Week ending 15 March 2019

ETF Flows: Weekly flows were higher last week $479mn. This was mostly from North American and European Funds. Global funds lost $641mn this month driven by North America and Europe. YTD flows are higher by $1.1bn (1.1% of AUM) with inflows coming from the US and Europe.

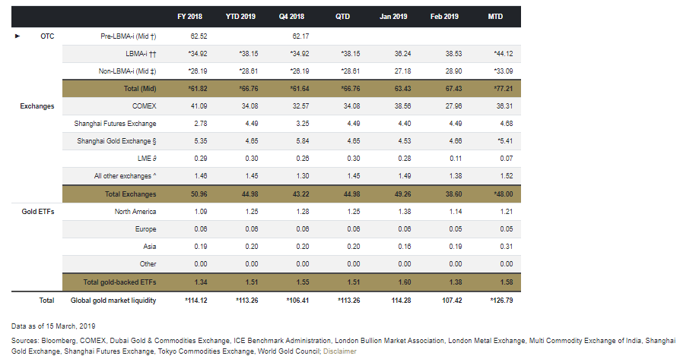

Liquidity – COMEX net longs held steady around 300t net long for the previous week. Liquidity remains high in the gold market with daily trading volume at $127bn. This has been driven by a 15% m-o-m increase in the LBMA OTC market and 29% increase in the COMEX futures market.

Option Exposure and Volatility – 30-day realized volatility in gold picked up over the past month from 8 to 11 which is in the 80th percentile over the past year, highlighting some of the recent daily moves. Call skew remains rich suggesting investors are paying for upside exposure. Today, 5k December $1,405 - $1,485 gold option future call spreads traded on the COMEX. This represents $65bn in notional and is profitable on expiration with a move 7.5% to 14% higher.

Technicals – Gold broke back above the $1,300 level and continues to trade near its 50-day average. The 50-day should continue to act as resistance until there is a meaningful close above the level.