This new independent research report, The direct economic impact of gold, commissioned by the World Gold Council and produced by PricewaterhouseCoopers LLP, reveals striking insights into the direct economic contribution of gold in the world’s major gold- producing and consuming countries.

The research is ground-breaking in the breadth of its perspective, covering the entire value chain of the gold industry, from mining and refining to end-user consumption.

Terry Heymann, Director of the World Gold Council’s Gold for Development programme, and Jason Burkitt, UK Mining Leader, PwC, discuss the research and its findings, with an introduction by Randall Oliphant, Chairman of the World Gold Council.

Key Findings:

Global gold supply reached 4,477 tonnes in 2012 with approximately two thirds coming from mining and one third from the recycling of gold.

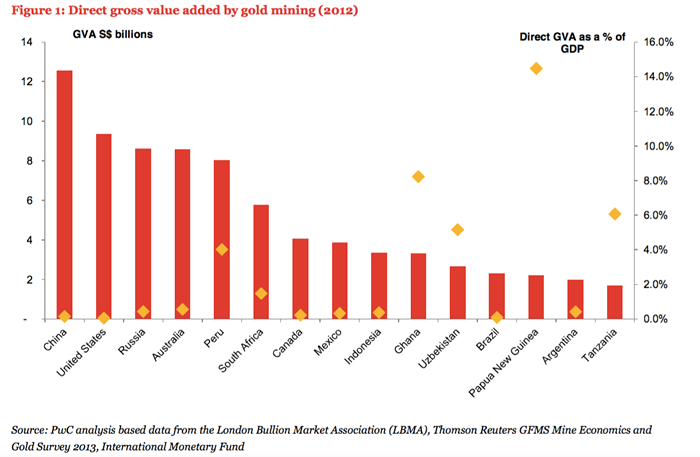

- The 15 largest gold producing countries, which accounted for around three quarters of global output, directly generated US$78.4 billion of gross value added (GVA) in 2012 – approximately equal to the GDP of Ecuador or Azerbaijan or 30% of the estimated GDP of Shanghai.

- Large scale, formal gold mining in the top 15 producing countries directly employed an estimated 527,900 people in 2012.

- Gold mining is a significant source of exports for some countries: in 2012, gold exports were 36% of all Tanzanian exports and 26% of exports in Ghana and Papua New Guinea.

- Limited data are available on the scale of the contribution of gold mining to the public finances: such evidence as exists suggests that mining royalties are only a small proportion of the total fiscal contribution of gold mining companies.

- The estimated GVA of global gold recycling is between US$23.4 billion and US$27.6 billion.

- The GVA per tonne of recycled gold is approximately US$16 million compared with approximately US$36 million for gold produced from mines.

In 2012, investment demand (consisting of bar and coin and gold-backed exchange traded funds (ETFs)) accounted for 35% of global gold demand, central bank gold purchases accounted for 12%, jewellery accounted for 43% and use in technology/manufacturing accounted for around 10% of gold demand.

- The 13 largest gold consuming countries in 2012 accounted for 75% of gold used for fabrication and 81% of gold used for (final) consumption, either in the form of jewellery or investment products such as small bars and coins.

- Their activities directly generate up to USS110 billion of GVA – approximately equal to the GDP of Bangladesh or half the GDP of Hong Kong or Singapore.

- The direct GVA associated with the fabrication of small bar and coin is estimated to be US$13.3 billion across the top 13 consuming countries whilst the direct GVA associated with consumption is estimated to be US$38.3 billion: these estimates are not additional since the estimated GVA based on fabrication will be included in the consumption based estimate.

- The direct GVA attributable to gold jewellery fabrication and consumption across the top 13 gold consuming countries is estimated at US$69.8 billion.

- The direct GVA attributable to gold’s use in technology fabrication is estimated at almost US$4 billion (excluding the value generated by the retail component of these goods).

Overall, the GVA associated with the supply of and demand for gold is estimated to be in excess of US$210 billion across those countries in scope of this analysis: this means it is similar to the GDP of the Republic of Ireland or the Czech Republic or Beijing.