As India’s demand for gold outpaces its domestic mine supply, demand is fulfilled by imports as well as gold recycled locally. Recycling in India is a Rs440bn industry making up 11% of the average local annual supply.1

The number of refineries in India has increased over the past decade and this has boosted local job creation. Local refineries have also enjoyed enhanced profitability through imports of gold doré, due to its advantageous duty differential.2 To position India as a competitive refining hub, policy measures have to create other advantages, including export of bars, consistent supply of doré or scrap and a strong framework of standards and infrastructure.

Executive summary

The refining industry in India

India’s gold refining industry has seen significant growth over recent years. It is estimated that from 2013 to 2021 capacity increased by 1,500t (500%). But the contribution of the informal sector should not be overlooked; it perhaps accounts for as much as an additional 300-500t.

Advantageous custom duty on gold doré fuelled the industry’s growth while it lasted. But the introduction of the Goods and Services Tax (GST), as well as the impact of the pandemic and other macro-economic factors affected refining profitability, especially among smaller players. Even today, the remaining small-scale refineries face stiff competition for a limited amount of imported gold doré.

The key role of recycling

The country ranks fourth in global gold recycling; over the past five years 11% of India’s gold supply has come from ‘old gold’; driven by movements in the gold price, future gold price expectations and the wider economic outlook. But gold recycling faces headwinds. Anticipated growth in the Indian economy could mean higher incomes and less distress selling. And while fashion conscious consumers tend to keep their gold jewellery for shorter periods of time and are more confident of gold’s value when they sell, refineries cannot always make use of this gold.

Collection centres for recycled gold – set up by some of the larger refineries – are few and far between, and refineries are reluctant to buy direct from jewellers who deal largely in cash as source verification is impossible. Until these issues are resolved it seems that a sizeable percentage of India’s gold recycling industry will remain unorganised.

Standards and sourcing

The gold refining industry is a big employer, recognised as such by the government and supported by beneficial fiscal policy, such as the lower customs duty on unrefined gold doré compared with refined bullion. Sourcing guidelines have been introduced to ensure that gold doré comes direct from the country where it is produced. Gold recycling has been aided by the introduction of the Indian Good Delivery Standards (2020), which help refineries to establish a chain of custody and produce bars that meet the requirements of commodity and stock exchanges. The Revamped Gold Monetisation Scheme (R-GMS) allows interbank lending of gold against gold metal loans; it also enables jewellers to act as collection and purity testing centres and larger refineries to act as centres for collection, testing and assaying.

Looking ahead

India’s demand for gold shows no sign of abating and while demand outweighs supply, recycling will continue to be key. The refining industry in India, currently stabilising after a period of change, is looking to the future. Some refineries choose to sell direct to investors and although only 5% of transactions are currently made digitally, doubtless this will increase as investors recognise the price advantage of buying direct. The raft of government guidelines, standards and processes will help refineries improve the traceability of recycled gold and become less dependent on gold doré imports, as well as limit the unorganised collection of scrap gold and increase efficiencies in recycling.

