Summary

- The domestic gold price increased by 4.1% in February m-o-m and 8.4% higher than the end of 2019.

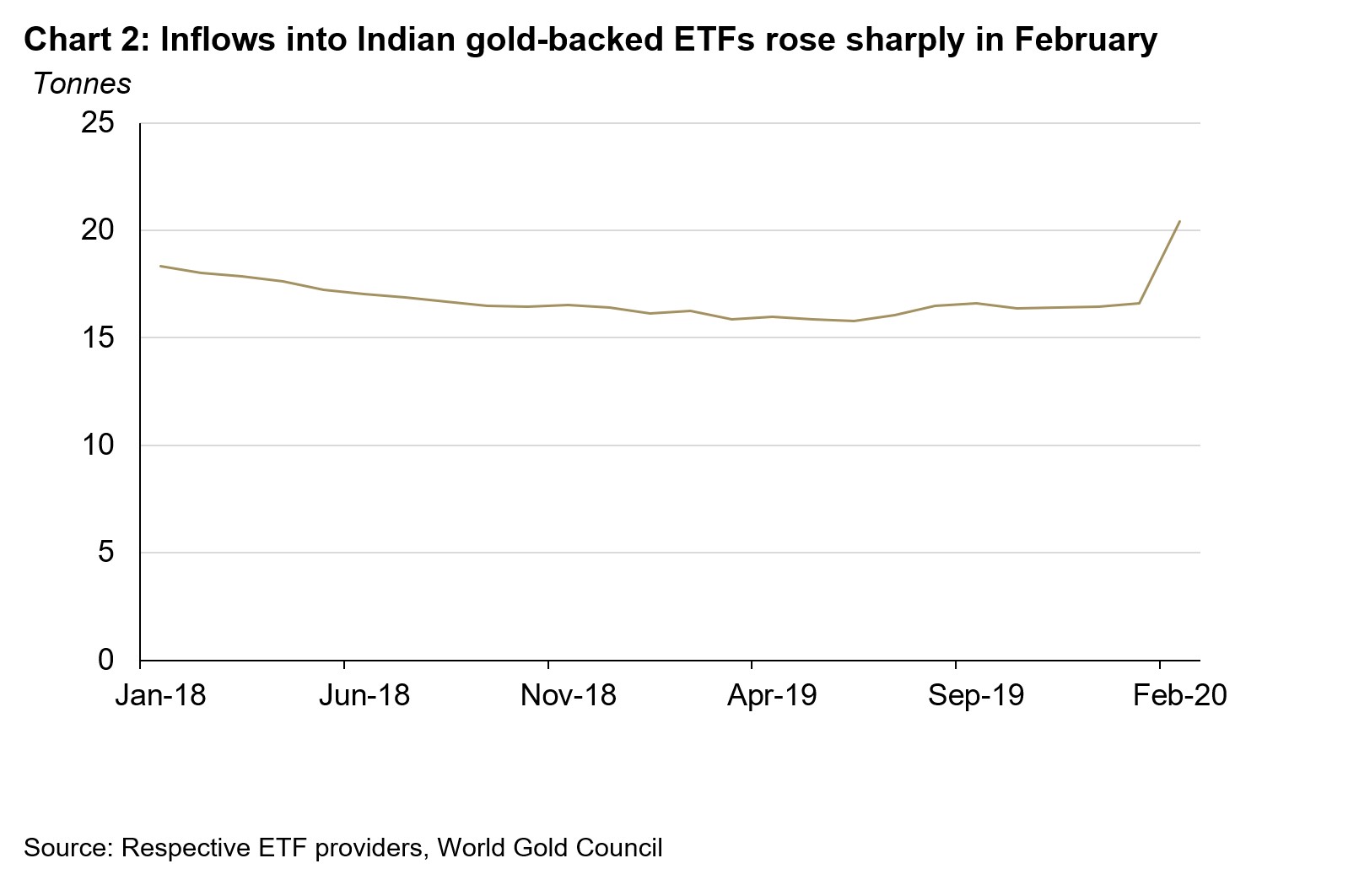

- Rising gold price and higher volatility in the market lured investors towards gold ETFs. With strong inflows of 3.8t in February, the total gold-holdings of Indian gold ETFs touched 20.4t at the end of February.

