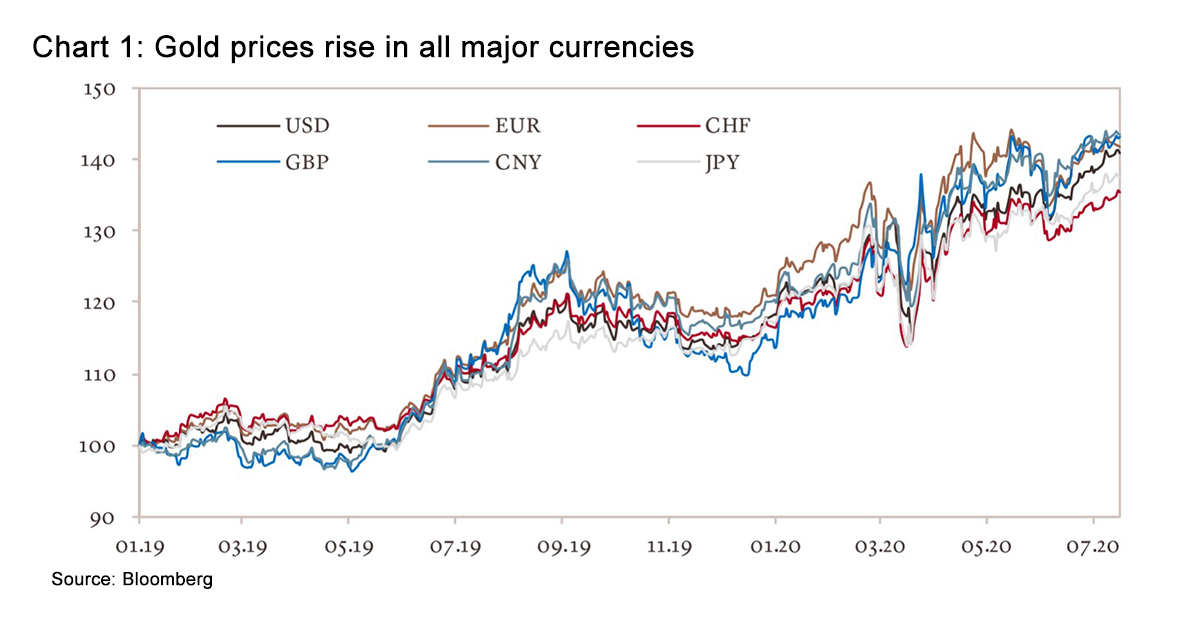

As fears over Covid-19 intensified in mid-March and investors sought liquidity, gold prices temporarily correlated with other assets and fell. Once it was clear to investors that the world faced a global pandemic, prices rallied in line with central banks’ massive financial asset buying programmes. Historically, the gold price may rise when the value of the dollar declines. But in recent months, the precious metal has risen across all major currencies (see chart 1) as global investment demand has grown through the pandemic. Gold has risen 15% year to date and traded at USD 1,801/oz on 17 July. That is near its historic close of USD 1,875.25/oz on 2 September 2011.

