The World Gold Council today publishes a new report ‘Why invest in gold?’ which reiterates and explains why gold should be viewed as a long-term asset in a portfolio.

The global economy has been slowly healing since the 2008-2009 financial crisis, however many investors have increased their exposure to risky assets on the back of strong equity market performance this year.

This environment reinforces the need to consider gold’s primary role in a portfolio - protecting purchasing power and smoothing out overall long-term portfolio returns. The research paper highlights gold’s role in long-term strategies and emphasises the fundamental role that it plays as a complementary asset alongside equities and fixed income securities to manage portfolio risks.

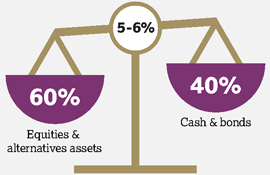

The World Gold Council research shows that for a moderate risk portfolio made up of 60% equities and 40% bonds, the optimal gold allocation is approximately 5-6%.

The focus on trading movements in gold prices based on single news items such as Fed statements or employment data loses sight of the long-term role that gold can play in a portfolio according to the World Gold Council.The research paper urges investors to view gold as a strategic component of their portfolios as a whole, rather than focusing on the price movement of the asset in isolation.

To put this into context, allocation to gold remains relatively low in comparison to growth in other investment asset classes. The explosive growth across financial assets from 2000 to 2012 saw debt markets grow three-fold, to almost US$90 trillion, while equity markets increased by US $20 trillion to US $51 trillion. In contrast, the private investment stock of gold sits at just US$1.8 trillion.

Download the infographic: Gold as long-term strategic asset

Juan Carlos Artigas, Head of Investment Research at the World Gold Council said:

“With the amount of coverage generated by movements in the markets, it is easy to lose track of the long-standing and fundamental role that gold can play in any portfolio. The primary benefit of having exposure to gold in an investment portfolio is that it is a cost-effective, long-term asset that can provide downside protection without reducing long-term returns.

“Like other assets, the value of an allocation to gold will move up or down, but to focus on daily movements misses the point of how gold performs in a portfolio. Gold is a long-term, core component of portfolios. At the right level of allocation, it will perform a role that no other asset or commodity is able to do, and investors and their advisers should continue to view it in that context.”

The research paper highlights the qualities that gold brings to a portfolio:

- It protects purchasing power (taking into consideration local inflation rates as well as currency fluctuations). Gold’s role as a hedge should be understood in the context of global inflation. Its negative correlation to many currencies as well as its relationship to global inflation make it a particularly useful tool to protect purchasing power and preserve capital wealth over time.

- Reduces portfolio volatility. Portfolio volatility is dictated not only by individual asset price variability, but how these assets correlate to each other. Gold has very low correlation to most assets over the long run, making gold’s contribution to portfolio volatility not only small, but in most instances it helps to significantly contract it.

- Serves as a high-quality, liquid asset that can be used when the selling of other assets can be costly or cause large losses. As gold bears no credit risk and, depending on how it is held, has no counterparty risk, it is viewed as a high-quality asset. Its market is large, accessible and extremely liquid which allows investors to use gold to easily meet immediate liabilities.

‘Why invest in gold?’ is published as part of the World Gold Council’s quarterly publication Gold Investor. Gold Investor also includes a paper entitled ‘Gold and currencies: the evolving relationship with the US dollar’ which further emphasizes gold as a robust, natural hedge to the US dollar.

ENDS

For further information please contact:

James Murray

World Gold Council

T +44 20 7826 4754

E [email protected]

Liz Roche

Edelman

T + 1 202 777 3846

E [email protected]