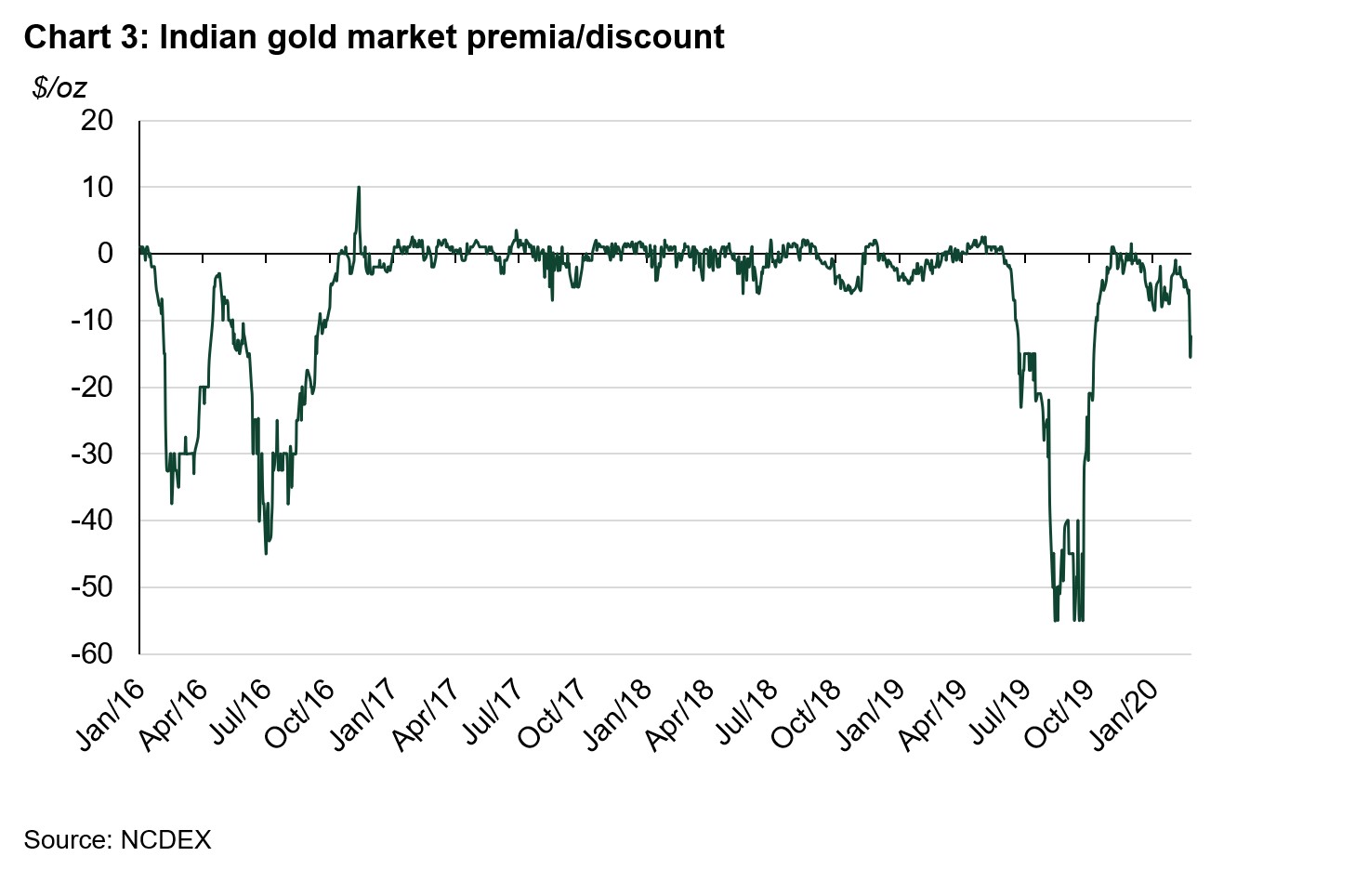

- Wedding season and stable price supported demand till 18th February, but demand faltered after the spike in domestic price after 18th February. With soft demand, the average discount in the local market widened to US$13-16/oz by the end of the month

