This edition of our Investment Commentary examines gold’s performance year-to-date and explores relevant macroeconomic factors that can influence gold’s performance into Q4 2014.

In our view, there are four main reasons investors should view gold as a valuable portfolio component today:

- Positive economic growth is supportive of gold’s long-term demand

- Rising interest rates do not necessarily push gold prices down

- Gold’s cost effectiveness makes it an attractive portfolio hedge compared to other strategies

- Constraints in mine production and falling gold recycling have kept the market in balance.

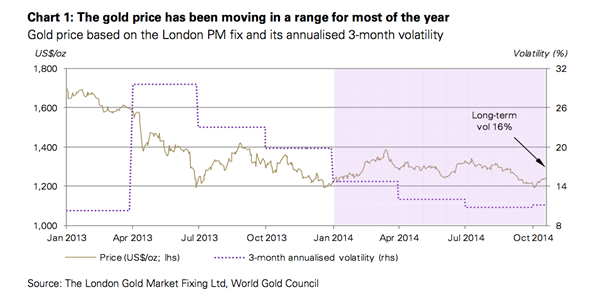

The gold price is up so far this year against analysts’ forecasts. Gold investment gets most of the attention, but market fundamentals provide a balance for the market. Gold is seen as a valuable hedge against market risk, yet can also benefit from GDP growth. We don’t believe interest rates will rise notably in the US anytime soon or that they’ll have the devastating effect for gold many experts predict. Finally, we consider that the gold market is structurally robust to support its long-term growth.