Summary

- Indian gold imports were 51.8t in December 2019 – 19% lower y-o-y

- The domestic gold price increased by 3.2% in December, ending the year 23.8% higher than the end of 2018

- Wedding and stable domestic gold price at ~Rs 37800/10gm helped demand in first half of December but demand tailed off after 15th December after the beginning of inauspicious period and rising gold price which jumped by 3.7% from mid-December till end of the month.1

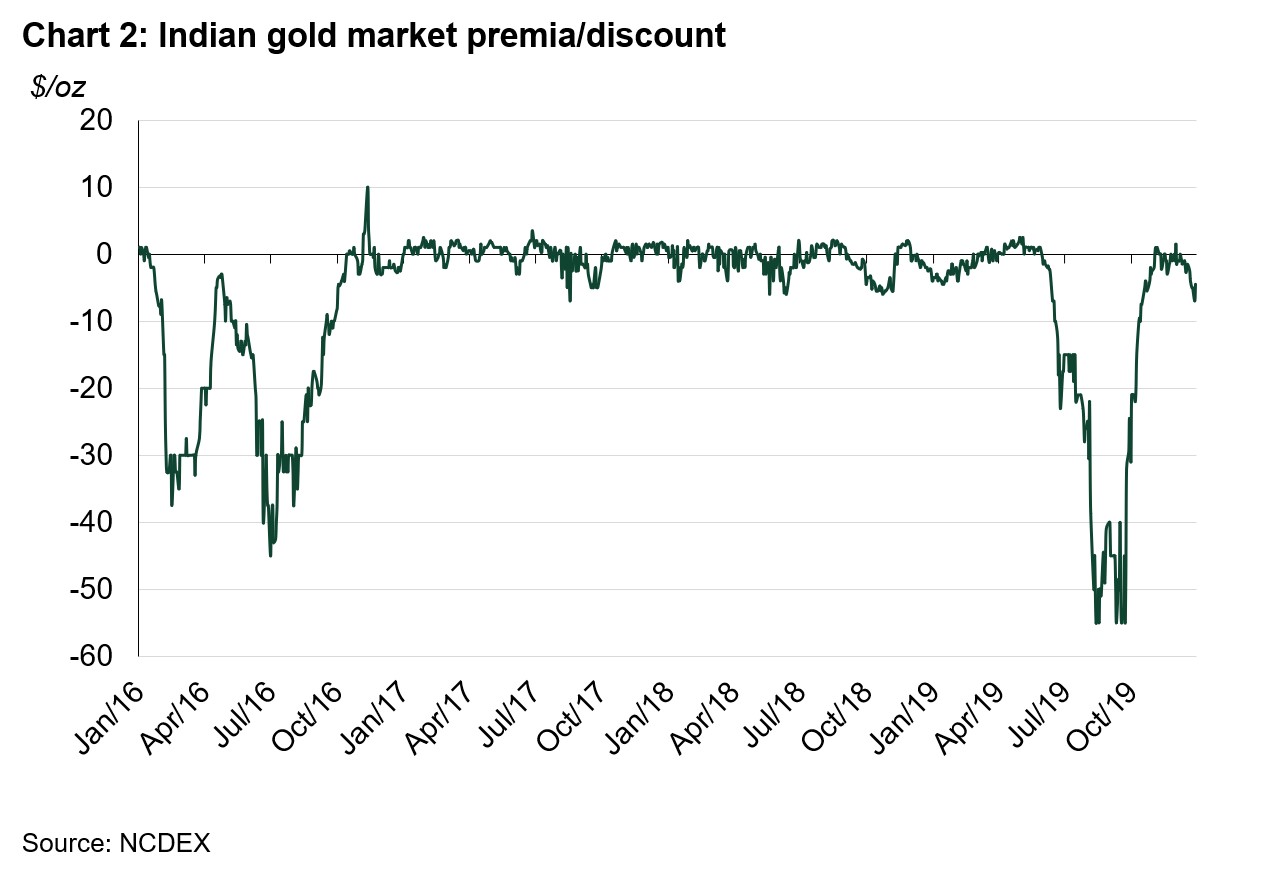

- With soft demand, the average discount in the local market widened to US$4/oz in the second half of December compared to an average discount of US$1/oz in first half of December

