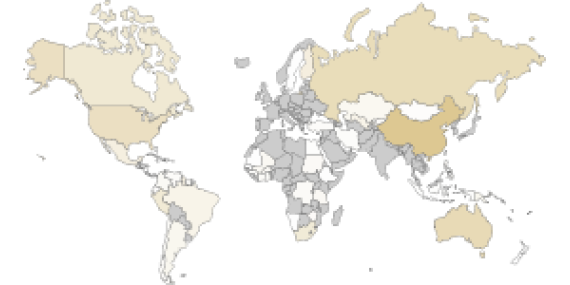

Outflows narrowed in March

Global gold ETFs lost US$823mn in March, extending their losing streak to ten months. But outflows narrowed significantly compared to previous months as inflows into North America (+US$360mn) and Asia (+US$217mn) cushioned European losses (-US$1.4bn).