India’s gold refining landscape

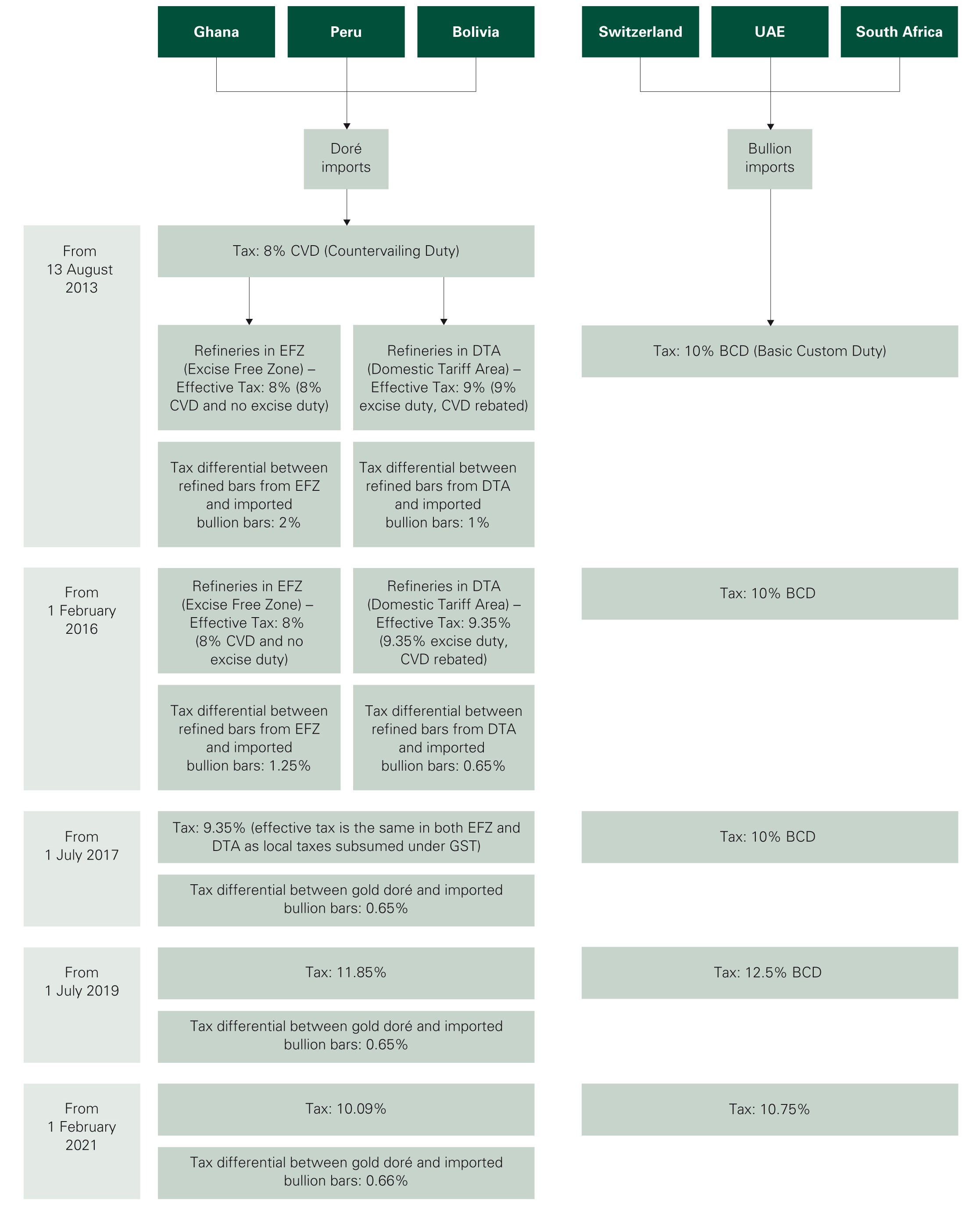

Tax advantages have underpinned the growth of India’s gold refining industry

The import duty differential that doré has enjoyed over refined bullion has spurred the growth of organised refining in India. To provide some context, in August 2013 the Indian government adopted a more accommodative stance towards domestic gold refining, introducing a duty differential between refined gold bullion and doré.3 From 13 August 2013 to 31 January 2016 the duty on gold bullion was 10% with a duty differential of 1%- 2% for refineries depending on the zone in which they operated. Post the union budget of 2016 the duty on gold doré imports for refineries in the Excise Free Zone (EFZ) and Domestic Tariff Area (DTA) was 8.75% and 9.35% respectively, while the custom duty on bullion was maintained at 10% – narrowing the gap for refineries to 0.65% and 1.25% respectively. Spurred by these tax incentives, around half of India’s new refining capacity since 2014 has opened in the EFZs, mostly in the state of Uttarakhand (Appendix 1).

The Goods and Services Tax (GST), introduced on 1 July 2017, subsumed other local levies – such as the excise duty and state-level value added taxes – and meant that there was no additional benefit to refiners in the EFZs as they now faced the same tax burden as those within the DTAs (9.35%). With the custom duty maintained at 10% post GST, the duty differential between gold doré imports and refined bullion remained at 0.65%. Changes to the import duty on gold doré since then have followed those on refined gold; the former still benefits from a differential. For instance, even after the duty cut in 2021, the gap between import duty on gold doré (10.09%) and refined bullion (10.75%) has remained at 0.66% (Figure 1).4

The refining sector has grown over the last decade but expansion is slowing

India’s gold refining landscape has changed notably over the last decade, with the number of formal operations increasing from less than five in 2013 to 33 in 2021.5 As a result, the country’s organised gold refining capacity has surged to an estimated 1,800t compared to just 300t in 2013.6 The majority of these refiners have an annual capacity less than 50t (Chart 1).