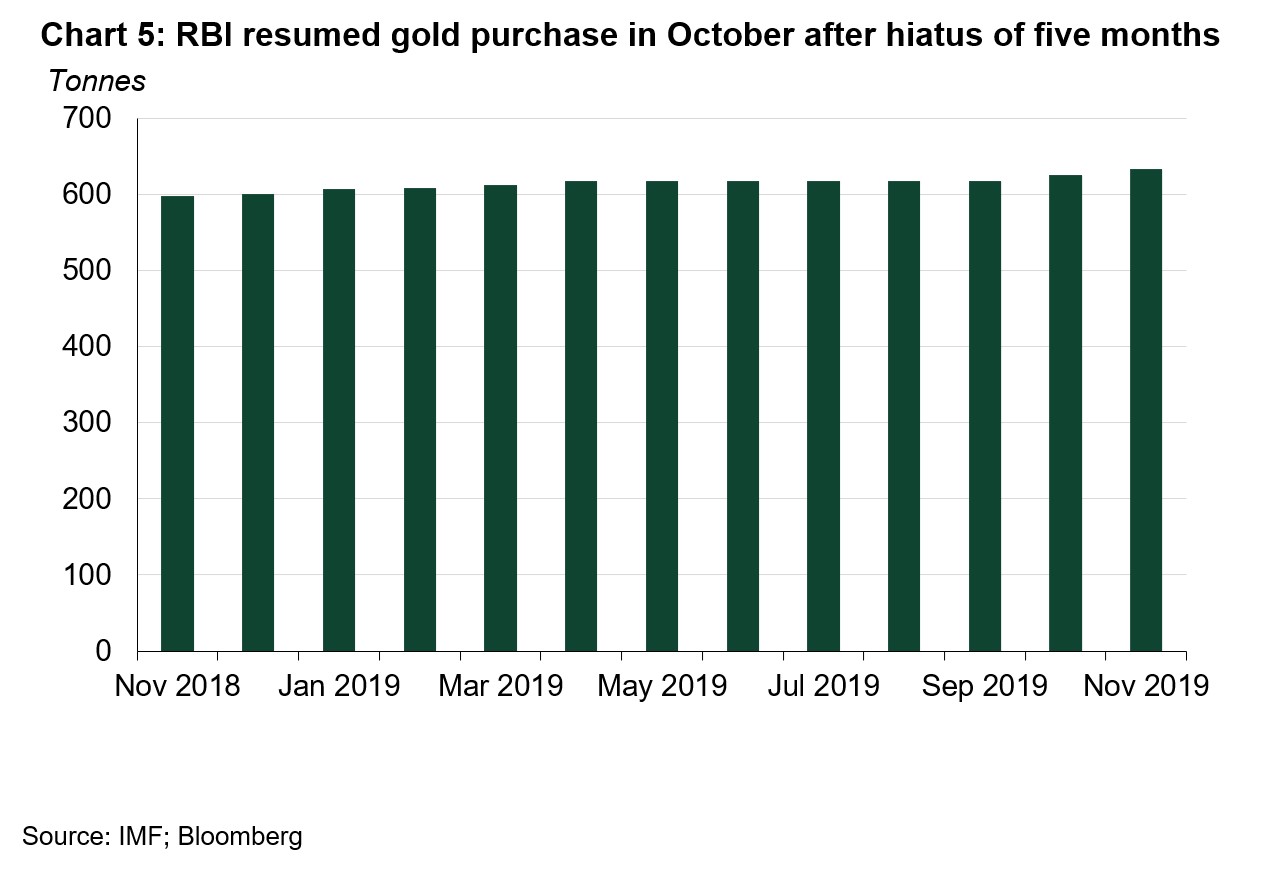

- RBI resumed gold purchase from October after a hiatus of 5 months and added ~ 15 tonnes of gold in October and November.