Indian stock market plunged on COVID-19 fears

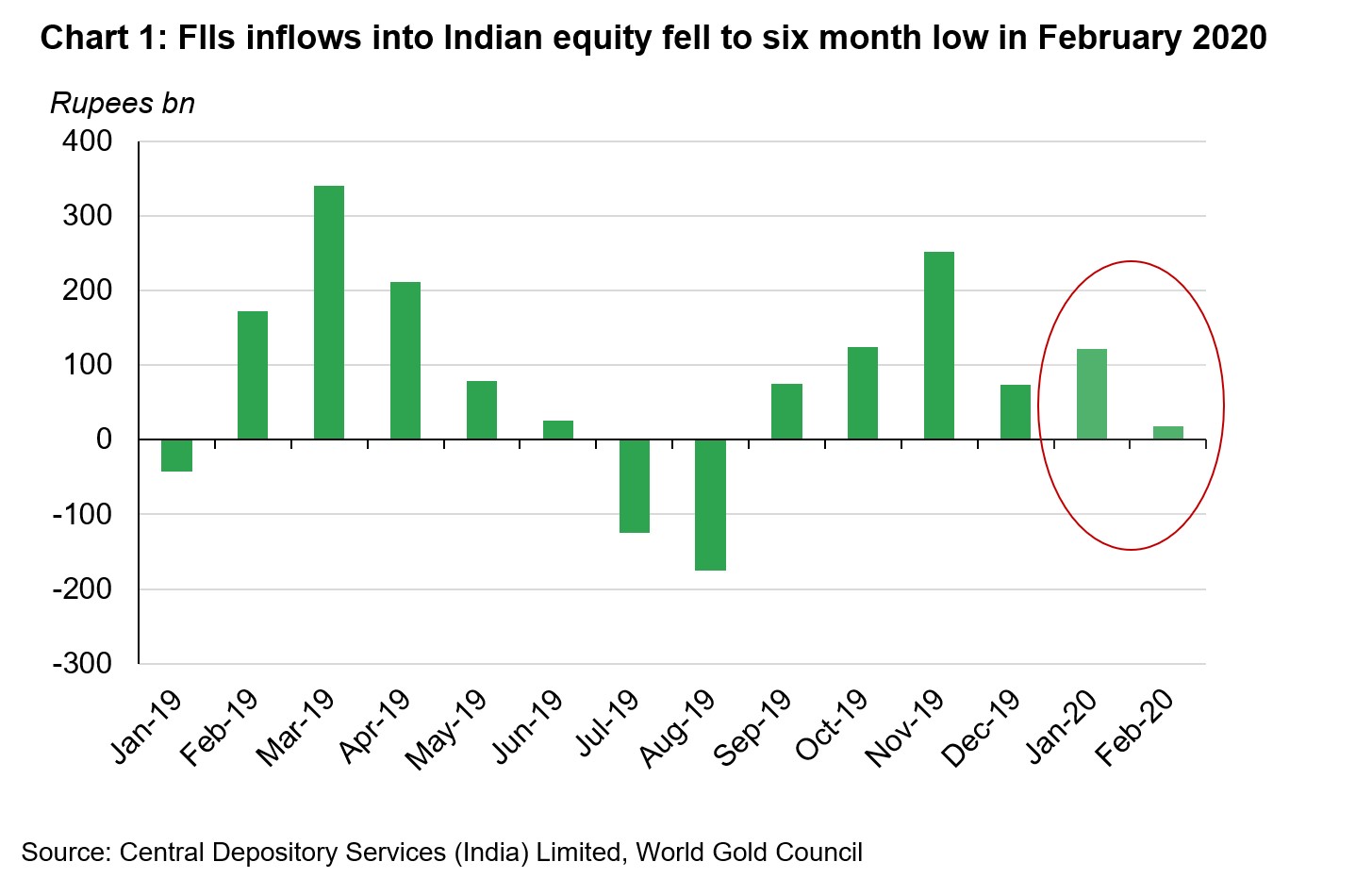

The Indian equity index S&P BSE SENSEX continued the downtrend for the second consecutive month in Februray 2020. The SENSEX plunged 6% over the month amid rising concerns over the spread of the COVID-19 outside China. The MCX iCOMDEX- India’s leading commodity index, followed the downward trajectory and also fell by 6% in February. The Indian rupee depreciated by 1% against the US dollar to a six month low of Rs 72.18/USD at the end of February. Against such a backdrop, foreign institutional investors (FIIs) continued to be net buyers of Indian equities in February but the inflows hit a six month low at Rs 18 billion (85% lower m-o-m). (Chart 1).

Rising gold price and volatility in the market lured strong inflows into gold ETFs amid weak consumer demand

The heightened US-Iran tensions and easing monetary policy stance by central banks in response to the virus outbreak supported the gold price. The MCX Gold Spot (995 fineness) in INR ended the month 4.1% higher than at the end of January, outperforming the LBMA Gold Price AM in USD (+2.9%) over the same period as the rupee weakened against the dollar.1

With the outbreak of COVID-19, the volatility index in the market rose sharply after middle of February jumping from 13.4% to 23.2% over the final two weeks.2 The rising volatility along with higher gold price lured investors towards gold-backed ETFs- a flight towards safe haven. Inflows into gold-backed ETFs rose by 3.8 tonnes in February ending at 20.4 tonnes in February (Chart 2).

