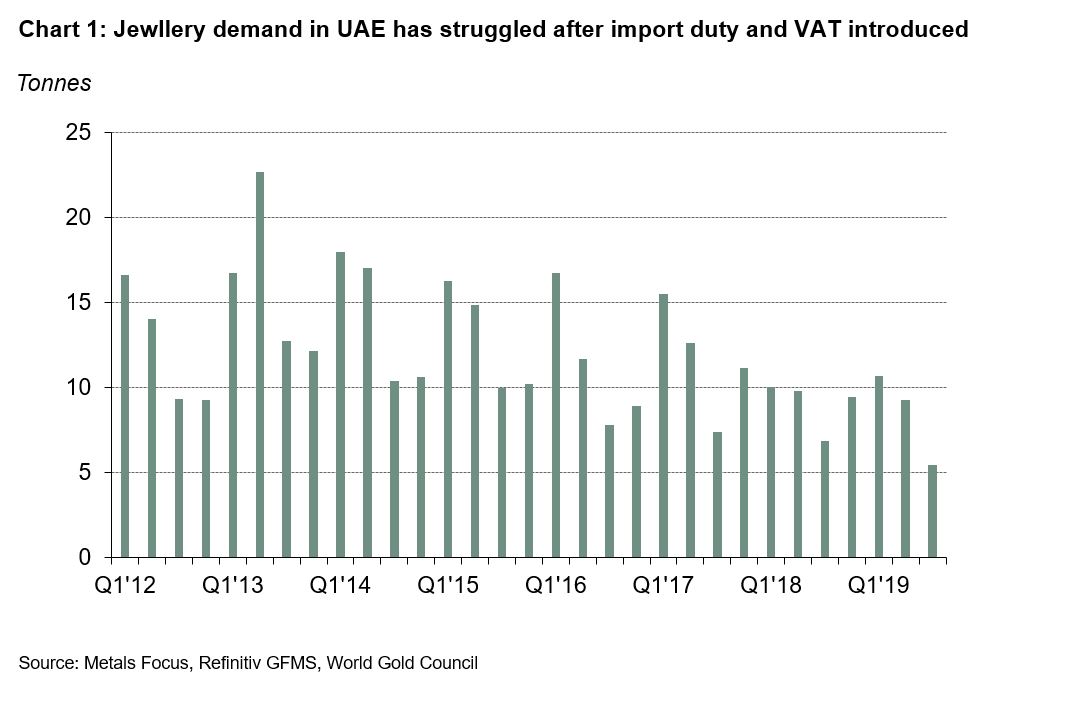

The UAE is an important jewellery market in the Middle East: its ten-year average jewellery demand in 2018 at 54.7t, only was second to Saudi Arabia. However, conditions in the UAE have been tough for gold in recent years. Gold jewellery consumption slumped from 64t in 2013 to 45t in 2016. The main drivers of the decline in demand were the escalating political tensions and armed conflicts in the region, lower government revenues due to weak oil prices, rising living costs and, as a result, deteriorating consumer sentiment. What’s more, the government also introduced a 5% custom duty on 1 January 2017 and 5% VAT on 1 January 2018.

Gold’s rising status in the Persian Gulf

15 November, 2019

Initially, VAT gave the UAE’s gold jewellery demand a boost. Jewellery demand in Q4 2017 was strong as consumers looked to buy ahead of introduction of the new tax. Once this came into effect, however, jewellery demand declined to 36.2t in 2018 (-23% y-o-y). Although demand recovered in Q4 2018 with VAT refunds, a weak economy, concerns over job security, and higher gold prices have continued to create headwinds to jewellery demand in 2019 (Chart 1).

And the impact wasn’t just on the retail side of the market. The introduction of 5% custom duty negatively impacted jewellery imports in UAE and jewellery imports in UAE declined by 20% in 2017 from 2016.1 The introduction of VAT also impacted the wholesale jewellery activity in UAE. According to Metals Focus, Turkey and Lebanon became more attractive destinations to jewellery exporters who were keen to avoid the 5% VAT in the UAE. With removal of 5% VAT on wholesale trade activity from 1 May 2018, the jewellery imports into UAE activity regained the momentum lost in 2017.