Chart 1: The majority of Indian gold refineries have an annual capacity less than 50t

The majority of Indian gold refineries have an annual capacity less than 50t

India’s gold refineries by capacity

The majority of Indian gold refineries have an annual capacity less than 50t

India’s gold refineries by capacity

*As of January 2022.

Source: Metals Focus, World Gold Counci

Sources:

Metals Focus,

World Gold Council; Disclaimer

But the informal sector still accounts for a sizeable volume, perhaps as much as an additional 300-500t.7 It is worth noting that the scale of unorganised refining has fallen as the scrap market has responded to the government’s tightening of pollution regulations (which led to the closure of many local melting shops) and as more retail chain stores recycle old gold using organised refineries.

This growth in refining capacity has facilitated a dramatic rise in doré shipments: from just 50t in 2013 to a record 276t in 2018.8 In 2020 imports fell sharply to 159t, largely due to the impact of COVID-19. However, in 2021 – as a sense of normality gradually returned – they rose to 220t (Chart 2). As a result, gold doré’s share of overall imports has risen from just 7% in 2013 to around 22% in 2021.

Chart 2: Indian gold doré imports recovered in 2021

Indian gold doré imports recovered in 2021

Indian gold doré imports (tonnes) and purity (%)

Indian gold doré imports recovered in 2021

Indian gold doré imports (tonnes) and purity (%)

Source: Metals Focus, World Gold Council

Sources:

Metals Focus,

World Gold Council; Disclaimer

The expansion of the Indian refining sector has slowed in recent years as GST eliminated the advantage enjoyed by EFZs and led to a cutback in new capacity within these zones. New refinery capacity was further discouraged when the Uttarakhand government levied an entry tax of around 0.2% in March 2016 in an attempt to narrow the duty differential between DTAs and EFZs.9

Other factors have also impeded growth in the refining sector. Duty differential in EFZs had encouraged many companies to start refineries but once those advantages disappeared, many closed, leaving only genuine operations in existence.10 Some refineries importing doré were unable to meet the accreditation standards set by the Bureau of Indian Standards (BIS) and the National Accreditation Board for Testing and Calibration Laboratories (NABL), and they too were forced to shut.11 And finally, the almost persistent gold market discount – due to slowing economic growth, weak gold demand and the pandemic – meant that some doré imports became unprofitable even with the duty differential (Chart 3). Changes to policy and taxation might have helped such refineries. For example, if they had been allowed to export bullion bars and able to reclaim custom duty and GST on exported bullion bars, their operations may have had the capacity to withstand times of weak domestic market demand or periods when the refinery had to close, such as the nationwide industry strike in 2016 or the COVID-19 lockdown in 2020.

Chart 3: The persistent discount in the domestic gold market has created headwinds for doré imports

The persistent discount in the domestic gold market has created headwinds for doré imports

National Commodity & Derivatives Exchange Limited (NCDEX) polled premia/discount for domestic gold spot price vs landed gold price in India

The persistent discount in the domestic gold market has created headwinds for doré imports

National Commodity & Derivatives Exchange Limited (NCDEX) polled premia/discount for domestic gold spot price vs landed gold price in India

Source: NCDEX, World Gold Council

Indian refineries face growing competition for a limited amount of doré and this too has impacted the industry’s growth. This is a particular challenge for small-scale refineries who struggle to source gold doré from large- scale mines due to a lack of finance and the scale of their operations. The situation could be alleviated if nominated agencies (such as MMTC and Diamond India Pvt Ltd) and banks were allowed to import gold doré. In addition, the Indian government could facilitate joint ventures with overseas mining companies to guarantee the secure off- take of gold doré. Such steps should help facilitate the growth of refining in India.

