Summary

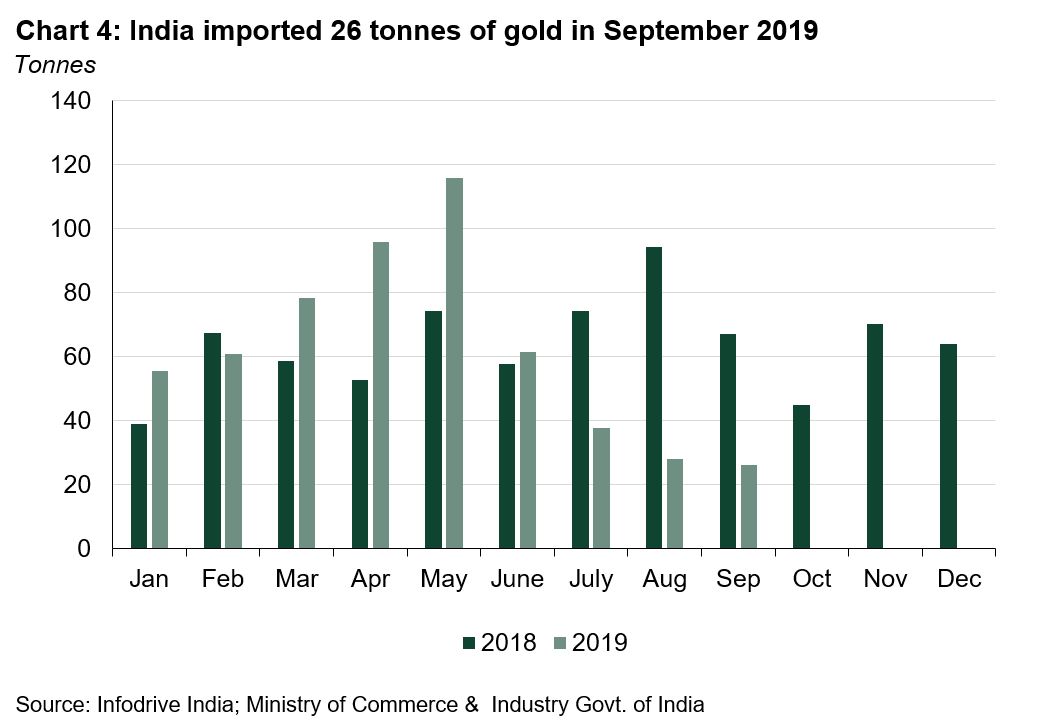

- Indian gold imports reached just 26.3t in September 2019 – 61% lower than the same month last year.

- The domestic gold price was 2.4% lower in September compared to August, but 18.7% higher y-t-d.

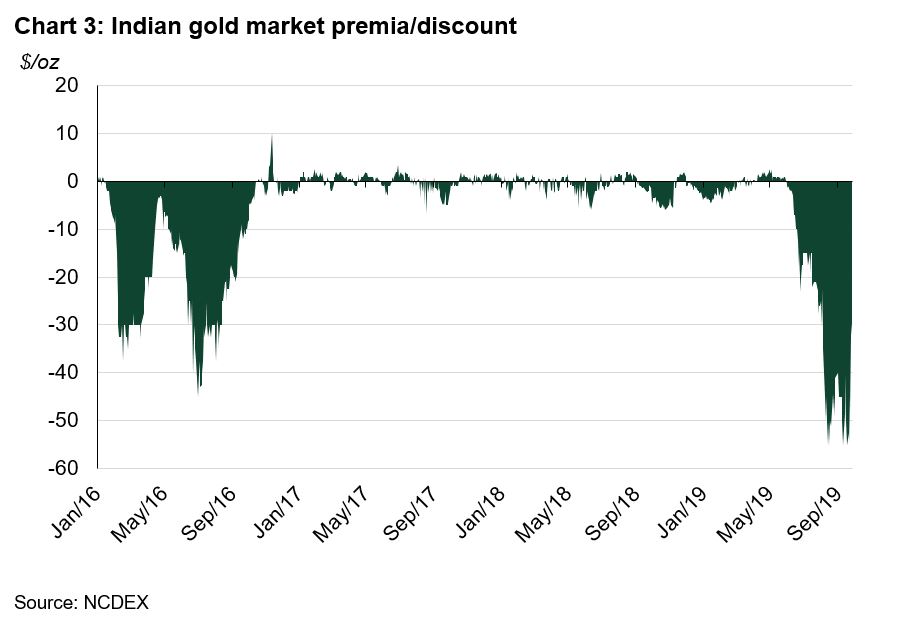

- With weak physical demand, the discount in the local gold market reached a peak of US$55/oz in September, but narrowed to US$29.5/oz by the end of the month.