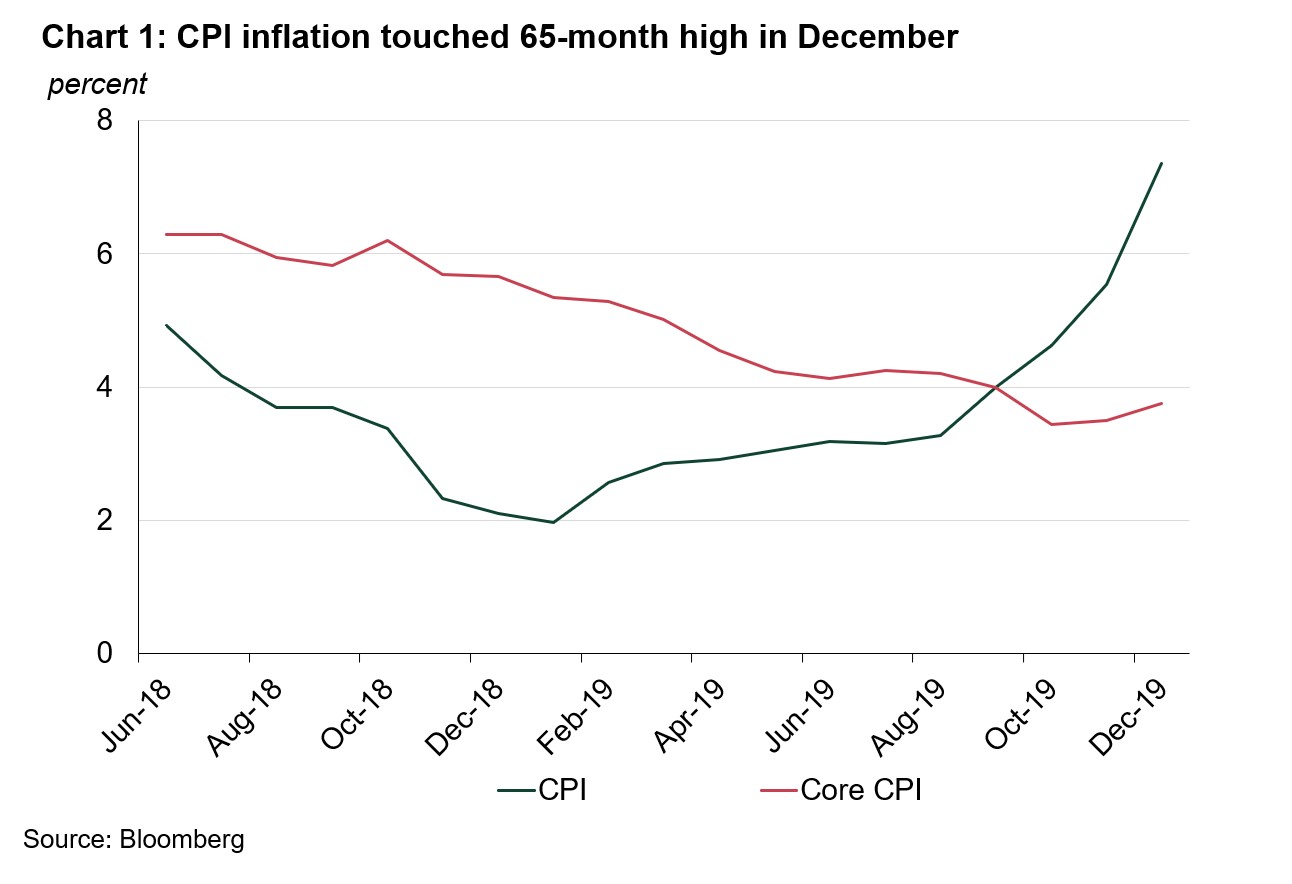

India’s consumer price inflation rises to 65-month high and SENSEX closed at all time high in December

The Indian economy continued to show signs of stress in December. Consumer price inflation (CPI) continued its upward trajectory and reached a 65-month high of 7.35% in December, led by 60.5% increase in vegetable prices. Core inflation crept up to 3.75% in December, up from 3.5% in November (Chart 1).

Sentiment in the equity market remained bouyant in December, supported by record inflows of more than US$14 bn of inflows in Indian equity market in 2019 and China-US’ first phase trade deal. As a result, SENSEX closed at an all-time high of 41,681 on 20th December.

Retail demand in December was softer than November with limited support from weddings

MCX Gold Price (995 fineness) was stable around Rs 37,800/10gm in first half of December. Stable gold price together with weddings supported demand in the first two weeks of December. However, demand started to falter in the seasonally quiet period before the end of the year. It also coincided with start of inauspicious period for gold purchase staring from 16th December as well as sharp rise in gold price where domestic gold price increased by 3.7% in the second half of the month. Retail gold demand in December remained softer than November.

Discount in the local market

As wedding demand fell short of the expectations in November, the discount in the local market at end of November was at US$1/oz. The discount persisted in the first half of December with an average discount of US$1/oz. In absence of any weddings in the second half of the month together with start of an inauspicious period of gold purchase and higher gold price, discount in the local market widened to US$5-7/oz by end of the month with an average discount of US$4/oz in the last two weeks of December. (Chart 2).