Most refineries focus on kilo bars and minted products

Only a small number of Indian refineries (MMTC-PAMP, Bangalore Refinery, Kundan and India Govt. Mint) have the capability to process speciality items such as chemicals, alloys and salts. These refineries also treat industrial scrap. The remaining refineries offer more traditional bars and coins – notably cast and minted.12

In general, Indian refineries tend to focus on producing kilo bars and small minted bars. The former is predominantly sold to manufacturers, wholesalers, large retailers and institutional/high-net-worth investors, whereas minted bars are offered to small/medium retailers and individuals. Metals Focus’ discussions with refineries revealed that 80% to 85% of their business is in the form of cast bars (100g and kilobars), with the balance in minted products of 100g and below.13 Interestingly, a large proportion of 100g cast and minted products are used by manufacturers particularly in Chennai and Ahmedabad.

Minted products include 2g, 5g, 8g, 10g, 50g and 100g, the most popular of which are 5g and 10g and account for more than 60% of sales.14 Retail premiums on these bars and coins vary between 2% and 8% depending on the weight and point of sale.15 Investors tend to pay less when buying direct from a refinery and many refineries now sell direct to investors via apps and websites or, more recently, through financial intermediaries such as Google Pay and Paytm. While digital gold and e-commerce have lifted online sales, less than 5% of overall gold purchases are transacted digitally16 with 80% to 85% of investment products still purchased from jewellery stores.17 Although jewellery retailers still account for the majority of investment product sales, this figure has declined from its previous level of more than 90%. Sales by jewellers fell as refineries began selling direct via online and in store, enhancing their profit margins by removing a step in the sales chain. And with small bars and coins now being sold predominantly during key festivals, jewellers prefer not to increase their inventories when margins do not justify the holding cost. Overall, margins on these products have been curtailed through competition and many jewellers have chosen to stop selling bars and coins altogether.

Responsible sourcing and India Good Delivery Standards

India’s legislative landscape enables responsible sourcing of doré

In recent years the gold industry has increasingly focused on responsible sourcing. The government has lent weight to this focus through the introduction of guidelines on sourcing doré. These ensure that gold is sourced directly from the country where it is produced. The Ministry of Finance also stipulates a minimum weight of 5kg per bar, with importers requiring a packing list and an assay certificate issued by the mining company.18 This legislation aims to help the industry establish a chain of custody. And for refiners, the intention is to ensure that the imported doré is genuine and is not, for example, recycled gold.

India Good Delivery Standards (IGDS) should boost the local refining industry

Prior to 2020 only London Bullion Market Association (LBMA) accredited 99.5% purity gold bars were accepted by the domestic commodity exchanges for delivery. However, in 2020, to help promote the government’s initiative of Atmanirbhar Bharat (Self-reliant India), the India Good Delivery Standards (IGDS) were introduced by the Bureau of Indian Standards (BIS). The standards specify a range of measures such as fineness, weight, markings and dimensions (Table 1).

Table 1: India Good Delivery Standards (IGDS) as per BIS

Source: Bureau of Indian Standards, Metals Focus, World Gold Council

These standards help BIS-accredited Indian refineries deliver their bars to the commodity/stock exchanges. To that effect, the National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and the Multi Commodity Exchange (MCX) have recognised eligible refiners who satisfy the criteria of each exchange. Currently, only select refineries are eligible to deliver to these exchanges such as:

- MMTC-PAMP Pvt Ltd: MCX

- Gujarat Gold Centre Pvt Ltd: NSE

- Kundan Care: NSE, MCX

- M D Overseas: NSE, BSE and MCX

- Augmont: NSE, BSE, MCX

- Parker Precious Metals: BSE

- Sovereign Metals Ltd: BSE

This initiative will lessen the dependency of refiners on doré as they are now able to deliver bars refined from recycled gold onto the exchange, in the process benefiting from more transparent price discovery due to the higher number of refineries now able to deliver bars on local exchanges. A collective effort is required from both BIS and industry players to ensure that, over next five years, all refineries become IGDS compliant, standards are implemented and overall trust is enhanced.