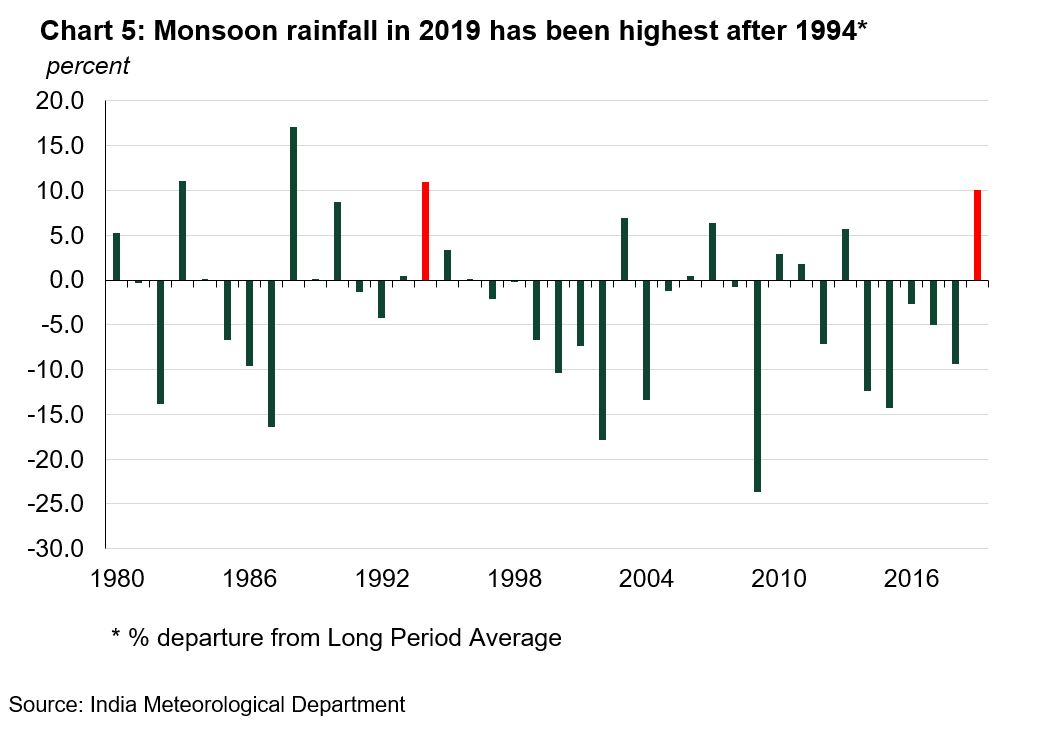

- Monsoon levels in 2019 are the highest for 25 years; Kharif sowing almost flat y-o-y.

Consumer demand weak in September

Following weak domestic retail demand in the preceding three months, gold demand remained soft in September. Domestic spot gold price (995 fineness) continued its ascendance and breached Rs39,000/10gm in first week of September to reach an all-time high of Rs39,011/10gm - on 4th September. Following the correction in international gold price and a strengthening rupee, the domestic gold spot price finished the month at Rs37,475/10gm; 2.4% lower than at the end of August. The impact of such a correction in the domestic price on retail jewellery demand was muted with Pitru-Paksha falling between 13th to 28th September - a 16 lunar day period where Hindus pay homage to their ancestors. Pitru-Paksha is considered inauspicious period for purchasing gold, new house or starting a new venture.

