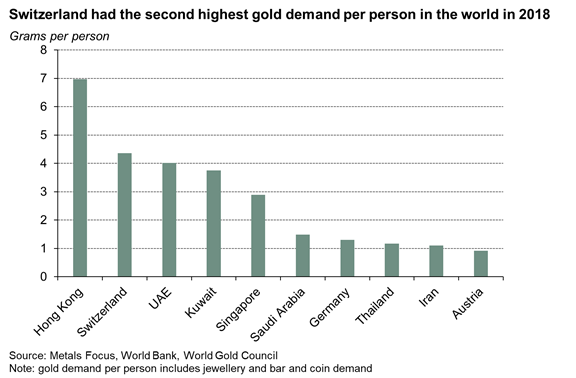

There’s no doubt about it: the Swiss like gold. Switzerland has the second-highest per capita gold demand in the world, a significant over-the-counter gold trading market and is home to the some of the world’s largest, most technologically advanced gold refiners. And the Swiss central bank holds a lot of gold too - 1,040t all told – the eighth largest central bank gold holding in the world.

What do Swiss investors think of precious metals?

29 May, 2019

Now, courtesy of a research team at the University of St Gallen on behalf of Philoro Edelmetalle, a precious metals dealer, we have insights into how Swiss investors think about gold and other precious metals. In April, the research team surveyed 2,300 adults from German-, French- and Italian-speaking regions. Standout stats include:

- Almost two-thirds of those surveyed consider precious metals to be a “sensible” form of investing

- One-fifth plan on investing in precious metals in the next 12 months

- Almost two-thirds invest in precious metals at their bank; fewer than one-in-ten buy gold online

- Wealthier respondents were more likely to own precious metals and were more likely to say they would buy precious metals in the next 12 months

- Just shy of two-fifths cited “security” as being the reason for investing in precious metals

These insights resonate strongly with research we conducted in 2016 assessing the attitudes of 2,000 German retail investors and illustrate the shared affinity that German and Swiss investors have with gold. And, as an aside, it is interesting that Austria also features in the top ten countries when ranked by gold demand per person. While it is easy to focus on India and China – the world largest gold markets – Europe is home to three countries with significant per capita gold demand. You can find the full report on the University of St Gallen’s website here.

And you can find gold demand per capita data in our supply and demand statistics here.