The gold price breached US$1,360/oz for a second time in 2016, as investors are starting to lose confidence in the effectiveness of unconventional monetary policies.

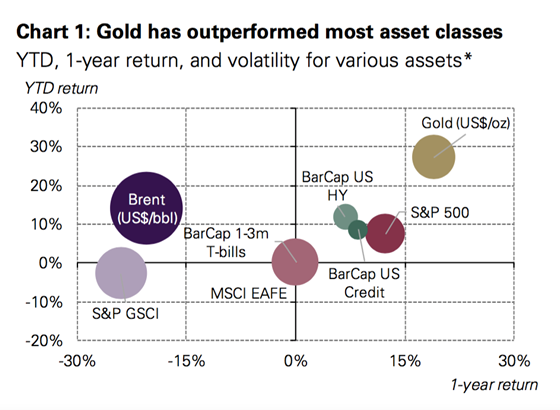

Analysts are scrambling to increase their gold price forecasts, as the gold price continues to rise, outperforming all major asset classes.

A weak Japanese bond auction on August 2nd unnerved markets, pushing the gold price up 29% for the year in US dollar terms. Many analysts are interpreting weak Japanese Government Bond demand as a signal that investors are starting to lose confidence in the effectiveness of unconventional monetary policies, following increasingly desperate bids by the world’s central banks to reflate the global economy.

In this environment, we believe investors are using gold to hedge portfolio risk as they add more stocks and low quality bonds to their asset mix.