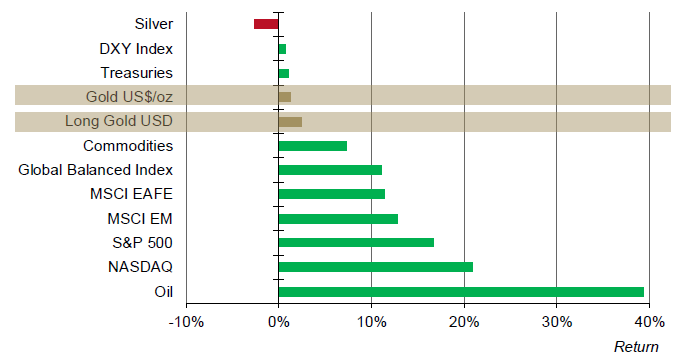

Broad Markets – Stock markets were marginally higher last week (8 April-12 April). US stocks were up by 0.6%-0.7%; Japanese by 0.3%, EM by 0.2% (in US dollars) while European stocks were flat. Treasury yields in the US also increased after the release of the Fed minutes from the March meeting and a speech by Vice Chair Clarida last week. Bond markets are still expecting a 40% chance of a rate cut by the end of the year, but this has come down substantially from 70% only a few weeks ago. Similarly, the US 3m/10y treasury curve remains flat but has moved again into positive territory, indicating a reduction in expectations of a recession by bond investors. And while the Fed appears to be on a watch-and-see approach, economic advisor Kudlow’s recent comments reiterate that the executive branch is not expecting rate hikes any time soon. Meanwhile, the UK and the EU agreed to delay Brexit until the end of October as the UK Parliament tries to find common ground and a way forward. This proved positive for both the pound the euro which rallied against the US dollar. German bund yields rose and while the front end is still negative, the 10-year bund is again on positive territory. Lastly, the commodities complex moved higher, led by oil (+1.3%) which is now close to 40% up for the year.

Gold Market – Gold had mixed results last week (LBMA +0.5%, XAU -0.1%). Support by a weaker dollar was counterbalanced by higher yields and continued strength in stock markets. Gold has moved below $1,290/oz but remains marginally higher for the year; it has been pulled back below US$1,300/oz twice over the past month and has reverted back up near US$1,280/oz. We expect US yields to influence gold’s short-to-medium term performance as broad markets continuously adjust expectations about what the Fed may do over the coming months (see: The impact of monetary policy on gold, March 2019).

Major markets performance year-to-date*

*As of 12 April 2019.Computations based on total return indices in US dollars for Bloomberg Barclays US Treasury Aggregate, Bloomberg Commodity Index, New Frontier Advisors Global Balanced Index, MSCI EAFE and EM Indices, S&P 500 and Nasdaq. Spot prices for LBMA Gold Price, Solactive Gold Long Dollar Index and LBMA Silver Price.

Source: Bloomberg, ICE Benchmark Administration, Solactive AG, World Gold Council

Positioning and liquidity – Volumes in the global gold market have decreased to US$105bn/day in April – approx. 20% down relative to March. Open interest in gold futures is at $81.9bn. COMEX net longs increased slightly to 365t and are close to their year-to-date as well as their 2-year average.

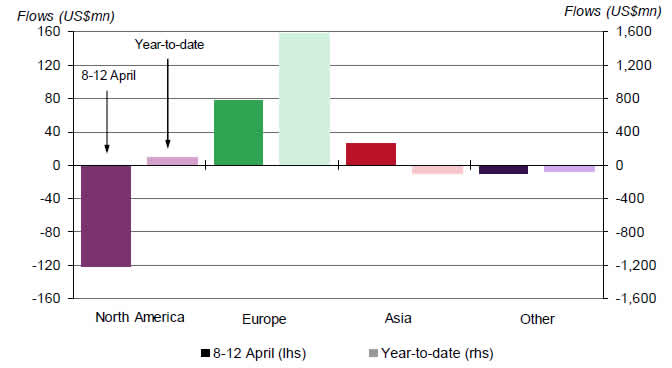

Gold-backed ETF flows by time periods – Globally, gold-backed ETFs experienced marginal outflows of US$28mn on the week ending 12 April. Net positive flows into European funds were offset by heavy net outflows in North America. Year-to-date, flows remain positive by US$1.5bn (1.5% of AUM) mostly supported by Europe inflows. Flows in the US are still positive (+US$174mn), recent outflows have dented an otherwise positive trend in US-listed low-cost gold-backed ETFs.**

**Low-cost US-based gold backed ETFs are defined as gold-backed ETFs that trade on US markets with annual management fees of 20bps or less.

Gold-backed ETF flows

*As of April 2019.

Source: Bloomberg, Regulatory filings, World Gold Council