Summary

- The domestic gold price was 10.3% higher in August compared to July, outpacing the LBMA gold price which rose by 7%

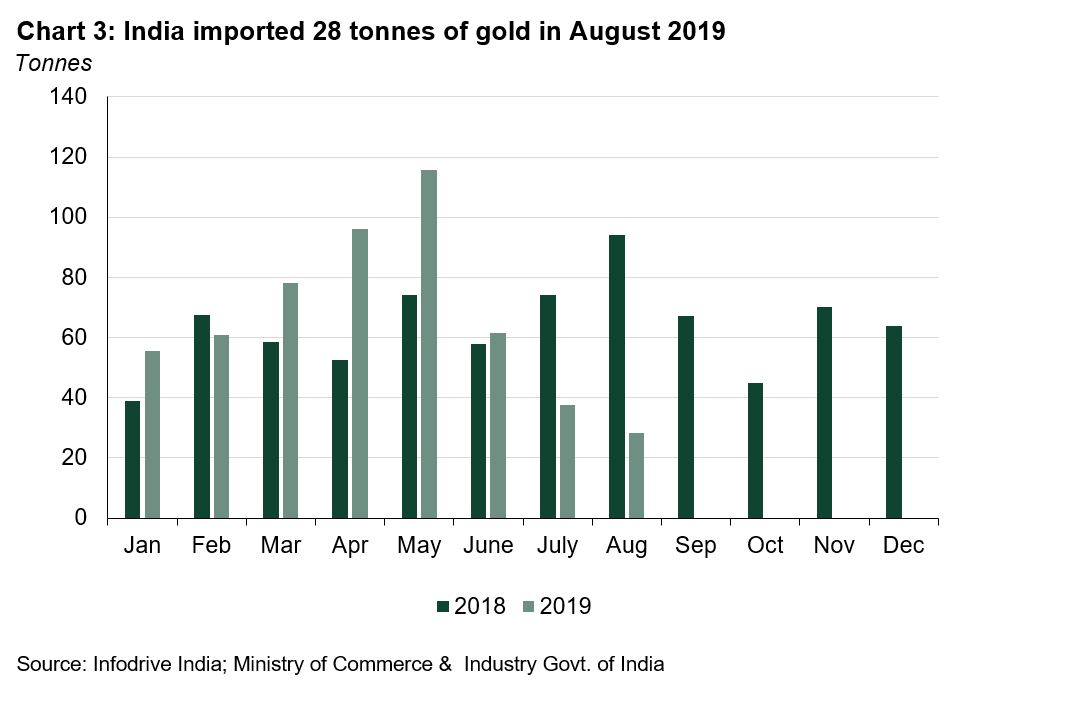

- Indian gold imports reached just 28.2t in August 2019 – 70% lower than the same month last year and lowest level since January 2018

- With elevated domestic gold prices and a higher custom duty, the discount in the local gold market widened out as far as US$55/oz in August

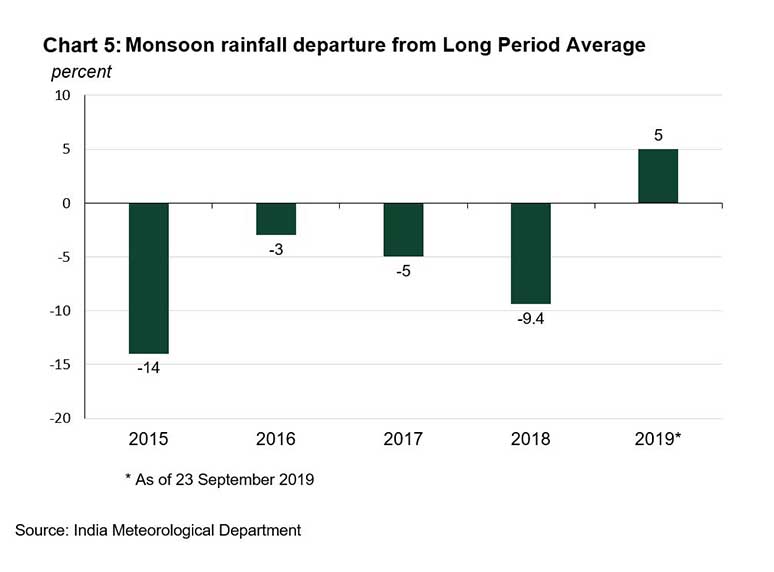

- Monsoon rainfall is 5% above Long Period Average (LPA) with Kharif sowing just 0.2% lower than last year; normal monsoon and healthy sowing bodes well for rural gold demand in Q4 2019.1

Another tough month for consumer demand

Following weak domestic retail demand in June and July, the gold market continued to face headwinds in August. The rally in the domestic gold price to record levels continued to exert pressure on consumer buying. The spot gold price (995 fineness) maintained its positive trajectory and touched a record high of Rs38,579/10gm on 26th August. The price finished the month 10.3% higher than at the end of July and year-to-date has increased 19.6%.