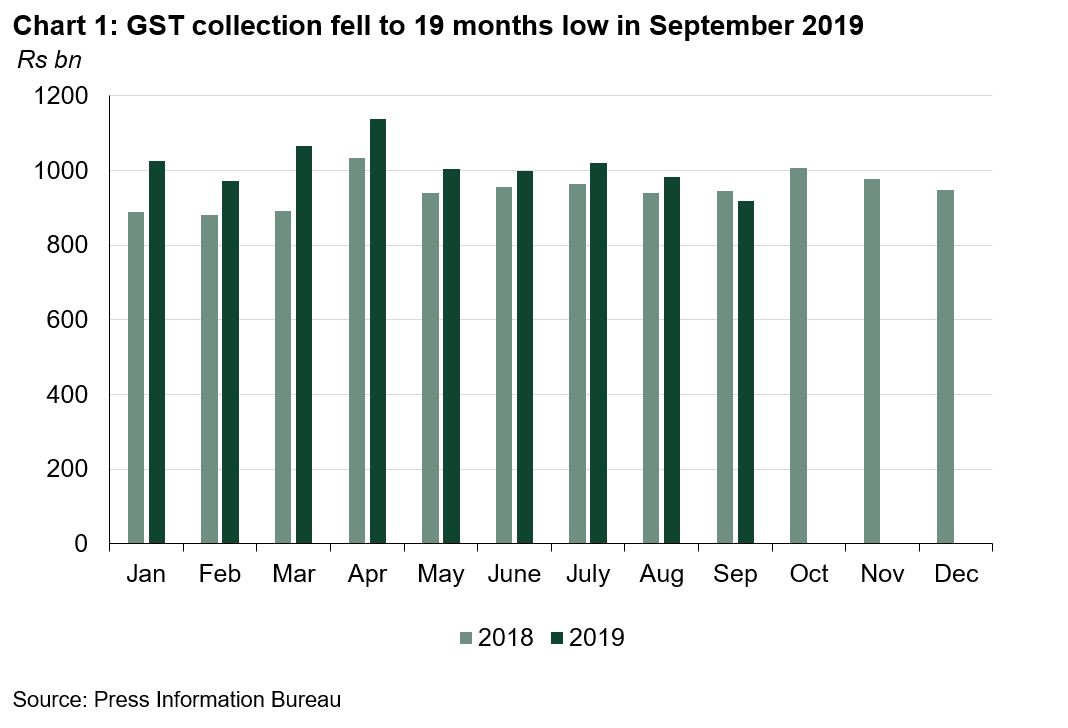

The economic slowdown persisted in September. For example, both passenger car and motorcycle sales fell by 33.4% and 23.3% y-o-y respectively in September. The slowdown in domestic economy also impacted Goods and Services (GST) collection which fell to a 19-month low of Rs919.16 bn (Chart 1).

