Summary

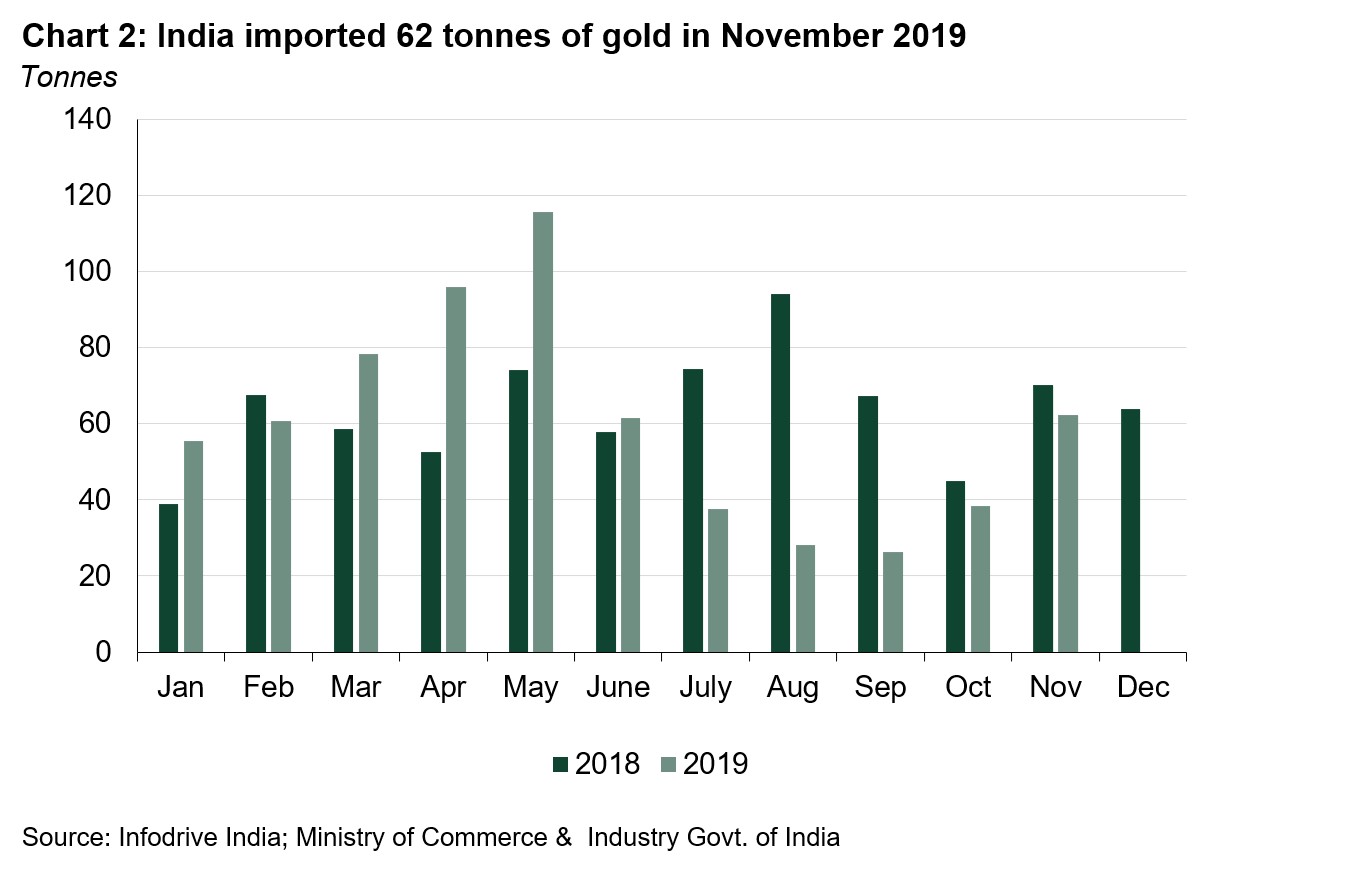

- Indian gold imports were 62.3t in October 2019 – 11% lower than the same month last year

- The domestic gold price declined by 2% in November, ending the month 20% higher than the end of 2018

- With the onset of the wedding season in November, the local market was back in premia of US$1/oz on 6th November after trading at discount for more than five months, but lower than expected wedding volumes pushed the market back into discount by end of November

