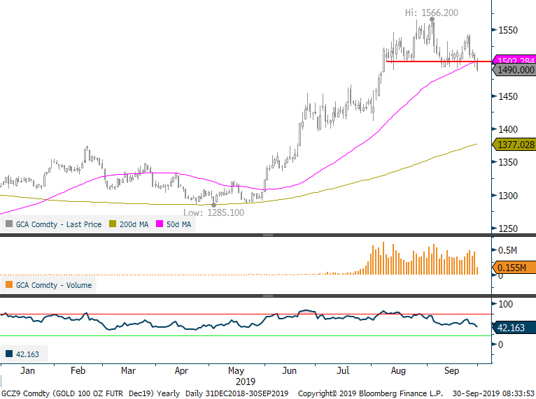

Gold performance/technicals:

- Gold fell last week (XAU -1.3%, LBMA -0.8%) as the US dollar strengthened to 2-yr highs.

- Gold moved back to the $1,500 level and is breaking that level this morning; a sign of a potential bearish head-and-shoulders break and move below the 50-day moving average.

Gold Price