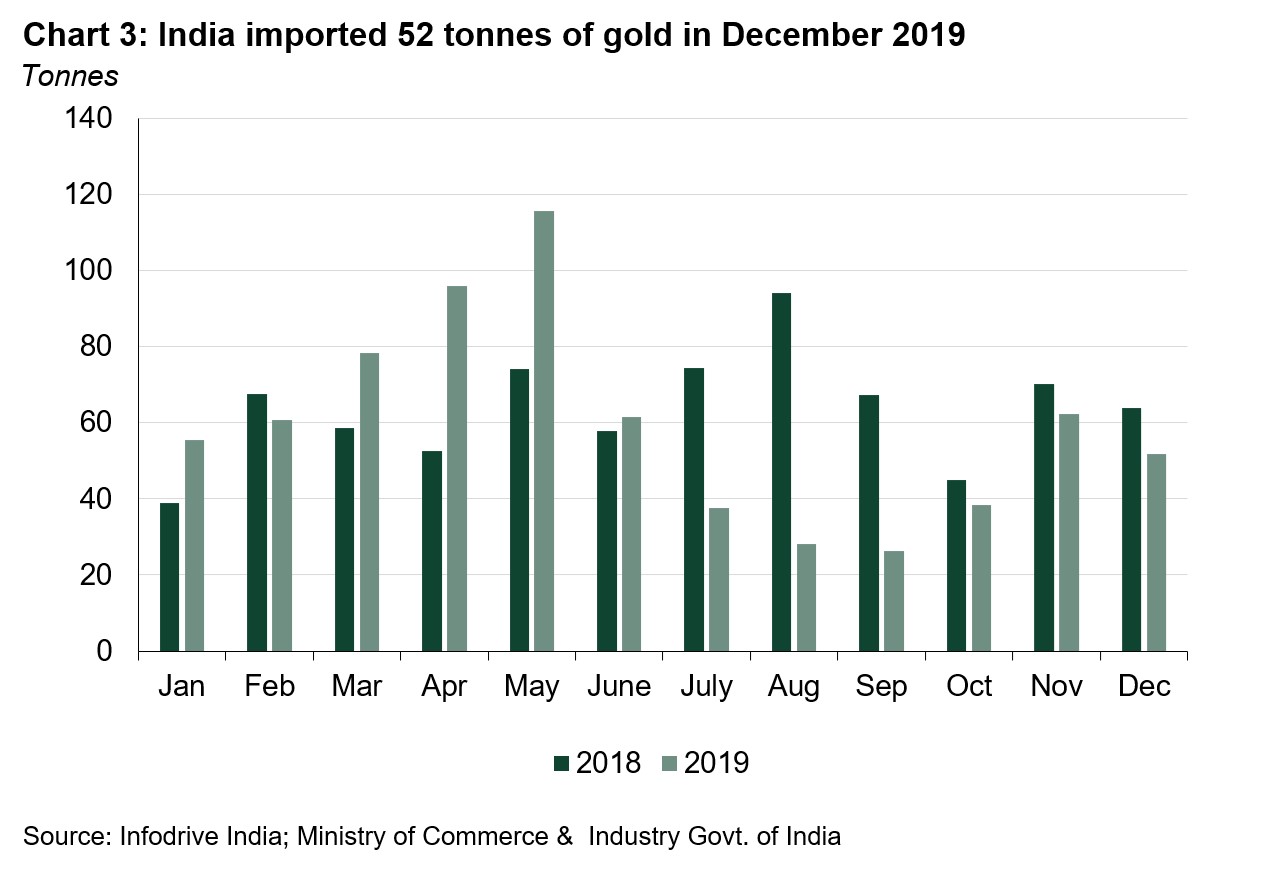

Imports were lower m-o-m

Indian gold imports totalled 51.8t in December 2019 – 19% lower y-o-y and 17% lower m-o-m (Chart 3).