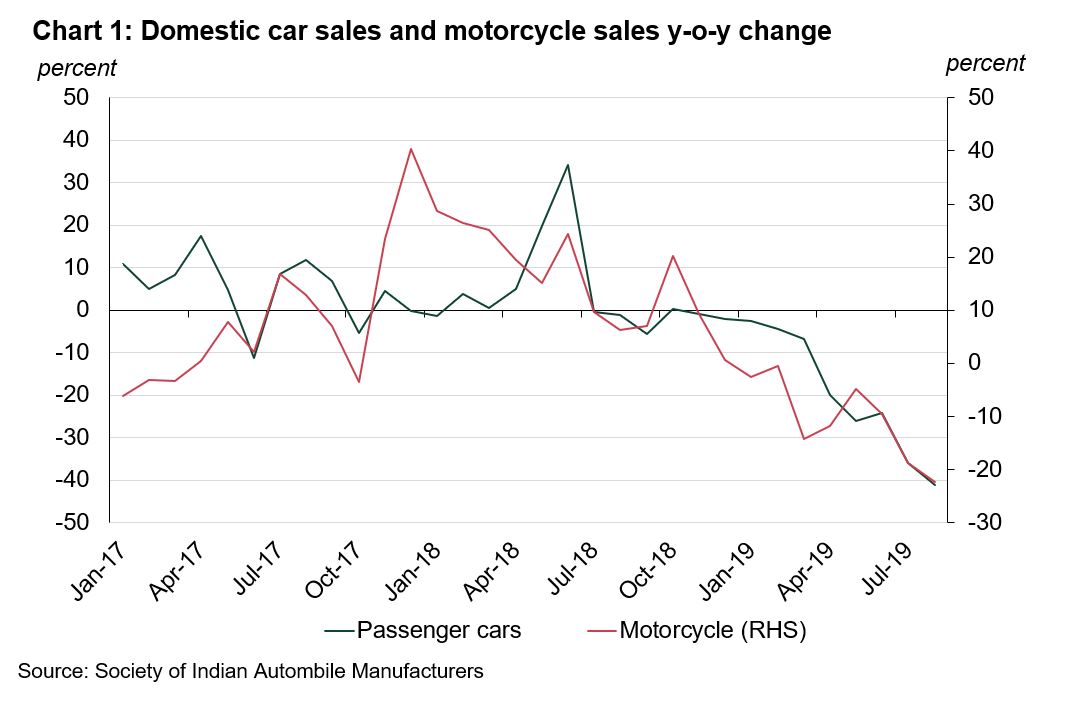

And the Indian economy is faltering. Leading indicators such as PMI manufacturing index, core sector growth, trade balance and INR have been on a downward trajectory. The slowing economy has also impacted sales volumes of large FMCG companies (such as Hindustan Unilever, Marico, Dabur), primarily led by lower rural growth. Confidence has also taken a hit, with the consumer confidence level falling to 95.7 in July from 97.3 in May.2 Weaker passenger car sales and motorcycle sales also pointed towards a slowdown urban and rural demand (Chart 1).

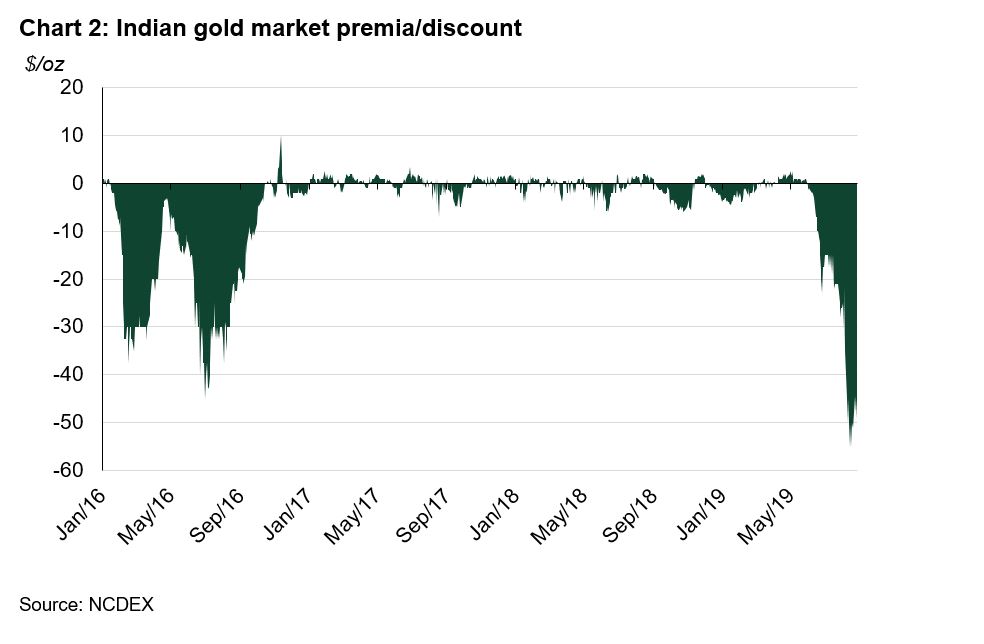

With the sharp rally in domestic gold price and lower government spending due to focus on fiscal consolidation, demand for gold was understandably subdued in August. Gold-for-gold exchange formed a larger part of retail demand and fresh purchases remained curtailed. Further, the rally in the domestic price also encouraged higher recycling (gold for cash) and the higher custom duty encouraged unofficial imports in the country. With muted retail demand and higher unofficial imports, the discount in the domestic market widened further to USS$55/oz in August (Chart 2).

