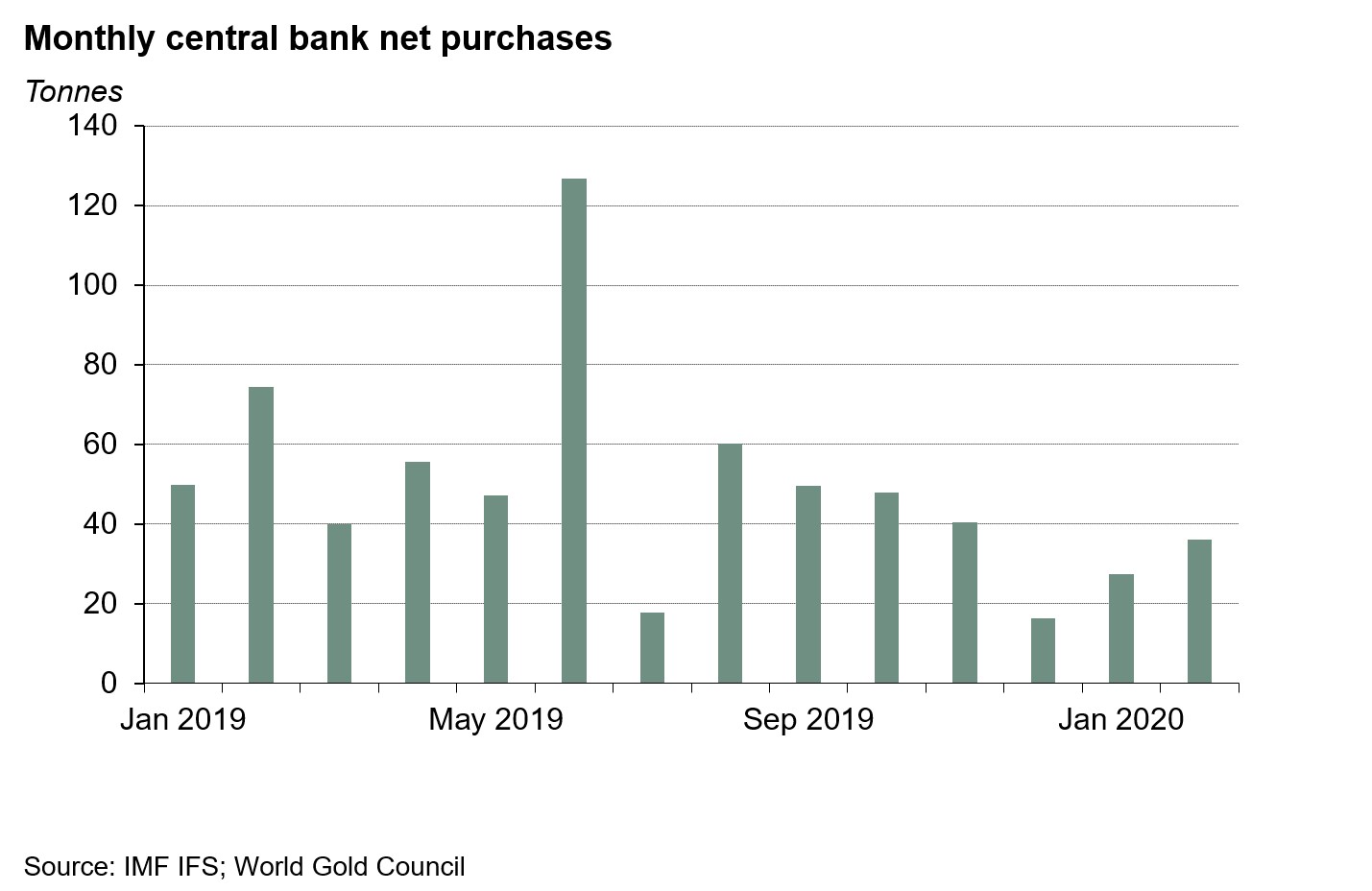

In February, central banks bought a net 36 tonnes (t) of gold, almost a third higher than January’s net purchases, but 52% lower y-o-y.1 This brings y-t-d net purchases to 64.5t, 44% lower than the 116.1t of net purchases over the first two months of 2019.