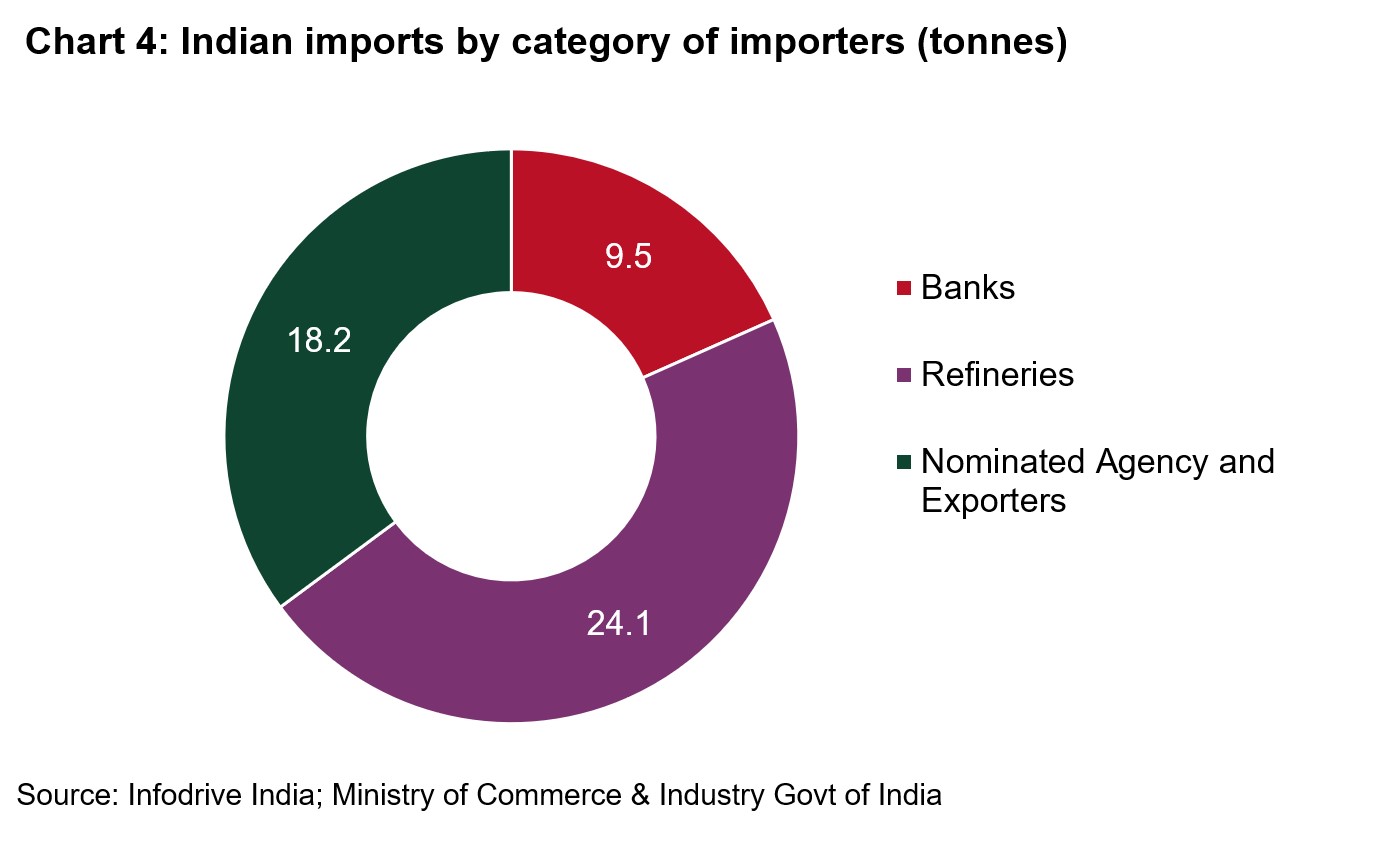

A total of 11 banks, nominated agencies and exporters imported 27.7t of bullion during the month, 17 refineries imported 24.1t of gold doré (fine gold content) (Chart 4). Including jewellery exports and round-tripping estimates, net gold imports in December were 36.3t, 23% lower than 47.4t imports seen in December 2018.2

Most of the bullion was sourced from Switzerland (84%) and the UAE (11%) in November. The prominent gold doré exporting countries to India were Peru, Ghana, Bolivia and USA - accounting for a combined 62% of gold doré imports in December.

Gold Imports moved to restricted list

As per a notification from Directorate General of Foreign Trade (DGFT) dated 18th December 2019, gold imports have been moved to restricted list.3 Under the new regulation, the import of gold in powder, plate, sheet, tube, pipes and other unwrought forms will only be allowed through the nominated agencies as notified by RBI (in case of banks) and DGFT (for other agencies). This notification is issued to curb the misuse of gold imports under Free Trade Agreement (FTA).4

RBI purchased ~ 15 tonnes of gold in the months of October- November

After a hiatus of five months, RBI resumed its gold purchases in October. It purchased a total of 15 tonnes of gold in October and November taking its total gold reserves to 633.1 tonnes at the end of November (Chart 5). The RBI stepped up its gold purchase to maintain safety and liquidity of its forex reserves.

