The global gold bar and coin market has boomed in the past 10 years. Several factors have underpinned this growth, perhaps the most important being that successive financial crises have tested investors’ faith in governments, banks, monetary policies and fiat currencies around the world.

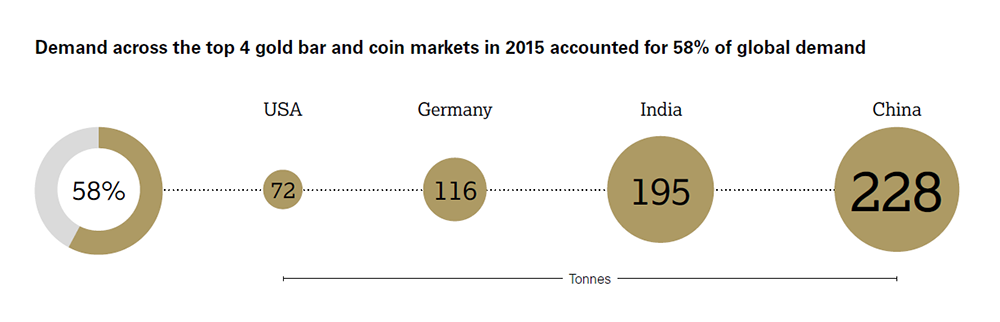

In 2016 we concluded a comprehensive research programme investigating gold buying behaviour across the major markets – China, India, Germany and the US. The objective was to better understand what motivates people to buy gold, what their purchase journey looks like, and what the triggers and barriers are when it comes to buying gold. And, importantly, to assess the potential for growth in global retail gold investment.

The most encouraging finding of the research is that the global retail investment market – although not without its challenges – is well positioned for growth.

This report is a summary of just some of the key finding from our research. We hope it will help mints, fabricators, banks and other retailers think about how to capture latent demand. We welcome the opportunity to discuss these insights in more detail with those looking to grow their businesses.