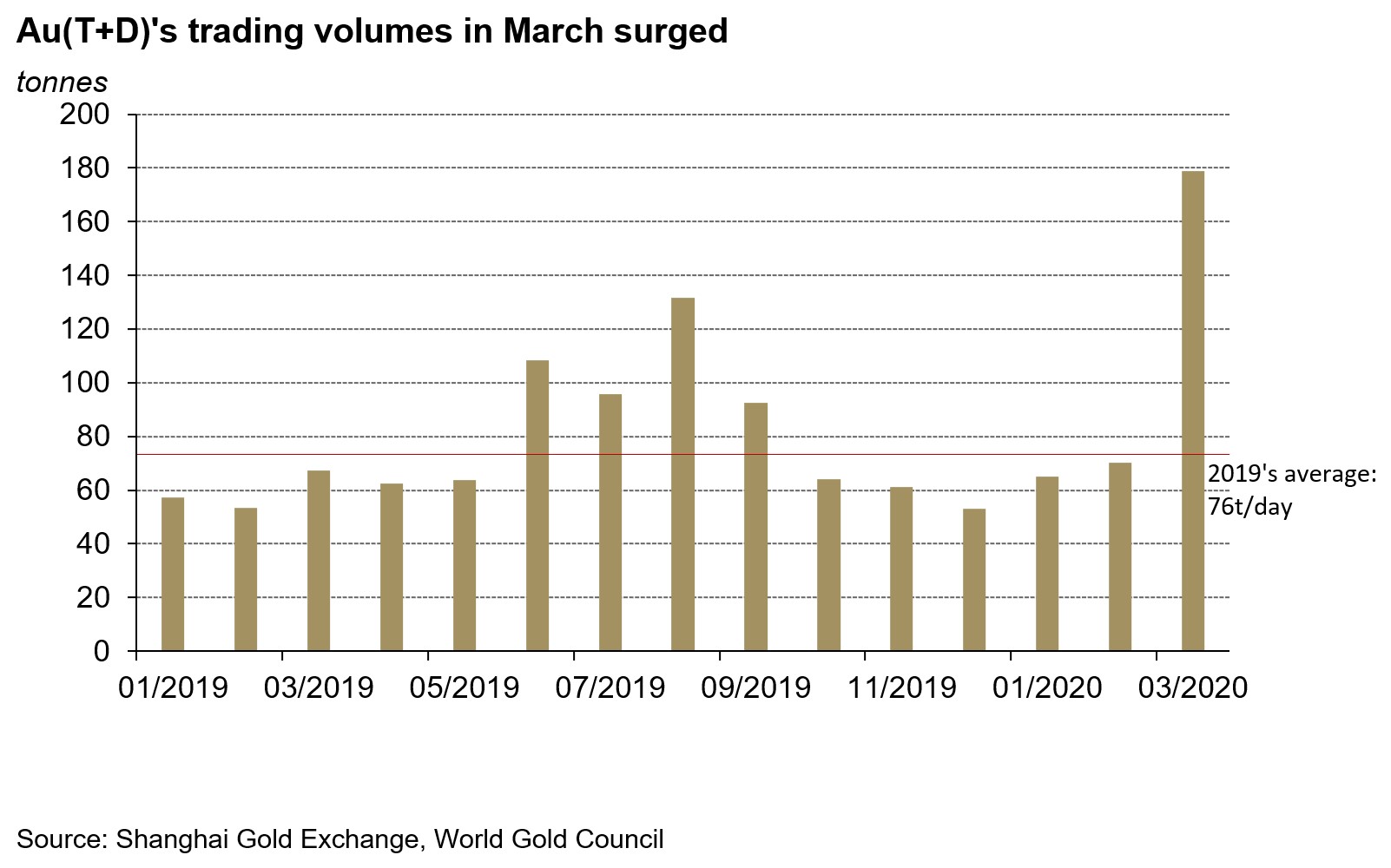

Driven by the gold price momentum and risk-hedging demand, Au(T+D)’s trading volumes, a proxy for China’s investors’ tactical positioning in the gold market, surged in March. Its trading volumes averaged 176t per day in the month, 151% greater than February and 130% higher than 2019’s average of 76t per day.

Conclusion

With imported COVID-19 infections still posing a threat, China’s output capacity and consumption will take longer to fully recover. And participants in China’s gold industry are doing their best to restore normalcy.

The COVID-19 outbreak has dented China’s already slowing economy and shaken investors’ confidence, leading to further monetary easing policy implementation in China.7 As such, gold’s investment demand has benefited thus far, and will likely remain well-supported the longer the recovery takes.