Key messages:

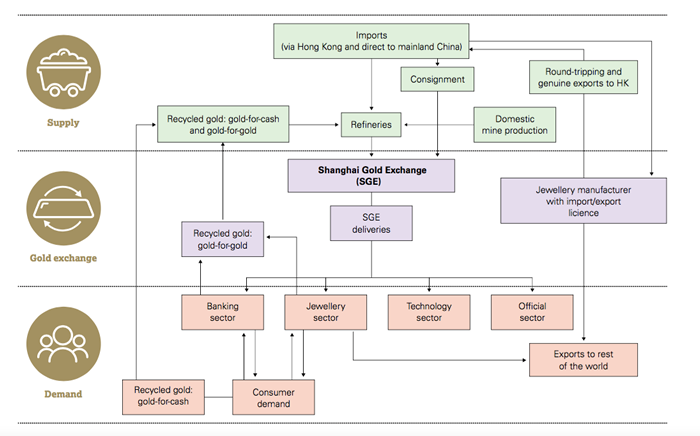

Because of the complexity of the market, assessing China’s gold flows and using them to infer end-user demand is challenging. Two issues stand out to us:

- Trade data are incomplete: China does not report gold imports or exports so, in order to build a picture of trade flows, information from other sources is required.1 Additionally, because these data can include scrap, doré and concentrates, they require careful interpretation and should not necessarily be taken at face value.

- The Shanghai Gold Exchange (SGE) delivery figure captures more than just end-user demand: Because of the structure of China’s gold market, the majority of gold flows through the SGE. A large portion of the gold delivered via the SGE relates to jewellery, bar and coin, and technology demand. But it also captures gold owing to other parts of the market, and some of the gold owing through the SGE relates to the circulation of gold within China rather than end-user demand at a particular point in time.

But one fact is clear: consumer appetite for gold has soared and represents a sustainable source of ongoing gold demand. Beyond jewellery, bar and coin, and technology demand, analysing data since 20093 suggests that gold demand has come from:

- Jewellery sector inventory growth: As jewellery consumption has boomed, the supply chain has expanded and, in aggregate, increased the sector’s inventory level, thereby absorbing some gold.

- Banking sector product innovation: In China gold is synonymous with money so it is not surprising that its banking system has increased its exposure to gold and developed a range of banking and investment products and services, such as gold accumulation plans, gold trading, gold pledging and gold leasing.

- Official sector purchases: It is likely that China’s authorities have increased their gold holdings in line with past activity, consistent with the trend of other emerging market central banks adding to their gold holdings.

Schematic diagram of gold flows in China