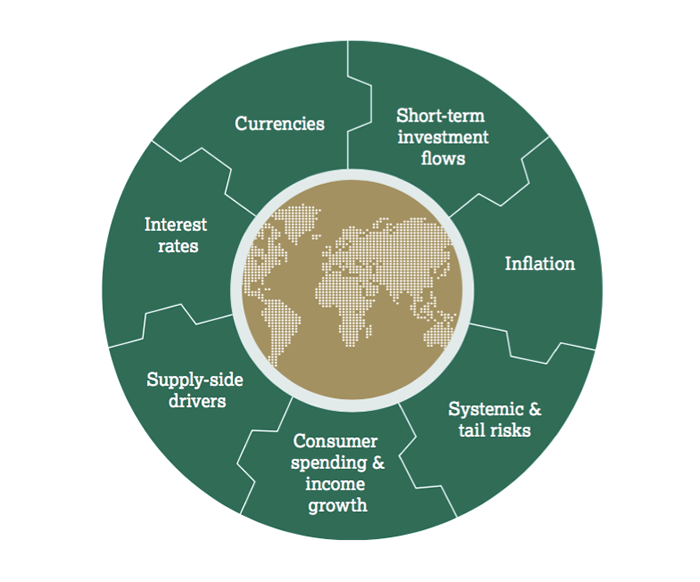

To some investors, gold seems arcane: a non-productive asset that is simply extracted and stored. To many others, gold plays an important role as a store of wealth and portfolio risk management vehicle. To most, a key challenge is nding an appropriate framework of reference: what gold does, what it does not do, how and why it responds to various economic environments. Gold’s performance can be understood in the context of seven primary interrelated global themes: its relation to currencies, global in ation and interest rates, consumer spending and income growth, market risks, short-term investment ows and supply-related drivers.

Factors that influence gold and its role in a portfolio