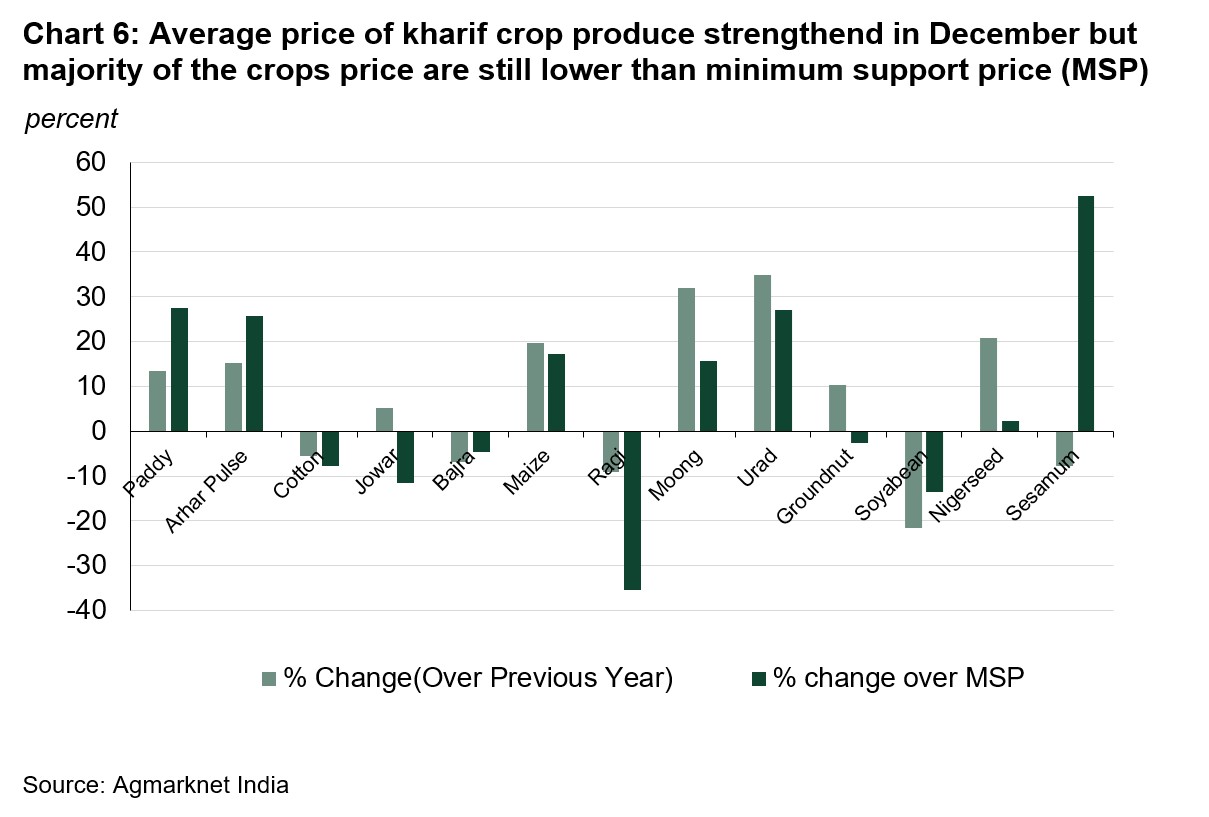

Kharif crops prices strengthened in December but majority of the crops price are still lower than minimum support price (MSP)5

Late and heavy rainfall in the states of Madhya Pradesh, Rajasthan, Gujarat, Uttar Pradesh and Maharashtra damaged standing kharif crops. The mandi price of kharif crops which arrived in December strengthened however six of the thirteen kharif crops were trading at price lower than MSP (Chart 6).

Footnotes

1 Inauspicious period was from 16th December 2019 to 14th January 2020

2 Round-tripping is the act of exporting gold, be it jewellery, bars or coins, with the sole purpose of melting it down before re-importing it back to the original exporting country.

3 Directorate General of Foreign Trade report 18/12/19

4 In 2019, an Indian gold trader imported gold in from Indonesia through Free Trade Agreement despite not being a nominated agency as notified by DGFT

5 Minimum Support Price (MSP) is a form of market intervention by the Government of India to insure farmers against any sharp fall in agricultural prices