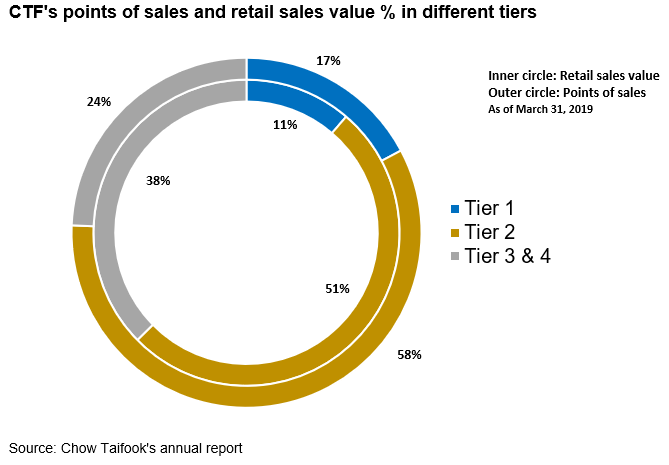

In recent years, expansion into tier three and four cities has been a major strategic focus for many Chinese jewellery retailers. Chow Tai Fook (CFT), a leading retailer based in Hong Kong, added 251 points of sales (POS) in lower tier cities in 2018 compared to only 50 in tier one cities.1 Lao Feng Xiang, another large jeweller with 3,521 POS domestically, also prioritised expansion into lower tier cities.2

Chinese jewellery retailers go lower for growth

22 August, 2019

While tier one and two cities are better positioned economically, politically and socially, tier three and four cities shouldn’t be disregarded. As shown above, consumers from lower tier cities contributed significantly to the overall sales for CFT in 2018. And other jewellers have told us the same. But what are the key reasons behind this strategic shift into lower tier cities?

Feeling the pressure: still profiting, but at a lower rate

Jewellery retailers’ profit growth has slowed in the past five years. Some retailers have even seen net profits shrinking over the period. Most of them have made efforts to address this: high-margin and innovative products such as 3D-hard gold and “5G” gold have been promoted heavily.3

Product innovations and new market opportunities are essential to all retailers. While there is no shortage of innovation among China’s jewellers, they need to find relatively untapped markets as the competition in tier one and two cities is fierce. Consequently, most jewellers have prioritised plans to expand into lower tier cities. But what do they see in lower tier markets?

Rising consumption potential in lower tier markets

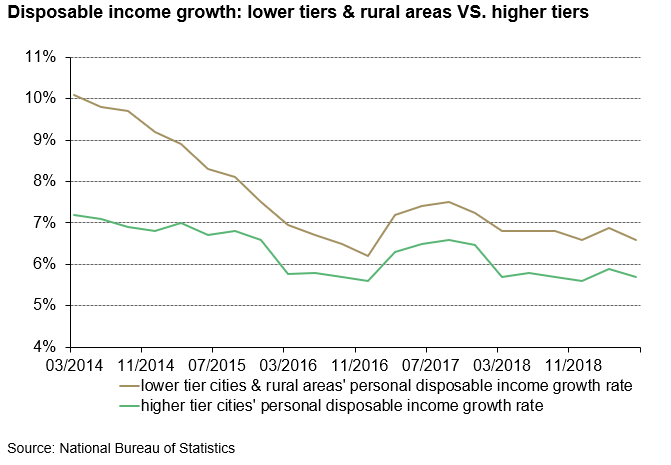

At the July Political Bureau Meeting – a monthly meeting where the president and most senior government ministers determine economic policies – boosting consumption was listed as a vital policy goal. Lower tier cities and rural areas have been the focus as these markets have larger room for consumption growth: disposable income growth rates are higher when compared with higher tier cities.

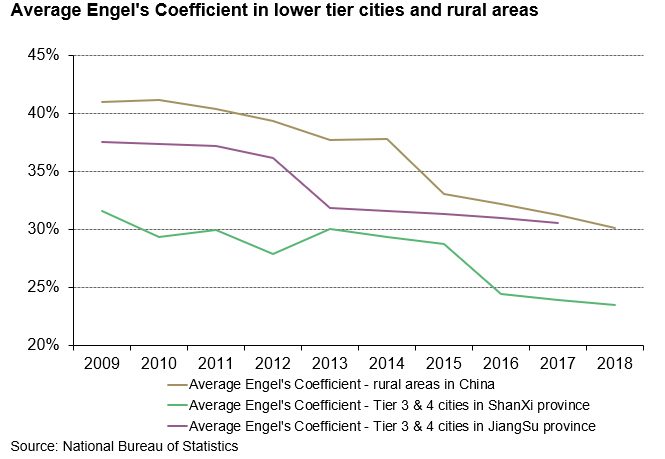

Faster growing incomes mean an improvement in the quality of life - reflected in the sliding Engel’s Coefficients of these areas.4 As consumers in these cities are spending proportionately less of their incomes on food, they are able to divert more of their disposable income towards other goods such as gold jewellery.