MCX Gold Spot price (995 fineness) remained stable around Rs 40,700/10gm in first half of February. A stable gold price together with an active wedding season supported demand in the first two weeks of December. Demand started to falter after the sharp rise in gold price after 18th February where gold price increased by 3.4% by the end of the month.3 With the gold price rising, consumers preferred gold-to-gold exchange rather than fresh purchases. Gold-to-Gold exchange accounted for ~ 45-50% of the retail purchase volumes in February. The average gold price was 24% higher y-o-y in February, keeping a lid on retail gold volumes and consumer demand.

Sentiment at India International Jewellery Show (IIJS) Signature 2020 was weak T

he sentiment at India International Jewellery Show (IIJS) Signature 2020 (B2B event) held between 13-16 February was weak. For the domestic market, retailers placed orders for light-weight jewellery pieces (machine made bangles and necklaces) but orders for heavy and bridal jewellery were muted. For the exports market, manufacturers who received orders from retailers in UAE and Turkey confirmed a rising number of order cancellations due to sudden spike in gold price and outbreak of COVID-19.

Discount in the local market widened in the month

With rising gold price and lower number of wedding days after 18th February, physical demand started to gradually weaken until the end of the month. The discount in the local market widened to US$13-16/oz by end of February from an average discount of US$3/oz before the 18th February 2020 (Chart 3).

