Gold performance/technicals:

- Gold was higher last week (XAU +0.1%, LBMA +0.7%) ending around $1,490/oz, as the US dollar weakened 1% against a stronger euro and pound.

- Gold remains close to the key $1,500 technical level which will remain very important as to sense the next price direction.

Gold Price/$oz

Liquidity:

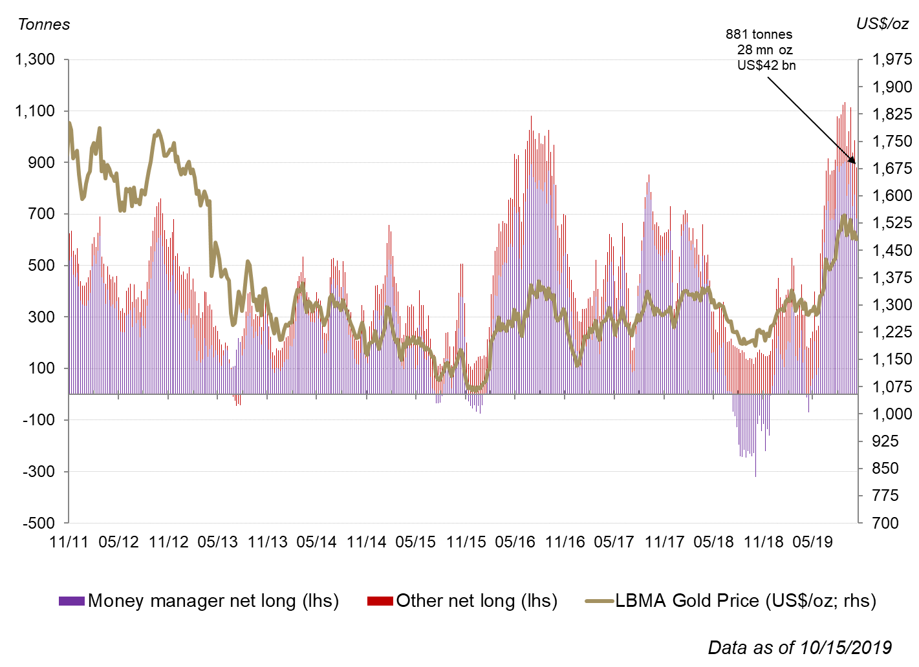

- COMEX net longs fell from 986t to 880t, driven by a reduction in money market longs which moved to the lowest levels since early July, but remain well above the long-term average.

- Trading volumes have begun the month lower at $170bn a day, but these levels are still 50% higher than 2018 daily averages.

COMEX Net Longs

Source: CFTC, Bloomberg

Gold-backed ETF flows by time periods:

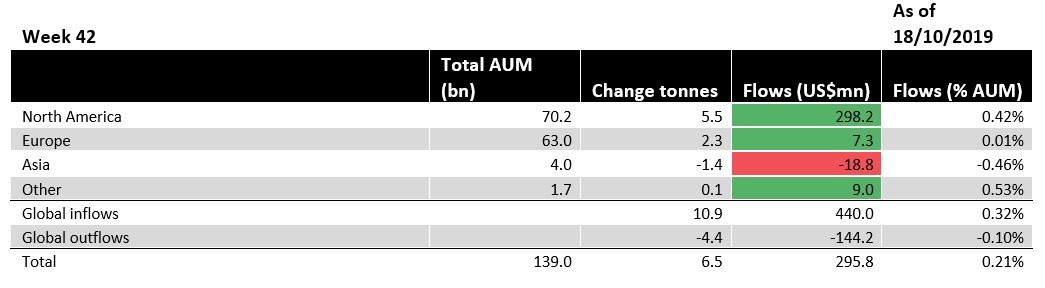

- $296mn worth of global gold-backed ETF inflows across the US (+$298mn) and Europe (+$7mn) last week.

- Flows are higher by $1.9bn in October, continuing to make all-time highs in tonnage.

Gold-backed ETF Flows

‘Global Inflows’ refers to the sum of changes of all funds that saw a net increase in ounces held over a given period (eg, month, quarter, etc.). Conversely, ‘global outflows’ aggregates changes from funds that saw ounces held decline over the same period.

Source: Bloomberg; Company Filings; World Gold Council