While the gold market is a complex place, full of interesting dynamics and uses, nothing quite gets people's attention like the gold price. Our gold price data set is by far the most popular on Goldhub. But unlike some other assets, gold doesn’t have a single price. Well, there’s the international price, which is mostly determined in the futures markets, but there are deviations from this depending on where you are in the world.

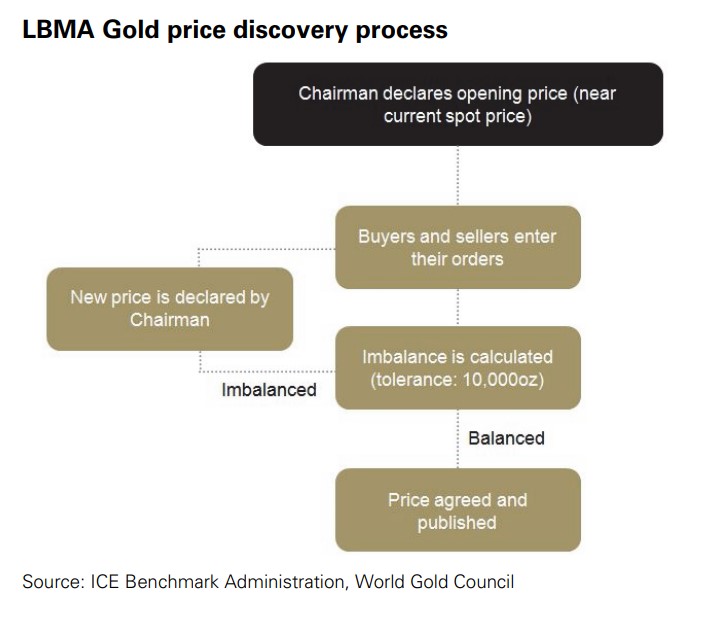

By far, the most important price in the gold market is the LBMA Gold Price (previously the London Gold Fixing). This globally-recognised price is set twice a day (10:30am and 3pm London) and is used as a reference within the global market: many long-term contracts will be agreed on the basis of either the morning or afternoon price. Unlike the spot price, the LBMA Gold Price is determined via an auction process, whereby participants submit buy and sell orders. The price is continually adjusted until these are in balance and the price is agreed.