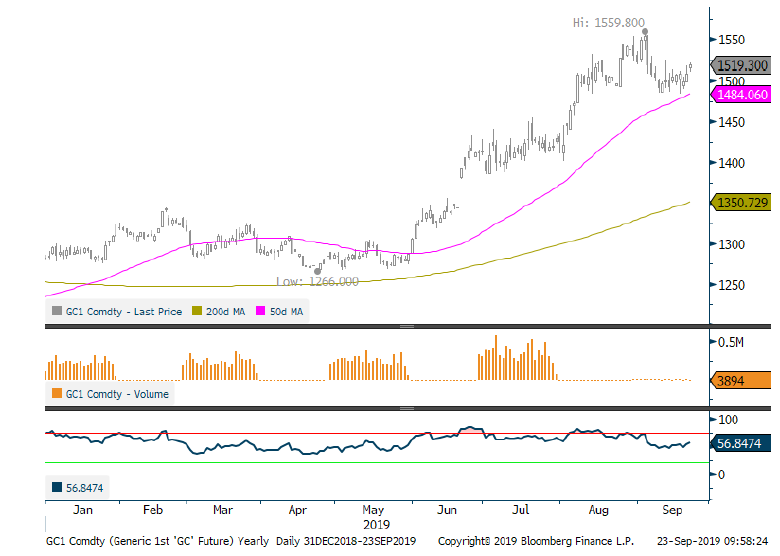

- Gold rallied on Friday following the LBMA fix which left the fix price flat on the week and XAU higher (XAU +2%, LBMA -0.1%) as yields fell following the Fed rate cut which left the market thinking the ‘organic growth’ Powell discussed could represent future QE.

Gold skew is at all-time 'cheapness' highlighting bullish sentiment

23 September, 2019

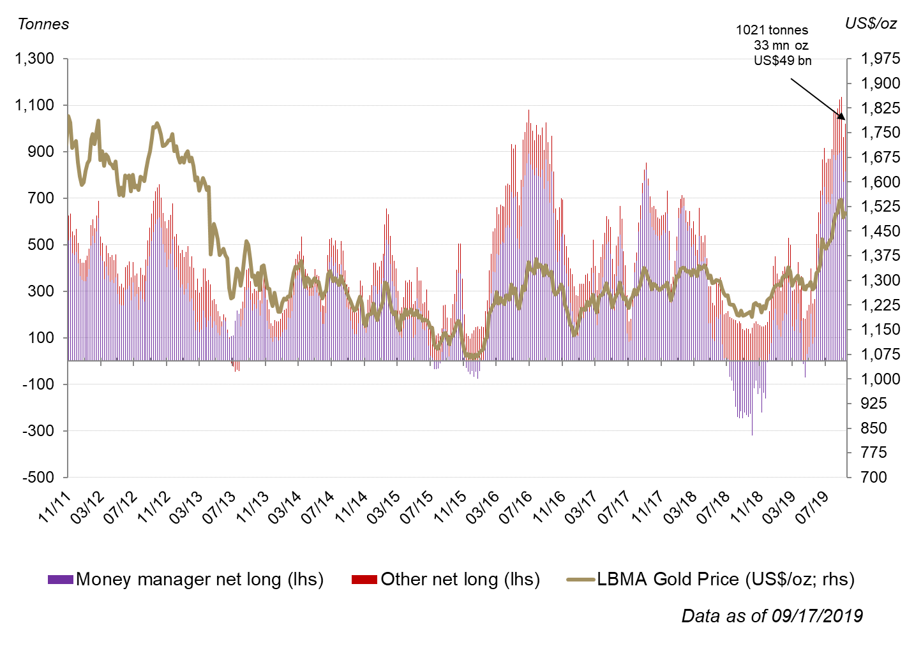

- COMEX net longs moved higher from 968t to 1,021 after falling the previous week.

- Global gold trading volumes fell again last week and at $197bn a day fell below $200bn for the first time in two months.

COMEX Net Longs

Source: CFTC, Bloomberg

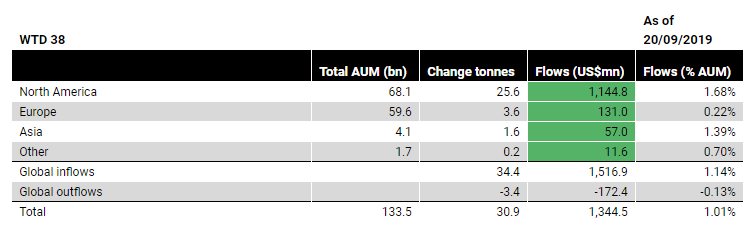

- $1.3bn worth of global gold-backed ETF inflows last week mainly coming from the US (+$1.1bn) and Europe (+$131mn). Other regions had minimal flows.

- Flows are higher by $1.5bn on the month, led by the US (+$1.3bn) and Asia (+$206mn). European flows are flat.

‘Global Inflows’ refers to the sum of changes of all funds that saw a net increase in ounces held over a given period (eg, month, quarter, etc.). Conversely, ‘global outflows’ aggregates changes from funds that saw ounces held decline over the same period.

Source: Bloomberg; Company Filings; World Gold Council

- Gold 3m options skew is the cheapest of all-time at an implied volatility differential of 6 (data going back to 2007). This is being driven by the surge in call implied volatility with minimal moves in put volatility. This means that investors are paying a significant premium for upside exposure in gold which is bullish.

Gold 3m 90/110 skew (positive number represents premium of calls to puts)

Source: Bloomberg