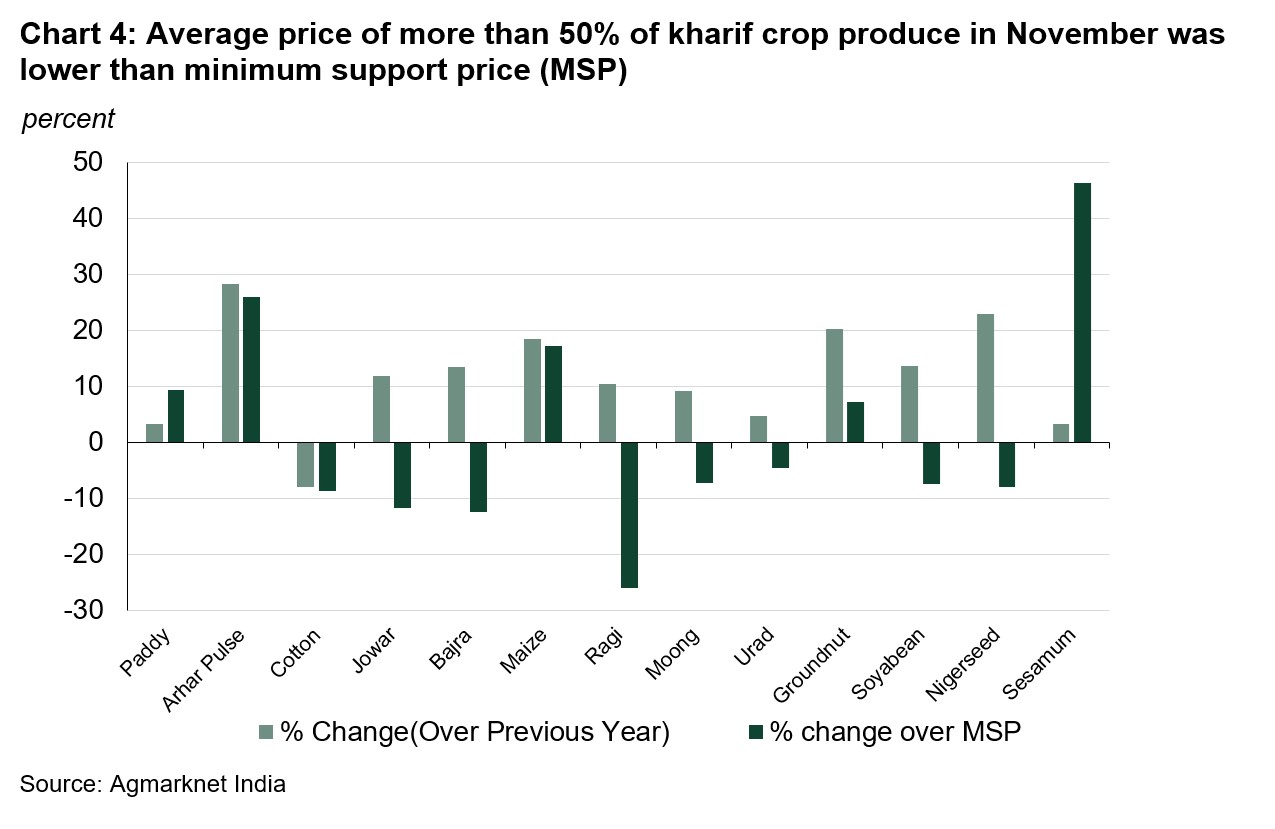

- Late withdrawal of the monsoon, with heavy rainfall in several states of India, damaged kharif crops, leading to more than 50% of kharif crops trading below the minimum support price (MSP) due to high moisture content and little progress in procurement of crops from government.1 This will impact rural income in Q4 2019.

Dichotomy between economy and financial market in November

The Indian economy continued to show signs of stress in November. A Consumer Confidence Survey conducted by RBI fell to 85.7 in November, down from 89.4 in September, its lowest level in five years.2 The decline in consumer confidence reflects concerns around the economy and employment in India. Consumer price inflation continued its upward trajectory and reached a three-year high at 5.5% in November, led by higher onion and pulses prices. Core inflation crept up to 3.5% in November, up from 3.47% in October.

Markets however seemed to be unfazed by the weakening economy. Sentiment remained bouyant, support by three factors: the reduction in corporate tax rate from 30% to 22%, disinvestment of government shareholding in five public sector enterprises and the possibility of a trade agreement between US and China. As a result, SENSEX touched an all-time high of 41,130 on 28th November, while foreign portfolio investors (FPIs) inflows into Indian capital markets touched an eight-month high of Rs230bn in November.

Weddings and lower gold prices boosted gold retail demand in November

MCX Spot Gold price (995 fineness) decreased by 2% in November, while the LBMA Gold Price (PM) decreased by 3.4%. Movements in the USD/INR – which depreciated by 1.3% over concerns in Indian economy – however helped the rise in local gold price. Lower gold price along with the onset of wedding season from 8th November, helped to boost gold demand. Wedding demand also received support from a higher number of auspicious days in November this year.3 Despite this, retailers reported wedding-related sales being 15-20% lower y-o-y owing to the higher gold price (+23%) compared to the same period last year.

Local market was back in premia after trading at discount for more than five months

Retail demand sentiment improved markedly after Dhanteras, and the trade (bullion dealers, fabricators and retailers) began to replenish their inventory ahead of wedding season in November. With the replenishment of inventory, the discount of US$3/oz at end of October finally vanished and market moved to a premium of US$1/oz on 6th November after trading in discount for more than five months (Chart 1). But the premium proved to be short-lived as wedding demand fell short of expectations. The market fell back to discount after 14th November, ending the month at a US$1/oz discount.