In our latest Gold Demand Trends Q1 2019 report, we highlighted the rise of digital gold investment platforms in India. Over the last two years, a host of internet investment gold providers has sprung up in this market. PayTM Gold, PhonePe, MobiKwik, SafeGold, and the latest to join the party – Google Pay – all allow investors to buy gold via a mobile app.

And this growth should spark further interest.

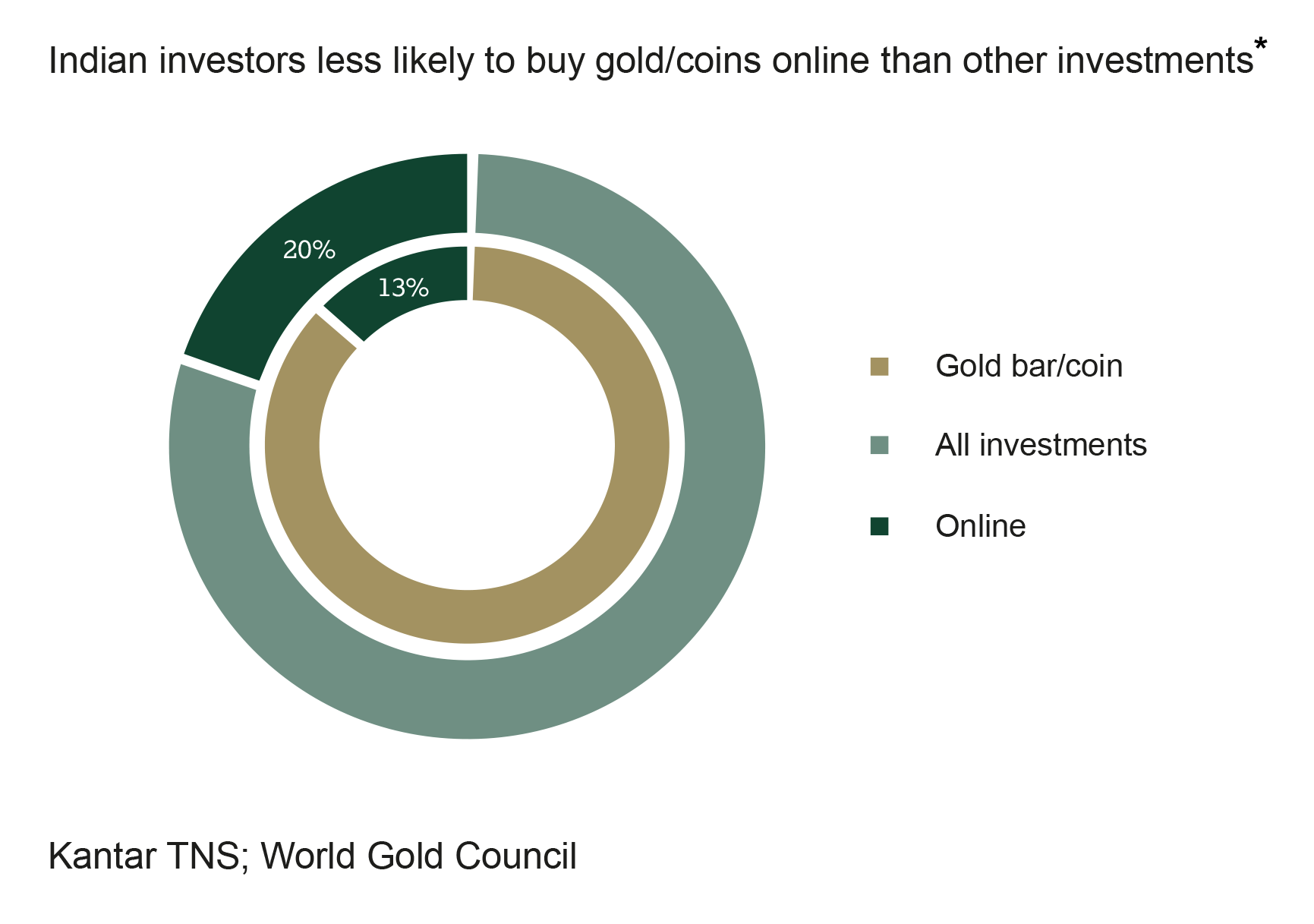

Consumer research we conducted in 2016 revealed a lack of online accessibility as a potential barrier to gold investment in India. According to the research, only 13% of urban Indian investors bought gold bars or coins online.1 This was lower than for other products: 20% of all investments were bought online.2 It is likely that this was at least partly due to gold not being widely digitally accessible at the time – particularly when we consider that a majority of Indian (56%) felt that the ‘ideal’ investment could be bought online.

*Base: all investments (1,000) / Gold bar/coin (308)

But the landscape today looks very different. Digital gold providers are proliferating. And this is occurring against a backdrop of increasing smartphone penetration in India. Statista estimates that in 2016, smartphones accounted for around 30% of the 684m mobile phones in India. In 2019, those numbers are predicted to rise to 39% and 813m respectively.3 That would give a vast swathe of this gold-loving nation the ability to invest in gold with the swipe of a finger.

We are running another large-scale consumer research programme this year that will shed more light on the development of this segment, revealing how important it is to investors in 2019 that gold is available to buy online. As the second-largest bar and coin market, which accounts for around 15% of global annual bar and coin demand, the results will be incredibly valuable.

[1] Of the 308 urban Indian investors who had bought gold in the past 12 months, only 13% had done so online.

[2] Including gold bar/coin as a subset

[3] www.statista.com/statistics/274658/forecast-of-mobile-phone-users-in-india/