The implementation of IGDS will likely boost the organised scrap market as it will allow refineries to aggressively source scrap in the domestic market, especially from organised retailers. Currently, scrap collection in India is largely unorganised, with jewellers often the first point of collection. Most jewellers also have their own melting shops, so can convert jewellery into crude bars that are sent to manufacturers or artisans. But this trend is diminishing: in 2015, an estimated 70% to 75% of the recycling industry was unorganised; by 2021 this had declined to 60% to 65%.19 With locally refined bars now meeting delivery requirements, the share of organised refining is likely to increase further, as the prospect of better price discovery encourages jewellers to convert crude bars into good delivery bars for delivery onto an exchange. This will be particularly helpful to jewellers who want to reduce their bullion inventory – for example during periods when demand slumps – as delivering onto the exchange will be easier and enable better price realisation, particularly when discounts in the spot market are high as was the case during 2020. 20

The Revamped Gold Monetisation Scheme (R-GMS) will further encourage IGDS

2021 saw other policy announcements specifically relating to the gold refining sector. These include a Revamped Gold Monetisation Scheme (R-GMS) and banks being allowed to buy locally refined IGDS bars.21 R-GMS will enable interbank lending of gold against gold metal loans (GMLs) and allow for repayment using Indian refined gold (IGDS). This has several positive implications for the country’s refining industry (as discussed in the following paragraph). The R-GMS scheme also allows jewellers to act as Collection and Purity Testing Centres (CPTCs). As they are often the primary collection centre for consumer scrap, the scheme could enable better monetisation of gold.

Allowing banks to buy locally produced IGDS bars and accept repayment of GMLs with Indian refined gold will reduce the need to lease gold from overseas – a process that can be quite expensive. It will also encourage refiners to increase output to meet this new demand. Previously, banks were only allowed to import gold on a consignment basis, as they were not allowed to source locally refined gold as per domestic regulation. To provide some context, import share of the banks fell from 40% in 2017 (348t)22 to 24% in 2021 (240t) – leaving aside 2020’s exceptional conditions when banks imported just 70t of gold (Chart 4).23 Increased demand from banks will mean that refineries will have to ramp up both doré imports and local scrap collection. This may eventually result in the share of refined gold in India’s import mix falling even further.

Under the R-GMS refineries will act as collecting, testing and assaying centres. They will also be responsible for delivering gold to banks to be used for leasing under the GML. The R-GMS allows all Scheduled Commercial Banks (SCBs) to be custodians but only BIS approved refiners to refine this gold, which could benefit the industry as a whole. Importantly, the deposits under the scheme can now be dematerialised (converted to a digital certificate) enabling them to be tradeable and mortgageable.

Finally, banks will also be able to import gold via the international bullion exchange and domestic gold spot exchange, once these exchanges are operational.

Chart 4: Bank’s share of official imports has declined with growth in refining

Bank’s share of official imports has declined with growth in refining

Bank’s share of official imports has declined with growth in refining

Source: Indian Customs, Metals Focus, World Gold Council

Sources:

Indian Customs,

Metals Focus,

World Gold Council; Disclaimer

Overall, these developments bode well for Indian refiners, especially those that are both BIS and LMBA-accredited. Additionally, as refiners compete for local scrap we expect to see a notable increase in scrap collection centres, which in turn will take market share from unorganised players. At present we estimate that organised refineries account for less than 20% of scrap collection but we believe this will increase to some 35% to 40% over the next four to five years.24

Recycling trends

Recycling is an important source of supply for jewellers

Recycling is an important component of gold supply, accounting for 11% of the total Indian gold supply over the last five years (Chart 5). Gold sold back for cash is usually linked to consumer sentiment and the economic backdrop. However, over the years the share of gold sold for cash has remained broadly steady, despite the economic slowdown of 2012-2014 and the pandemic. This is due to the vibrant gold loan industry in India, which makes it straightforward to borrow funds against gold rather than selling it.

Chart 5: Recycling accounted for 11% of total Indian supply in last five years

Recycling accounted for 11% of total Indian supply in last five years

Recycling volume in tonnes

Recycling accounted for 11% of total Indian supply in last five years

Recycling volume in tonnes

* Total supply includes official imports, unofficial imports and mine production.

Total supply excludes round tripping (RT) and bullion export volumes.

Source: Metals Focus, World Gold Council

Sources:

Metals Focus,

World Gold Council; Disclaimer

*Total supply includes official imports, unofficial imports and mine production.

Total supply excludes round tripping (RT) and bullion export volumes.

