Most Recently Updated

Performance metrics

Returns, volatility, correlations and trading volumes for gold, bonds, equities and other major asset classes

Demand and supply

Data on various sectors of gold demand and supply, as well as productions costs and futures market positioning

Central banks

Data on central bank gold holdings, sales and purchases, as well as insights from annual surveys into central bank attitudes towards gold.

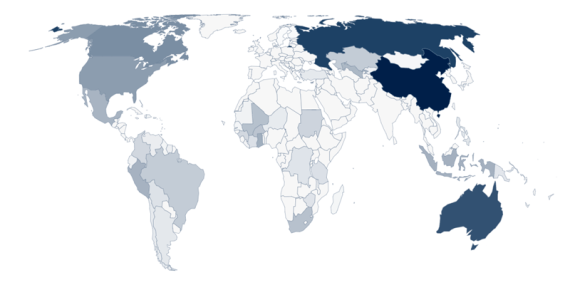

Central Bank Gold Reserves Survey

Beginning in 2018, the World Gold Council has collaborated with YouGov to conduct an annual global survey of central banks.