Following this, on 13 October the UAE government approved a new gold policy to enhance the country’s position as a global hub for gold and jewellery trade, along with initiatives and tools to support its implementation. It will introduce a centralised platform for trading and tracking gold trade in line with international standards. The trading and clearing platform will act like a bourse and will bring increased transparency and competitiveness.

The new gold policy is based on three main pillars: governance, sustainability and innovation. This includes ten strategic programmes and initiatives aimed at supporting the country’s position and competitiveness. Some of the important programmes are listed below:

- Governance of the gold sector at the federal and state level

- Establishment of a federal platform for gold trading and tracking the source of gold

- International marketing of the gold sector

- Use of technology in the manufacturing of gold jewellery

- Establishment of a uniform gold standard to UAE

- Promotion of conferences and trade shows related to the gold sector

Talking with contacts in the local trade, only some details about the proposed new gold policy have been released in the local media, with full details to follow in due course. Trade contacts expect that there will also be a focus on responsible sourcing and anti-money laundering guidelines.

UAE is already an important gold hub

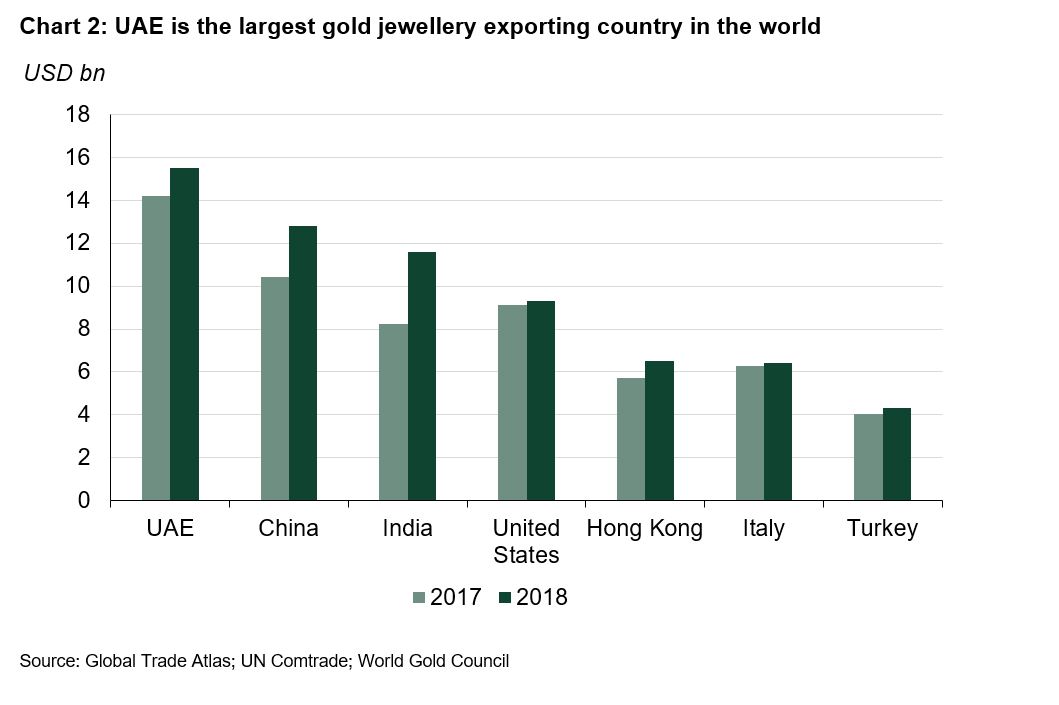

The UAE also remains a major trading hub for gold jewellery. It was the world’s largest exporter of gold jewellery in 2018 in values terms2 - higher than China and India (Chart 2).

The UAE is already a significant gold centre within the global market, and the new policy initiatives announced in October could boost its role further.The new policy is a welcome step for the local industry in UAE, however we’ll have more clarity once the full details are publicly released.

Footnotes

1 UN Comtrade database

2 UN Comtrade database