The pay-out received after selling back gold differs according to the type of jewellery being liquidated and where it is sold but will usually be 3% to 5% lower than the prevailing gold price.25 As a guide, 22k gold will be paid at a rate that includes the entire weight of the contained gold, whereas non-hallmarked items will be paid at a rate that decreases in line with the caratage. Pay-outs decline further in rural India due to low consumer awareness, and here pay-outs can be 5% to 10% below those given in urban centres. Metals Focus’ discussions with refineries and scrap collectors revealed that the average purity of gold collected in south India is about 90%, in the north it is around 85%, while in the west and east it is 86% to 89%.26 It is worth noting, however, that as awareness about hallmarking has grown, purities have risen. And with compulsory hallmarking now in force, consumers should increasingly receive a fairer price for their gold.

One significant development over the last few years has been the increased organisation of scrap collection (Focus 1), which is eroding the bargaining power of jewellers and other scrap buyers. This new trend is encapsulated by some of the large corporates, such as MMTC-PAMP and Muthoot, who are setting up collection centres across the country.

Jewellery is the largest source of recycling

There are three sources of gold recycling: jewellery, manufacturing scrap, and end-of-life industrial scrap. Metals Focus’ recycling data captures “old scrap”. In the context of jewellery, this is jewellery that is either sold back for cash or a retailer’s unsold stock that is melted down. It does not include jewellery that a consumer exchanges with the retailer for a new piece, where the consumer only pays the labour charge. Metals Focus’ definition also excludes process or manufacturing scrap that is collected from fabricating jewellery and coins.

Old jewellery scrap represents the largest source of recycling in India, with an approximate 85% share of the total.27 Major refineries have set up scrap collection centres where organised retailers usually send scrap for recycling, while individuals generally visit their local retail jeweller to recycle their gold. These jewellers also collect scrap from pawnbrokers/money lenders and gold loan companies. Gold loan companies tend to offer loans against jewellery over time periods ranging from one to 36 months. Should the borrower default, the company will auction the gold to jewellers, scrap aggregators or refineries. For many refineries, jewellery scrap from pawnbrokers/money lenders and gold loan companies forms the lion’s share of their jewellery scrap intake.

The other key component is old bars and coins that people either sell or exchange for jewellery; these Metals Focus estimate to make up about 10% to 12% of scrap gold supply. While consumers often visit retail jewellers to exchange their bars and coins for jewellery, these investment products are seldom melted and converted into fresh minted products. Metals Focus’ discussions with the trade reveal that many independent jewellers in small towns and cities tend to sell them back to new customers.

Finally, industrial scrap is generated from end-of-life electronic products, such as printed circuit boards, mobile phones, connectors and contact points. This industrial segment accounts for less than 5% of total Indian scrap supply. The industrial scrap market in India is largely unorganised and only a small proportion finds its way to refineries. This may be largely due to the fact that only a handful of Indian gold refineries have the capability to refine industrial scrap.

Focus 1: Growth of organised recycling in India

India’s gold refining landscape has witnessed a significant shift over the past few years owing to the push towards organised recycling. But even against this backdrop, organised refineries have been hampered by the presence of local scrap collectors who have dominated the traditional gold recycling market, despite the favourable duty on doré imports and advancements in refining capacity.

One of the challenges in sourcing scrap is the fact that this part of the industry is still primarily reliant on cash. This reliance has deterred organised refineries such as MMTC- PAMP, who have steered clear of cash transactions in the scrap trade. In addition, scrap suppliers – such as local jewellers – usually require a fast turnaround time and so prefer to process scrap locally rather than sending it to an organised refinery further away. Furthermore, as local scrap sellers (for example, jewellers) are extremely cost- sensitive, organised refineries – with their relatively higher refining charges – are less popular than small-scale ones; consequently, the amount of scrap available to organised players like MMTC-PAMP is limited.

As the country’s only refinery with LBMA accreditation for both gold and silver, MMTC-PAMP maintains the highest global standards for refined gold products. As jewellery manufactured by MMTC-PAMP’s rigorous refining process is of such a high quality, manufacturers can significantly reduce the rate of rejection due to quality issues.