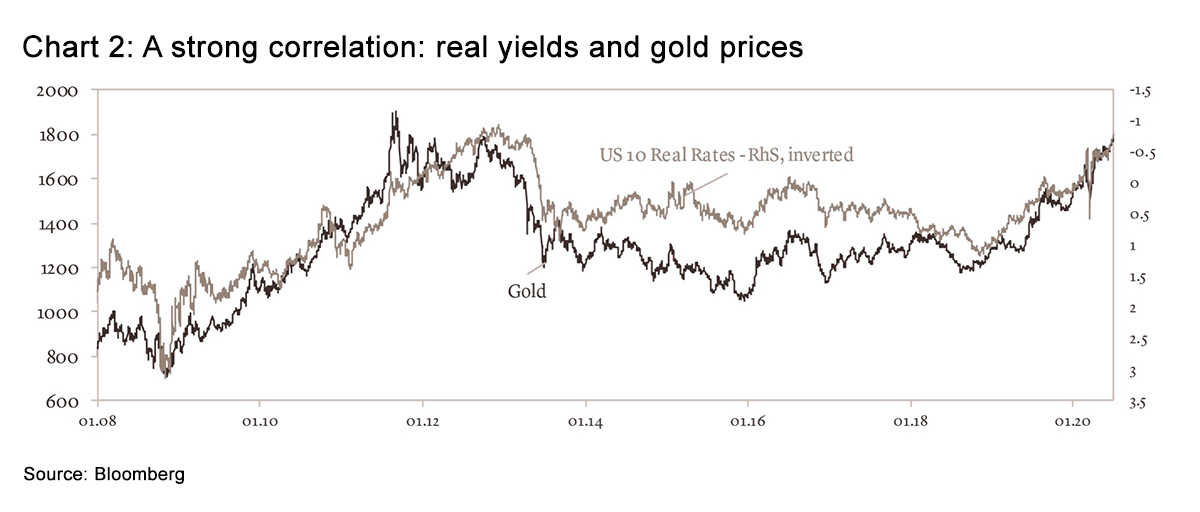

At these levels, why own gold in a portfolio? The combination of low-to-negative government bond yields plus a weakening US dollar, and most importantly, massive central bank accommodation, supports financial demand. This relationship between gold and real yields (see chart 2) has held for the last decade and recent central bank interventions have reinforced the case for holding gold as a portfolio diversification tool. In addition, as investors consider the pandemic’s longer-term implications, they are likely to look harder at their exposure to sovereign debt and the solvency of indebted governments. This further increases the attractiveness of gold, which even if it produces no income and is costly to store, carries no credit risk.

Mining less

All of these factors create a positive environment for gold prices and add to the precious metal’s attractions as a portfolio hedge. In fact, this accommodative, low-yield environment may prove historically persistent over the long term. The Bank of England and International Monetary Fund have written recently about the shock of pandemics on economies. Both studies, working with evidence starting in the 14th century, show that these events tend to depress real interest rates not for years but for decades.

Most commodity prices are a balance between supply and demand. But in the case of gold, threats to supply are sometimes overblown. In 2019, the supply from gold mines fell 1%, according to the World Gold Council. This year, the supply declined 3% in the first quarter as many mines shut during the Covid-19 crisis. The interruptions, which intensified in the second quarter, have made some deep mines uneconomical and the pipeline of new mines will not compensate. Closed refineries and more complex logistics chains also complicated supply of gold bar and coins.

However, investors should not pay too much attention to variations in gold production and supply. Unlike the oil market, gold is not in short supply. The equivalent of about 60 years of supplies are already above ground, and there is a large market for recycled gold.

Jewellery and central banks

A more convincing explanation for recent gold moves comes from the shifting sources of demand. Global demand is a balance of consumer spending on physical gold and financial investments. In line with the broad economic contraction, demand for jewellery fell significantly in the pandemic. Demand from Greater China, which accounted for 28% of purchases in 2019 as the world’s largest market, fell by almost two-thirds in the first quarter. India, the second-largest market, is still managing the pandemic with public confinements. Between them, China and India account for more than half of the world’s gold consumption of physical gold.

In contrast to this falling consumer demand, investors increased gold purchases through the pandemic. The first half of 2020 saw Exchange Traded Funds buy a record 734 tonnes of gold, worth around USD 39.5 billion, a 600% increase from the same period a year ago and more than any full-year period in history, according to World Gold Council data.

Central banks reversed their 20-year trend of net gold sales in 2010 in the wake of the financial crisis and have since remained major buyers, accounting for around 45% of mined supply in the six months through June. Still, central banks have slowed their purchases this year from record levels of 2018 and 2019, in part because Russia halted purchases in April.

Raising resilience

We have adapted our strategic approach to create a dedicated exposure to gold for clients. Gold continues to increase portfolios’ resilience and strengthen diversity in asset allocations. The outlook for gold depends on this continued shift in balance from physical consumption to financial demand from investors. And investor demand depends largely on the shape of the global economic recovery, and in particular, the evolution of real yields. If, as we fully expect, the low-to-negative yield environment persists in line with sluggish post-pandemic global growth, this financial demand will likely offset the weak consumer demand for gold.

We expect gold prices to remain supported, and trade around USD 1,600 /oz a year from now, as the outlook for the global economy improves. The risk to this would be a stronger-than-expected economic recovery, persuading central banks globally that they can safely taper or halt their extraordinary stimulus spending on assets. That implies that the Federal Reserve would then be prepared to increase interest rates, although in an election year, and the current circumstances, that remains hard to imagine.