Imports declined m-o-m

Indian gold imports totalled 28.2t in August 2019 – 70% lower y-o-y and 25% lower m-o-m (Chart 3). The rally in the gold price, weak domestic economy and higher custom duty were the primary reasons for the lower levels of imports. Imports were further dampened by muted demand from rural communities, who diverted their spending towards the sowing of Kharif crops.

The bulk of the gold (23.8t) was bullion imported largely by nominated agencies and exporters, while 4.4t (fine gold content) was in doré form. Including jewellery exports and round-tripping estimates, net gold imports in August were 8.8t, some way off the 78t seen in August 2018.3

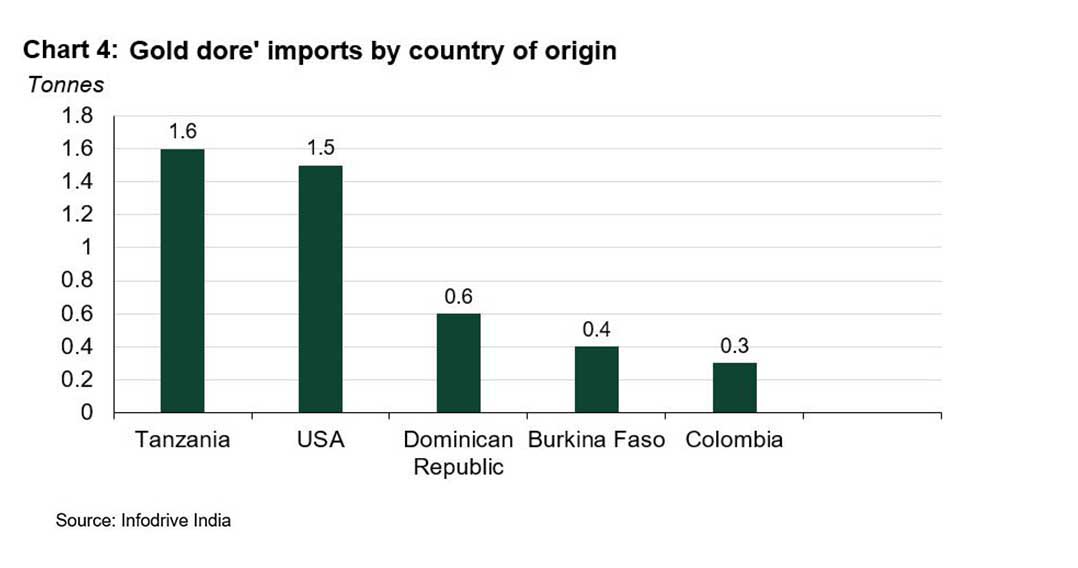

Most of the bullion was sourced from Switzerland (81%) and the UAE (13%) in August. But gold doré imports came from a wider range of sources, including Africa, USA and Latin America. The prominent gold doré exporting countries to India were Tanzania and the USA– accounting for a combined 70% of gold doré imports in August (Chart 4).

Monsoon shows sign of hope for rural gold demand

Monsoon rains have shown great strength in August and September, recovering well from its weak start. As of 23rd September, the monsoon rainfall is 5% above the LPA with a good regional distribution. Kharif crop sowing is now virtually unchanged y-o-y, just 0.2% lower than last year (Chart 5).4

Outlook for September 2019

With the correction in international gold prices, domestic gold prices fell by Rs1,000/10gm from end of August to reach Rs37,500/10gm levels in third week of September. This, along with the arrival of Navratri and Diwali in October, could mean official gold imports gain some momentum in September.5 But higher gold prices and the 16-day inauspicious period between 13- 28 September (Pitru Paksha) – when gold purchases are considered inauspicious – mean that retail demand is expected to remain muted.

Footnotes

1 Long Period Average Rainfall is defined as average rainfall for 50-year period of 1951-2000 and LPA rainfall is 89 cm. Kharif crops also known as summer crops are sown during June-September (monsoon season) and harvested during October-November.

2 rbidocs.rbi.org.in/rdocs/Publications/PDFs/CCS070820192112A583493A409185992A3A84FE9023.PDF.

3Round-tripping is the act of exporting gold, be it jewellery, bars or coins, with the sole purpose of melting it down before re-importing it back to the original exporting country.

4 Monsoon rainfall is taken from India Meteorological Department and Kharif crop sowing is from Ministry of Agriculture with data as of week ending on 20 September.

5 Navratri is a ten-day (nine nights) Hindu festival celebrated every autumn after the end of the monsoon.