That apart, to address other challenges in the industry, MMTC-PAMP has adopted measures to improve scrap collection. The company has set up several collection points called Purity Verification Centres, where scrap is weighed on authenticated scales and value is measured from industry-best German XRF (X-Ray Fluorescence Technology) machines, in order that the customer receives the total value of the gold. After deducting the service charge the customer is paid the full value of their gold via instant bank transfer. As logistics improve, even customers who live in cities without collection centres can now send their gold direct to the refinery.

That aside, as the jewellery industry has become more organised we have seen small jewellers increasingly opt to recycle gold with organised refineries. The implementation of strict pollution control norms in some cities has also negatively impacted smaller refineries and helped push business to the organised players.

While the recycling industry is gradually becoming more formalised, the challenges mentioned earlier remain, impeding the progress of organised refining in India. Despite the considerable progress made with regard to scrap collection, Indian refineries continue to depend largely on processing imported doré.

Vikas Singh

Managing Director and CEO

MMTC-PAMP India Pvt Ltd

Drivers and challenges to gold recycling in India

Key drivers of recycling in India

Despite being the fourth largest recycler in the world, India recycles little of its own stock of gold (Table 2). On average, the country accounts for about 8% of the global scrap supply.28 Recycling is driven by current gold price movements, future price expectations and the economic backdrop. When the gold price jumps people tend to sell their gold holdings either to gain from the price rise or to avoid spending on new gold jewellery. Research from Metals Focus found that the percentage of consumers exchanging old jewellery increases when the gold price rises, and when the economy is under stress – as we saw during COVID-19 – gold is sold to meet everyday needs. Surprisingly, during the pandemic, although scrap levels were elevated, distress selling was not a major contributing factor. In India, people prefer to pledge their gold with banks and non-banking financial companies (NBFCs) rather than making an outright sale.

Table 2: Recycling volumes (tonnes) by top recycling countries

Source: Metals Focus, World Gold Council

Our econometric analysis revealed that in the short run, quite intuitively, a 1% increase in price pushes recycling up by 0.6%. Conversely, positive GDP growth in the same year and the previous year pushes recycling down by 0.3% and 0.6% respectively. In addition, a 1% increase in jewellery demand pushes recycling down by 0.1%.29

A policy that enables households to recycle gold through banks and exchanges – with appropriate incentives – in return for standard gold coins that can be used to purchase jewellery, could augur well for a sustainable growth in recycling. Discussions with retailers also revealed that the average time consumers keep their jewellery has fallen noticeably over the last four or five years, falling from around eight to 10 years to around three to five.30 This reflects a new transparency in buyback transactions from organised jewellers, enabling consumers to receive the full value of the gold content in their old jewellery when they sell or exchange. This enhanced trust between jeweller and buyer, along with changing fashion trends, has encouraged consumers to replace their jewellery pieces more frequently.

While this enhanced trust does not automatically translate into higher scrap volumes, it is a key determinant in the consumer’s decision-making process when exchanging or selling their old jewellery.

Challenges to gold recycling in India

Despite the gradual move towards a more structured and process-driven industry, the majority of India’s gold recycling trade remains unorganised. This is largely due to:

- The prevalence of cash transactions in the scrap market. One of the main difficulties for organised refiners has been the inability to source meaningful quantities of scrap from jewellers. This is because small jewellers prefer cash, particularly those based in more rural areas. Given that accredited refineries need to be able to show a clear source for the scrap they buy, they prefer not to purchase with cash and to work only with organised jewellers or bullion dealers.

- Logistical hurdles to scrap collection. Many refineries have opened additional scrap collection centres over the years but these are still few and far between and often located in bigger towns or cities. As a result, the process of sending scrap to a refinery can be cumbersome and more time consuming than melting it locally. Small jewellers who have only small scrap volumes need to wait longer before they accumulate a meaningful quantity of scrap to be sent for processing. Unsurprisingly, they tend to use their local melting shop or small-scale unorganised refinery with faster turnaround times.

- GST loss on sale of old gold. The current GST regulations do not allow consumers to reclaim the 3% tax they would have paid when they initially bought their jewellery. This loss of GST on gold is significant and could be a barrier to consumers looking to create liquidity by selling old gold.31

Outlook

Recycling is driven by trends in the local rupee gold price and the prevailing economic environment. The Indian economy is expected to grow in the coming years and higher incomes may reduce outright selling by consumers as the need for distress selling lessens. And as NBFCs expand across rural India, consumers will find it easier to pledge their gold rather than selling it outright. This will bring more people into the institutional credit system and further discourage selling back gold to raise cash.