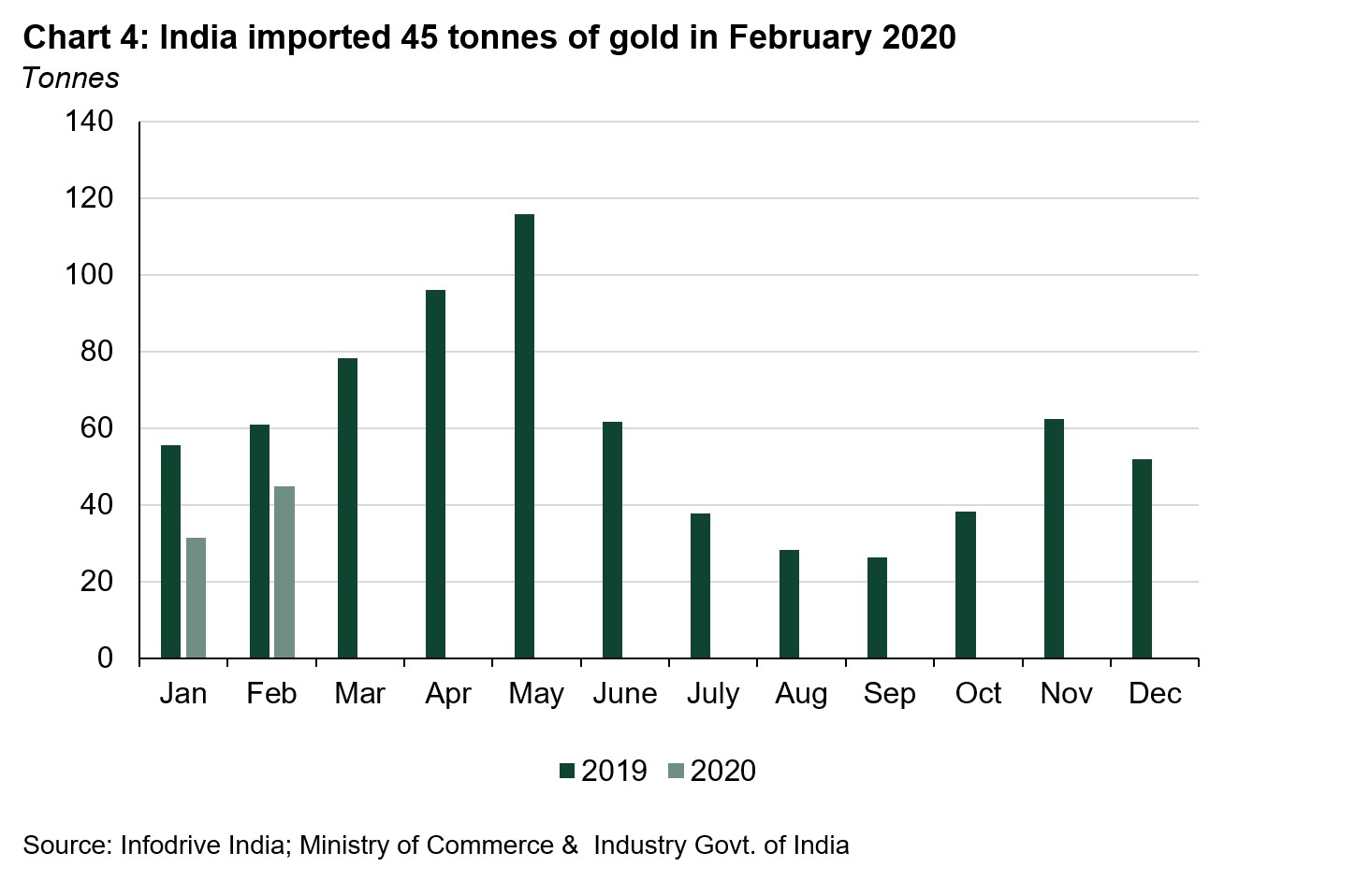

Imports were higher m-o-m

Indian gold imports totalled 44.8t in February 2020 – 42% higher m-o-m but 26% lower y-o-y (Chart 4). A total of 9 banks, nominated agencies and exporters imported 25.4t of bullion during the month, 15 refineries imported 19.4t of gold doré (fine gold content).

Footnotes

1 We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

2 India VIX (NSE) is volatility index based on NIFTY Index option prices.

3 As per Hindu wedding dates, there were 9 auspicious wedding dates in February. There were 6 wedding dates from 3rd to 18th February and only 3 wedding dates were after 18th February.