Global luxury brand, Tiffany & Co, recently announced a sharp drop in US sales to overseas tourists. Sales to tourists visiting the US in Q1 2019 dropped by 25% from the same period in 2018. Notably, the drop was even more pronounced among tourists from China.

In Q1 2018, the US and China took their first steps towards protectionism before a series of rapidly escalating retaliatory measures led to an all-out trade war later that year. The data suggests that Chinese tourists were apparently very quick to vote with their feet…and their wallets.

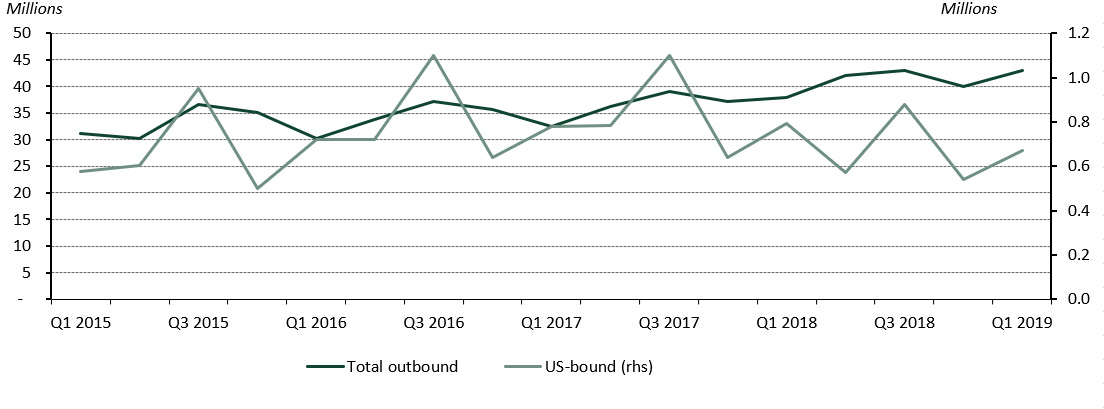

The number of Chinese tourists visiting the US dropped in Q2 of last year and has been in a downtrend ever since. Which contrasts sharply with the bigger picture: overall outbound Chinese tourist numbers have been on a rising trend for the last five years.1

Chinese outbound tourist numbers

Source: Bloomberg; China Outbound Tourism Research Institute

It could be argued that the simultaneous strengthening of the US dollar played a role – by reducing the spending power of Chinese visitors and pushing up the cost of their trip in renminbi.

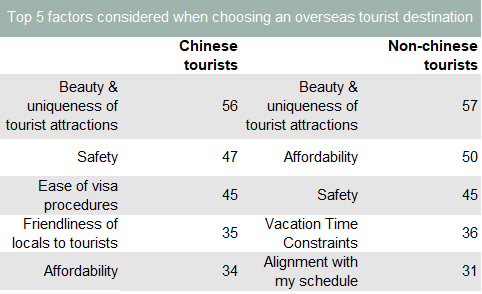

But research by global consumer research agency Nielsen suggests otherwise. According to its 2017 survey, Chinese tourists are far less influenced by affordability than by other factors such as tourist attractions, the travel experience and the beauty, uniqueness and safety of their destination. When choosing an overseas travel destination, cost was the fifth highest priority among Chinese tourists, far lower than among non-Chinese tourists, who ranked it the second highest consideration.

Source: Outbound Chinese Tourism and Consumption Trend: 2017 Survey, Nielsen

We are currently running a large-scale consumer research programme that will shed light on the buying decisions of global jewellery consumers. We are surveying jewellery buyers in China, India and the US – including whether they bought a jewellery piece from a global luxury brand such as Tiffany’s, whether they bought it overseas, and how much they spent on it. And we can compare these responses with how confident consumers say they are feeling about their personal financial situation, against the political and economic background. So the results should give us an indication of whether jewellery consumers in China – and other key markets – are reacting to the global geo-political environment.

And this is just the tip of the iceberg in terms of the insights we will uncover through the research. We will be investigating the purchase journey for jewellery buyers, their key buying occasions, as well as where gold jewellery performs particularly well….and where it doesn’t. The insights will help industry to understand the drivers of behaviour among a swathe of jewellery consumers that together account for over 60% of global annual gold jewellery demand.

[1] Source: Bloomberg; China Outbound Tourism Research Institute (COTRI)