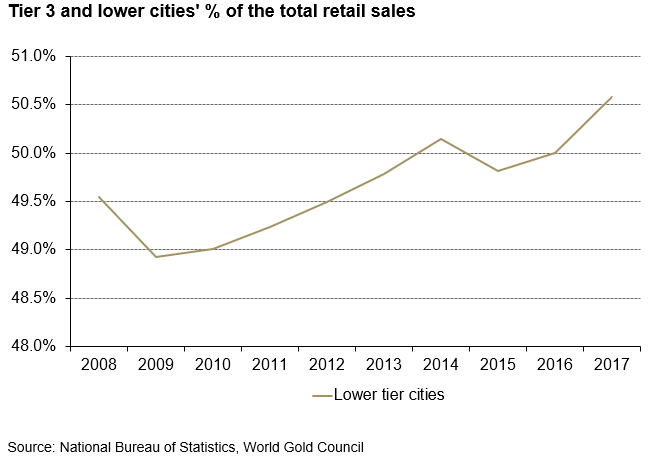

And this seems to be reflected in retail sales data. Lower tier cities’ (tier three and below) proportion in total retail sales in China is rising steadily. In 2017, more than 50% of total retail sales came from lower tier cities.

In lower-tier cities, the average personal income is growing at a faster rate, and more importantly, these consumers are willing to consume.

What do they prefer?

Discussions with the industry indicate that jewellery consumers in lower tier cities are much more traditional than those in big urban centres, preferring high purity products. To them, value preservation outweighs design. But demographic changes could be leading to changes in tastes. And it is increasingly becoming clear that younger generations are at the heart of this change.

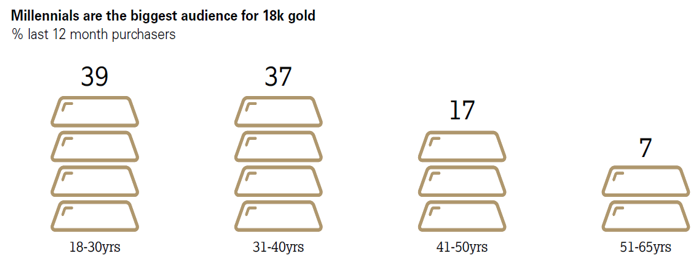

Our consumer research in 2016 showed that instead of the traditional 24K gold jewellery, 18K gold jewellery is the popular choice among younger generations.5 The lower entry cost and broader array of designs made 18K gold jewellery more attractive to younger consumers with a desire for enhanced styles.

This year, we will be publishing an update to our consumer research which will allow us to see if consumers’ behaviour has changed further over the last three years and shine a spotlight on the fast-changing tier 3 and 4 cities.

Lower tier cities: driving future growth

Jewellery retailers’ expansion into lower tier cities has been a clear trend in recent years. And efforts to move into these markets have led to rewards. Some retailers have reported higher sales growth in lower tier cities than in tier one and two cities. And this expansion trend is likely to be a long-term phenomenon. With a large consumption potential, lower tier cities’ consumers might soon become the driving force of China’s jewellery demand.

1Data sourced from Chow Tai Fook’s 2019 annual report: https://www.ctfjewellerygroup.com/en/investor-relations/reports.html

2Data and statement from its 2018 annual report: http://pdf.dfcfw.com/pdf/H2_AN201904251322502930_1.pdf

3Please find more detailed information on these products and trends in our Gold Demand Trend reports here: https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2017/jewellery

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2019/jewellery

4Engel’s Coefficient refers to food consumption’s proportion in a family’s total expenses. The higher the number is, the poorer the family could be and vice versa.

5Please visit https://www.gold.org/goldhub/research/china-jewellery-market-new-perspectives for more information.