That said, the recycling market will be supported by initiatives such as the revamped GMS, which will attract gold held by Indian households, some of which will eventually be recycled. Furthermore, Metals Focus’ research suggests that holding periods of jewellery will continue to decline as younger consumers look to change designs more frequently; a trend that could contribute to higher levels of recycling.

Appendix 1: List of gold refineries in India

Table 3: List of gold refineries in India*

* As of January 2022

Source: Metals Focus, World Gold Council

Contributors

We commissioned Metals Focus, one of the world’s leading precious metals consultancies, to conduct this independent research study with the help of their ‘on the ground’ presence in India. With a team spread across nine countries, Metals Focus is dedicated to providing world-class statistics, analysis and forecasts to the global precious metals market. We are extremely thankful to Chirag Sheth and Harshal Barot from Metals Focus for their contributions to this report.

Mukesh Kumar from the World Gold Council also played a key role in providing timely comments and insights that helped towards final publication of this report.

Chirag Sheth is a principal consultant with Metals Focus and based in the company’s Mumbai office. Chirag analyses the precious metals market of South Asia, as well as Indonesia, Thailand and Vietnam. He has over 16 years’ experience in precious metals trading and research work for UBS and Latin Manharlal Commodities. He is also a visiting faculty to management institutes and features on business news channels in India.

Mukesh Kumar is a lead analyst with the World Gold Council. Mukesh plays an important role in maintaining and strengthening World Gold Council’s understanding of India’s gold market. He has over 16 years’ experience in metals and mining consulting and research. Mukesh has previously worked with CRU International, Hatch Associates and Steel Authority of India Limited.

Harshal Barot is a senior consultant with Metals Focus, also based in the Mumbai office. He has a decade’s experience as a precious metals analyst and is a regular contributor to Metals Focus’ work on prices and macroeconomics. Harshal is also jointly responsible for Metals Focus’ precious metals research and analyses other South Asia markets, focusing on Sri Lanka and Nepal.

Recycling industry size calculated as per gold recycling volumes in 2021 and average domestic gold price in 2021. Average annual Indian supply based on last five-year Indian supply (2016-2021).

Metal recovered from an ore body formed into unrefined bars is known as “doré”. These unrefined bars contain gold as well as other metals (such as silver or copper). The gold doré bar contains less than 5% impurities.

Press Information Bureau.

Union budget impact on Indian gold market.

Bureau of Indian Standards.

Metals Focus.

Metals Focus.

Fine gold content terms.

The Uttarakhand Tax on Entry of Goods into Local Areas (Amendment) Bill, 2016.

A ‘genuine operation’ refers to an actual gold refining setup rather than a refining and melting shop disguised as a refining operation to avail the tax benefit.

Bureau of Indian Standards.

Cast bars/coins are produced through moulding whereas minted bars/coins are produced through a continuous casting process.

Metals Focus.

Metals Focus.

Metals Focus.

The key festive periods of Akshaya Tritiya and Diwali accounts for more than 50% of online sales.

Metals Focus.

Custom notification 12/2012 dated 17 March 2012.

Metals Focus.

The discount in the local market widened to U$73/oz in April 2020 with the introduction of lockdowns across India due to the pandemic.

Amendments/Revamping of Gold Monetisation Scheme

Indian Customs, Metals Focus.

Indian Customs, Metals Focus.

Metals Focus.

Metals Focus.

Metals Focus.

Metals Focus.

Metals Focus.

Based on data from 1990 to 2020. 2020 was an aberration globally and had unexpected consequences for gold demand in that physical buying was constrained by restrictions on movement. Likewise, recycling was also impacted. In 2020 recycling volumes in India did not respond as much to a higher gold price as consumers preferred to use gold jewellery as collateral against loans to meet their liquidity needs. Similarly, the response of recycling to jewellery demand was weak as consumers chose to exchange gold to meet their jewellery needs particularly during the wedding season.

Metals Focus.

Press Information Bureau