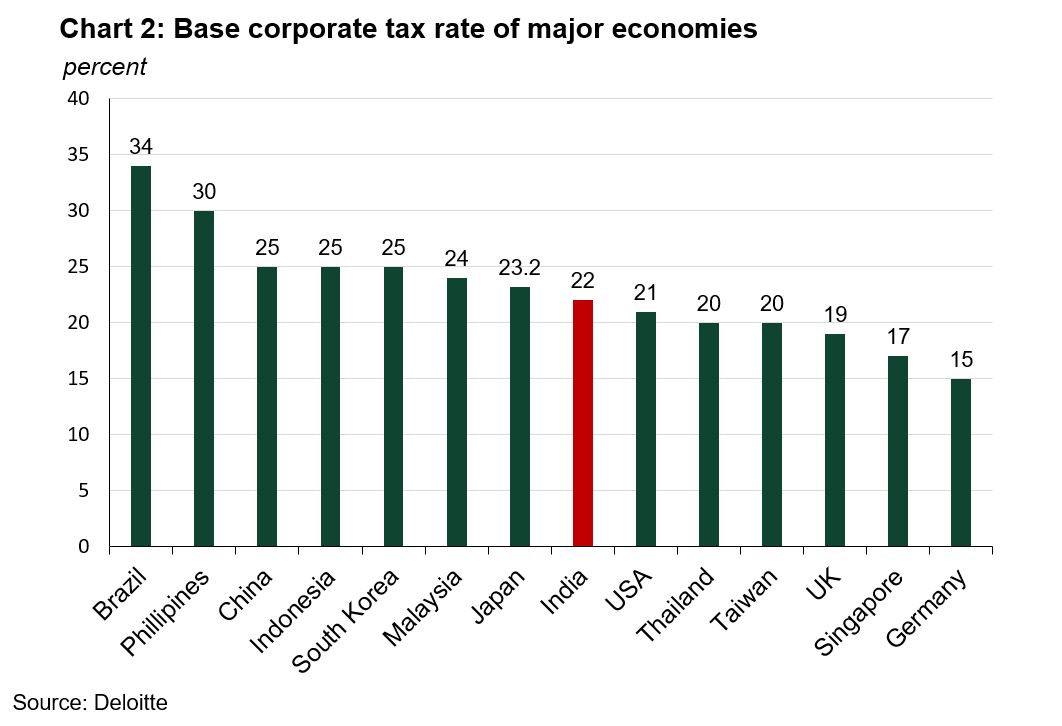

Aiming to boost business investment, the Finance Minister announced on 20th September that the corporate tax rate would be cut from 30% to 22% (taking effect from financial year FY 2019-20).1 This is a more competitive rate compared to other countries (Chart 2). The immediate impact of this cut was visible on foreign portfolio investments (FPI) in India and strengthening of Indian rupee. Following the announcement, September witnessed an inflow of Rs65.8bn in capital markets and USD/INR appreciated by 1.5% in September as compared to a depreciation of 4% in August. The cut in corporate tax will boost investments, however, a demand revival may take a bit longer. India’s leading rating agency CRISIL expects that top 1,000 listed companies could save ~Rs370 bn in tax as a result.2 A sample of 69 companies that published results in September reported a 12.5% y-o-y increase in net profit due to the boost from cut in the tax rate, but revenue grew at a five quarter low of 5.6% y-o-y due to weak consumer demand.3

Gold-to-gold exchange formed a larger part of retail demand and fresh purchases remained weak. With muted retail demand and higher unofficial imports, the discount in the domestic market widened further to US$55/oz on 20th September (Chart 3). The discount in the market narrowed to US$29.5/oz by end of September due to some uptick in wholesale demand ahead of Navratri.4

Imports were marginally lower m-o-m

Indian gold imports totalled 26.3t in September 2019 – 61% lower y-o-y and 7% lower m-o-m (Chart 4). The inauspicious period of Pitru Paksha and slowing economy were the primary reasons for the lower levels of imports.

A total of ten banks, nominated agencies and exporters imported 25.6t of bullion during the month, while just one refinery imported a meagre 0.7t of gold doré (fine gold content). Axis Bank began importing bullion again after a 16-month hiatus after RBI had prohibited it from importing bullion in FY 2018-19. Including jewellery exports and round-tripping estimates, net gold imports in September were 6t, some way off the 50t seen in September 2018.5

Most of the bullion was sourced from Switzerland (66%) and the UAE (25%) in September. Gold doré imports came from a just one country - Colombia.

Monsoon rainfall in 2019 was at its highest for 25 years. After an initial delay in its arrival, and weak rainfall until July, the monsoon gained momentum in August and September. By end of the monsoon on 30th September, the cumulative rainfall surpassed the long period average (LPA) by 10% – the highest level of rainfall since 1994 (Chart 5). The monsoon was well distributed and 85% of India received normal or above normal rainfall. With this healthy monsoon rainfall, Kharif crop sowing hit 106.3Mt, almost the same as compared to last year.6

Footnotes

1 The corporate tax rate including surcharge and cess is 25.17% from earlier level of 35%.

2 https://www.crisil.com/content/dam/crisil/our-analysis/views-and-commentaries/impact-note/2019/september/CRISIL-Research-Impact-note-tax-s(h)aving.pdf

3 https://economictimes.indiatimes.com/markets/stocks/news/q2-results-tax-cut-boosts-profit-but-revenue-crawls/articleshow/71680091.cms

4 Navratri is a ten-day (nine nights) Hindu festival celebrated every autumn after the end of the monsoon.

5 Round-tripping is the act of exporting gold, be it jewellery, bars or coins, with the sole purpose of melting it down before re-importing it back to the original exporting country.

6 http://agricoop.nic.in/sites/default/files/Cwwg-Data-as-on-27.09.2019.pdf