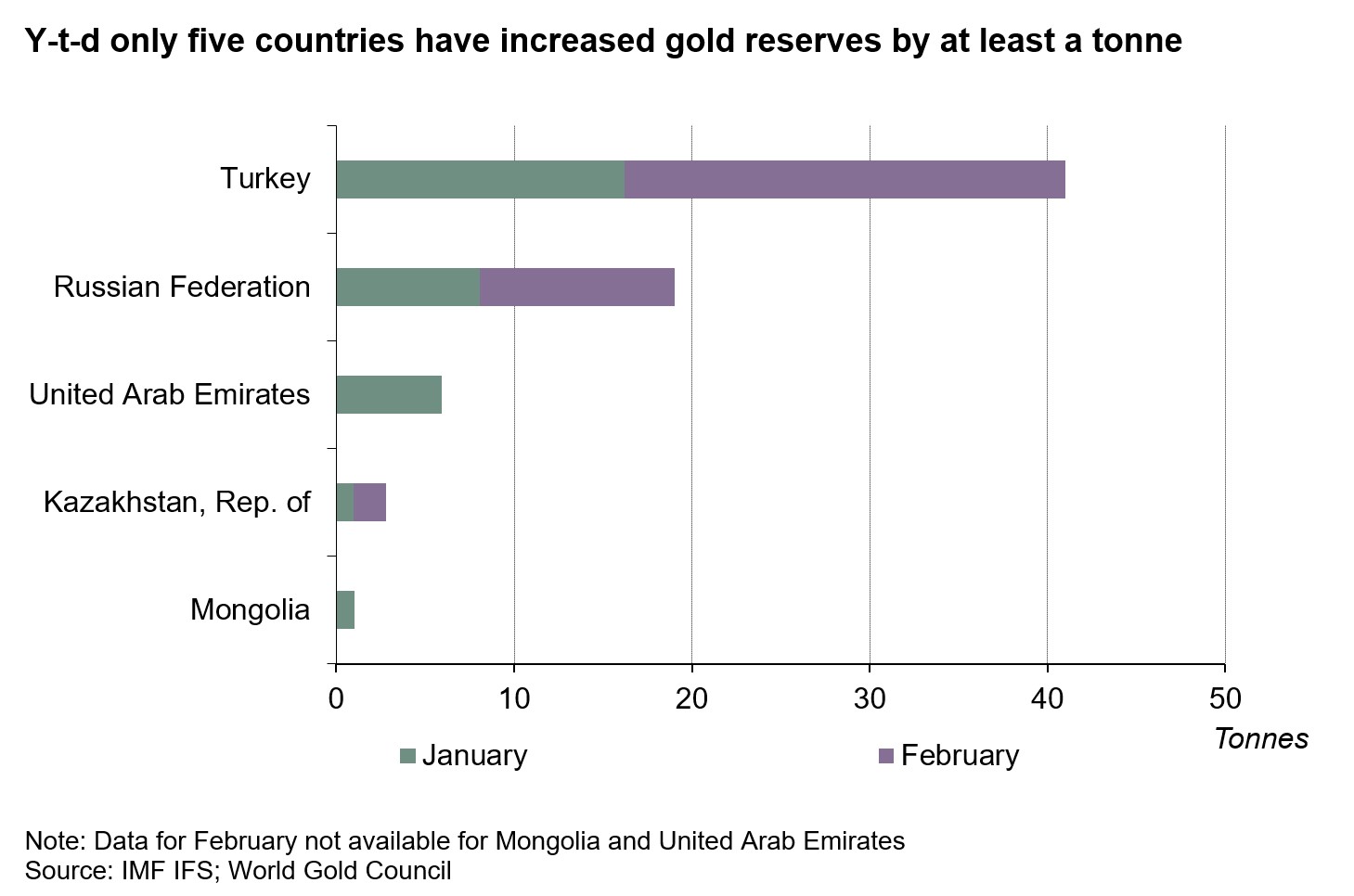

Breaking down February’s net total into its component gross purchases (39.1t) and sales (3.1t) shows that purchases remain healthy and sales remain low. Of the central banks which have reported their gold reserves at the end of February, Turkey (24.8t), Russia (10.9t), Kazakhstan (1.8t) and Qatar (1.6t) were the only noteworthy buyers during the month.2 Meanwhile, Uzbekistan (3.1t) was the only significant seller.

Year-to-date, a total of five central banks have increased gold reserves by at least a tonne compared with eight over the first two months of 2019.

While we expect more data for February will be released in the coming few months (it is common for this data to come with a lag), it’s fair to question how this new data fits with any existing trends. Following the steady decline in monthly net purchases since August, resulting in December’s five-month low of 16.3t, we have seen a pick-up in the level of monthly net purchases in both January and February.

We often get asked if central bank demand will be sustained. The past two months clearly suggest gold continues to be an important component of foreign reserves despite heightened levels of demand in recent years. But like everyone else, the recent market instability and uncertainty will be at the forefront of central bankers’ mind. And while we believe central banks will remain net buyers in 2020, it’s reasonable to think we may not see as much buying as we did over the past two years.

If you want to interrogate the central bank statistics yourself, and I encourage you to do so, you can find them here. We will take a more complete look at central bank demand for the first quarter of 2020 in our next Gold Demand Trends report, which will be published on 30th April.

We have also recently published our central bank primer, which provides an introduction to global official gold reserves and demand from central banks. You can download the primer here.

Stay safe.

Footnotes

1 All figures in this post at calculated using net purchases or sales of at least a tonne only.

2 The IMF IFS currently shows a decline of 2t in Portuguese gold reserves in February. Our sources indicate that this was an unintended clerical error. As such, we have corrected Portugal’s figure in our data set, showing no change in their 382.5t of gold reserves. Please note that the IMF IFS may not reflect this update until next month’s release.